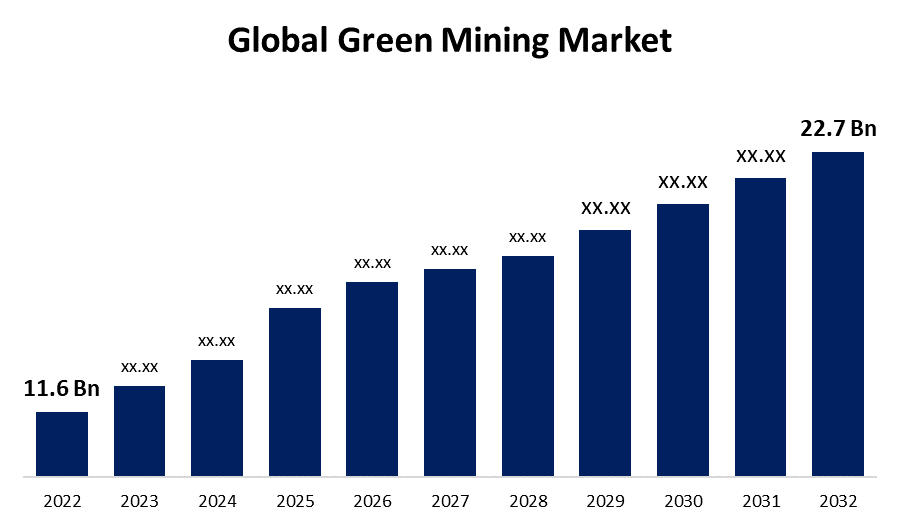

Global Green Mining Market Size To Worth USD 22.7 Billion by 2032 | CAGR of 9.2%

Category: Chemicals & MaterialsGlobal Green Mining Market Size To Worth USD 22.7 Billion By 2032

According to a research report published by Spherical Insights & Consulting, the Global Green Mining Market Size to Grow from USD 11.6 Billion in 2022 to USD 22.7 Billion by 2032, at a Compound Annual Growth Rate (CAGR) of 9.2% during the forecast period.

Get more details on this report -

Browse key industry insights spread across 200 pages with 110 market data tables and figures & charts from the report on the “Global Green Mining Market Size, Share, and COVID-19 Impact By Mining Type (Underground, Surface), By Technology (Carbon Capture And Storage (Ccs), Dust Suppression Technique (Dst)), by Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032.” Get Detailed Report Description Here:https://www.sphericalinsights.com/reports/green-mining-market

"Green mining" in the mining industry refers to the adoption of environmentally friendly practises and tools. Conventional mining has a number of negative effects on the environment, including habitat loss, water pollution, and greenhouse gas emissions. Green mining aims to lessen these negative effects while still generating abundant minerals and commodities. One of the most crucial aspects of green mining is the use of renewable energy sources, such as solar, wind, or hydropower, to power mining operations. Mining operations reduce their carbon footprint in this way, which aids in the fight against global warming. Green mining seeks to maximise resource efficiency by reducing waste and enhancing extraction methods.

COVID 19 Impact

The pandemic had an influence on global supply chains, which hindered the accessibility of equipment, spare parts, and other essential supplies for mining operations. This disruption may have significantly hampered the uptake of green mining technologies. Mines had a labour shortage because of lockdowns, travel restrictions, and health difficulties. This might have made it more difficult to employ sustainable mining methods and slowed down programmes meant to improve environmental performance. Numerous mining companies were financially strained as a result of the epidemic's decreasing commodity demand and shifting commodity prices. This might have reduced their ability to support initiatives and innovations in green mining. The outbreak accelerated the adoption of automation and remote work in a number of industries, including mining.

Growing environmental awareness and the need for sustainability have raised demand for environmentally friendly mining methods. Green technologies are being encouraged for usage by mining companies to reduce their environmental impact. The progress of technology has made it possible to develop and use more ecologically friendly mining methods. The environmental effect of mining operations, for instance, can be reduced through the use of data analytics, automation, and renewable energy. Investor interest in companies that prioritise sustainability and ethical mining practises is rising. As a result, mining companies now include eco-friendly practises into their operations to attract capital.

Green mining methods and technology adoption usually need a large upfront investment. Companies could be hesitant to employ these solutions due to their potential detrimental implications on profitability and financial viability. It might be challenging to find lithium and rare earth elements, two key minerals and metals for green technologies. Securing a consistent supply of these resources is vital for the success of green mining. Although green mining promotes the use of renewable energy sources, it can be challenging for mining businesses to make the transition to renewable energy sources. The need for energy infrastructure upgrades and the unpredictable nature of renewable energy sources could provide difficulties.

Mining Type Insights

Surface mining segment is dominating the market over the forecast period

On the basis of mining type, the global green mining market is segmented into underground and surface. Among these, the surface mining segment is dominating the market over the forecast period. Energy is needed in abundance for surface mining operations. In an effort to reduce their carbon footprint, many mining companies looked into using renewable energy sources like solar and wind to power their equipment. The expansion of the renewable energy infrastructure may have a substantial impact on the sustainability of surface mining operations. Green mining practises sometimes include process optimisation to save energy and waste utilisation. Utilising cutting-edge drilling, blasting, and material handling technology, for instance, can boost production while consuming less resources. Companies that engage in surface mining have increased their commitment to the protection of biodiversity. Programmes for reclamation and restoration must be implemented in order to reduce the long-term effects on ecosystems and return mined areas to their pre-mining state.

Technology Insights

Power reduction segment holds the largest market share over the forecast period

Based on the technology, the global green mining market is segmented into Power Reduction, Fuel and Maintenance Reduction, Emission Reduction, Water Reduction, and Other. Among these, power reduction segment holds the largest market share over the forecast period. Power reduction techniques can significantly lower costs for mining companies. Energy-efficient equipment and practises enable reduced electricity use, which is typically one of the highest operational costs in mining. By lowering their energy expenses, businesses can become more profitable. Particularly in industries like electronics and automotive that are under pressure to have a lower environmental impact, minerals and metals that are supplied sustainably are in increased demand. Mining companies that can demonstrate a commitment to environmentally friendly mining methods will be better equipped to meet this demand.

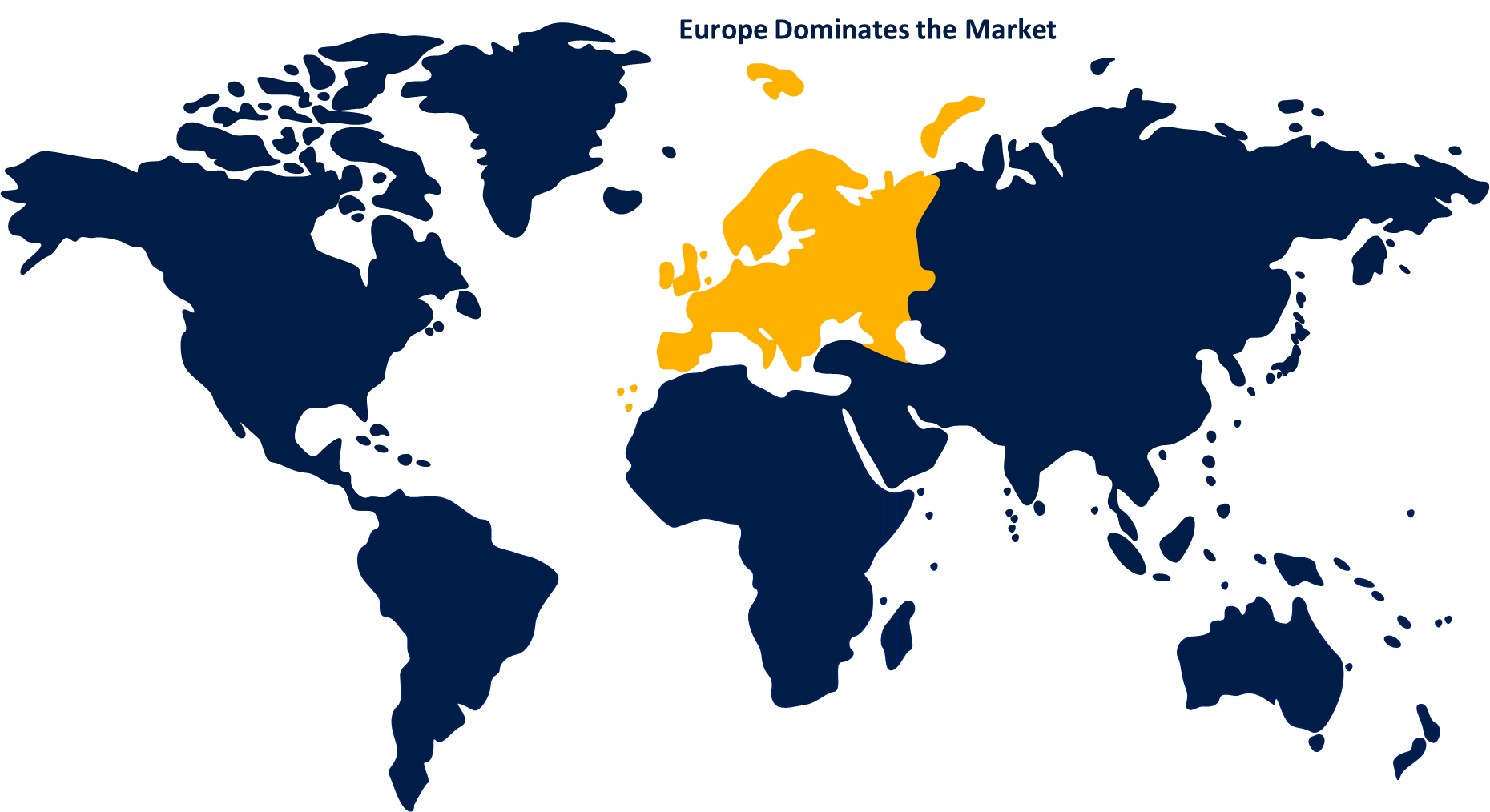

Regional Insights

Europe is dominating the market over the forecast period.

Get more details on this report -

Europe is dominating the market with the largest market share over the forecast period. Many mining companies in Europe have embraced renewable energy sources including wind, solar, and hydropower to reduce their reliance on fossil fuels. Switching to cleaner energy sources not only reduces carbon emissions but also lowers energy bills. European mining companies have invested in energy-efficient technology and practises to reduce their overall energy use. This includes improving equipment, utilising cutting-edge data analytics, and applying automation and digitization to boost operational effectiveness. Europe places a high premium on the circular economy, which prioritises reducing waste and fostering recycling and reuse. Initiatives to lower waste output and promote moral resource management are how this manifests in the mining sector.

North America is witnessing the fastest market growth over the forecast period. In mining operations, electric trucks, loaders, and other vehicles are becoming more and more common. Electric mining equipment can reduce emissions and operating expenses. Mining companies were investing in cutting-edge technology and automation to boost energy efficiency and reduce waste. This includes the use of data analytics, AI, and IoT devices to optimise mining processes. The green mining sector was receiving investments from both public and commercial sources. Investor interest in mining projects that demonstrated a commitment to sustainability was growing.

List of Key Companies

- Anglo American Plc

- BHP Group Limited

- Dundee Precious Metals Inc.

- Freeport-McMoRan Inc.

- Glencore plc

- Ma’aden (Saudi Arabian Mining Company)

- Rio Tinto Group

- Sany Heavy Industry Co. Ltd.

- Shandong Gold Mining Co. Ltd

- Tata Steel Limited

- Vale S.A

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global Green Mining Market based on the below-mentioned segments:

Green Mining Market, Form Type Analysis

- Underground

- Surface

Green Mining Market, Technology Analysis

- Power Reduction

- Fuel and Maintenance Reduction

- Emission Reduction

- Water Reduction

- Other

Green Mining Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?