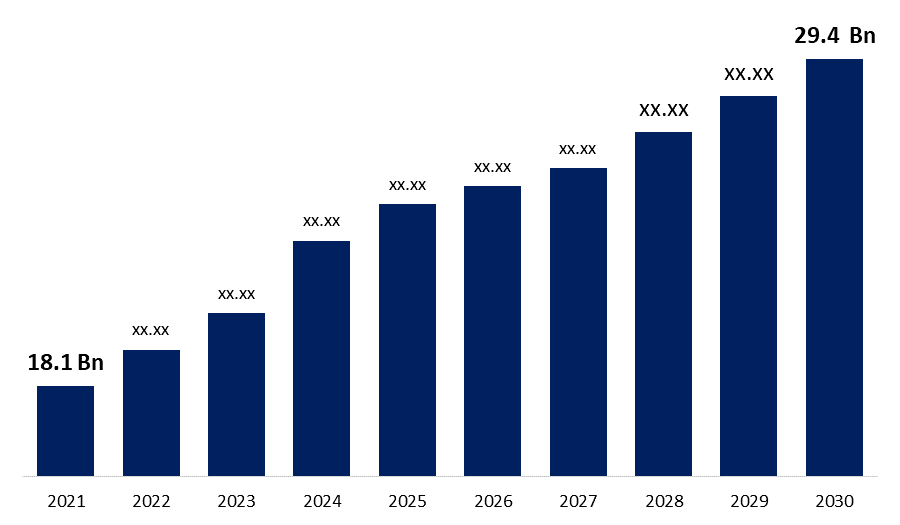

Global Construction Fabrics Market Size To Reach USD 29.4 Bn By 2030 | CAGR 4.4%.

Category: Chemicals & MaterialsGlobal Construction Fabrics Market Size To Reach USD 29.4 Bn By 2030

The Global Construction Fabrics Market was valued at USD 18.1 billion in 2021. The market is projected to grow USD 29.4 billion in 2030, at a CAGR of 4.4%. as per the latest research report by Spherical Insights & Consulting.

The noble coronavirus is an unprecedented worldwide pandemic that has spread to over 180 nations and resulted in massive human and economic losses all over the world. Due to disruptions in the supply chain for construction fabrics products, the construction fabrics market has been significantly damaged as a result of the COVID-19 pandemic. Furthermore, during the COVID-19 period, increased raw material prices, particularly cotton and cotton yarn, reduced construction fabrics output. Cotton and cotton yarn prices, for example, increased by 20-30 percent in December 2020 compared to March 2020, according to a report published by the Denim Manufacturers Association of India (DMAI). Furthermore, there is a significant shift in investment from other sectors to healthcare in order to limit the increase of novel coronavirus cases. In addition, due to the risk of infection among the staff, some construction fabrics production enterprises and mills have closed or reduced their operations. This has temporarily slowed the construction fabrics market's production rate.

Get more details on this report -

Browse key industry insights spread across 230 pages with 120 market data tables and figures & charts from the report “Global Construction Fabrics Market Size, Share, and COVID-19 Impact Analysis, By Fabric Type (Raw, Sanforized, Crushed, Stretch, Vintage, Selvedge, and Others), By Raw Material (Cotton, Spandex, Polyester, and Others), By End-Use (Clothing, Homeware, Accessories & Others) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa) Analysis and Forecast 2021 – 2030” in detail along with the table of contents https://www.sphericalinsights.com/reports/construction-fabrics-market

According to an article released by Textile Value Chain, the total number of construction fabrics mills operating in India has increased by 53.3 percent since 2012, to 46 in 2021 from 30 in 2012. As a result, there may be more affordable construction fabrics available. In the coming years, this aspect is projected to propel the construction fabrics industry forward. Furthermore, unbranded denim manufacturers account for a significant portion of construction fabrics use. This may provide an extra boost to the construction fabrics market's growth. Favored preference for denim amongst youth owing to boosting the sales of denim market. Increasing usage of denim products by women and millennials in smaller cities and rural areas is likely to propel the growth of the construction fabrics market.

Get more details on this report -

The raw segment dominated the global construction fabrics market share owing to raw denim is also known as unwashed or dry denim. It has a lengthy lifespan, although the color fades with each wash. The cotton segment dominated the global construction fabrics market share owing to cotton fabric has been used for apparel and home adornment since prehistoric times. It provides comfort and durability while also being less in weight. The homeware segment dominated the global construction fabrics market share owing to surging usage of the denim used in the homeware & décor applications. Denim upholstery is a lesser-known use for the fabric.

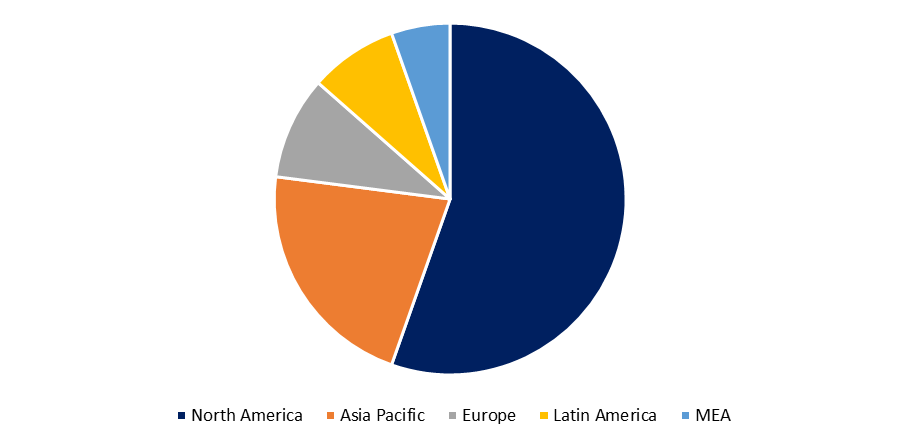

Asia Pacific region is expected to dominate the market share of global construction fabrics market owing to attributable to an increase in consumer’s disposable income in developing nations and individuals rising standards of living. The rising use of construction fabrics in the production of a wide range of denim products such as jeans, shirts, jackets, and other denim products is a major market trend in the global market. Cotton's widespread availability has fueled the region's construction fabrics market's expansion. Furthermore, preferential market access is a vital component boosting Bangladesh's textile sector, which has resulted in a huge increase in demand for construction fabrics. Due to steady economic growth and urbanization, China is likely to maintain its supremacy over the predicted period. Increased government investment in innovative textiles, growing taste for luxury brands, and changing lifestyles are likely to propel India's textile and clothing industry into double digit growth.

KEY INDUSTRY DEVELOPMENTS:

December 2021- Advance Denim has setup a production unit in in Nha Trang, Vietnam, named Advance Sico. It is this focused approach to sustainability that gave way to such innovations as Big Box dyeing, which saves up to 95 percent of the water used in conventional dyeing while using traditional liquid indigo.

October 2019- Bextex has invested USD 20 Mn to upgrade South Asia’s advanced washing plant for denims, garment dyeing and special finishing of woven and knits.

April 2019- Wrangler has collaborated with local cotton farmers and mount vernon mills expanding their customer base.

March 2019- Advance Denim collaborated with Denham, which is a jean manufacturer to expand their collection of stretch jeans.

LIST OF KEY COMPANIES PROFILED:

- Kontoor Brands, Inc.

- Advance Denim Co. Ltd.

- Arvind Limited

- Nandan Denim Ltd.

- Cone Denim LLC

- Ha-Meem Group

- UNITIN-INDUSTRIAS MORERA S.A.

- KAIHARA DENIM

- Kilim

- Artistic Denim Mills

- ISKO

- Mount Vernon Mills, Inc.

- Modern Denim Ltd.

- Nice Denim Mills Ltd (NDML)

- Raymond UCO Denim Pvt. Ltd.

SEGMENTATION

By Fabric Type

- Raw

- Sanforized

- Crushed

- Stretch

- Vintage

- Selvedge

- Others

By Raw Material

- Cotton

- Spandex

- Polyester

- Others

By End-Use

- Clothing

- Homeware

- Accessories

- Others

By Region

- North America- U.S., Mexico, Canada

- Europe- UK, France, Germany, Italy

- Asia-Pacific- China, Japan, India

- Latin America- Brazil, Argentina, Colombia

- The Middle East and Africa- United Arab Emirates, Saudi Arabia

Need help to buy this report?