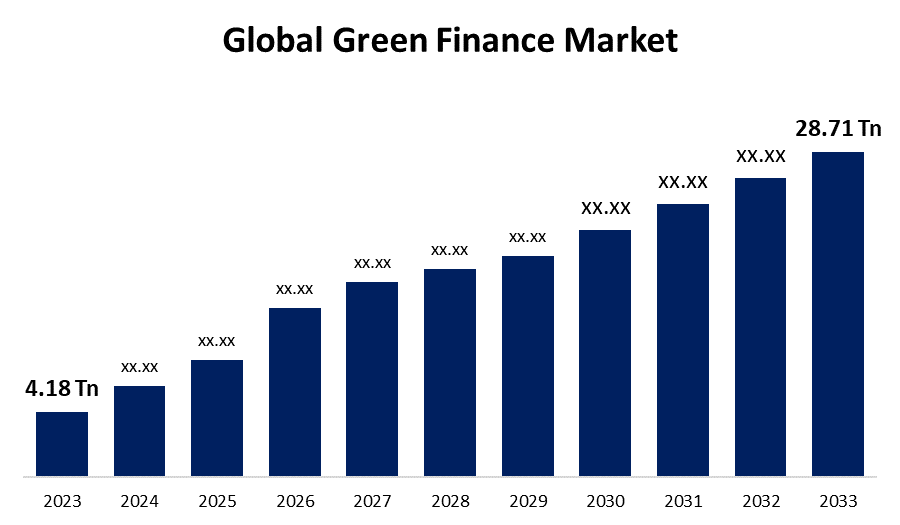

Global Green Finance Market Size To Exceed USD 28.71 Trillion by 2033 | CAGR Of 4.18%

Category: Banking & FinancialGlobal Green Finance Market Size To Exceed USD 28.71 Trillion by 2033

According to a research report published by Spherical Insights & Consulting, The Global Green Finance market Size is to grow from USD 4.18 Trillion in 2023 to USD 28.71 Trillion by 2033, at a Compound Annual Growth Rate (CAGR) of 21.25% during the projected period.

Get more details on this report -

Browse key industry insights spread across 200 pages with 110 market data tables and figures & charts from the report on The "Global Green Finance Market Size, Share, and COVID-19 Impact Analysis, By Type (Equity, Fixed Income, Mixed Allocation), By Transaction (Green Bond, Social Bond, Mixed-Sustainability Bond), By End- User (Utilities, Transport and Logistics, Chemicals, Food and Beverage, Government, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/green-finance-market

Green finance is also known as the sustainable finance market. The phrase "green finance" refers to the financing procedure as well as the promotion of social and environmental aspects of the market for sustainable finance. Environmental issues like decarbonization and biodiversity loss were the main focus of green finance. Activities like these are included in the category of "green finance" and fall under "socio-environmental financing," which allocates funds to address social and environmental problems. It also includes a variety of financing options that direct funds toward green-label initiatives, efforts to mitigate climate change, or efforts to adapt to it. Furthermore, the expanding consciousness of social issues like diversity and inclusivity, access to healthcare and education, income inequality, and labour rights. Stakeholders demand accountability and responsibility for business practices, including communities and employees. However, the lack of globally accepted definitions, a reporting framework for sustainability, and standardization hinder the green finance market. New efforts are being made to create frameworks and standards in order to overcome the constraining factors.

The fixed income segment dominates the market with the largest revenue share over the forecast period.

On the basis of type, the global green finance market is segmented into equity, fixed income, and mixed allocation. Among these, the fixed income segment is dominating the market with the largest revenue share over the forecast period. In recent years, green and sustainability bonds have gained popularity as fixed income instruments. Issuers can raise capital for environmentally friendly and green projects with fixed income.

The green bond segment is witnessing significant CAGR growth over the forecast period.

On the basis of transection, the global green finance market is segmented into green bond, social bond, and mixed-sustainability bond. Among these, the green bond segment is witnessing significant growth over the forecast period. For instance, the study compares international green bond markets and discovers that China and the United States have the world's largest green bond markets, accounting for 13.6% and 11.6% of total global green bond issuance between 2012 and 21. A wider range of mainstream investors have joined the green bond expansion. There are several advantages that green bonds can offer to issuers and investors alike. the benefits and financier base expansion.

The government segment is expected to hold the largest share of the global green finance market during the forecast period.

Based on the end user, the global green finance market is classified into utilities, transport and logistics, chemicals, food and beverage, government, and others. Among these, the government segment is expected to hold the largest share of the green finance market during the forecast period. Growing global awareness of environmental and social issues such as social inequality and climate change has prompted people to seek out investment opportunities with a positive social impact. Furthermore, government sectors can now more easily research and access sustainable investment products utilized to technological advancements and easier access to information on government websites.

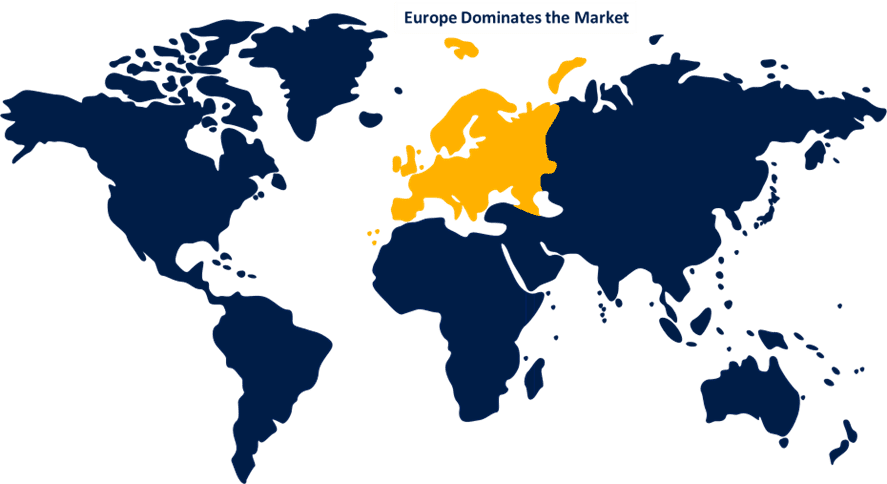

Europe dominates the market with the largest market share over the forecast period.

Get more details on this report -

Europe dominates the market with the largest market share over the forecast period. The Sustainable Finance Action Plan of the European Union aims to reroute capital flows towards sustainable projects and synchronize financial markets with sustainability objectives. Moreover, the EU Taxonomy Regulation provides a standard framework for classifying sustainable economic activities, enhancing legitimacy and transparency in sustainable finance practices across Europe.

Asia Pacific is expected to grow the fastest during the forecast period. Businesses and governments in the region are beginning to recognise the importance of sustainable development and addressing social and environmental issues. A conducive environment for sustainable finance has been established by countries such as China, Japan, and South Korea putting their ambitious sustainability goals and initiatives into practice. Moreover, demand for sustainable investment products is growing among investors in the Asia Pacific region.

Major vendors in the global green finance are BNP Paribas, Clarity AI, Refinitiv, Starling Bank, Stripe, Inc., Triodos Bank UK Ltd., KPMG International, Pwc, Acuity Knowledge Partners, Arabesque Partners, Goldman Sachs, NOMURA HOLDINGS, INC., and Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2023, KPMG and Workiva Inc. have strengthened their partnership to offer comprehensive ESG-focused solutions and services. KPMG can now more effectively assist organizations in implementing ESG data, processes, controls, and reporting capabilities to this expanded partnership. In doing so, it improves trust, reduces risks, and opens up new opportunities for businesses as they strive to create a sustainable future. Businesses are better equipped to handle the challenges of ESG integration to the partnership between KPMG and Workiva. This partnership guarantees that businesses can satisfy the growing expectations of stakeholders and authorities in the ever-changing field of sustainable business practices.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the global Green Finance Market based on the below-mentioned segments:

Green Finance Market, Type Analysis

- Equity

- Fixed Income

- Mixed Allocation

Green Finance Market, Transection Analysis

- Green Bond

- Social Bond

- Mixed-Sustainability Bond

Green Finance Market, End User Analysis

- Utilities

- Transport and Logistics

- Chemicals

- Food and Beverage

- Government

- Others

Green Finance Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?