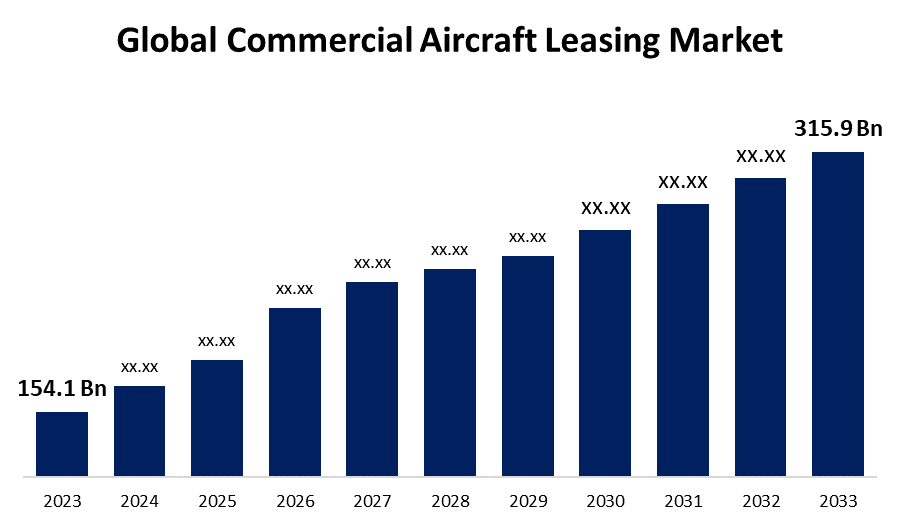

Global Commercial Aircraft Leasing Market Size To Exceed USD 315.9 Billion By 2033 | CAGR of 7.3%

Category: Aerospace & DefenseGlobal Commercial Aircraft Leasing Market Size To Exceed USD 315.9 Billion By 2033

According to a research report published by Spherical Insights & Consulting, the Global Commercial Aircraft Leasing Market Size is to grow from USD 154.1 Billion in 2023 to USD 315.9 Billion by 2033, at a Compound Annual Growth Rate (CAGR) of 7.3% during the projected period.

Get more details on this report -

Browse key industry insights spread across 200 pages with 120 Market data tables and figures & charts from the report on the "Global Commercial Aircraft Leasing Market Size, Share, and COVID-19 Impact Analysis, By Aircraft Type (Narrow-Body Aircrafts, Wide-Body Aircrafts, Others), By Leasing Type (Dry Leasing, Wet Leasing), By Security Type (Asset-Backed Security (ABS), Non-Asset Backed Security (Non-ABS)), By Application (long haul aircraft, and medium distance aircraft), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/commercial-aircraft-leasing-market

An aircraft lease is a legal agreement between two parties, usually a lessor and a lessee. The lessor agrees to provide the aircraft to the lessee for a set period of time in exchange for regular payments known as lease payments. Airlines sometimes lease planes rather than buy them. The leasing company uses its capital to purchase the aircraft and rents it to the operator for a monthly or annual fee. The tenant holds ownership. As previously stated, the airline pays a fixed monthly or annual rent to operate the jet under its own brand and, in most cases, in its own color. There are five major benefits to leasing an aircraft rather than buying one. The rising demand for air travel as disposable incomes rise, the opening of new routes, and the introduction of low-cost carriers are all major drivers of the global commercial aircraft leasing market. Furthermore, rising demand for aircraft leasing services from airlines looking to cut operating costs is expected to boost market growth. Furthermore, the need to reduce operational costs and the increasing demand for environmentally friendly aircraft are expected to create new market opportunities. Aviation has consistently been the most dependable and safest mode of transportation in the world today. The lack of modern airport infrastructure presents a significant challenge for aircraft lessors because newly leased aircraft must be located and stored in the appropriate location. The availability of efficient airports is one of the most important requirements for an investor or lessor interested in investing in the aircraft leasing industry.

COVID-19 Impact

The COVID-19 outbreak in 2020 severely disrupted the regional economy. However, the implementation of effective vaccination campaigns in all industrial sectors has shown signs of improvement since 2021. As a result, safety and travel restrictions have been lifted, with the goal of restoring commercial aircraft rental demand by 2021 at the latest. Furthermore, increased capital spending by airlines is expected to boost demand for commercial aircraft leasing, which will benefit the regional market growth during the forecast period.

The narrow-body aircrafts segment is expected to hold the largest share of the global Commercial aircraft leasing market during the forecast period.

Based on the aircraft type, the global commercial aircraft Leasing market is categorized into narrow-body aircrafts, wide-body aircrafts, and regional aircrafts. Among these, the narrow-body aircrafts segment is expected to hold the largest share of the global commercial aircraft leasing market during the forecast period. Narrow-body aircraft are the most common type of commercial aircraft, primarily used for short- to medium-distance flights. These smaller aircraft typically have a single aisle and a limited number of passenger seats.

The wet leasing segment is expected to grow at the highest pace in the global commercial aircraft leasing market during the anticipated period.

Based on the leasing type, the global commercial aircraft leasing market is divided into dry leasing and wet leasing. Among these, the wet leasing segment is expected to grow at the highest pace in the global commercial aircraft leasing market during the forecast period. Wet leasing is a type of aircraft leasing in which the lessee has the right to use the aircraft as if it were their own, including the pilot and ground crew. In this case, the lessor not only provides the aircraft but also manages all operational services such as maintenance, insurance, and crew hire.

The non-asset backed security (non-ABS) segment dominates in the global Commercial Aircraft Leasing market during the forecast period.

Based on the security type, the global Commercial Aircraft Leasing market is divided into asset-backed security (ABS) and non-asset backed security (non-ABS). Among these, the non-asset backed security (non-ABS) segment is expected to hold the largest share of the global Commercial Aircraft Leasing market during the forecast period. Asset-backed securities allow investors to receive principal and interest payments on a variety of assets without having to generate them themselves. Because of the small number of underlying assets at each security level, the risk of default and other credit issues is extremely low.

The long-haul aircraft dominates in the global commercial aircraft leasing market during the forecast period.

Based on the application, the global commercial aircraft leasing market is divided into long haul aircraft, and medium distance aircraft. Among these, the long-haul aircraft segment is expected to hold the largest share of the global commercial aircraft leasing market during the forecast period. Long haul aircraft are usually large planes that fly long distances, such as international flights. These planes are usually larger and heavier than other types of aircraft. These aircraft are preferred for longer flights because they have a significant impact on airline operating costs and occupancy rates.

North America dominates the market with the largest market share over the forecast period.

Get more details on this report -

North America is expected to hold the largest share of the global Commercial Aircraft Leasing market in the forecast period. This is owing to increased demand for air travel, the growth of low-cost carriers, and airlines' need to replace aging fleets. The region is also home to some of the world's largest aircraft leasing companies, such as GECAS and AerCap. The United States is North America's largest market for aircraft leasing, accounting for more than 50% of total leasing activity. Asia Pacific is projected to hold the significant share of the global commercial aircraft leasing market over the forecast period. This is due to rising regional demand for air travel, as well as an increase in the number of airlines. The region also has some of the world's largest aircraft leasing companies, such as Air Lease Corporation and GECAS. Asia is also home to some of the world's fastest growing economies, such as China and India.

Major vendors in the global Commercial Aircraft Leasing market are SMBC Aviation Capital, AerCap, ALAFCO Aviation Lease and Finance Company K.S.C.P, CIT Commercial Air, Boeing Capital Corporation, GE Capital Aviation Service, AerCap Holdings N.V., BOC Aviation, SAAB Aircraft Leasing, Ansett Worldwide Aviation Services, and others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2022, Air Lease Corp. (ALC) announced that it has received a confirmed order for 32 additional 737-8 and 737-9 jets. As the travel market recovers from the pandemic, ALC is expanding its 737 MAX fleet to meet airline demand for modern, fuel-efficient, and sustainable operations.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global commercial aircraft leasing market based on the below-mentioned segments:

Global Commercial Aircraft Leasing Market, By Aircraft Type

- Narrow-Body Aircrafts

- Wide-Body Aircrafts

- Others

Global Commercial Aircraft Leasing Market, By Leasing Type

- Dry Leasing

- Wet Leasing

Global Commercial Aircraft Leasing Market, By Security Type

- Asset-Backed Security (ABS)

- Non-Asset Backed Security (Non-ABS)

Global Commercial Aircraft Leasing Market, By Application

- Long Haul Aircraft

- Medium Distance Aircraft

Global Commercial Aircraft Leasing Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?