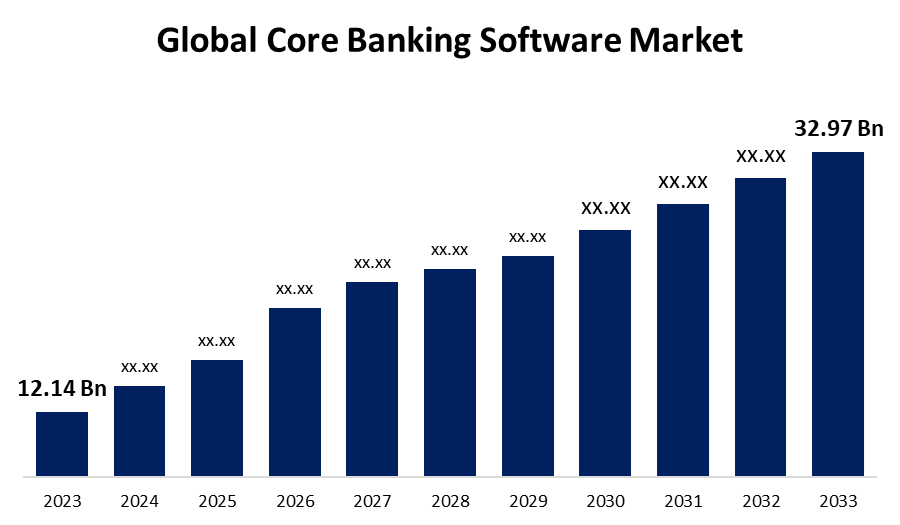

Global Core Banking Software Market Size To Exceed USD 32.97 Billion by 2033 | CAGR of 10.51%

Category: Information & TechnologyGlobal Core Banking Software Market Size To Exceed USD 32.97 Billion by 2033

According to a research report published by Spherical Insights & Consulting, The Global Core Banking Software Market Size is Expected to Grow from USD 12.14 Billion in 2023 to USD 32.97 Billion by 2033, at a CAGR of 10.51% during the forecast period 2023-2033.

Get more details on this report -

Browse key industry insights spread across 234 pages with 110 Market data tables and figures & charts from the report on the "Global Core Banking Software Market Size, Share, and COVID-19 Impact Analysis, By Component (Solution and Service), By Deployment (Cloud and On-premise), By End-use (Banks, Financial Institutions, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/core-banking-software-market

The core banking software market refers to the industry that provides banks and other financial institutions with technical solutions and software so they can manage their core banking functions. These core functions include, for instance, financial reporting, loan management, client data management, transaction processing, and account management. With the use of core banking software, banks may enhance customer service, boost productivity, simplify operations, and ensure regulatory compliance. The market growth is driven by the banks are developing rapidly as they adopt modern technologies and digitization. Increased mobile banking and digital payments are boosting the demand for efficient, secure systems. Ongoing technical developments and more client involvement are projected to fuel market expansion. However, the market growth is hindered by the data security, privacy, and operational flexibility hinder the growth of the core banking software market.

The solutions segment accounted for the largest share in 2023 and is estimated to grow at a remarkable CAGR during the forecast period.

Based on the component, the core banking software market is categorized into solutions and services. Among these, the solution segment accounted for the largest share in 2023 and is estimated to grow at a remarkable CAGR during the forecast period. The segmental growth can be attributed to the banks and other financial institutions looking to enhance operations and customer experiences, there is a growing need for core banking solutions. Many institutions are modernizing their infrastructure by integrating cutting-edge technologies to stay competitive. Loan management processes can be streamlined and optimized with the help of core banking technologies.

The on-premises segment accounted for the majority of the share in 2023 and is estimated to grow at a remarkable CAGR during the forecast period.

Based on the deployment, the core banking software market is categorized into cloud and on-premise. Among these, the on-premises segment accounted for the majority of the share in 2023 and is estimated to grow at a remarkable CAGR during the forecast period. The segmental growth can be attributed to the organizations set up an on-premise solution, they assume complete responsibility for integration as well as any risks linked to IT and security. Companies that use legacy platforms often work with IT service providers to fix security risks, reduce operational costs, and retrieve data. It adds more control to the operational infrastructure.

The banks segment held the largest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end use, the core banking software market is categorized into banks, financial institutions, and others. Among these, the banks segment held the largest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth can be attributed to the increasing investments in modern IT infrastructure. By guaranteeing precise data processing and entry, automated systems minimize inaccurate data entry. With access to real-time data and advanced analytics, banks may make data-driven decisions by learning crucial information about consumer preferences, behavior, and financial patterns.

North America is anticipated to hold the largest share of the global core banking software market over the forecast period.

Get more details on this report -

North America is anticipated to hold the largest share of the global core banking software market over the forecast period. The region's thriving telecom and IT industries, the presence of multiple banks dedicated to digital transformation, and the availability of cutting-edge technology that makes availability easier are all factors contributing to the rise. The North American region is known for its early embrace of technology across industries. Major regional banks' growing emphasis on updating vital infrastructure is expected to drive regional growth.

Asia Pacific is estimated to grow at the fastest CAGR of the global core banking software market during the forecast period. The growing number of digital transactions, consumers' increased use of digital technology, and the rising need for safe and scalable core banking technologies all have a significant impact on this market. The arrival of several foreign banking and financial institutions into the unexplored markets of this region is also helping with the expansion.

Major vendors in the global core banking software market are Finastra, Infosys Limited, Capgemini, Fiserv, Inc., Unisys, Oracle Corporation, HCL Technologies Limited, Jack Henry & Associates, Inc., FIS, Temenos AG, and others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Key Market Development

- In February 2025, Al Rayan Bank chose Finastra to provide an innovative, bespoke core banking solution. Al Rayan, one of Qatar's leading banks, is undertaking digital transformation and adopting innovative technologies to provide its clients with increased performance and hassle-free experiences.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global core banking software market based on the below-mentioned segments:

Global Core Banking Software Market, By Component

- Solution

- Service

Global Core Banking Software Market, By Deployment

- Cloud

- On-premise

Global Core Banking Software Market, By End-use

- Banks

- Financial Institutions

- Others

Global Core Banking Software Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?