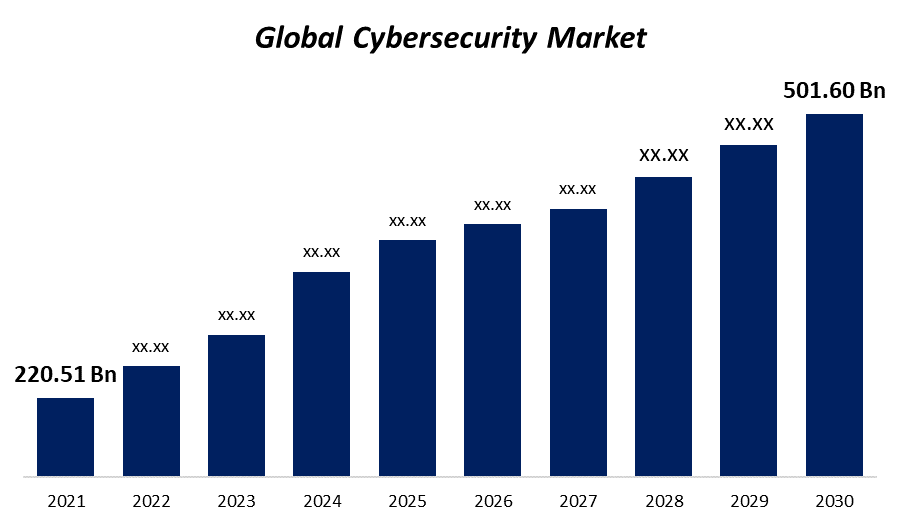

Global Cybersecurity Market Size To Grow USD 501.6 Billion By 2030 | CAGR 11.6%

Category: Information & TechnologyGlobal Cybersecurity Market worth $501.60 billion by 2030

According to a research report published by Spherical Insights & Consulting, the Global Cybersecurity Market Size to grow from USD 220.51 Billion in 2021 to USD 501.60 Billion by 2030, at a Compound Annual Growth Rate (CAGR) of 11.6% during the forecast period.

Get more details on this report -

Browse key industry insights spread across 211 pages with 118 market data tables and figures & charts from the report “Global Cybersecurity Market Size, Share, and COVID-19 Impact Analysis, By Component (Hardware, Software, Services), By Security Type (Endpoint Security, Cloud Security, Network Security, Application Security, Infrastructure Protection, Data Security, Others), By Solution (Unified Threat Management (UTM), IDS/IPS, DLP, IAM, SIEM, DDoS, Risk And Compliance Management, Others), By Services (Professional, Managed), By Deployment (Cloud-Based, On-Premise), By Organization Size (SMEs, Large Enterprises), By Applications (IT & Telecom, Retail, BFSI, Healthcare, Defense/Government, Manufacturing, Energy, Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2021 – 2030“ in detail along with the table of contents. https://www.sphericalinsights.com/reports/cybersecurity-market

These are just a few of the factors driving the market's growth, along with the spread of smart devices, the development of e-commerce platforms, and the increase in cyberattacks. Cyber dangers are expected to change as the use of devices with intelligent and IoT technology increases. Businesses are anticipated to purchase and implement advanced cyber security solutions in order to identify, mitigate, and limit the risk of cyberattacks, supporting the growth of the cybersecurity sector. The growth of e-commerce platforms, the proliferation of smart gadgets, and the increase in cyberattacks are just a few of the factors driving the market's progress. It is anticipated that cyber dangers will change as the use of devices with intelligent and IoT technology increases. It is anticipated that businesses would purchase and implement advanced cyber security solutions to identify, mitigate, and limit the risk of cyberattacks, which will drive the growth of the cybersecurity sector. Cybersecurity had a little dip in 2020 as a result of the closure of numerous businesses in the first and second quarters. However, the industry started to recover by the end of the second quarter as more companies adopted remote working practises and cyber security solutions. By connecting to private Wi-Fi or anonymous networks while working on personal devices, employees jeopardised the organization's security. To manage and secure the increasing number of endpoint devices and to obtain network threat protection, many businesses adopted cyber security solutions. After the pandemic, it is projected that the industry will continue to grow due to the hybrid working trend, which is likely to persist into the future. Numerous employees are expected to continue working from home or other remote places due to the expanding BYOD trend. Businesses can automate their IT security thanks to the development of security solutions utilising AI and machine learning by cybersecurity companies. These solutions allow IT organisations to track malicious behaviours and strategies with less time and effort by enabling automated threat identification. These technologies include real-time monitoring, emergent threat detection, and autonomous response. By allowing the security teams to examine the breach information that has been filtered and to recognise and respond to cyberattacks, this minimises the cost of security incident response.

The Services segment holds the largest revenue share over the forecast period.

Based on the component, the global cybersecurity market is segmented into Hardware, Software, Services. Among these, the services segment holds the largest revenue share over the forecast period. This may be a result of the increased demand for maintenance and upgrade services as well as consultancy services from small and medium-sized organisations. Smaller teams and limited resources force SMEs to routinely consult with other companies before putting any suggestions into practise. Additionally, the pandemic epidemic increased the need for cyber security services as several companies sought to enhance their network and IT security, control remote workers, and protect themselves from threats from unsecured networks and devices.

The Infrastructure segment holds the largest market share over the forecast period.

On the basis of security type, the global cybersecurity market is segmented into Endpoint Security, Cloud Security, Network Security, Application Security, Infrastructure Protection, Data Security, Others. Among these, the infrastructure segment holds the largest market share over the forecast period. The rise of IoT and connected devices, as well as the expansion of data centres, are factors in the sizeable market share. Additionally, a number of programmes established by governments in some regions, such the Critical Infrastructure Protection Program in the United States and the European Programme for Critical Infrastructure Protection (EPCIP), are predicted to boost market expansion.

The IAM segment accounts the largest market share over the forecast period.

Based on the solution segment, the global cybersecurity market is segmented into Unified Threat Management (UTM), IDS/IPS, DLP, IAM, SIEM, DDoS, Risk and Compliance Management, Others. Among these, the IAM segment accounts the largest market share over the forecast period. Due to the increase in mobile endpoint devices, which put the business at risk of cyberattacks and data breaches, the high market share is to blame. Additionally, it is projected that the increasing need to control user access to essential information during the epidemic will promote market growth. The need to automate, monitor, and track end-user actions and security incidents is also anticipated to have an impact on the adoption of IAM solutions.

The Managed Service segment is witnessing the highest growth rate over the forecast period.

On the basis of service, the global cybersecurity market is segmented into professional services, managed services. Among these, the managed service segment is witnessing the highest growth rate over the forecast period. The significant growth rate could be attributed to the increased demand for outsourced IT security services that are used to monitor and manage security protocols. Managed services provide a more affordable option to internal teams handling the responsibility for the organization's IT security. The use of managed services will increase as managed service providers exclusively concentrate on recognising threat trends and strengthening security protocols in order to lower the chance of cyberattacks.

The Cloud based segment is witnessing the highest CAGR over the forecast period.

Based on the deployment, the global cybersecurity market is segmented into cloud based, on-premise. Among these, the cloud based segment is witnessing the highest CAGR over the forecast period. The rapid increase of cloud infrastructure deployment and the corporate migration of on-premises solutions to the cloud can be attributed to the growth. The ease, affordability, and speed of administration and update of cloud-based security systems is another important aspect that is expected to boost market progress. The ability to access solutions remotely from various devices thanks to cloud deployment is anticipated to further enhance the segment's growth.

The SMEs segment is witnessing the highest growth rate over the forecast period.

On the basis of organization size, the global cybersecurity market is segmented into SMEs, Large Enterprises. Among these, the SMEs segment is witnessing the highest growth rate over the forecast period. Small and medium-sized enterprises are more susceptible to cyberattacks with a low level of security because of budgetary constraints. Additionally, the absence of security policies and personnel competencies is one of the main factors contributing to the growth in cyberattacks against SMEs. As a result, it is anticipated that the requirement to secure IT assets and lower operational and data breach costs would be a driving force behind adoption among SMEs.

The Defence segment holds the highest market share over the forecast period.

Based on application, the global cybersecurity market is segmented into IT & Telecom, Retail, BFSI, Healthcare, Defense/Government, Manufacturing, Energy, Others. Among these, the Defence segment holds the highest market share over the forecast period. Government and defence firms constantly face a security danger from state-sponsored hacktivists because of the sensitive information they possess. As a result, a large number of governments worldwide are investing heavily in strengthening their nations' cyber security, which ultimately aids in the segment's growth.

Get more details on this report -

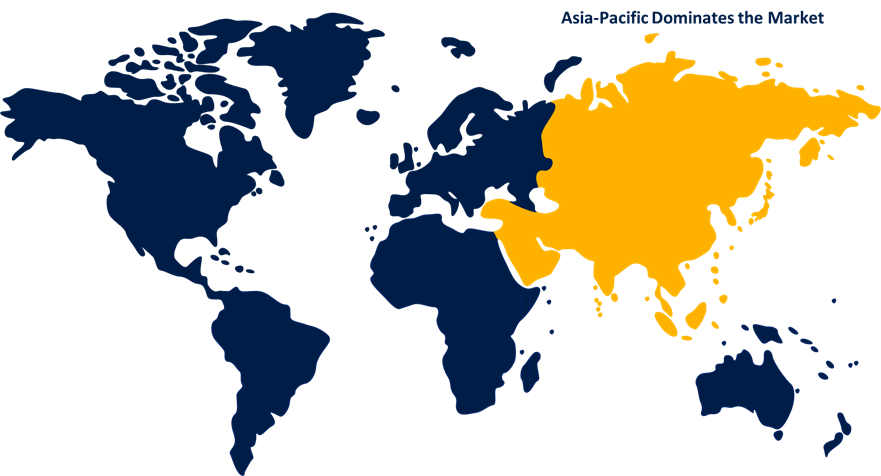

Asia Pacific segment is witnessing the highest CAGR over the forecast period.

The Asia-Pacific region is expanding for a variety of reasons, including the widespread usage of cloud technologies, the proliferation of IoT devices, and the surge in data centre development. The region's large working population also uses a lot of endpoint devices and generates a lot of data, which is why many companies are implementing cyber security measures. Increasing government and defence sector spending in countries like China, India, Japan, South Korea, and others to defend themselves against cyberwarfare is also projected to fuel market growth.

Major vendors in the Global Cybersecurity Market Cisco Systems, Inc., Palo Alto Networks, McAfee, Inc., Broadcom, Trend Micro Incorporated, CrowdStrike, Check Point Software Technology Ltd., Fortinet, Inc., Juniper Networks, Inc., Palo Alto Networks, Inc., IBM, F5 Networks, Inc. , FireEye, Inc. , Splunk Inc. , Symantec Corporation, Oracle, Microsoft Corporation , Intel, Imperva Inc, CyberArk Software Ltd., RSA Security LLC.

List of Key Companies

- Cisco Systems, Inc.

- Palo Alto Networks

- McAfee, Inc.

- Broadcom

- Trend Micro Incorporated

- CrowdStrike

- Check Point Software Technology Ltd.

- Fortinet, Inc.

- Juniper Networks, Inc.

- Palo Alto Networks, Inc.

- IBM

- F5 Networks, Inc.

- FireEye, Inc.

- Splunk Inc.

- Symantec Corporation

- Oracle

- Microsoft Corporation

- Intel

- Imperva Inc

- CyberArk Software Ltd.

- RSA Security LLC

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2030. Spherical Insights has segmented the global Cybersecurity market based on the below-mentioned segments:

Cybersecurity Market, By Component

- Hardware

- Software

- Services

Cybersecurity Market, By Security Type

- Endpoint Security

- Cloud Security

- Network Security

- Application Security

- Infrastructure Protection

- Data Security

- Others

Cybersecurity Market, By Solution

- Unified Threat Management (UTM)

- IDS/IPS

- DLP

- IAM

- SIEM

- DDoS

- Risk And Compliance Management

- Others

Cybersecurity Market, By Services

- Professional

- Managed

Cybersecurity Market, By Deployment

- On-Premise

- Cloud Based

Cybersecurity Market, By Organization Size

- SMEs

- Large Enterprises

Cybersecurity Market, By Application

- IT & Telecom

- Retail

- BFSI

- Healthcare

- Defense/Government

- Manufacturing

- Energy

- Others

Cybersecurity Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?