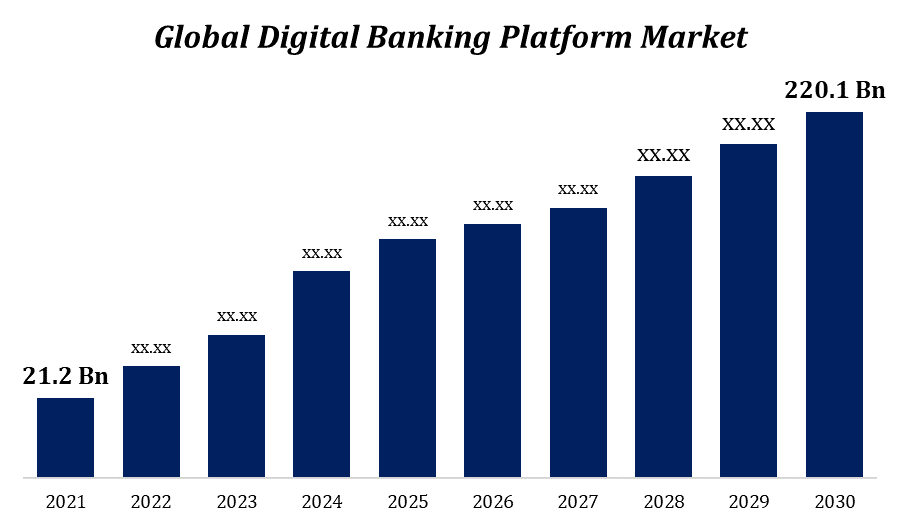

Global Digital Banking Platform Market Size to grow USD 220.1 Billion by 2030 | CAGR of 29.7%

Category: Banking & FinancialGlobal Digital Banking Platform Market worth $220.1 billion by 2030

According to a research report published by Spherical Insights & Consulting, the Global Digital Banking Platform Market Size to grow from USD 21.2 billion in 2021 to USD 220.1 billion by 2030, at a Compound Annual Growth Rate (CAGR) of 29.7% during the forecast period. The digital banking platform market has been growing owing to the widespread digitalization in the financial sector. It is expected to drive the demand for Digital Banking as it enables users with tech-enabled analytics offered by Digital Banking for investment consultations.

Get more details on this report -

Browse key industry insights spread across 207 pages with 180 market data tables and figures & charts from the report "Global Digital Banking Platform Market Size, Share, and COVID-19 Impact Analysis, By Deployment (On-Premise and Cloud), By Mode (Online Banking and Digital Banking), By Component (Platforms and Services), By Service (Platform segment and Managed Service), By Type (Retail Banking, Corporate Banking and Investment Banking) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2021 – 2030 in detail along with the table of contents. https://www.sphericalinsights.com/reports/digital-banking-platform-market

View a detailed Table of Content here–

The COVID-19 pandemic has made an adverse impact on credit portfolios. There has been an unprecedented rise in unemployment and disruption in economic activity, putting a strain on the solvency of customers and companies. Central banks have taken a proactive approach by injecting liquidity into the market by lowering interest rates and asset purchase programs. Managing and monitoring credit, market, liquidity, and operational risk across financial markets were hard enough with ongoing geopolitical tensions, international trade wars, and the occasional hurricanes and earthquakes. The current pandemic situation has forced chief risk officers and their teams to recalibrate old assumptions and models used to manage and monitor risk. COVID-19’s global impact has shown that interconnectedness plays an important role in international cooperation. As a result, many governments started rushing toward identifying, evaluating, and procuring reliable solutions powered by AI.

The On- Premise segment to account for the largest market size during the forecast period

Based on the deployment, The digital banking platform market is divided into On-Premise and Cloud. The on- premise segment accounts for the largest market size during the forecast period. Many customers choose the on-premise solution because it is safer than using cloud software. Additionally, because the software is installed and only utilized on the user's network, security and IT employees have direct access to it. The staff has full control over its management, security, and configuration. Adoption of SaaS and the cloud will be essential to inclusive banking's success in the future. The difficulties of the inclusive banking environment are greatly mitigated by the advantages of cloud computing and software as a service for underserved communities. The COVID-19 crisis's impact on financial stability made cloud and SaaS technology appealing to the developed world as well.

The online banking segment to hold a higher CAGR during the forecast period

Based on the mode, The digital banking platform market is divided into Online Banking and Mobile Banking. The online banking segment to hold higher CAGR during the forecast period. Online banking is the most recent technique for providing retail financial services. Inter-account transfers, balanced reporting, and other typical retail banking duties are just a few of the features that are included in online banking. Customers utilize these services so they may do tasks like making information requests and paying bills over a telecommunications network without having to leave their homes or places of business.

The platform segment to hold a higher CAGR during the forecast period

Based on the Component, the Digital Banking Platform market is divided into Platforms and Service. The platform segment to hold higher CAGR during the forecast period. With the introduction of fintech, when tech corporate giants began enforcing reforms and developing new platforms for conducting business, banks have been pursuing digital transformation. To meet client needs and proactively launch new products, banks are now embracing digital technology and fully capitalizing on these advances. The advancement of financial services to the cloud is providing the opportunity to develop and reinforce a customer-centric strategy lowering obstacles to entry into the sector and expanding access to banking solutions. Additionally, it's opening possibilities for brand-new service packages that may take advantage of scale, data, and technology. Hence, there can be faster and easier access to data for ensuring regulatory reports, mitigation of risks, and identifying abnormalities in risk management.

The managed services segment to hold a higher CAGR during the forecast period

Based on the Service, the digital banking platform market is divided into professional Services and Managed Services. The managed services segment to hold higher CAGR during the forecast period. Managed data center services can improve business management and increase business automation to help organizations run more efficiently in a hybrid IT environment. The utilization of managed security services in end-use industries is anticipated to rise as the frequency of cyberattacks rises.

Get more details on this report -

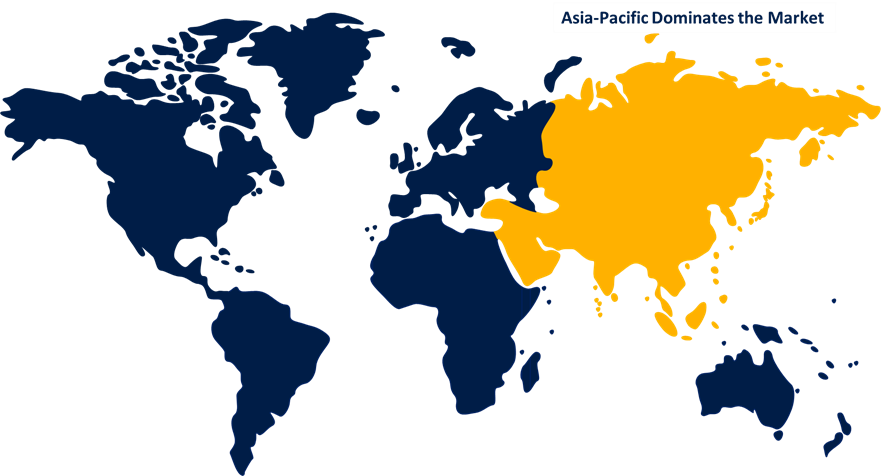

Asia- Pacific is estimated to account for the highest market share in 2021.

- The Global Digital Banking Platform Market has been segmented into five major regions: Asia-Pacific, Europe, APAC, Latin America, and MEA. The regional market development can be attributed to the growing awareness among consumers of the benefits of using automated financial assistance for savings and investments. The efforts being opted by several firms across the Asia Pacific to promote the use of Digital Banking Platform are also expected to contribute to the regional growth. For instance, in July 2021, TradeSmart, one of India's leading new-age online discount brokerage firms, announced its partnership with Modern Algos to offer advisory services powered by AI. This platform is equipped with AI to provide users with an efficient order management system. It employs in-depth insights based on algorithms ensuring they have the suitable customized advisory based on their age, investment, and future goals. North America to hold a higher CAGR during the forecast period.

Major vendors in the Global Digital Banking Platform Market include Appway AG, Alkami Technology Inc., Finastra, Fiserv, Inc., Crealogix AG, Temenos, Urban FT Group, Inc., Q2 Software, Inc., Sopra

Banking Software, Tata Consultancy Service

Related Report:

Data Center Equipment Market Size, Forecast 2030

https://www.sphericalinsights.com/reports/data-center-equipment-market

Extended Warranty Market Size, Forecast 2030

https://www.sphericalinsights.com/reports/extended-warranty-market

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?