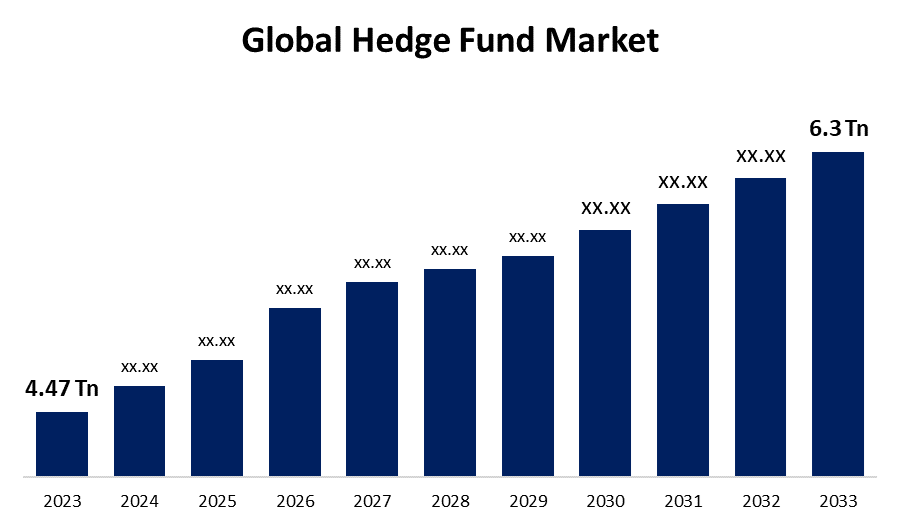

Global Hedge Fund Market Size To Worth USD 6.3 Trillion By 2033 | CAGR of 4.84%

Category: Banking & FinancialGlobal Hedge Fund Market Size To Worth USD 6.3 Trillion By 2033

According to a research report published by Spherical Insights & Consulting, the Global Hedge Fund Market Size is to Grow from USD 4.47 Trillion in 2023 to USD 6.3 Trillion by 2033, at a Compound Annual Growth Rate (CAGR) of 4.84% during the projected period.

Get more details on this report -

Browse key industry insights spread across 269 pages with 110 Market data tables and figures & charts from the report on the "Global Hedge Fund Market Size, Share, and COVID-19 Impact Analysis, By Investment Strategies (Long And Short Equity, Macro, Event-Driven, Credit, Relative Value, Niche, Multi-Strategy, Managed Futures/CTA Strategies, and Others), By Type (Offshore, Offshore Hedge Funds, Fund of Funds, Domestic), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/hedge-fund-market

A hedge fund is a limited partnership where funds are pooled and managed by professional fund managers. These fund managers invest in various securities, using hedging techniques to reduce volatility. Hedge funds can be private partnerships or offshore corporations and are less regulated than mutual funds, allowing riskier investments. They target high-net-worth individuals and large institutions. Benefits include expert management, risk mitigation, diversification, and high returns. Market-driving factors include algorithmic trading, advanced analytics, and emerging markets that could offer new opportunities. Trends show a move towards transparent, cost-effective fees, with regulations boosting scrutiny and robustness.

Increasing investments in digital assets and advanced technologies like artificial intelligence (AI) and machine learning (ML) drive the global hedge fund market, along with enhanced regulatory scrutiny and the rise of quantitative strategies. These factors boost diversification, efficiency, and investor confidence. However, strict regulations, high operational costs, significant investment requirements, market volatility, and limited disclosure of the use of funds might create barriers for the global hedge fund market.

The multi-strategy segment is anticipated to hold the greatest share of the global hedge fund market during the projected timeframe.

Based on the investment strategy, the global hedge fund market is divided into long and short equity, macro, event-driven, credit, relative value, niche, multi-strategy, managed futures/CTA strategies, and others. Among these, the multi-strategy segment is anticipated to hold the greatest share of the global hedge fund market during the projected timeframe. Multi-strategy funds benefit from flexibility by combining investment approaches like long/short equity, macro, event-driven, and relative value. This dynamic diversification optimizes returns, reduces risks, and offers a balanced risk-reward ratio, enhancing resilience to changing market conditions.

The offshore hedge funds segment is anticipated to hold the greatest share of the global hedge fund market during the projected timeframe.

Based on type, the global hedge fund market is divided into offshore, offshore hedge funds, fund of funds, and domestic. Among these, the offshore hedge funds segment is anticipated to hold the greatest share of the global hedge fund market during the projected timeframe. Offshore hedge funds are typically established in tax-friendly jurisdictions like the Cayman Islands or Bermuda, offering reduced tax liabilities and greater operational flexibility. These funds attract global investors by providing diversification and strategic exposure across multiple geographies with fewer regulatory constraints.

North America is anticipated to hold the largest share of the global hedge fund market over the forecast period.

Get more details on this report -

North America is anticipated to hold the largest share of the global hedge fund market over the predicted timeframe. The North American market is driven by the well-established financial infrastructure in hubs like New York and Connecticut, attracting investments from institutional investors seeking diversification and asset management solutions. A robust regulatory framework ensures transparency and investor protection, boosting confidence. Additionally, a mature capital market, a strong appetite for alternative strategies, and rapid technological adoption enhance the North American hedge fund market.

Asia Pacific is expected to grow fastest in the global hedge fund market during the forecast period. The region's booming economies, increasing wealth, and expanding high-net-worth population drive rapid growth in the hedge fund market. Robust regulations and technical advancements in financial hubs like Hong Kong and Singapore boost investor confidence and attract global hedge fund managers.

Major vendors in the Global Hedge Fund Market include Two Sigma Investments, Renaissance Technologies, Citadel Enterprise Americas, Elliott Investment Management, Millennium Management, Davidson Kempner Capital Management, Man Group, Bridgewater Associates, AQR Capital Management, BlackRock, TCI Fund Management, D.E. Shaw Group, Farallon Capital Management, Ruffer Investment Company, Winton Capital Management, and Others.

Recent Developments

- In August 2024, Millennium Management is set to support Sone Capital Management, former Echo Street Capital portfolio manager George Panos’s new systematic market-neutral hedge fund firm, as part of a strategy to allocate more capital to external traders, according to a report by Bloomberg.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Global Hedge Fund Market based on the below-mentioned segments:

Global Hedge Fund Market, By Investment Strategies

- Long and Short Equity

- Macro

- Event-Driven

- Credit

- Relative Value

- Niche

- Multi-Strategy

- Managed Futures/CTA Strategies

- Others

Global Hedge Fund Market, By Type

- Offshore

- Offshore Hedge Funds

- Fund of Funds

- Domestic

Global Hedge Fund Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?