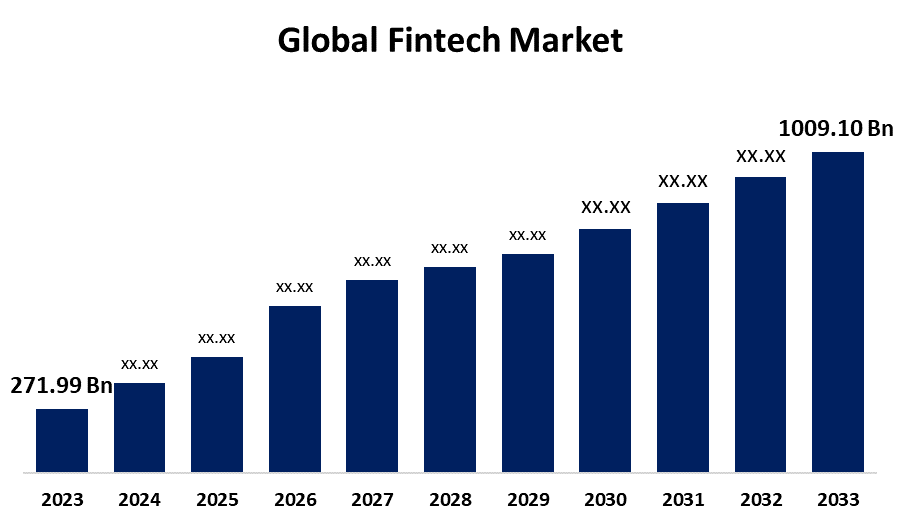

Global Fintech Market Size To Worth USD 1009.10 Billion by 2033 | CAGR Of 14.01%

Category: Banking & FinancialGlobal Fintech Market Size To Worth USD 1009.10 Billion by 2033

According to a research report published by Spherical Insights & Consulting, The Global Fintech Market Size is to Grow from USD 271.99 Billion in 2023 to USD 1009.10 Billion by 2033, at a Compound Annual Growth Rate (CAGR) of 14.01% during the projected period.

Get more details on this report -

Browse key industry insights spread across 230 pages with 110 Market data tables and figures & charts from the report on the "Global Fintech Market Size, Share, and COVID-19 Impact Analysis, By Technology (AI, Blockchain, RPA, and Others), By Application (Fraud Monitoring, KYC Verification, and Compliance and Regulatory Support), By End Use (Banks, Financial Institutions, Insurance Companies, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/fintech-market

The fintech market refers to the connection between financial services and technology. It comprises the use of innovative technologies and digital solutions to provide financial products, services, and processes. Fintech companies’ stimulus expansions in applications such as mobile apps, artificial intelligence, blockchain, data analytics, and cloud computing to dislocate and advance several features of the financial industry. Fintech companies deliver several financial technology facilities, tools, or solutions to other businesses (B2B) as a service. The development of innovative fintech solutions has been made conceivable by progress in artificial intellect, blockchain, cloud computing, and big data analytics. The fintech business is increasing as a result of these advances, which advance financial services' convenience, security, and efficiency. When it comes to financial services and transactions, clients are becoming more and more dependent on digital platforms. Peer-to-peer lending platforms, robo-advisors, and mobile payment apps are examples of fintech industries that have enlarged traction due to customer necessity for easy-to-use, personalized, and manageable financial solutions. However, governing guidelines for fintech industries are frequently complicated and active, and they can differ significantly throughout states. It can be private and time-consuming to satisfy these requirements, precisely for new and smaller industries. Because fintech industries collect private financial data, hackers are drawn to them. To defend against fraud, data breaches, and other security risks, it is domineering to keep up robust cybersecurity measures.

The blockchain segment is anticipated to hold the greatest share of the global fintech market during the projected timeframe.

Based on the technology, the global fintech market is divided into AI, blockchain, RPA, and others. Among these, the blockchain segment is anticipated to hold the greatest share of the global fintech market during the projected timeframe. This is attributed to blockchain delivering an extremely protected and absolute ledger, making it enormously tough for illegal parties to alter or tamper with business information. This improves security in financial transactions, mitigating the risk of fraud and data breaches.

The fraud monitoring segment is anticipated to hold the greatest share of the global fintech market during the projected timeframe.

Based on the application, the global fintech market is divided into fraud monitoring, KYC verification, and compliance and regulatory support. Among these, the fraud monitoring segment is anticipated to hold the greatest share of the global fintech market during the projected timeframe. This is attributed to fintech solutions providing real-time monitoring of financial transactions, enabling the instant exposure of doubtful events or differences. These facilities utilize innovative analytics and machine learning algorithms to recognize patterns and trends related to fraudulent activities, optimizing the accuracy of fraud detection.

The bank segment is predicted to hold the greatest share of the fintech market during the estimated period.

Based on the end-user, the global fintech market is divided into banks, financial institutions, insurance companies, and others. Among these, the bank segment is predicted to hold the greatest share of the fintech market during the estimated period. This is attributed to banks' ability to onboard new customs rapidly and effortlessly, reducing the time and energy essential for account setup. Furthermore, market players are suggestively participating with financial technology-qualified banks to provide modern digital payment solutions, including mobile wallets and contactless payment, which contributes to the segment's development.

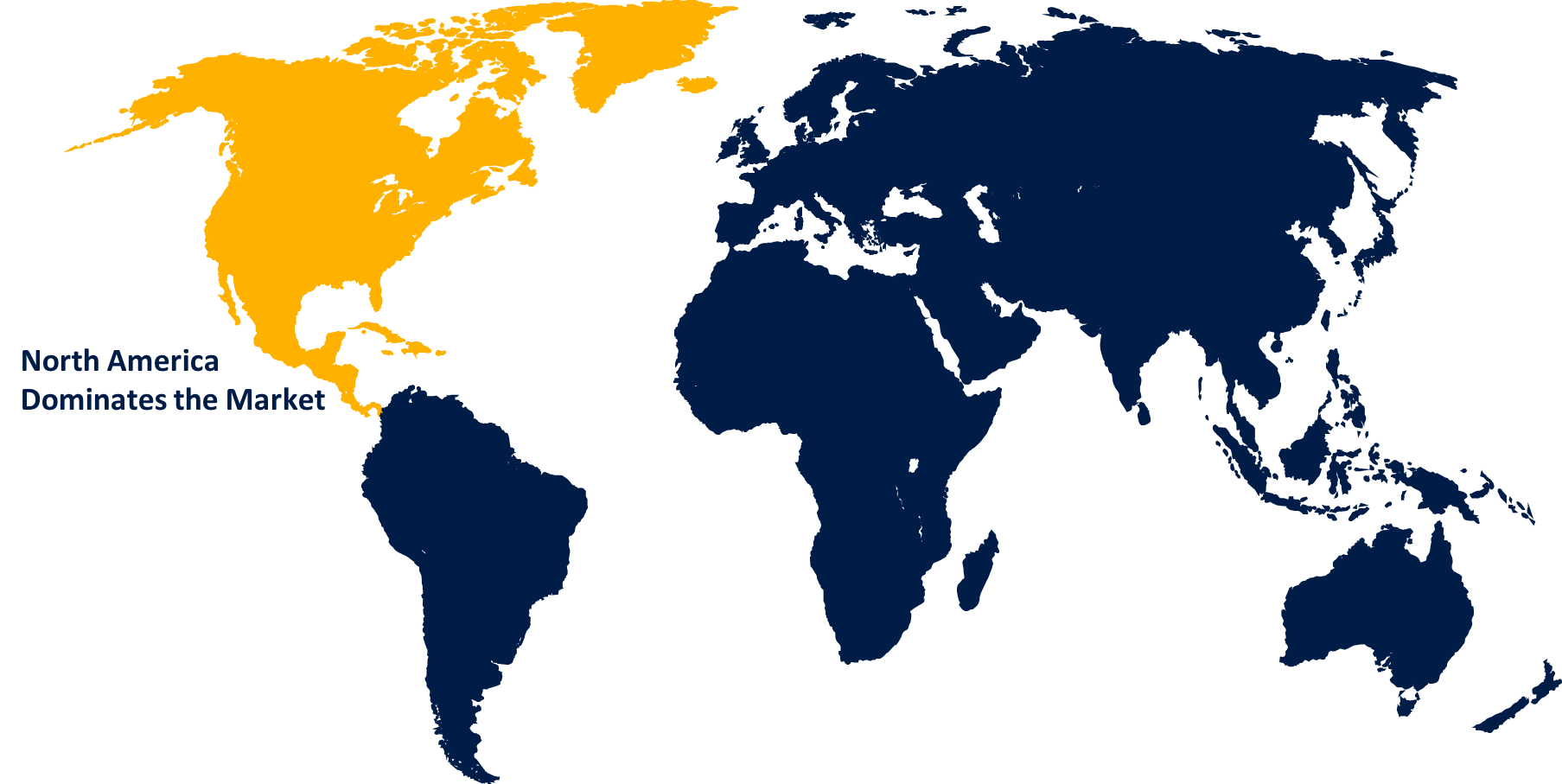

North America is expected to hold the largest share of the global fintech market over the forecast period.

Get more details on this report -

North America is expected to hold the largest share of the global fintech market over the forecast period. This is attributed to North America, mostly Silicon Valley is a global center for fintech innovation. Financial technology stimulates this environment to regulate constant innovation in financial services. The growing demand for customization, regulatory compliance, cross-selling opportunities, and fintech industry trends are some of the crucial factors driving market growth in the region. North America is home to some of the world's foremost financial centers, with New York City and Silicon Valley, which substitute an animated fintech ecosystem. This region boasts a powerful infrastructure, innovative technological abilities, and a highly innovative financial sector, making it an ideal environment for fintech innovation and development.

Asia Pacific is predicted to grow at the fastest pace in the global fintech market during the projected timeframe. This is attributed to fintech services' amplified access to financial products and services, mostly in underserved and unbanked areas of the Asia Pacific region. Frequent countries in the region, such as China, South Korea, Japan, and India are mobile-first markets, and financial technology services deliver high mobile saturation, creation financial services more accessible. Asia-Pacific is profitable over-vigorous growth and growing demand in the fintech market, obsessed with several key factors.

Major vendors in the Global Fintech Market include PayPal Holdings, Inc., Block, Inc., Mastercard Incorporated, Envestnet, Inc., Upstart Holdings, Inc., Rapyd Financial Network Ltd., Solid Financial Technologies, Inc., Railsbank Technology Ltd., Synctera Inc., Braintree, Adyen, Plaid Inc., Neo Mena Technologies Ltd., Finastra, and others.

Recent Developments

- In March 2023, MANGOPAY and PayPal prolonged their long-term strategic partnership to give marketplaces instant access to PayPal's international payment abilities.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Global Fintech Market based on the below-mentioned segments:

Global Fintech Market, By Technology

- AI

- Blockchain

- RPA

- Others

Global Fintech Market, By Application

- Fraud Monitoring

- KYC Verification

- Compliance and Regulatory Support

Global Fintech Market, By End-Use

- Banks

- Financial Institutions

- Insurance Companies

- Others

Global Fintech Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?