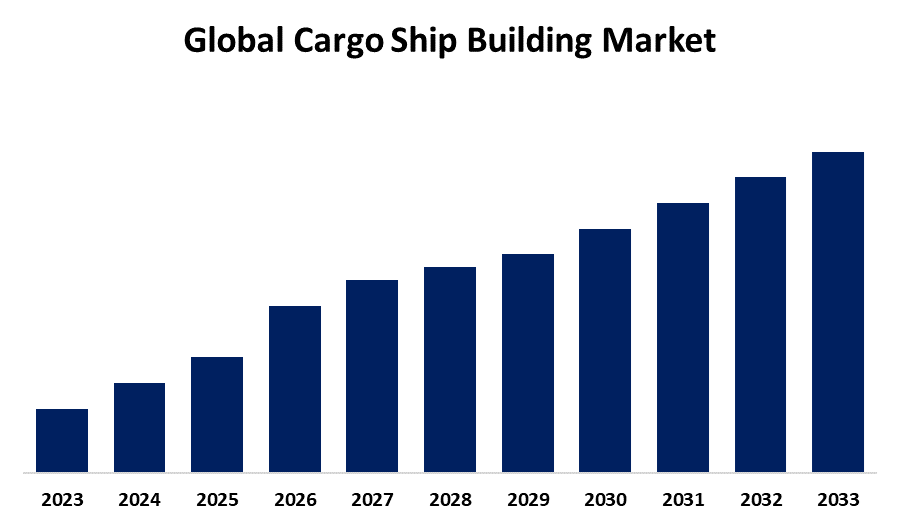

Global Cargo Ship Building Market Size is Expected to Hold a Significant Share By 2033

Category: Automotive & TransportationGlobal Cargo Ship Building Market Size is Expected to Hold a Significant Share by 2033.

According to a research report published by Spherical Insights & Consulting, the Global Cargo Vessel Building Market Size is Expected to Hold a Significant Share by 2033, at a Substantial CAGR from 2023 to 2033.

Get more details on this report -

Browse key industry insights spread across 220 pages with 114 Market data tables and figures & charts from the report on the " Global Cargo Vessel Building Market Size, Share, and COVID-19 Impact Analysis, By Ship Type (Container Ships, Tanker, Roll on/Roll off Ships, Bulk Carriers, General Cargo Vessel, and Others), By Propulsion Type (Diesel & Gasoline, Nuclear, Hydrogen, Hybrid, LNG, Electric, and Others), By Material Type (Aluminum Alloys, Composites, Steel, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/cargo-ship-building-market

The global cargo ship building industry, also known as the global cargo vessel building market, is the process of designing, developing, manufacturing, and commissioning various types of commercial cargo boats for use in moving commodities and raw materials over global trade routes. In fact, it is a critical industry that has facilitated international trade by providing the efficient movement of bulk commodities, containerized goods, oil and gas, and other specialized cargo across oceans and rivers. The worldwide cargo ship building market is seeing transformative developments in terms of sustainability, digitalization, and efficiency improvement. Furthermore, government rules and subsidies in key shipbuilding countries like China, South Korea, and Japan encourage domestic production and technological advancement. Geopolitical issues such as trade agreements, shifting supply chain strategies, and regional crises all have an impact on vessel construction demand and fleet expansion. However, the worldwide cargo vessel building industry is limited by costly capital investment, long production cycles, and labor shortages, making entry and expansion difficult. Stringent environmental regulations raise costs while fluctuating raw material prices reduce profitability.

The container ships segment held the highest share in 2023 and is anticipated to grow at a significant CAGR during the projected timeframe.

Based on the ship type, the cargo vessel building market is divided into container ships, tanker, roll on/roll off ships, bulk carriers, general cargo vessel, and others. Among these, the container ships segment held the highest share in 2023 and is anticipated to grow at a significant CAGR during the projected timeframe. The growing popularity of massive container ships needs the employment of current manufacturing technology to accommodate their size and complexity. Shipyards are investing in cutting-edge technologies to build larger ships with greater fuel efficiency and cargo capacity in response to the industry's demand for cost-effective operations.

The LNG segment held the highest share in 2023 and is anticipated to grow at a significant CAGR during the projected timeframe.

Based on the propulsion type, the cargo ship building market is divided into diesel & gasoline, nuclear, hydrogen, hybrid, LNG, electric, and others. Among these, the LNG segment held the highest share in 2023 and is anticipated to grow at a significant CAGR during the projected timeframe. LNG is less expensive than traditional maritime fuels in the long run because to its lower price volatility and higher energy density. Shipbuilders and shipping companies are increasing their investment in LNG-powered boats since the long-term fuel savings exceed the higher initial capital expenditures required for LNG infrastructure and technology.

The steel segment accounted for the majority of the share in 2023 and is estimated to grow at a remarkable CAGR during the projected timeframe.

Based on the material type, the cargo vessel building market is divided into aluminum alloys, composites, steel, and others. Among these, the steel segment accounted for the majority of the shares in 2023 and is estimated to grow at a remarkable CAGR during the projected timeframe. Continuous advancements in high-strength, corrosion-resistant steel improve the performance and lifetime of steel-based ships. Advanced coatings and steel alloys are being developed to withstand harsh maritime environments like rust, corrosion, and wear. These technological advancements help ships last longer and require less maintenance, making steel a more desirable material.

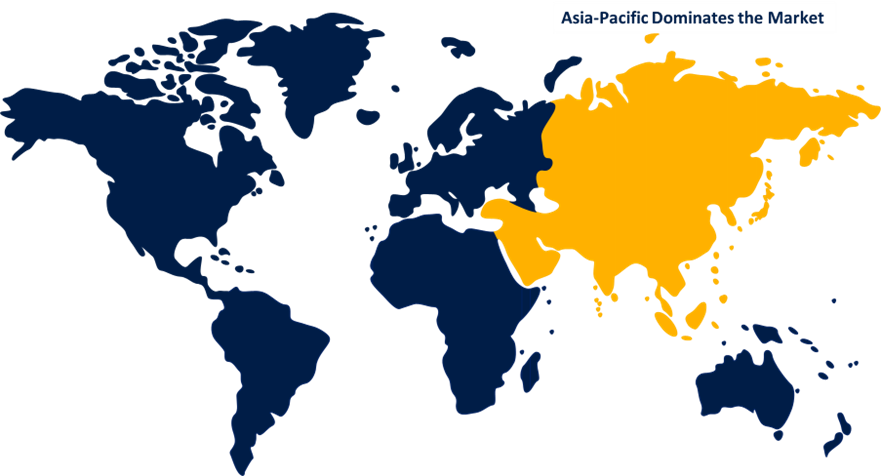

Asia-Pacific is estimated to hold the largest share of the cargo ship building market over the forecast period.

Get more details on this report -

Asia-Pacific is estimated to hold the largest share of the cargo vessel building market over the forecast period. China, South Korea, and Japan have long been global shipbuilding giants, with well-established shipyards and extensive industrial capacities. These countries have made significant investments in new infrastructure and technology, allowing them to build a wide range of cargo boats at low cost and on a large scale. Furthermore, Asian governments, particularly those in China and South Korea, provide major assistance for the marine industry through subsidies, incentives, and favorable legislation. These regulations encourage investment in shipbuilding infrastructure, technological innovation, and environmentally friendly solutions, cementing the region's dominance.

Middle East and Africa is predicted to have the fastest CAGR growth in the cargo ship building market over the forecast period. Several MEA states, particularly Saudi Arabia, the UAE, and Qatar, are investing heavily in maritime infrastructure as part of their long-term economic diversification strategy. For example, the Saudi Vision 2030 initiative and the UAE's expansion of its ports and shipyards have resulted in greater capacity and technological advances in shipbuilding, positioning the region as a growing hub for cargo vessel construction. Furthermore, Middle Eastern governments actively promote the maritime and shipbuilding industries through incentives, subsidies, and favorable laws. These regulations have helped to attract domestic and international investment in the region's shipbuilding industry, resulting in greater growth.

Major key players in the Cargo Vessel Building market include Hyundai Heavy Industries (HHI), Daewoo Shipbuilding & Marine Engineering (DSME), Samsung Heavy Industries (SHI), China Shipbuilding Industry Corporation (CSIC), China State Shipbuilding Corporation (CSSC), Mitsubishi Heavy Industries (MHI), Imabari Shipbuilding, Shoei Kisen Kaisha, STX Offshore & Shipbuilding, Oshima Shipbuilding, China Merchants Industry Holdings, Fincantieri S.p.A., ThyssenKrupp Marine Systems, Samsung Heavy Industries (SHI), Navantia, and Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2025, The Union Minister of Ports, Shipping & Waterways announced major initiatives to increase capacity at Kandla Port, totaling over Ruppes 57,000 crore. The two major announcements include the construction of a new Mega Shipbuilding Project worth Rupees 30,000 crore. A new cargo terminal outside Kandla Creek, worth Ruppes 27,000 crores, will increase Kandla Port's capacity by 135 MTPA. The new Mega Shipbuilding Facility at Kandla Port will develop the country's technical capability to manufacture large Very Large Crude Carrier (VLCC) or similar class vessels with DWT capacities of up to 3,20,000 tonnes. Every year, the facility has the capacity to build 32 new ships and repair 50 existing ones.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the cargo ship building market based on the below-mentioned segments:

Global Cargo Ship Building Market, By Ship Type

- Container Ships, Tanker

- Roll on/Roll off Ships

- Bulk Carriers

- General Cargo Vessel

- Others

Global Cargo Vessel Building Market, By Propulsion Type

- Diesel & Gasoline

- Nuclear

- Hydrogen

- Hybrid

- LNG

- Electric

- Others

Global Cargo Ship Building Market, By Material Type

- Aluminum Alloys

- Composites

- Steel

- Others

Global Cargo Ship Building Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?