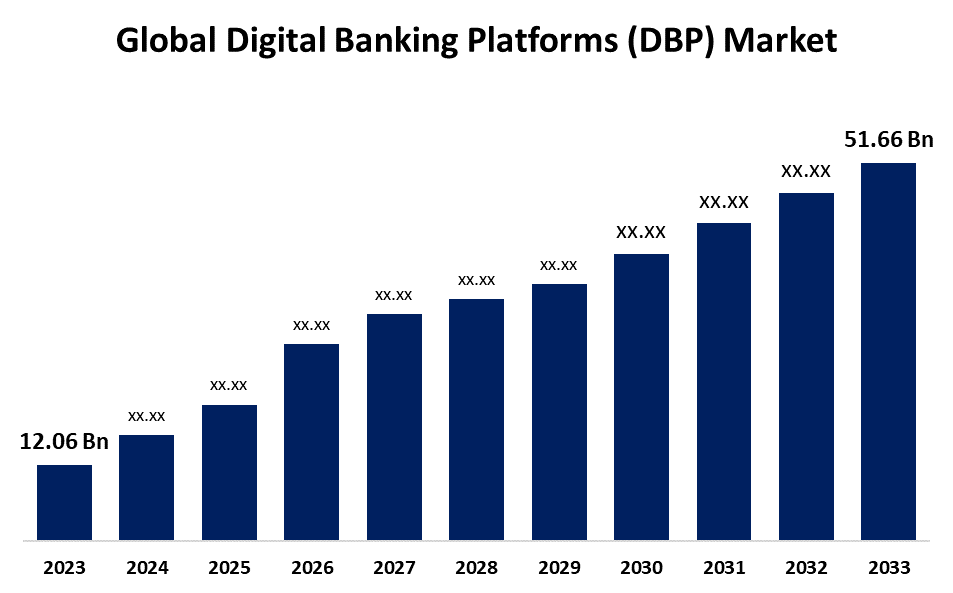

Global Digital Banking Platforms (DBP) Market Size To Exceed USD 51.66 Billion By 2033 | CAGR of 15.66%

Category: Banking & FinancialGlobal Digital Banking Platforms (DBP) Market Size To Exceed USD 51.66 Billion By 2033

According to a research report published by Spherical Insights & Consulting, the Global Digital Banking Platforms (DBP) Market Size is Expected to Grow from USD 12.06 Billion in 2023 to USD 51.66 Billion by 2033, at a CAGR of 15.66% during the forecast period 2023-2033.

Get more details on this report -

Browse key industry insights spread across 214 pages with 110 Market data tables and figures & charts from the report on the "Global Digital Banking Platforms (DBP) Market Size, Share, and COVID-19 Impact Analysis By Components (Platforms and Services), By Banking Type (Retail Banking, Corporate Banking, and Investment Banking), By Deployment Mode (On-Premises and Cloud), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033." Get Detailed Report Description Here:https://www.sphericalinsights.com/reports/digital-banking-platforms-dbp-market

The digital banking platforms (DBP) market refers to a technology solution that allows banks and financial institutions to provide a variety of banking services. These platforms offer a centralized, integrated environment for managing customer accounts, transactions, payments, loans, and other financial services securely and efficiently without the requirement of physical branch visits. The market for digital banking platforms is picking up pace because of the rising need among banks for providing improved customer experience and enhanced use of cloud-based solutions by financial institutions. Moreover, customer demands change, banks are looking for means of offering more personalized and user-friendly banking solutions. Furthermore, the emergence of neo-banks and digital-only banks creates an opportunity for traditional banks to go for digital banking platforms and remain competitive in the increasingly dynamic banking environment. However, the dynamic nature of the regulatory environment poses a challenge to banks in maintaining compliance with numerous regulations and standards. Having to regularly upgrade and enhance digital banking platforms in order to satisfy regulatory requirements is expensive and time-consuming, and may jeopardize the expansion of the DBP market.

The platforms segment accounted for a significant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period.

Based on component, the global digital banking platforms (DBP) market is divided into platforms and services. Among these, the platforms segment accounted for a significant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. The growth is driven by the advancements in road sweepers, including the incorporation of automatic sweeping systems and dust control systems, which are further enhancing their uptake.

The retail banking segment held the largest share of the market in 2023 and is projected to grow at a substantial CAGR during the forecast period.

Based on banking type, the digital banking platforms (DBP) market is segmented into retail banking, corporate banking, and investment banking. Among these, the retail banking segment held the largest share of the market in 2023 and is projected to grow at a substantial CAGR during the forecast period. The growth is attributed to most channels, financial institutions are transforming their process of operations to offer customers superior services and enhance their account management.

The cloud segment accounted for the biggest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on deployment mode, the global digital banking platforms (DBP) market is categorized into on-premises and cloud. Among these, the cloud segment accounted for the biggest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth is due to increases in cloud computing and the growing availability of secure and trustworthy cloud services. Banks are increasingly aligning themselves with cloud providers as a way of tapping into their resources and capabilities.

North America is expected to hold the majority share of the global digital banking platforms (DBP) market during the forecast period.

Get more details on this report -

North America is expected to hold the majority share of the global digital banking platforms (DBP) market during the forecast period. North America dominates the market due to the high penetration of digital banking solutions and the increasing demand for personalized banking experiences. Additionally, the strong regulatory environment in the region and the availability of technology-savvy consumers are also fueling the use of digital banking platforms.

Asia-Pacific is anticipated to grow at the fastest pace in the global digital banking platforms (DBP) market during the forecast period. The market is driven by the strong adoption rate of digital technologies, particularly in emerging markets like Singapore, Australia, India, China, and Japan, which have transformed APAC into a profitable market in the IT sector. Moreover, government campaigns such as India's Digital India initiative are creating a supportive environment for digital banking solution adoption.

Major vendors in the global digital banking platforms (DBP) market are Finastra, Oracle Corporation, SAP SE, Tata Consultancy Services (TCS), Infosys Limited, FIS Global, Fiserv, Inc., Appway, Backbase, EdgeVerve Systems Limited, Intellect Design Arena, Kony, Inc., Q2Software, and Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In July 2024, 10x Banking, the cloud-native core banking platform, launched a new category of core technology – a 'meta core' to enable banks and financial services to accelerate towards complete transformation

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the digital banking platforms (DBP) market based on the below-mentioned segments:

Global Digital Banking Platforms (DBP) Market, By Component

- Platforms

- Services

Global Digital Banking Platforms (DBP) Market, By Banking Type

- Retail Banking

- Corporate Banking

- Investment Banking

Global Digital Banking Platforms (DBP) Market, By Deployment Mode

- On-Premises

- Cloud

Global Digital Banking Platforms (DBP) Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?