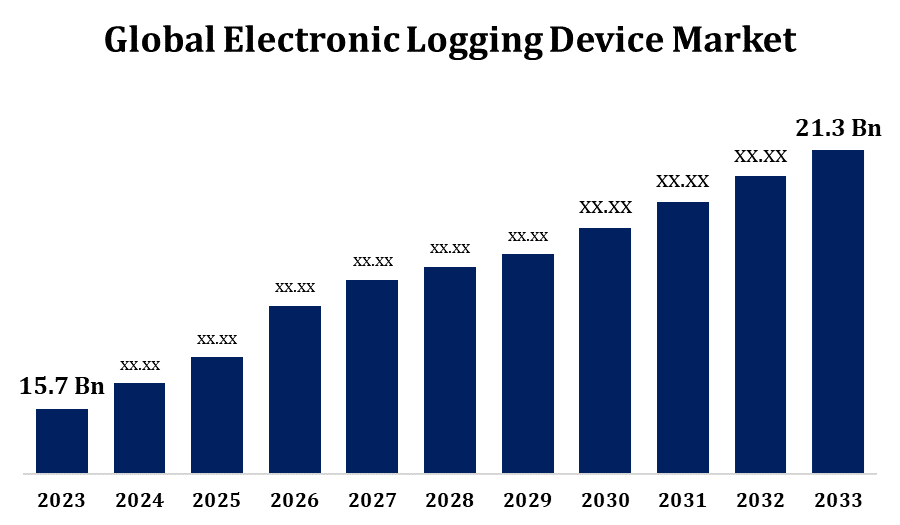

Global Electronic Logging Device Market Size Worth USD 21.3 Billion By 2033 | CAGR of 3.10%

Category: Automotive & TransportationGlobal Electronic Logging Device Market Size Worth USD 21.3 Billion By 2033

According to a research report published by Spherical Insights & Consulting, the Global Electronic Logging Device Market Size to grow from USD 15.7 billion in 2023 to USD 21.3 billion by 2033, at a Compound Annual Growth Rate (CAGR) of 3.10% during the forecast period.

Get more details on this report -

Browse key industry insights spread across 220 pages with 95 Market data tables and figures & charts from the report on the "Global Electronic Logging Device Market Size, Share, and COVID-19 Impact Analysis, by Component (Display, Telematics unit), by Form factor (Embedded, Integrated), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/electronic-logging-device-market

The Electronic Logging Device market is growing steadily, driven by regulatory requirements, improved fleet management, and the increasing adoption of digital solutions in transportation. Electronic Logging Devices (ELDs) streamline hours-of-service (HOS) tracking, ensuring compliance with safety regulations such as the U.S. FMCSA ELD mandate. Market growth is fueled by rising demand for real-time vehicle tracking, data analytics, and fuel management solutions. Leading companies include Geotab, Omnitracs, Samsara, and Verizon Connect. Small and mid-sized fleets are embracing cost-effective cloud-based ELD solutions. However, challenges such as cybersecurity risks and resistance from traditional fleet operators persist. Advancements in AI and telematics integration are expected to further expand the market. While North America leads in adoption, Asia-Pacific and Europe are witnessing increasing growth.

Electronic Logging Device Market Value Chain Analysis

The Electronic Logging Device market value chain consists of several key stages, from component suppliers to end users. It begins with hardware and software providers that supply GPS modules, sensors, cloud computing, and telematics solutions. Device manufacturers integrate these components into Electronic Logging Devices (ELDs) with user-friendly interfaces. Software developers design fleet management platforms for real-time monitoring, compliance tracking, and data analytics. System integrators ensure seamless connectivity between ELDs, fleet management systems, and regulatory databases. Distributors and resellers deliver ELDs to fleet operators, trucking companies, and independent drivers. End users, such as logistics firms, transport operators, and regulatory agencies, leverage ELDs for compliance, safety, and operational efficiency. AI, IoT, and cloud-based innovations continue to drive automation and enhance data-driven decision-making across the value chain.

Electronic Logging Device Market Opportunity Analysis

The Electronic Logging Device market offers significant growth opportunities, driven by regulatory requirements, technological advancements, and increasing demand for fleet efficiency. The rising adoption of Electronic Logging Devices (ELDs) among small and medium-sized fleets presents a key growth avenue, with cost-effective, cloud-based solutions becoming more accessible. The integration of artificial intelligence, IoT, and telematics enhances predictive analytics, fuel optimization, and real-time tracking, adding value for fleet operators. The expansion of e-commerce and logistics further fuels market demand. Emerging markets in Asia-Pacific and Latin America present untapped potential as transportation regulations evolve and digital transformation accelerates. Additionally, collaborations between ELD providers and vehicle manufacturers create new revenue streams. Overcoming cybersecurity risks and resistance to adoption will be crucial for continued market expansion.

The increasing adoption of fleet management systems to improve regulatory compliance is a key factor driving growth in the Electronic Logging Devices (ELD) market. With stringent government regulations mandating accurate hours-of-service (HOS) tracking, fleet operators are integrating ELDs with advanced management solutions. These systems enhance compliance by automating recordkeeping, minimizing human errors, and enabling real-time data monitoring. Additionally, they boost operational efficiency through GPS tracking, fuel optimization, and predictive maintenance. Small and mid-sized fleets are turning to cloud-based ELD solutions for affordability and scalability. The rise of IoT, AI-powered analytics, and telematics further strengthens compliance efforts while offering valuable insights for fleet managers. As global regulations continue to evolve, the demand for integrated fleet management and ELD solutions is expected to expand further.

High upfront costs and recurring subscription fees can be a challenge, especially for small and medium-sized fleet operators. Resistance from traditional drivers and fleet managers also hinders adoption, as some view Electronic Logging Devices (ELDs) as intrusive or difficult to use. Cybersecurity threats present another concern, as ELDs handle sensitive data that may be vulnerable to hacking. Technical challenges, including device malfunctions, connectivity issues in remote areas, and software compatibility problems, can affect reliability. Additionally, the constantly evolving regulatory landscape across different regions creates compliance complexities for multinational fleet operators, requiring continuous adaptation to new standards.

Insights by Form Factor

The embedded segment accounted for the largest market share over the forecast period 2023 to 2033. Unlike bring-your-own-device (BYOD) solutions, embedded ELDs are permanently installed in vehicles, minimizing tampering risks and ensuring compliance with hours-of-service (HOS) regulations. These systems provide greater durability, real-time data transmission, and improved integration with fleet management software, making them the preferred choice for large fleets. The growing adoption of smart transportation, AI-powered analytics, and IoT-driven telematics is further accelerating demand. Additionally, regulatory authorities worldwide are promoting the use of secure, tamper-proof ELD solutions, driving market growth.

Insights by Component

The telematics unit segment accounted for the largest market share over the forecast period 2023 to 2033. The growth is fueled by rising demand for real-time fleet monitoring, regulatory compliance, and data-driven decision-making. These units incorporate GPS, IoT, and AI-powered analytics to improve route optimization, fuel efficiency, and driver safety. With government mandates enforcing accurate hours-of-service (HOS) tracking, fleet operators are increasingly adopting telematics-based ELDs for automated logging and compliance. The expansion of connected vehicles, smart logistics, and cloud-based fleet management solutions is further driving adoption. Additionally, the growth of e-commerce and long-haul transportation is boosting demand for advanced telematics units.

Insights by Region

Get more details on this report -

North America is anticipated to dominate the Electronic Logging Device Market from 2023 to 2033. The Federal Motor Carrier Safety Administration (FMCSA) ELD mandate, requiring commercial motor vehicle operators to use Electronic Logging Devices (ELDs) for hours-of-service (HOS) compliance, has been a key driver of market growth. The U.S. and Canada lead in ELD adoption, while Mexico is seeing increased interest due to evolving transportation regulations. Advancements in AI-driven analytics, IoT integration, and cloud-based fleet management systems further accelerate market expansion. Leading companies such as Samsara, Geotab, Omnitracs, and Verizon Connect provide advanced solutions to enhance fleet efficiency, compliance, and safety.

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Australia, China, India, and Japan are tightening regulatory frameworks to improve road safety and ensure accurate hours-of-service (HOS) tracking for commercial drivers. Governments are implementing stricter mandates for Electronic Logging Devices (ELDs) to combat driver fatigue, reduce accidents, and enhance operational transparency. In Australia, the National Heavy Vehicle Regulator (NHVR) is driving ELD adoption, while China is integrating ELDs into its expanding smart transportation network. India’s growing logistics sector and evolving transport regulations are increasing demand for digital fleet management solutions. Meanwhile, Japan is utilizing telematics and AI to enhance compliance and efficiency. The rapid growth of e-commerce and logistics is driving demand for real-time tracking, automated reporting, and data-driven insights. Advancements in AI, IoT, and cloud-based fleet management systems continue to accelerate ELD adoption across the region.

Recent Market Developments

- In March 2024, Geotab, a prominent ELD provider, has joined forces with Daimler Trucks North America to integrate its MyGeotab platform into Daimler trucks. This partnership seeks to improve data connectivity and streamline fleet management for trucking companies.

Major players in the market

- Geotab Inc.

- Verizon Connect

- Wabco Holdings Inc.

- Omnitracs

- KeepTruckin

- EROAD

- Coretex Telematics

- GPS Insight

- Samsara Inc.

- Fleetmatics

- Eflow

- BigRoad

- Azuga

- Teletrac Navman

- Roadtec Solutions

- Macmit LLC

- Logit Systems Inc.

- Gurtam

- Onfleet

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Electronic Logging Device Market, Component Analysis

- Display

- Telematics unit

Electronic Logging Device Market, Form Factor Analysis

- Embedded

- Integrated

Electronic Logging Device Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?