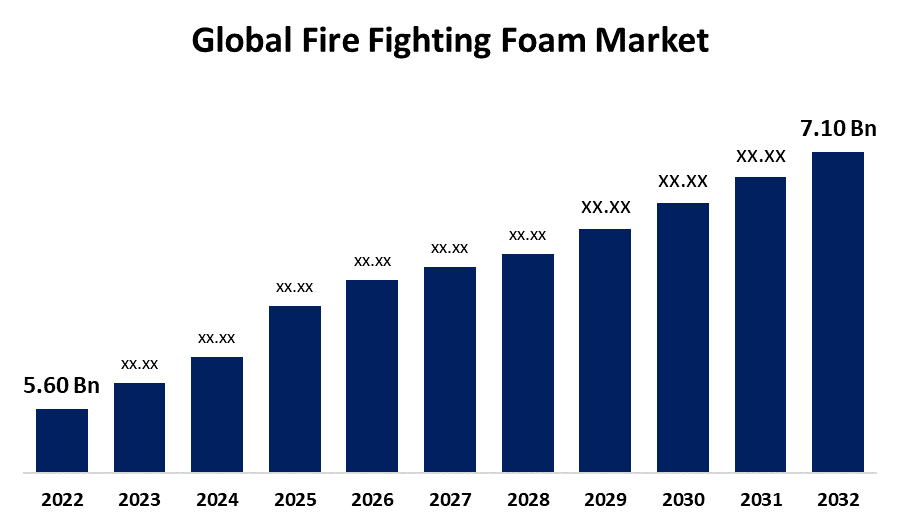

Global Fire Fighting Foam Market Size to Worth USD 7.10 Billion by 2032 | CAGR of 2.40%

Category: Chemicals & MaterialsGlobal Fire Fighting Foam Market Size to Worth USD 7.10 Billion by 2032

According to a research report published by Spherical Insights & Consulting, the Global Fire Fighting Foam Market Size to grow from USD 5.60 Billion in 2022 to USD 7.10 Billion by 2032, at a Compound Annual Growth Rate (CAGR) of 2.40% during the forecast period.

Get more details on this report -

Browse key industry insights spread across 200 pages with 110 Market data tables and figures & charts from the report on the "Global Fire Fighting Foam Market Size, by Foam Type (AFFF, AR-AFFF), By Fire Type (Class A, B, C), By End-use (Oil & Gas, Chemical), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2032". Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/fire-fighting-foam-market

The growth of the fire fighting foam market is influenced by a number of factors. The growing emphasis on industrial safety, as well as the stringent legislation governing fire safety standards in many businesses, are key factors. As companies expand and infrastructure advances, there will be a growing demand for enhanced fire suppression technologies, such as effective foams. Furthermore, the growth of industries such as petrochemicals, oil and gas, and manufacturing contributes to the market's progress. Because these businesses routinely handle combustible products, they are great candidates for comprehensive fire prevention measures. Furthermore, technological advancements and innovations in the composition of fire fighting foams help to drive market expansion. Manufacturers are constantly working to create new and improved foams with improved firefighting capabilities, environmental sustainability, and lower environmental impact.

Fire Fighting Foam Market Value Chain Analysis

The value chain begins with the acquisition of raw materials needed in foam manufacturing. As main ingredients, water, foam concentration, and chemical additives are typically used. Foam concentrate producers are crucial at this stage. Water, foam concentration, and other ingredients are combined to create the foam concentrate. Following manufacture, the foam concentrate is packaged and sent to a number of end users, including fire departments, industrial facilities, and airports. Distribution methods include wholesalers, distributors, and direct sales to end customers. End users such as fire departments, industrial plants, airports, and other facilities utilise fire fighting foam to suppress fires. Foam application equipment such as foam generators and foam proportioning devices may be used in this step. To use fire fighting foam efficiently, training is essential. Companies and educational organisations may offer training programmes to educate end-users on how to use foam properly in various fire scenarios. Proper disposal of old foam and debris generated during manufacturing is crucial for minimising environmental effect. At this time, environmental regulations must be obeyed.

Fire Fighting Foam Market Opportunity Analysis

Opportunities exist in the development of enhanced foam technologies that are more effective at suppressing various types of fires. Customising foam solutions for individual industries like as oil and gas, aviation, and manufacturing represents a significant opportunity. Customised formulations tailored to each area's distinct concerns can aid in market penetration. As the world's industry accelerates, fire safety solutions are in high demand. Foam makers can profit from expanding their global market presence, particularly in emerging areas with developing infrastructure. Creating a specialised opportunity for end-users through comprehensive training and education packages. This includes not just foam application training, but also maintenance, testing, and safety requirements compliance.

Firefighting foams are well-known for their ability to extinguish a wide range of flames, especially those involving flammable liquids. Their ability to form a blanket or film over the surface of the liquid, preventing the emission of flammable vapours, makes them particularly effective in fire suppression. As companies expand around the world, so does the demand for dependable fire suppression systems. Firefighting foam's popularity stems from its role in defending industrial sites, petrochemical plants, manufacturing units, and other infrastructure. Companies and organisations are increasingly implementing proactive risk management techniques. The use of firefighting foam is seen as a critical component in lowering the hazards associated with fires, particularly in high-risk areas.

If regulations and restrictions on specific foam formulas, notably those containing PFAS, alter, manufacturers may face challenges. Adapting to new regulatory standards and ensuring compliance may necessitate significant investments and modifications to existing product lines. Advanced firefighting foam formulations, especially those with environmentally friendly qualities, may be more expensive than regular foams. Cost-conscious enterprises may be cautious to adopt these solutions, affecting market penetration. For the effective use of firefighting foam, proper training is essential. End-user training in foam application and equipment maintenance can be difficult to ensure. Supply chain interruptions, whether caused by geopolitical difficulties, natural disasters, or other unforeseen events, can affect the supply of raw materials and components needed for foam production.

Insights by Foam Type

The Aqueous Film Forming Form (AFFF) segment accounted for the largest market share over the forecast period 2023 to 2032. AFFF is very effective in extinguishing flames involving combustible liquids such as petrol, diesel and jet fuel. Its ability to produce a thin coating on the liquid surface limits the production of flammable vapours, resulting in faster and more efficient fire suppression. AFFF is versatile and used in a wide range of industries, including petrochemicals, oil and gas, aviation, and manufacturing. Its ability to deal with numerous types of combustible liquid flames makes it a popular choice in businesses where such incidents occur frequently. AFFF is frequently used in aviation and military applications where there is a high risk of fuel-related burns. It is a crucial component of fire safety standards for airports, military bases, and aircraft because of its capacity to extinguish flames using aviation fuels.

Insights by Fire Type

The Class A type segment accounted for the largest market share over the forecast period 2023 to 2032. In wildland firefighting, Class A foams are widely used to improve the effectiveness of water in extinguishing flames. The foams improve water penetration and moistening of the fuels, assisting in wildfire management and extinguishment. Municipal fire departments regularly use Class A foams in building firefighting scenarios. The foams encourage water absorption by fire-related materials, allowing for more effective fire suppression in residential and commercial structures. Firefighters are trained in the usage of Class A foams to increase their firefighting abilities. Training and instructional efforts highlight the right use of these foams in diverse fire conditions, which aids in their effective deployment.

Insights by End Use

The oil and gas segment accounted for the largest market share over the forecast period 2023 to 2032. Combustible liquids such as crude oil, petrol, diesel, and different chemicals are utilised in the oil and gas industry. Exploration, production, refining, and storage all pose the potential of flammable liquid fires, making firefighting foams critical for risk management. Large flammable liquid storage tanks require effective fire protection. Foam systems, such as foam monitors and foam chambers, create a foam blanket over the liquid surface, preventing vapour leaks and fires. Offshore oil and gas sites are particularly vulnerable to fire. On these platforms, firefighting foams are utilised to quickly extinguish fires, protect personnel and assets, and prevent emergency escalation in remote offshore locations.

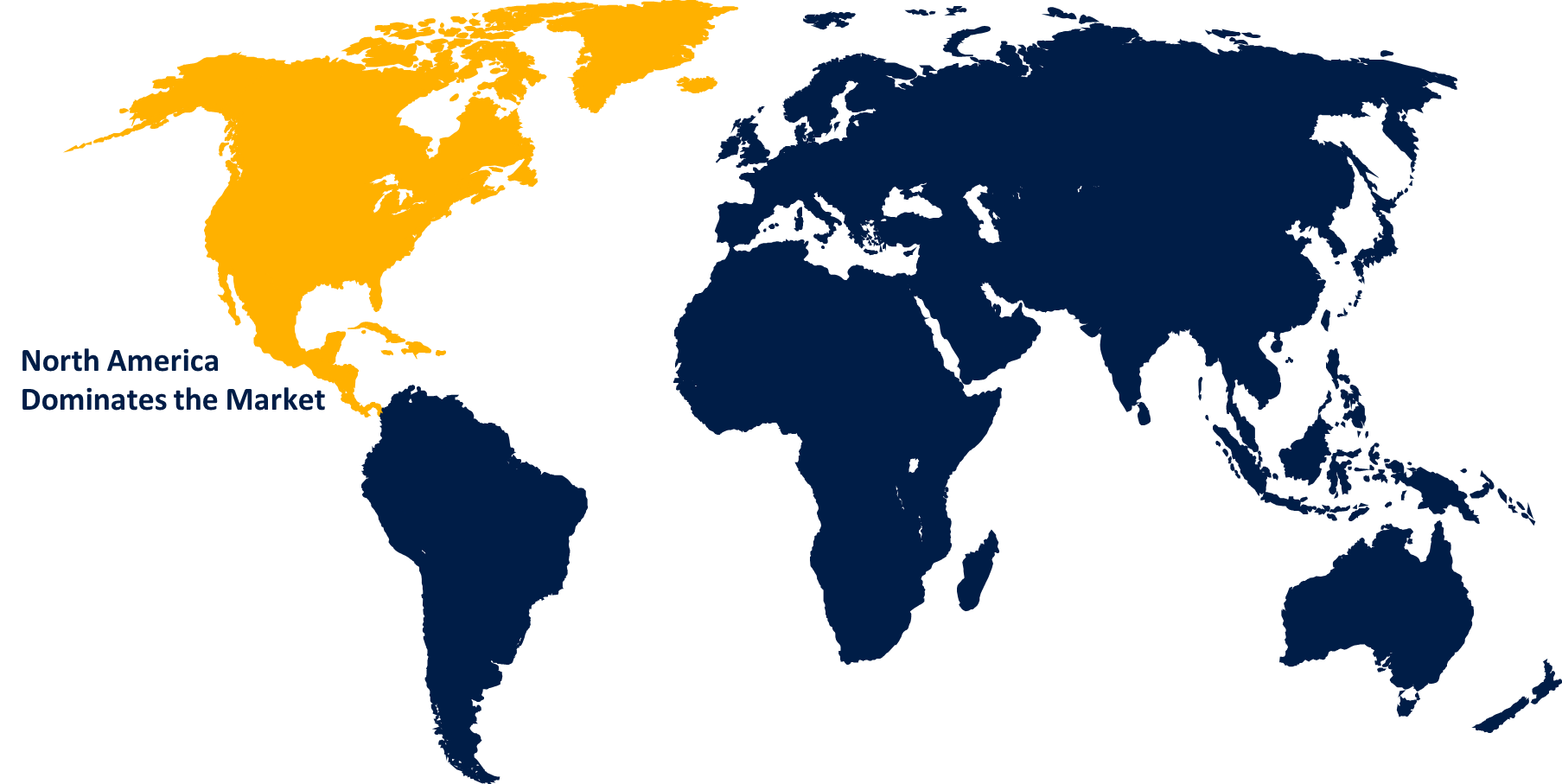

Insights by Region

Get more details on this report -

North America is anticipated to dominate the Fire Fighting Foam Market from 2023 to 2032. Many industries, such as petrochemicals, manufacturing, and aviation, contribute to the need for excellent fire suppression technologies. Firefighting foams are vital in keeping industrial sites safe from combustible materials. The North American market is distinguished by the employment of modern firefighting technologies. Companies invest in research and development to offer foams with improved effectiveness, faster knockdown times, and versatility in dealing with various types of flames. The huge aerospace and defence industries in North America contributes to the demand for specialty firefighting foams. These foams are designed to satisfy the specific needs of aircraft and military applications. The North American fire fighting foam sector is highly competitive, with many companies vying for market dominance.

Asia Pacific is witnessing the fastest market growth between 2023 to 2032. The Asia-Pacific area is rapidly industrialising, which is increasing demand for fire safety solutions. Firefighting foams are widely used in industries such as manufacturing, petrochemicals, and energy installations. The expansion of the oil and gas industry in nations such as China, India, and Australia has increased demand for fire suppression technologies. In this industry, firefighting foams are critical for tackling the special issues given by volatile liquids. The Asia-Pacific region's rapid urbanisation and growth of commercial centres add to the demand for fire safety solutions. In heavily populated metropolitan areas, firefighting foams are critical for saving lives and assets. Risk management strategies are becoming increasingly important in Asia-Pacific industries.

Recent Market Developments

- In April 2021, Johnson Controls' Chemguard 33 non-fluorinated foam concentrate is designed to provide effective and aggressive fire suppression of Class B hydrocarbon and polar solvent fuel fires.

Competitive Landscape

Major players in the market

- Angus Fire Limited

- Auxquimia

- Bavaria Egypt S.A.E.

- Buckeye Fire Equipment Company

- Chemguard

- Dafo Fomtec AB

- Fireade Inc.

- Johnson Controls International PLC.

- KV Fire Chemicals Pvt. Ltd.

- Orchidee

- Oil Technics Limited

- Perimeter Solutions

- Profoam srl

- SEPPIC

- VimalFire

- Vintex Fire Protection Pvt Ltd.

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2032.

Fire Fighting Foam Market, Foam Type Analysis

- AFFF

- AR-AFFF

Fire Fighting Foam Market, Fire Type Analysis

- Class A

- Class B

- Class C

Fire Fighting Foam Market, End Use Analysis

- Oil & Gas

- Chemical

Fire Fighting Foam Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?