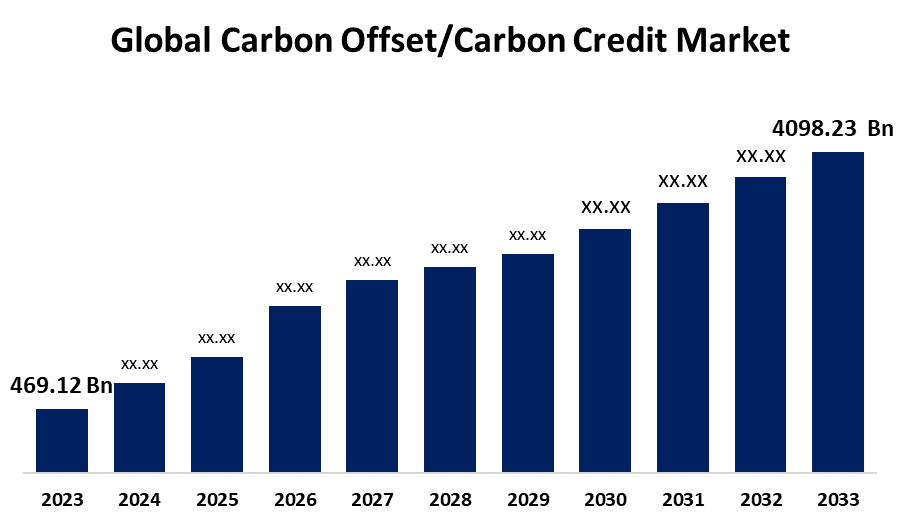

Global Carbon Offset/Carbon Credit Market Size To Worth USD 4098.23 Billion By 2033 | CAGR Of 24.32%

Category: Energy & PowerGlobal Carbon Offset/Carbon Credit Market Size To Worth USD 4098.23 Billion By 2033

According to a research report published by Spherical Insights & Consulting, the Global Carbon Offset/Carbon Credit Market Size is to Grow from USD 469.12 Billion in 2023 to USD 4098.23 Billion by 2033, at a Compound Annual Growth Rate (CAGR) of 24.32% during the projected period.

Get more details on this report -

Browse key industry insights spread across 188 pages with 120 Market data tables and figures & charts from the report on the "Global Carbon Offset/Carbon Credit Market Size, Share, and COVID-19 Impact Analysis, By Type (Voluntary Market, Compliance Market), By Project Type (Avoidance/Reduction Projects, Removal/Sequestration Projects [Nature-based Projects and Technology-based Projects]), By End User (Energy, Power, Transportation, Industrial, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033."

Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/carbon-offset-carbon-credit-market

Reducing the intensity of carbon dioxide and other dangerous feasts is what's meant by a carbon offset, which is another name for a carbon credit. A quantifiable escape or junking of dangerous feasts is called carbon offset. By supporting carbon offset programs, consumers can finance individualities’ operation of greenhouse gas reduction measures to lessen their carbon duty burden, rather than paying further than would be necessary to invest in a company's operations. Carbon equilibriums, also known as carbon credits, are styles grounded on the request designed to reduce greenhouse gas emigrations. Emigration caps are set by governments or nonsupervisory agencies. The growing number of tree populations and the emission of carbon dioxide from the atmosphere are the main drivers of this proposal. By lowering emigration, carbon credits contribute to the removal of carbon from the atmosphere. The ability of organizations to purchase carbon credits to lower the emigration of hothouse gases also supports the desire. Similarly, it is expected that the request would increase due to the growing market for carbon credits. Carbon offset initiatives have a significant danger of having a negative environmental impact since isolated carbon might be released back into the atmosphere. It follows that a constrained market demand is expected.

The voluntary market segment is anticipated to rule the global carbon offset/carbon credit market with the highest returns share during the prediction period.

On the basis of type, the global carbon offset/carbon credit market is classified into voluntary market and compliance market. Among these, the voluntary market segment is anticipated to rule the global carbon offset/carbon credit market with the highest returns share during the prediction period. Because this market is global in scope, businesses and consumers from many regions may participate and support carbon offset initiatives globally.

The removal/sequestration projects is expected to control the market during the anticipated period.

On the basis of project type, the global carbon offset/carbon credit market is classified into avoidance/reduction projects, and removal/sequestration projects. The removal/sequestration projects is further divided into nature-based projects and technology-based projects. Among these, the removal/sequestration projects is expected to control the market during the anticipated period. Carbon dioxide from the air is efficiently captured and stored by these initiatives. Removal or sequestration is more visually appealing as an emission countermeasure since it is a practical means of lowering the amount of carbon dioxide in the atmosphere.

The industrial segment is estimated to lead the market during the prediction period.

On the basis of end user, the global carbon offset/carbon credit market is classified into energy, power, transportation, industrial, and others. Among these, the industrial segment is estimated to lead the market during the prediction period. Industries sometimes take part in carbon offset programs as a means of compensating for their output. Due to its often-large output, the industrial sector is a major supporter of the market for carbon offsets and credits.

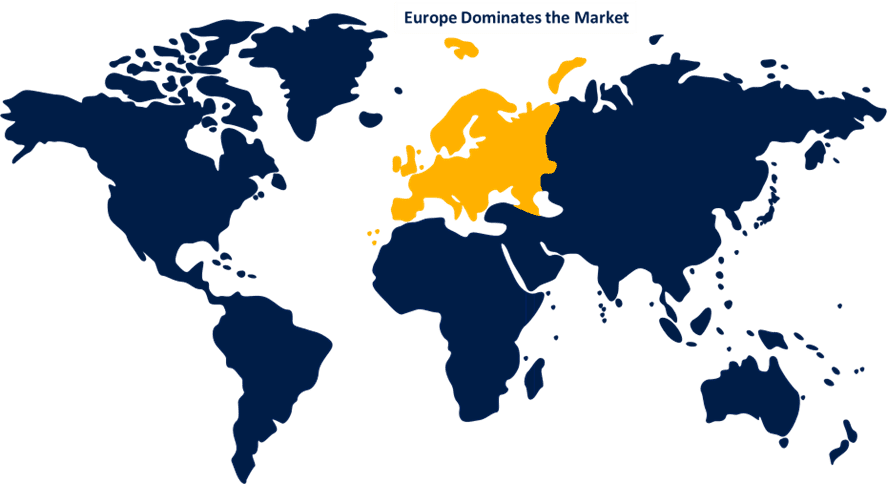

Europe is expected to lead the global carbon offset/carbon credit market during the estimation period.

Get more details on this report -

Europe is expected to lead the global carbon offset/carbon credit market during the estimation period. The reason for this is that the government has strict rules and opposes reducing the emigration of greenhouse gases, which has increased the need for carbon offsets. Europe's dominance in the demand for carbon equilibrium and credits has been aided by the number of significant carbon-neutralized systems and organizations in the region. This includes actions similar to planting, landing methane, and establishing renewable energy sources. Therefore, the demand for these systems is being driven by a rising number of European firms and people who are ready to invest in carbon credits to offset their emigration.

Asia Pacific region is anticipated to be the fastest-growing region in the global carbon offset/carbon credit market during the projected period. The biggest economies of the world, including China, India, and Japan, are concentrated in the Asia Pacific area, and each has a notable carbon footprint. These nations are increasingly focusing on sustainability and the mitigation of climate change, which is driving up demand for carbon offsets and credits.

Major vendors in the global carbon offset/carbon credit market South Pole Group, 3Degrees, Finite Carbon, EKI Energy Services Ltd, Native Energy, Carbon Trade Exchange (CTX), Carbon Streaming Corporation, Brookfield Renewable Partners, Gold Standard, ClimateCare, Terrapass, WGL Holdings, Inc., Enking International, Green Mountain Energy, Cool Effect, Inc., and others.

Recent Developments

- In May 2023, OpenInvest is a platform for sustainable investment JPMorgan Chase bought. Carbon-neutralized finances are among the sustainable investing choices that OpenInvest offers to both individualities and associations.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the Global Carbon Offset/Carbon Credit Market based on the below-mentioned segments:

Global Carbon Offset/Carbon Credit Market, By Type

- Voluntary Market

- Compliance Market

Global Carbon offset/carbon credit Market, By Project Type

- Avoidance/Reduction Projects

- Removal/Sequestration Projects

- Nature-based Projects

- Technology-based Projects

Global Carbon Offset/Carbon Credit Market, By End User

- Energy

- Power

- Transportation

- Industrial

- Others

Global Carbon Offset/Carbon Credit Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?