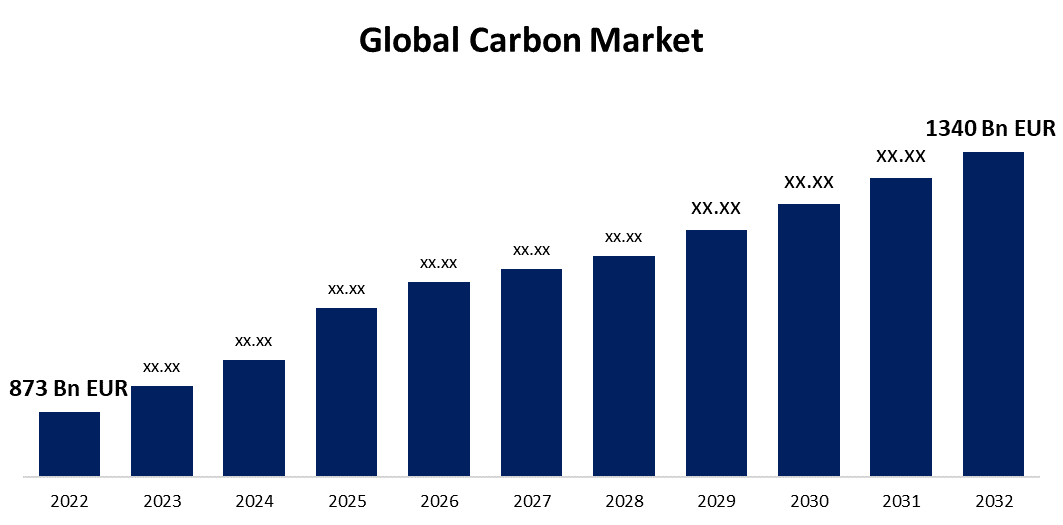

Global Carbon Market Size To Exceed USD 1340 Billion Euros By 2032 | CAGR of 4.38%

Category: Energy & PowerGlobal Carbon Market Size To Exceed USD 1340 Billion Euros By 2032

According to a research report published by Spherical Insights & Consulting, the Global Carbon Market Size is to Grow from USD 873 Billion Euros in 2022 to USD 1340 Billion Euros by 2032, at a Compound Annual Growth Rate (CAGR) of 4.38% during the projected period. Demand for organizations to reduce greenhouse gas emissions, stricter environmental regulations, and increased awareness of the effects of climate change are all expected to drive significant growth in the worldwide carbon market throughout the forecast period.

Get more details on this report -

Browse key industry insights spread across 200 pages with 120 Market data tables and figures & charts from the report on the "Global Carbon Market Size, Share, and COVID-19 Impact Analysis, By Market Type (Voluntary Market, Compliance Market), System Type (Cap & Trade, Baseline & Credit, Carbon Offset Programs), By End-Use Industry (Energy & Power, Petrochemical, Industrial, Utilities, Aviation, Transportation, Buildings, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/carbon-market

The global carbon market, also known as the carbon trading market or the emissions trading market, is a project to reduce greenhouse gas emissions and mitigate climate change. It works on the principle of putting a monetary value on carbon emissions in order to encourage businesses and governments to reduce their carbon footprint. Additionally, most countries around the world are taking proactive steps to reduce carbon emissions, such as the deployment of low-carbon technologies such as EVs, abatement subsidies for fossil fuels, a carbon pricing system, and the purchase and manufacture of green energy and EE products. Regulatory measures, voluntary corporate actions, growing carbon prices, and technological advancements are critical driving forces in the growth and development of the global carbon market. Furthermore, factors such as the stringency of caps or targets, monitoring and verification systems, and market integration across many regions determine the efficacy and overall impact of carbon markets in lowering emissions. The market's purpose in instituting a carbon price is to absorb the environmental costs of emitting greenhouse gases while encouraging investments in clean and sustainable industries.

The compliance market segment is dominating the market with the largest revenue share over the forecast period.

On the basis of market type, the global carbon market is segmented into the voluntary market and compliance market. Among these, the compliance market segment is dominating the market with the largest revenue share of 53.6% over the forecast period. This market operates inside governmental or international regulatory frameworks, such as the European Union Emissions Trading System (EU ETS). Compliance market participants are frequently businesses with mandatory emission reduction targets, such as large corporations or power plants. They must keep enough carbon permits to cover their emissions or face fines. Carbon credits can be traded between market parties.

The cap & trade segment is witnessing significant CAGR growth over the forecast period.

On the basis of system type, the global carbon market is segmented into cap & trade, baseline & credit, and carbon offset programs. Among these, the cap & trade segment is witnessing significant CAGR growth over the forecast period. The European Union Emissions Trading System (EU ETS) is one example of a market that operates inside federal or international regulatory frameworks. Compliance market players are typically large firms or power plants with statutory emission reduction targets. They must maintain sufficient carbon permits to cover their emissions or risk fines. Carbon credits can be traded among market participants.

The utilities segment accounted for the largest revenue share of more than 46.1% over the forecast period.

On the basis of end-use industry, the global carbon market is segmented into energy & power, petrochemical, industrial, utilities, aviation, transportation, buildings, and others. Among these, the utilities segment is dominating the market with the largest revenue share of 46.1% over the forecast period. Power companies are now focusing on ecology and implementing revolutionary strategies and global best practices to dramatically reduce carbon emissions. Carbon emissions from the power sector and electrical industries are rapidly increasing; hence, decarbonization within these sectors is vital, which eventually accelerates demand for carbon credits, leading to the creation of the carbon market.

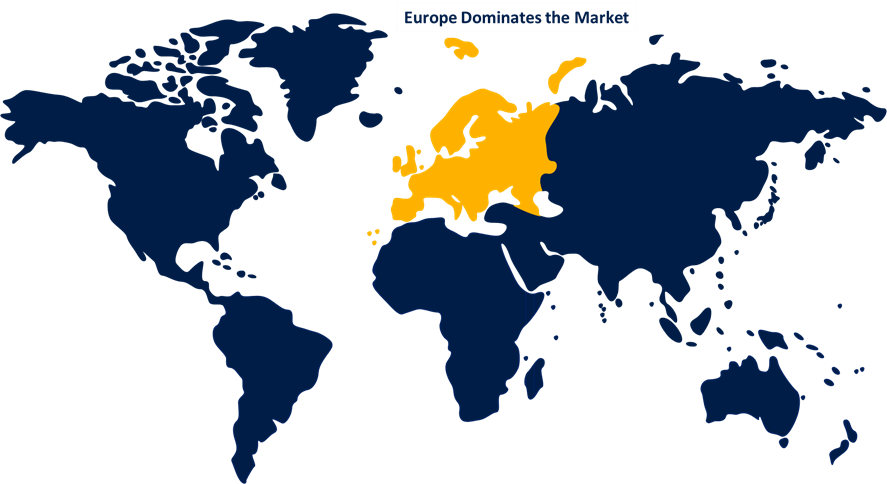

Europe dominates the market with the largest market share over the forecast period.

Get more details on this report -

Europe is dominating the market with more than 38.7% market share over the forecast period. Europe's ETS is a core of the EU's climate change policy and its major weapon for cutting greenhouse gas emissions at a reasonable cost. It was the world's first big carbon market and remains the largest today. On the contrary, Asia Pacific is predicted to grow the fastest during the forecast period. The Republic of Korea possesses Asia Pacific's most advanced national emission trading system (ETS). China is looking for an emission trading system (ETS) that fits its needs, is adaptable, has no fundamental problems, and can improve operations. During the forecast period, the North American market is expected to rise at a rapid CAGR.

Major vendors in the Global Carbon Market include Carbonfund, NativeEnergy, Climate Partner GmbH, South Pole Group, Climeco LLC, EKI Energy Services Ltd., Climetrek Ltd., Moss.Earth, TEM, ForestCarbon, Natureoffice GmbH, Climetrek Ltd., Terrapass, Finite Carbon, Climate Impact Partners, CarbonBetter, Carbon Credit Capital, Carbon Care Asia Limited, Environmental Markets, and several others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- On July 2023, AirCarbon Exchange and Blue Carbon, a project developer located in Dubai, have signed a memorandum of understanding (MoU) to collaborate on the development of carbon markets in the Middle East and North Africa (MENA) area. This program, in collaboration with Blue Carbon, will accelerate the growth of carbon market activities in the MENA area.

- On May 2023, State Street Corporation announced the launch of the State Street Carbon Asset Servicing Solution and depositary services, which will enable asset managers, asset owners, and other financial institutions around the world to incorporate carbon-related assets into their portfolios as demand for the asset class grows. With the implementation of this solution, clients can now take use of State Street's comprehensive suite of asset services for this expanding carbon asset class.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Carbon Market based on the below-mentioned segments:

Carbon Market, Market Type Analysis

- Voluntary Market

- Compliance Market

Carbon Market, System Type Analysis

- Cap & Trade

- Baseline & Credit

- Carbon Offset Programs

Carbon Market, End-Use Industry Analysis

- Energy & Power

- Petrochemical

- Industrial

- Utilities

- Aviation

- Transportation

- Buildings

- Others

Carbon Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?