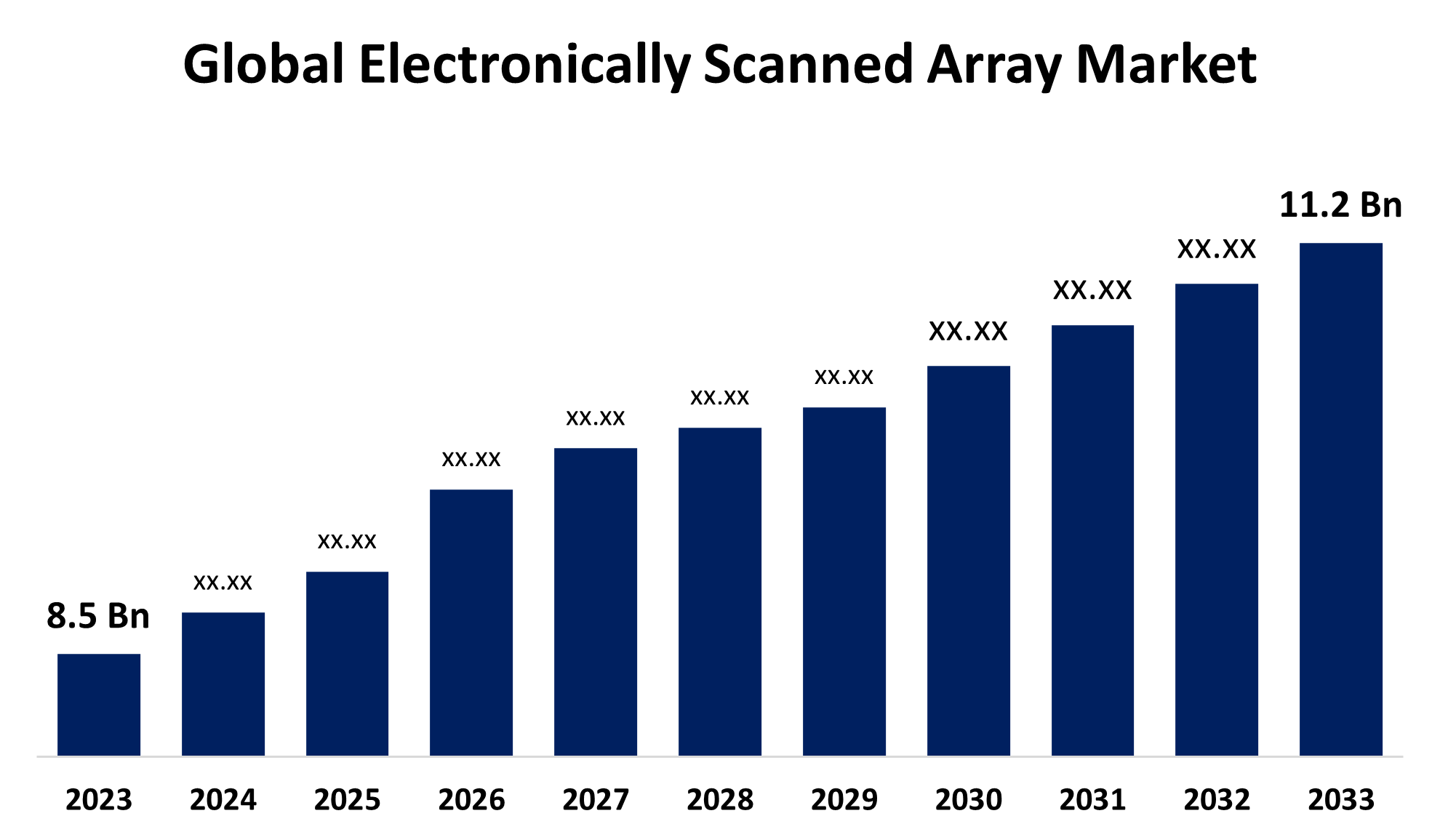

Global Electronically Scanned Array Market Size To Worth USD 11.2 Billion By 2033 | CAGR Of 2.80%

Category: Aerospace & DefenseGlobal Electronically Scanned Array Market Size To Worth USD 11.2 Billion By 2033 | CAGR Of 2.80%

According to a research report published by Spherical Insights & Consulting, the Global Electronically Scanned Array Market Size to grow from USD 8.5 billion in 2023 to USD 11.2 billion by 2033, at a Compound Annual Growth Rate (CAGR) of 2.80% during the forecast period.

Get more details on this report -

Browse key industry insights spread across 201 pages with 114 Market data tables and figures & charts from the report on the "Global Electronically Scanned Array Market Size, Share, and COVID-19 Impact Analysis, by Type (AESA, PESA), by Component (Transceiver module, Phase Shifters, Beamforming Network, Signal Processing Module, Radar Data Processor, Others), by Platform (Air, Marine, Land), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/electronically-scanned-array-market

The Electronically Scanned Array (ESA) market is experiencing strong growth, driven by defense modernization initiatives and rising demand for advanced radar and communication systems. These arrays, including Active Electronically Scanned Arrays (AESA) and Passive Electronically Scanned Arrays (PESA), play a crucial role in military and aerospace applications, enhancing situational awareness and precision targeting. Technological advancements, miniaturization, and artificial intelligence integration are key market drivers. Leading companies such as Northrop Grumman, Raytheon Technologies, and Lockheed Martin are shaping industry developments. The Asia-Pacific region, particularly China and India, is emerging as a significant market due to increased defense spending. However, challenges such as high development costs and complex system integration persist. Future trends emphasize software-defined radar and multi-function capabilities for enhanced performance.

Electronically Scanned Array Market Value Chain Analysis

The Electronically Scanned Array market value chain consists of multiple key stages, from raw material suppliers to end-users. It starts with component suppliers providing semiconductors, transmit/receive modules, and radar processors. Major defense contractors and manufacturers integrate these components into complete radar and communication systems. System integrators then tailor these solutions for military, aerospace, and commercial applications. Distribution channels include direct government contracts, defense procurement agencies, and commercial sales. Primary end-users include defense organizations, the aviation industry, and emerging sectors such as automotive and maritime security. The market is shaped by technological advancements, regulatory policies, and substantial R&D investments. While supply chain disruptions and high production costs pose challenges, trends such as software-defined radar, miniaturization, and AI-driven innovations enhance operational efficiency and drive market growth.

Electronically Scanned Array Market Opportunity Analysis

The Electronically Scanned Array market offers substantial growth opportunities, fueled by rising defense budgets, escalating geopolitical tensions, and advancements in radar technology. Demand for Active Electronically Scanned Arrays (AESA) is increasing due to their superior tracking, jamming resistance, and multi-target capabilities. Expanding applications in commercial aviation, space exploration, and autonomous vehicles further broaden the market potential. The integration of artificial intelligence and software-defined radar systems enhances adaptability, unlocking new business prospects. The Asia-Pacific region, particularly China and India, is emerging as a key market, driven by ongoing defense modernization efforts. Additionally, the transition to lightweight, energy-efficient arrays fosters innovation. While challenges like high costs and complex integration remain, investments in miniaturization and 5G-enabled radar solutions continue to propel market growth.

The growing demand for radar modernization contracts is a major factor driving the expansion of the Electronically Scanned Array market. Defense agencies worldwide are upgrading outdated radar systems with advanced Active Electronically Scanned Arrays (AESA) to improve detection, tracking, and electronic warfare capabilities. This trend is particularly prominent in North America, Europe, and Asia-Pacific, where governments are heavily investing in next-generation military technologies. The commercial sector, including aviation and maritime industries, is also adopting advanced radar systems for enhanced navigation and surveillance. Leading companies such as Raytheon Technologies, Northrop Grumman, and Lockheed Martin continue to secure large-scale radar upgrade contracts. While high costs and integration complexities remain challenges, ongoing advancements in miniaturization, software-defined radar, and AI-driven technologies are fueling market growth.

Despite its rapid expansion, the Electronically Scanned Array market encounters several challenges. High development and production costs create significant entry barriers, particularly for emerging players. Integrating electronically scanned arrays into existing defense and commercial systems is complex and demands specialized expertise, leading to extended deployment timelines. Supply chain disruptions, especially in semiconductor and microelectronics components, affect manufacturing efficiency. Additionally, stringent regulatory policies and export restrictions on advanced radar technology constrain market growth. The need for power-efficient and lightweight solutions pressures manufacturers to innovate while keeping costs manageable. Cybersecurity threats targeting radar and communication systems further add to industry concerns. However, advancements in artificial intelligence, software-defined radar, and miniaturization continue to enhance performance, offering solutions to mitigate these challenges and drive future growth.

Insights by Type

The AESA segment accounted for the largest market share over the forecast period 2023 to 2033. AESA radars provide superior target tracking, electronic warfare capabilities, and strong resistance to jamming, making them the preferred choice for modern military aircraft, naval vessels, and ground-based systems. Rising defense budgets, particularly in the U.S., China, and India, are fueling large-scale procurement and upgrades of AESA-equipped platforms. Additionally, advancements in gallium nitride (GaN) technology are enhancing efficiency and lowering power consumption, further driving adoption. The commercial sector, including aviation and automotive industries, is also incorporating AESA radars for improved surveillance and safety.

Insights by Platform

The air segment accounted for the largest market share over the forecast period 2023 to 2033. Defense forces globally are upgrading fighter jets, unmanned aerial vehicles (UAVs), and airborne early warning and control (AEW&C) aircraft with Active Electronically Scanned Arrays (AESA) to enhance target detection, tracking, and electronic warfare capabilities. Nations such as the U.S., China, and India are making significant investments in next-generation fighter programs equipped with AESA radars. In the commercial sector, electronically scanned arrays are improving air traffic management and weather monitoring. Advances in miniaturization and gallium nitride (GaN)-based technology are further enhancing radar performance while optimizing power consumption.

Insights by Component

The transceiver module segment accounted for the largest market share over the forecast period 2023 to 2033. Market growth is driven by the rising demand for advanced radar and communication systems across defense and commercial sectors. Transceiver modules, crucial for signal transmission and reception, are increasingly integrated into Active Electronically Scanned Array (AESA) and Passive Electronically Scanned Array (PESA) systems to enhance detection, tracking, and jamming resistance. Innovations in semiconductor technologies, particularly gallium nitride (GaN) and gallium arsenide (GaAs), are improving module efficiency, lowering power consumption, and extending operational range. Additionally, the growing deployment of unmanned systems, next-generation fighter jets, and space-based radar systems is further fueling market expansion.

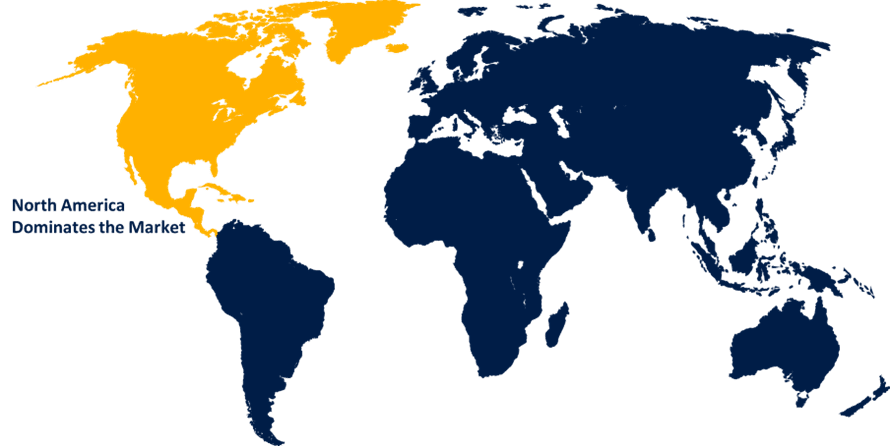

Insights by Region

North America is anticipated to dominate the Electronically Scanned Array Market from 2023 to 2033. The U.S. military is actively modernizing radar systems with Active Electronically Scanned Arrays (AESA) to enhance situational awareness, missile defense, and electronic warfare capabilities. Increased investments in space-based radar, unmanned aerial vehicles (UAVs), and naval surveillance are further driving market demand. In the commercial aviation sector, advanced radar systems are being adopted for air traffic management and weather monitoring. While stringent defense regulations and high R&D costs present challenges, ongoing government funding and private-sector innovation continue to propel technological advancements. The integration of artificial intelligence and 5G-enabled radar technology is expected to play a key role in shaping future market growth.

Get more details on this report -

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. China, India, Japan, and South Korea are making significant investments in advanced radar technologies, particularly Active Electronically Scanned Arrays (AESA), to strengthen air defense, naval surveillance, and electronic warfare capabilities. Regional market growth is further driven by increasing indigenous defense production, supported by government initiatives such as India’s "Make in India" and China's military advancements. The commercial aviation and maritime industries are also integrating electronically scanned arrays to enhance safety and navigation. While high initial costs and complex system integration pose challenges, ongoing R&D, collaborations with global defense firms, and AI-powered radar innovations are expected to accelerate future advancements.

Recent Market Developments

- In January 2024, Thales Goup secures a contract with the French Ministry of Defense to deliver Ground Master 400 AESA radars for air defense, enhancing France’s national security capabilities.

Major players in the market

- Lockheed Martin (US)

- Northrop Grumman (US)

- Leonardo-Finmeccanica (Italy)

- Raytheon (US)

- Saab AB (Sweden)

- Israel Aerospace Industries (Israel)

- Thales Group (France)

- Toshiba (Japan)

- RADA Electronic Industries (Israel)

- Defence Research and Development Organization (India)

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Electronically Scanned Array Market, Type Analysis

- AESA

- PESA

Electronically Scanned Array Market, Component Analysis

- Transceiver module

- Phase Shifters

- Beamforming Network

- Signal Processing Module

- Radar Data Processor

- Others

Electronically Scanned Array Market, Platform Analysis

- Air

- Marine

- Land

Electronically Scanned Array Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?