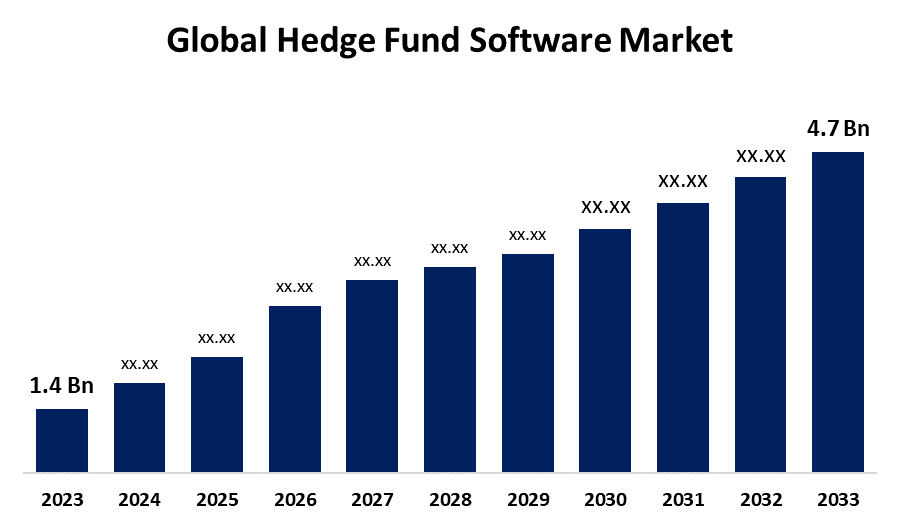

Global Hedge Fund Software Market Size To Worth USD 4.7 Billion by 2033 | CAGR of 12.87%

Category: Banking & FinancialGlobal Hedge Fund Software Market Size To Worth USD 4.7 Billion by 2033

According to a research report published by Spherical Insights & Consulting, the Global Hedge Fund Software Market Size is to Grow from USD 1.4 Billion in 2023 to USD 4.7 Billion by 2033, at a Compound Annual Growth Rate (CAGR) of 12.87% during the projected period.

Get more details on this report -

Browse key industry insights spread across 215 pages with 115 Market data tables and figures & charts from the report on the "Global Hedge Fund Software Market Size, Share, and COVID-19 Impact Analysis, By Company Size (Large Enterprises, and Small and Medium-Sized Enterprises (SMEs)), By End-User (Asset Managers, Hedge Funds, Pension Funds, Insurance Companies, and Others), By Deployment (Cloud-Based and On-Premise), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/hedge-fund-software-market

A hedge fund is a limited partnership of investors. The investor’s money is pooled and managed by professional fund managers for investing in securities and other types of investments. This investment strategy uses hedging methods to minimize portfolio volatility. Hedge funds operate as private partnerships or offshore investment companies. They are subject to fewer regulations compared to mutual funds and other financial instruments, allowing riskier investment opportunities. They cater to high-net-worth individuals (HNIs), large institutional investors such as pension funds, and accredited investors who satisfy specific income or asset criteria. The hedge fund software includes applications for assisting hedge funds in managing portfolios, analyzing risks, ensuring compliance, and optimizing trading strategies. The market is driven by several factors including the rapid advancements in technology, like artificial intelligence and machine learning. The complexity and volume of financial transactions necessitate the use of software solutions. Strict financial regulations, paired with the growing demand for efficiency and cost reduction boosts the market growth. However, the market faces several challenges such as the technical complexities of deploying advanced hedge fund software, concerns regarding data security, and the rising cybersecurity threats.

The large enterprises segment is anticipated to hold the greatest share of the global hedge fund software market during the projected timeframe.

Based on the company size, the global hedge fund software market is divided into large enterprises, and small and medium-sized enterprises (SMEs). Among these, the large enterprises segment is anticipated to hold the greatest share of the global hedge fund software market during the projected timeframe. This is because they have substantial financial resources, and handle higher volume and complex transactions which need advanced analytical and management tools.

The hedge funds segment is anticipated to hold the greatest share of the global hedge fund software market during the projected timeframe.

Based on the end-user, the global hedge fund software market is divided into asset managers, hedge funds, pension funds, insurance companies, and others. Among these, the hedge funds segment is anticipated to hold the greatest share of the global hedge fund software market during the projected timeframe. The growth of this segment is because hedge fund companies need advanced tools to execute trading strategies quickly and manage complex investment portfolios.

The cloud-based segment is anticipated to grow at the fastest pace in the global hedge fund software market during the projected timeframe.

Based on the deployment mode, the global hedge fund software market is divided into cloud-based and on-premise. Among these, the cloud-based segment is anticipated to grow at the fastest pace in the global hedge fund software market during the projected timeframe. The cloud-based software offers advantages like scalability, flexibility, remote access, low upfront costs, and lower maintenance expenses.

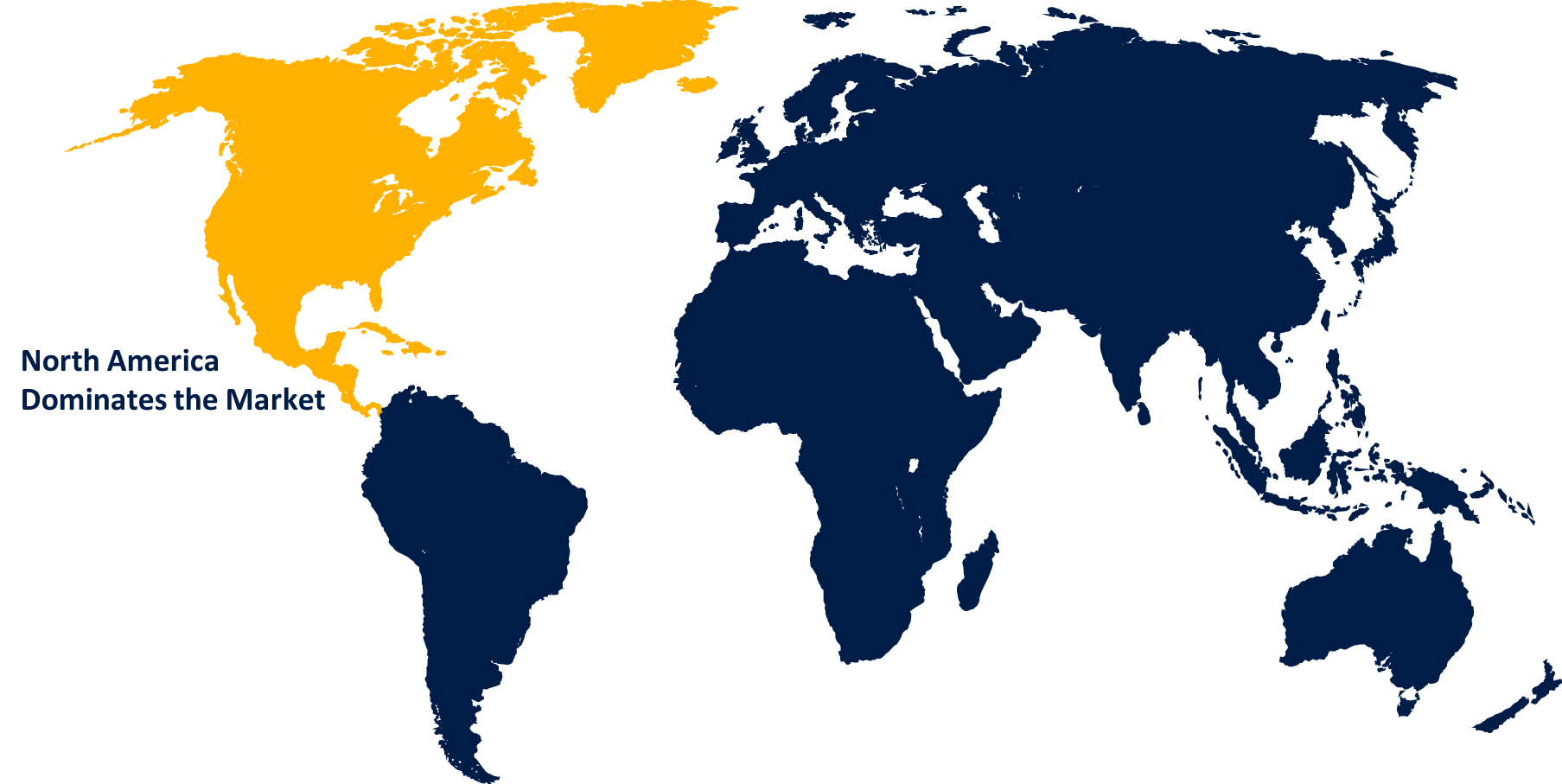

North America is anticipated to hold the largest share of the global hedge fund software market over the forecast period.

Get more details on this report -

North America is anticipated to hold the largest share of the global hedge fund software market over the predicted timeframe. The North American regional market is driven by increasing demand for high-risk investment options, the region's well-established financial sector and the concentration of leading hedge fund firms, particularly in the United States. The innovation and research in financial technologies, skilled professionals, and widespread awareness about the benefits of advanced financial software boost the market growth in this region.

Asia Pacific is expected to grow at the fastest pace in the global hedge fund software market during the forecast period. This is because developing nations like India, China, Japan, and Indonesia have been adopting hedge fund investments due to the rise in disposable income. This is leading to a high demand for hedge fund software from financial firms in the region.

Major vendors in the Global Hedge Fund Software Market include Altreva, FundCount, VestServe, Backstop Solutions Group, FXCM, AlternativeSoft, Northstar Risk, Eze Software, Fi-Tek, Obsidian Suite, PortfolioShop, FinLab Solutions, Imagineer Technology Group, Ledgex, Numerix, and Others.

Recent Developments

- In July 2024, former Millennium Management co-chief investment officer Bobby Jain’s hedge fund started trading with star portfolio managers, four global offices and billions of dollars in capital.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Global Hedge Fund Software Market based on the below-mentioned segments:

Global Hedge Fund Software Market, By Company Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

Global Hedge Fund Software Market, By End-User

- Asset Managers

- Hedge Funds

- Pension Funds

- Insurance Companies

- Others

Global Hedge Fund Software Market, By Deployment

- Cloud-based

- On-premise

Global Hedge Fund Software Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?