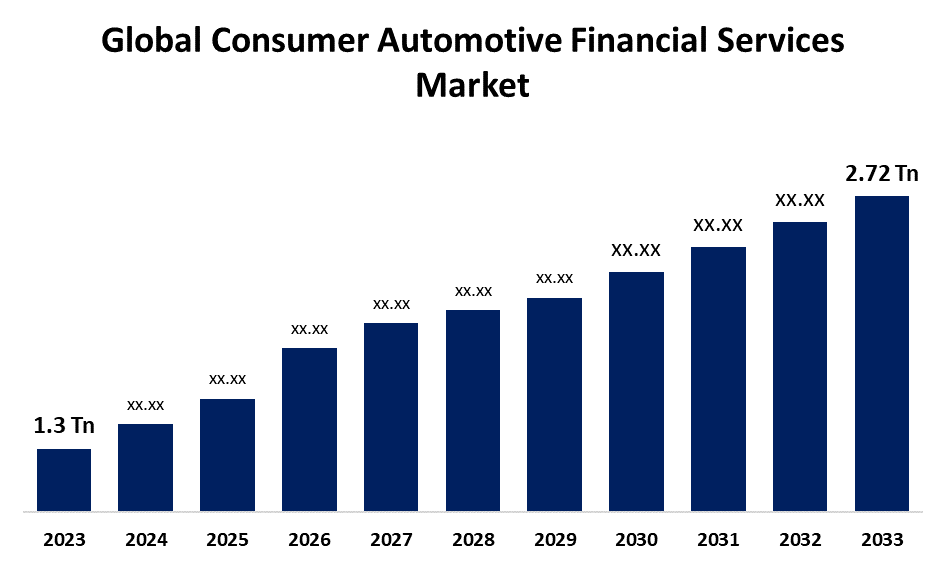

Global Consumer Automotive Financial Services Market Size To Worth USD 2.72 Trillion By 2033 | CAGR of 7.66%

Category: Banking & FinancialGlobal Consumer Automotive Financial Services Market Size To Worth USD 2.72 Trillion By 2033

According to a research report published by Spherical Insights & Consulting, the Global Consumer Automotive Financial Services Market Size was valued at USD 1.3 Trillion in 2023 and is Expected to reach USD 2.72 Trillion by 2033, Growing at a CAGR of 7.66% from 2023 to 2033.

Get more details on this report -

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the "Global Consumer Automotive Financial Services Market Size, Share, and COVID-19 Impact Analysis, By Service Type (Financing, Leasing, Insurance, and Others), By Provider (Banks, OEMs, Credit Unions, and Others), By Vehicle Type (Passenger Vehicles, Commercial Vehicles), By End-User (Individual, Corporate), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033." Get Detailed Report Description Here:https://www.sphericalinsights.com/reports/consumer-automotive-financial-services-market

The consumer automotive financial services industry includes the process of funding for the sale of pre-owned cars and new cars to buyers. This procedure includes prepaid service contracts, creditor insurance, extended warranties, and auto insurance. The rise of the consumer automotive financial services business is aided by the increase in sales of both new and used passenger automobiles due to growing customer demand. The rising demand for car ownership and the changing available finance options for customers. Rising disposable incomes, the growing automobile industry, and the expansion of financing and leasing options that make car ownership more accessible to a wider range of people are driving the market. Furthermore, smooth transactions made possible by the quick developments in digital financial services boost customer satisfaction and trust, which propels industry expansion. Additionally, a growing trend of financial service providers and automotive companies forming strategic alliances that allow for creative solutions catered to specific client needs. Also, consumers' increasing preference for leasing and flexible ownership options over direct ownership. Younger consumers who value the flexibility to regularly improve cars without the obligations of ownership are particularly likely to make this shift. However, during uncertain economic times, when corporate investment is declining, companies frequently turn to cost-cutting measures and layoffs. In turn, this lowers consumer spending and confidence, which reduces demand for products and services. which may hinder the expansion of the consumer automotive financial services sector.

The financing segment secured a significant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period.

Based on the service type, the global consumer automotive financial services market is separated into financing, leasing, insurance, and others. Among these, the financing segment held a significant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. Auto finance helps people and companies buy cars without having to pay the entire amount up front, which makes big purchases easier to handle. The availability of several financing options, such as loans and hire purchases, has increased its allure. Consumer interest has been further increased by financial institutions and automakers working together to offer alluring packages with competitive interest rates.

The banks segment held a significant share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the provider, the global consumer automotive financial services market is categorized as banks, OEMs, credit unions, and others. Among these, the banks segment held a significant share in 2023 and is expected to grow at a significant CAGR during the forecast period. Banks control the market by utilizing their financial resources and clientele. In partnership with auto dealers, they provide alluring financing and leasing alternatives. Banks are dependable partners in the automotive financial services industry, offering borrowers comfort and security through their vast networks and knowledge of risk management.

The passenger vehicles segment accounted for the highest share in 2023 and is anticipated to grow at a prominent CAGR during the forecast period.

Based on the vehicle type, the global consumer automotive financial services market is divided into passenger vehicles and commercial vehicles. Among these, the passenger vehicles segment accounted for the highest share in 2023 and is anticipated to grow at a prominent CAGR during the forecast period. This segmental growth is driven by a strong demand from customers for personal transportation choices. Low-cost financing options have been more widely available, which has significantly increased the number of people who can now own passenger cars. Increased urbanization and changing consumer behaviour are expected to support the growing demand for passenger cars in emerging regions as their economies develop.

The individual segment held a significant share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the end-user, the global consumer automotive financial services market is classified into individual and corporate. Among these, the individual segment held a significant share in 2023 and is expected to grow at a significant CAGR during the forecast period. Financial solutions have become necessary due to the growing demand for individual ownership and personal vehicles. Customers are calling for more individualized services as they become more fiscally conscious. Programs that provide access to car ownership, such as insurance, maintenance discounts, and purchasing funding, raise the number of people who own a car.

North America is projected to hold the largest share of the global consumer automotive financial services market over the forecast period.

Get more details on this report -

North America is expected to hold the largest share of the global consumer automotive financial services market. Improved user experiences, more accessibility, and streamlined procedures are the reasons for this domination. Technologies that provide individualized financial solutions, quicker loan approvals, and smooth transactions include artificial intelligence (AI), big data, and mobile applications. Increased demand for leasing services, sophisticated internet financial systems, and high car ownership all contribute to growth. The industry grew in 2024 as about one in four cars in the US were rented. The move toward electric vehicles, technological advancements, and government incentives that provide consumer access to automotive finance services all contribute to the industry expansion.

The Asia Pacific consumer automotive financial services market is expected to grow with the fastest CAGR during the forecasting period. The increasing per capita income, growing urbanisation due to migration, as well as a growing middle class with a heightened desire for car ownership. The buying of environmentally friendly vehicles or electric cars is being made easier by shifting consumer habits, growing knowledge, and encouraging government regulations. Additionally, the region's industry is expanding thanks to the growing use of digital financial services.

Major key players in the consumer automotive financial services market include Westpac Banking Corporation, Zurich Insurance Group Ltd., Ally Financial, Bank of America, LeasePlan, Hertz, Allstate, JPMorgan Chase & Co., Toyota Financial Services, Volkswagen Financial Services, Wells Fargo & Company, and Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2024, Chase expanded its consumer financing options by partnering with the digital automotive marketplace CarGurus. This collaboration integrates Chase's financing solutions into the CarGurus platform, enhancing the online car-buying experience for consumers.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global consumer automotive financial services market based on the below-mentioned segments:

Global Consumer Automotive Financial Services Market, By Service Type

- Financing

- Leasing

- Insurance

- Others

Global Consumer Automotive Financial Services Market, By Provider

- Banks

- OEMs

- Credit Unions

- Others

Global Consumer Automotive Financial Services Market, Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

Global Consumer Automotive Financial Services Market, By End-User

- Individual

- Corporate

Global Consumer Automotive Financial Services Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?