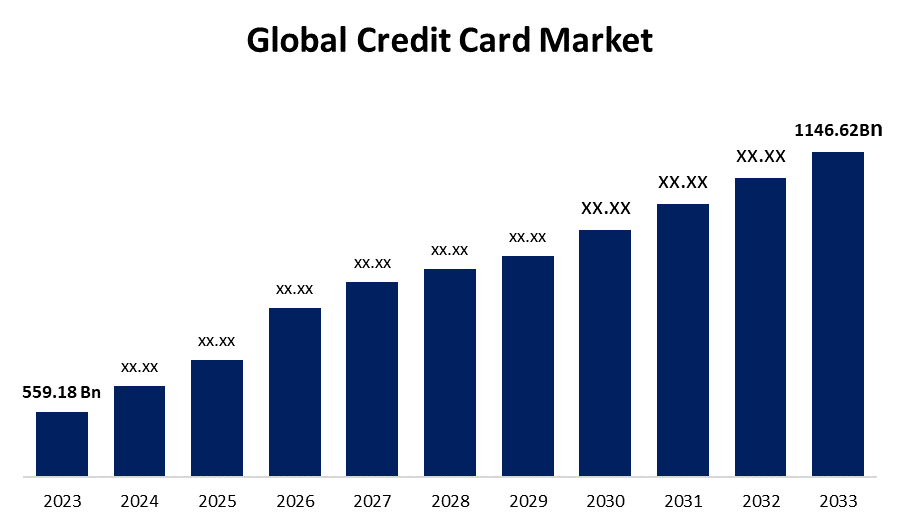

Global Credit Card Market Size To Worth USD 1146.62 Billion By 2033 l CAGR of 7.45%

Category: Banking & FinancialGlobal Credit Card Market Size To Worth USD 1146.62 Billion By 2033

According to a research report published by Spherical Insights & Consulting, the Global Credit Card Market Size is to Grow from USD 559.18 Billion in 2023 to USD 1146.62 Billion by 2033, at a Compound Annual Growth Rate (CAGR) of 7.45% during the projected period.

Get more details on this report -

Browse key industry insights spread across 290 pages with 110 Market data tables and figures & charts from the report on the "Global Credit Card Market Size, Share, and COVID-19 Impact Analysis, By Card Type (General-Purpose Credit Cards, Specialty Credit Cards, and Others), By Application (Food and Groceries, Health and Pharmacy, Consumer Electronics, Media and Entertainment, and Others), By Provider (Visa, Mastercard, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/credit-card-market

A credit card is a small, rectangular piece of plastic or metal received from a bank or another provider of financial services. Credit cardholders can borrow money using their cards to pay for products and services from companies that accept credit cards. Credit cardholders must return all borrowed monies, along with any applicable interest and any other agreed-upon expenses, in full by the billing date or over time. In addition to the standard credit limit, the credit card issuer might offer its customers an additional cash line of credit (LOC). Customers can now access cash advances through ATMs, bank tellers, or credit card convenience checks, enabling them to borrow money. Due to the increased need for convenient cash alternatives and the increased accessibility of more affordable credit cards, the worldwide market for credit card payments is expanding. Additionally, the industry is rising since credit cards are becoming more and more necessary in emerging countries. The credit card payment market is expanding. Furthermore, the increased demand for credit card payments due to customers' increasing emphasis on convenience and flexibility presents a positive outlook for the sector. As a result, the market is growing as more and more customers select secure payment methods. Furthermore, numerous countries with weaker military capabilities buy howitzers for defensive or peacekeeping missions. Furthermore, the increasing popularity of online transactions and the growth of e-commerce activities might be the reasons behind credit card payments' supremacy in the digital world. Customers like credit cards owing to their ease of use, security, and features that protect them as buyers when they shop online across a range of platforms. However, the credit card payment system has significant security vulnerabilities and raises questions about fraud.

The general-purpose credit cards segment is anticipated to hold the greatest share of the global credit card market during the projected timeframe.

Based on the card type, the global credit card market is divided into general-purpose credit cards, specialty credit cards, and others. Among these, the general-purpose credit cards segment is anticipated to hold the greatest share of the global credit card market during the projected timeframe. General-purpose credit cards are versatile assets that allow cardholders to conduct a wide range of transactions. The cards are not restricted to any specific companies or sectors, thus they can be used for traditional offline as well as online transactions. Specified credit limits are often offered with general-purpose credit cards, contingent on the creditworthiness of the cardholder. They are widely accepted in a variety of settings, including shops, eateries, and service providers.

The food and groceries segment is expected to grow at the fastest pace in the global credit card market during the projected timeframe.

Based on the application, the global credit card market is divided into food and groceries, health and pharmacy, consumer electronics, media and entertainment, and others. Among these, the food and groceries segment is expected to grow at the fastest pace in the global credit card market during the projected timeframe. Using credit cards to pay for groceries and dining is common. Customers pay their supermarket and restaurant expenditures with credit cards regularly. For those who keep tabs on home expenses, this category of credit cards is an appealing payment option because it provides points or cashback for purchases made at restaurants, supermarkets, and grocery stores.

The visa segment is projected for the largest revenue share in the global credit card market during the estimated period.

Based on the provider, the global credit card market is divided into visa, mastercard, and others. Among these, the visa segment is projected for the largest revenue share in the global credit card market during the estimated period. Visa is a global payment network that facilitates electronic money transfers and credit card transactions. Visa-branded credit cards are a popular option for both consumers and companies because of their broad acceptance in millions of locations globally. Visa provides a variety of credit card options, including general-purpose, rewards, and co-branded cards with other financial institutions. Visa cards' extensive network and global presence make them a convenient and accessible payment option for clients in a variety of businesses and industries.

North America is expected to hold the largest share of the global credit card market over the forecast period.

Get more details on this report -

North America is expected to hold the largest share of the global credit card market over the forecast period. Owing to reputable merchant banking service providers are present. Furthermore, people are growing more interested in simple and quick ways to make payments. As a result, the sector is growing as a result of advancements in payment processing technology, such as the growing acceptance of contactless and mobile wallet payments. These developments also enhance credit card usage security and convenience.

Europe is predicted to grow at the fastest pace in the global credit card market during the projected timeframe. Due to the growth in loyalty programs, the expansion of credit card reward points offered by companies to increase their market share, and the expanding trend of credit card use among young people in developed countries. Furthermore, many credit card companies are pushing their goods to expand their market share and revenue due to individuals in this region like to pay with cash. This opens up valuable opportunities for the local market.

Major vendors in the Global Credit Card Market include Capital One, Chase, Citibank, Discover, HSBC, ICICI Bank, JPMorgan, Mastercard, MUFG, Santander, SBI Cards, State Farm, and Others.

Recent Developments

- In February 2024, the improved Delta SkyMiles American Express Cards were introduced by American Express and Delta Air Lines to improve travel and provide regular value to consumers and business owners.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Global Credit Card Market based on the below-mentioned segments:

Global Credit Card Market, By Card Type

- General-Purpose Credit Cards

- Specialty Credit Cards

- Others

Global Credit Card Market, By Application

- Food and Groceries

- Health and Pharmacy

- Consumer Electronics

- Media and Entertainment

- Others

Global Credit Card Market, By Provider

- Visa

- Mastercard

- Others

Global Credit Card Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?