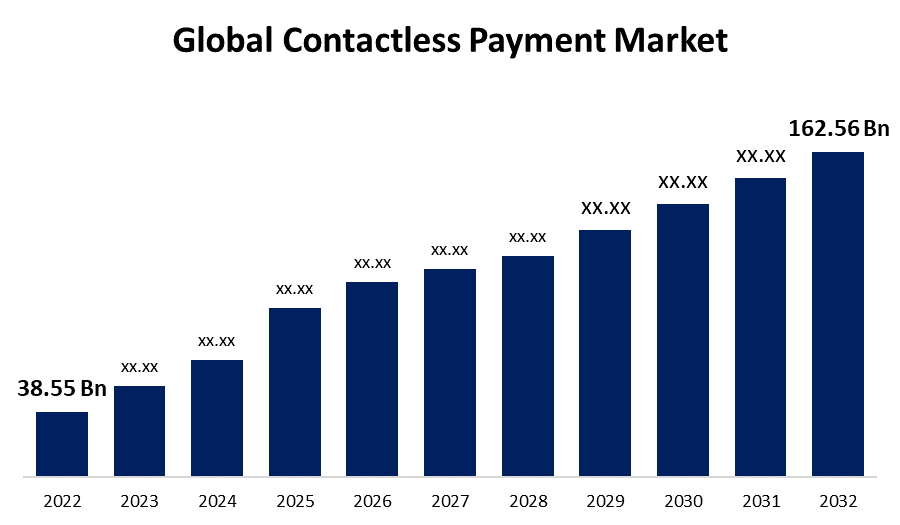

Global Contactless Payment Market Size to Exceed USD 162.56 Billion by 2030 | CAGR of 19.71%

Category: Banking & FinancialGlobal Contactless Payment Market Size to Exceed USD 162.56 Billion by 2030

According to a research report published by Spherical Insights & Consulting, the Global Contactless Payment Market Size is to Grow from USD 38.55 Billion in 2022 to USD 162.56 Billion by 2030, at a Compound Annual Growth Rate (CAGR) of 19.71% during the projected period. In order to allow client payments more rapidly, digital payment systems are being used more frequently, which is related to the expansion. Innovative hardware, cutting-edge software, and smart services are all part of contactless payments such as debit card, credit card, smart card, near-field communication (NFC), digital wallet, which enhance conventional payment methods and produce intelligent transactions.

Get more details on this report -

Browse key industry insights spread across 200 pages with 110 market data tables and figures & charts from the report on The "Global Contactless Payment Market Size, Share, and COVID-19 Impact Analysis, By Type (Smartphone-Based Payments, Card Based Payments, Others), By Application (Retail, Transportation, Healthcare, Hospitality, Others), By Technology (Radio Frequency Identification (RFID), Near Field Communication, Host Card Emulation, Others) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2030." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/contactless-payment-market

Contactless payment can be made with a debit card, credit card, near-field communication (NFC), smart card, digital wallet, or QR (quick response) code. By entering their unique PIN, users can use contactless payments to make rapid purchases. Among other industries, the BFSI, retail, IT & telecom, transit, hotel, and government routinely conduct transactions using contactless payments. Contactless payments provide quick and fast money transfers. With contactless payments, customers can now make purchases more swiftly and conveniently, especially for smaller items. Customers opt to tap their card or mobile device rather than carrying cash or laboriously typing their PIN number. Contactless payments are often safer than traditional payment methods because they use cutting-edge encryption technology to protect sensitive financial data. This helps to reduce the likelihood of fraud and other security issues, which benefits customers. NFC-capable gadgets are more expensive than other kinds of readers. An industry will have to spend a significant number of money to adopt, purchase, and maintain linked devices in addition to other equipment if it is willing to invest in new readers or POS terminals that support contactless technology. Even while large and well-established firms have successfully accepted this technology, smaller enterprises may find it difficult to maintain their existing turnover and boost sales while applying it.

COVID-19 Impact

During the projection period, the COVID-19 pandemic played a crucial influence in driving market growth. Contactless payment solutions are becoming more popular as people become more aware of them. In the aftermath of the epidemic, there is a growing demand for contactless payment solutions, which opens up chances for contactless payment adoption. At the same time, numerous suppliers are incorporating contactless payments into their daily operations to provide customers with a safe and secure method of payment.

The smartphone-based payments segment dominates the market with the largest revenue share over the forecast period.

The global contactless payment market is divided into two types of transactions: card-based transactions and smart phone-based transactions. With the greatest revenue share of 30–40% during the anticipated term, the smart phone-based payments sector is leading the industry. The growing use of cellphones for payment purposes by young people around the world is anticipated to provide new industry opportunities. The ability to utilize digital wallets on smartphones to make contactless payments for everyday tasks and activities has increased the use of smartphones. The market is also expected to grow as a result of wearable innovations like payment rings and bands for contactless payments. Additionally, contactless cards are being accepted by more and more shops worldwide. Additionally, by allowing card payments for quick transactions, merchant outlets are focusing on reducing end-user lineups.

The retail segment is witnessing significant CAGR growth over the forecast period.

The global contactless payment market is divided into four categories based on the applications: retail, transit, healthcare, and hospitality. Among them, the retail segment is expected to experience a considerable CAGR increase. The retail industry dominated the market in 2021 and generated around 59.0% of global revenue. This market segment's growth can be attributed to an increase in "tap-and-go" transactions across the globe. The hospitality sector is now using self-service kiosks, which allow customers to pay for goods without dealing with hotel workers. Additionally, because of the various benefits that payment solutions offer—such as great customer satisfaction and rapid, safe transactions—hotels and motels are turning to them.

The Radio Frequency Identification (RFID), segment is expected to hold the largest share of the Global Contactless Payment Market during the forecast period.

The global contactless payment market is divided into three categories based on technology: radio Frequency Identification (RFID), Near Field Communication, and Host Card Emulation. The radio frequency identification (RFID) sector is estimated to account for the majority of the worldwide contactless payment market throughout the forecast period. Customers are mostly concerned about the security of contactless payments due to their ongoing fear of fraud. Businesses are attempting to address these issues by providing secure payment methods that are validated by passcodes.

North America dominates the market with the largest market share over the forecast period.

Get more details on this report -

With a market share of more than 30% during the forecast period, North America is the industry leader. In North America, significant investments are being made in the creation of technologically cutting-edge contactless payment methods like NFCs and RFIDs. However, during the predicted period, Europe is anticipated to grow the fastest. Wearable devices for payments are still growing in popularity in Europe as consumers quickly and readily integrate them into their daily routines. For instance, a wearable with near-field communication (NFC) capabilities, such as a smartwatch, bracelet, or other accessory. Wearables that are both 'active' and 'passive' exist.

Major vendors in the Global Contactless Payment Market include MasterCard, Thales, Visa Inc., PayU, Amazon.com, Inc, Giesecke & Devrient GmbH, Apple Inc, PayPal Holdings Inc, American Express Company, Alibaba.com, VeriFone, and among others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2022: Paycor HCM, Inc., Employees could access earned salaries and pay card information using the Paycor wallet, which was made available by a company that provided Human Capital Management software.

- In September 2022: PayPal, Inc. created the PayPal app, a new all-in-one program that offers its users greater financial services. The new PayPal app offers a single dashboard for all user accounts, a wallet page to manage payment methods, and other banking tools to enhance the client experience.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Contactless Payment Market based on the below-mentioned segments:

Contactless Payment Market, Type Analysis

- Smartphone-Based Payments

- Card Based Payments

- Others

Contactless Payment Market, Application Analysis

- Retail

- Transportation

- Healthcare

- Hospitality

- Others

Contactless Payment, Technology Analysis

- Radio Frequency Identification (RFID)

- Near Field Communication

- Host Card Emulation

- Others

Contactless Payment Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?