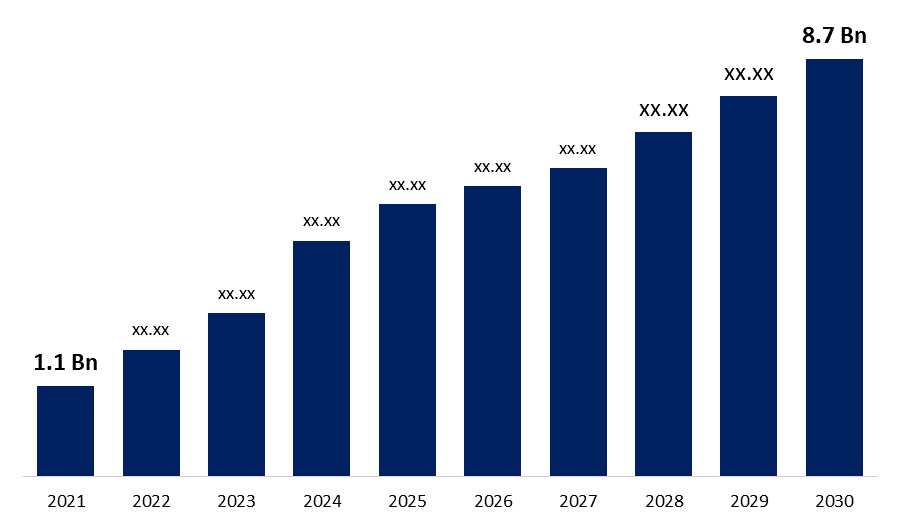

Global FinTech Blockchain Market Size to Grow USD 8.7 Billion by 2030 | CAGR of 43.8%

Category: Information & TechnologyThe Global Market for FinTech Blockchain estimated at USD1.1 Bn in the year 2021, is projected to reach a revised size of USD8.7 Billion by 2030, Growing at a CAGR of 43.8%. as per the latest research report by Spherical Insights & Consulting.

Get more details on this report -

Blockchain technology is transforming operations in a wide range of industries, including finance. Blockchain and fintech are emerging as the most promising technology pairing, with the potential to completely transform the fintech industry. Fintech blockchain, the application of blockchain technology in finance, provides solutions, software, and other fintech blockchain services that businesses may utilize to provide better and more automated financial services. The global fintech blockchain market is expanding because of factors such as faster cross-border payment systems, the need for cheaper, greater compatibility with ecosystems, rising consumer demand for bitcoin ownership and investment, in the financial services industry, and increased demand for comprehensive safety mechanisms.

Browse key industry insights spread across 210 pages with 120 market data tables and figures & charts from the report Global FinTech Blockchain Market Size, Share & Trends, COVID-19 Impact Analysis Report, By Application (Smart Contracts, Exchanges and Remittance, Clearing and Settlements, Identity Management, Compliance Management/KYC, Others), By End-User (Small and Medium Size Enterprises (SMEs), Large Enterprises), By Industry (Banking, Non-Banking Financial, Insurance) : Global Opportunity Analysis and Industry Forecast, 2021 – 2030 in detail along with the table of contents https://www.sphericalinsights.com/reports/fintech-blockchain-market

The rising power of buyers for bitcoins, a larger need for faster, lower cross-border payment systems, greater interoperability with the financial services industry ecosystem, and a growing desire for comprehensive security measures are the primary reasons driving the FinTech blockchain market's rise. However, problems such as ambiguous legal standards and frameworks, as well as the economic depression caused by the COVID-19 epidemic, have posed significant challenges to the FinTech blockchain market's growth.

The market is projected to experience substantial growth throughout the epidemic as many governments establish fintech blockchain facilities. Many industries suffered significant financial losses because of the global epidemic, forcing many to embrace digitization in order to develop resilience. Because the data pushed into supply chains is inaccessible and unreliable, an increasing number of firms are adopting blockchain technology for key financial operations. The pandemic is also fueling expansion in the fintech blockchain market as more individuals work from home, use telebanking services, telemedicine, teleconferencing, and use online and e-commerce payment methods, which will fuel growth in the fintech blockchain industry.

Get more details on this report -

The blockchain provides clear information about transactions, which fosters confidence because the department in charge of confirming the veracity of the claim and determining how much of the claim can be covered is always in need of a reliable repository of data. Because of the rapid growth of technology, such as IoT, the amount of data generated by the numerous linked devices is multiplying, necessitating the use of technology capable of managing a high volume of data. Insurance businesses may manage huge, complicated networks using blockchain by having devices connect and manage each other securely on a peer-to-peer basis, rather than creating an expensive data center to handle the processing and storage load. The cost of having these devices manage themselves is substantially lower than the cost of running a data center, and this is projected to boost the market in the future.

Segmentation:

By Application

- Smart Contracts

- Exchanges and Remittance

- Clearing and Settlements

- Identity Management

- Compliance Management/KYC

- Others

By End-User

- Small and Medium Size Enterprises (SMEs)

- Large Enterprises

By Industry

- Banking

- Non-Banking Financial

- Insurance

Key Players

- Accenture

- Amazon Web Services, Inc.

- Bitfury Group Limited

- BTL

- Chain, Inc.

- Digital Asset Holdings, LLC

- Earthport PLC

- Huawei Technologies Co. Ltd.

- IBM Corporation

- Infosys Limited

- Liquefy Limited

- Microsoft

- Oracle

- RecordesKeeper

- Ripple Labs Inc.

- SAP SE

- Symbiont

- Tata Consultancy Services Limited

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Follow Us: LinkedIn | Facebook | Twitter

Need help to buy this report?