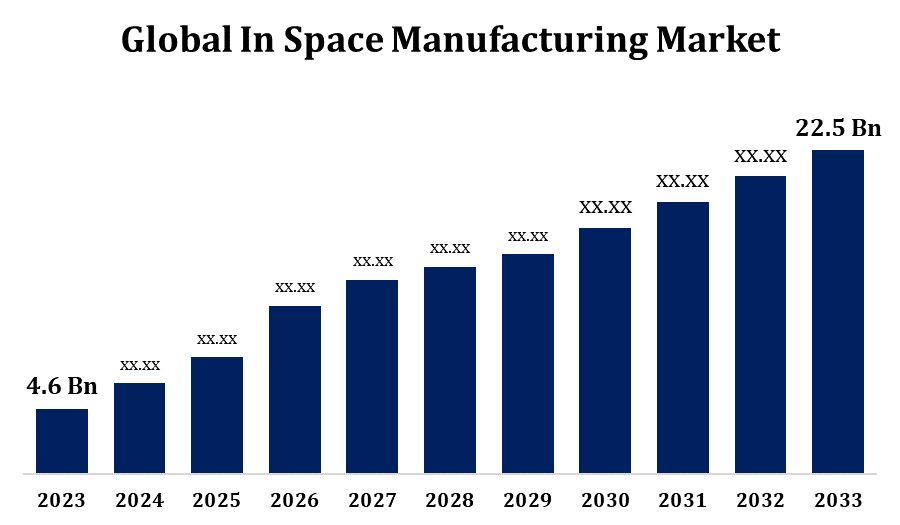

Global In Space Manufacturing Market Size To Worth USD 22.5 Billion By 2033 | CAGR of 17.20%

Category: Aerospace & DefenseGlobal In Space Manufacturing Market Size To Worth USD 22.5 Billion By 2033

According to a research report published by Spherical Insights & Consulting, the Global In Space Manufacturing Market Size to grow from USD 4.6 billion in 2023 to USD 22.5 billion by 2033, at a Compound Annual Growth Rate (CAGR) of 17.20% during the forecast period.

Get more details on this report -

Browse key industry insights spread across 200 pages with 120 Market data tables and figures & charts from the report on the "Global In Space Manufacturing Market Size By Product (Perovskite Photovoltaics cell, Graphene and solid-state Lithium batteries, Quantum Dot Display), By Point of Use (Space, Terrestrial), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/in-space-manufacturing-market

In space manufacturing market encompasses a broad range of activities, including the production of goods and materials in space rather than on Earth. This topic has acquired popularity in recent years due to advancements in space technology, decreasing launch costs, and the possibility of using resources discovered in space, such as asteroids or lunar regolith. 3D printing technology has the potential to revolutionise space manufacturing by enabling the on-demand manufacture of parts and equipment in space, removing the need for costly and time-consuming launches from Earth. Because gravity is not present in space, materials can be treated in unique ways. This raises the possibility of developing unique materials with superior properties for usage in a wide range of industries, including electronics, construction, and medicine.

In Space Manufacturing Market Value Chain Analysis

The space manufacturing market value chain is a multifaceted ecosystem requiring collaboration across government, private sector, research institutions, and international partners. It encompasses ongoing research and development to enhance technologies, infrastructure development for facilities and transportation, launch services for deployment, resource acquisition and utilization, various manufacturing processes like additive and biomanufacturing, quality control, logistics, market analysis, and regulatory compliance. This intricate network aims to advance space manufacturing, ensuring product standards, identifying market opportunities, and driving continuous innovation to realize the industry's full potential.

In Space Manufacturing Market Opportunity Analysis

Satellite manufacturing is a well-established sector of space manufacturing. This includes the creation of communication satellites, Earth observation satellites, navigation satellites, and more. The satellite manufacturing industry is growing in response to increased demand for satellite-based services such as telecommunications, television, and remote sensing. The space environment provides a unique opportunity to develop sophisticated materials with properties that are not attainable on Earth. This includes materials with enhanced strength, thermal properties, or radiation resistance, which are used in aerospace, military, and other industries. This research could result in important breakthroughs in materials science. Space-based solar power satellites (SBSP) are proposed as a potential solution to address Earth's energy needs.

Venture capitalists, private equity firms, and corporate investors are all eager to invest in the private sector. This additional funding can be used to support research and development, the construction of space manufacturing facilities, and the deployment of infrastructure such as satellite servicing platforms or space-based laboratories. Profit motivates private firms to explore and capitalise on the commercial potential of space manufacturing. This includes manufacturing goods and materials with microgravity properties, as well as developing products and services for space exploration, satellite installation, and telecommunications. Increased competition in the private sector can lead to cost savings through economies of scale, process optimisation, and technological innovation.

Establishing space manufacturing facilities, launching equipment and supplies into space, and carrying out orbital activities all involve large upfront costs. This barrier to entry may discourage investment and limit the participation of smaller companies in the space manufacturing industry. Managing the supply chain and logistics for space industrial operations has unique challenges, including transferring raw materials and equipment into space, storing and handling in microgravity, and managing waste. Ensuring reliable and efficient logistics is key to the success of space manufacturing projects. It is challenging to identify and establish market demand for goods created in space, particularly for sectors other than traditional space uses such as satellites and telecommunications.

Insights by Point of Use

The space segment accounted for the largest market share over the forecast period 2023 to 2033. With a renewed emphasis on space research by both government agencies and private companies, there is an increased interest in establishing space manufacturing capabilities. Missions to the Moon, Mars, and beyond require in-situ resource utilisation (ISRU) and on-site manufacturing to reduce reliance on Earth-bound logistics. The growth of satellite constellations for communication, Earth observation, and remote sensing is driving rising demand for space manufacturing. Companies are investigating the prospect of manufacturing satellites and satellite components in orbit to reduce launch costs and increase operating flexibility. Space applications make use of additive manufacturing technologies such as 3D printing. In-space 3D printing enables on-demand production of parts and components, reducing the need for extensive pre-launch planning and inventory management.

Insights by Product

The quantum dot display segment is dominating the market with the largest market share over the forecast period 2023 to 2033. Quantum dot displays provide several advantages over traditional display technologies, including higher brightness, better colour accuracy, and lower power consumption. These features make them appropriate for space-related applications including as navigation, monitoring, and crew interfaces. Quantum dot materials can be made more radiation resistant, which is a serious concern in space where electronics are exposed to large amounts of cosmic radiation. Manufacturers can use radiation-hardened quantum dot displays to meet the dependability and durability requirements of space missions. As technology progresses and manufacturing procedures are optimised, the cost of producing quantum dot displays is expected to reduce. Mass production technologies could help to reduce manufacturing costs and enable large-scale production of quantum dot displays for space applications.

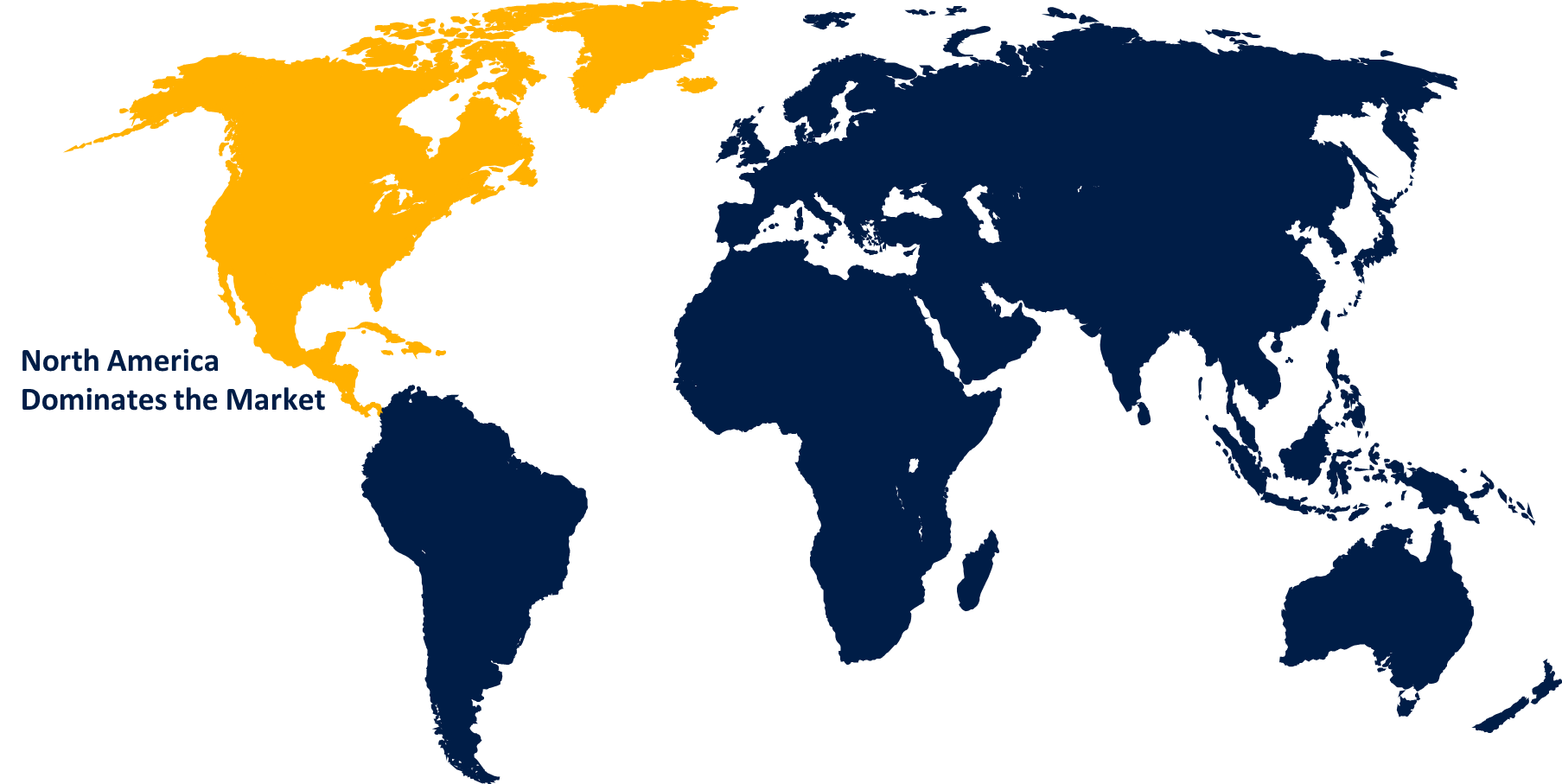

Insights by Region

Get more details on this report -

North America is anticipated to dominate the In Space Manufacturing Market from 2023 to 2033. North America's capital markets are robust and liquid, offering funding for space entrepreneurs and enterprises seeking to expand space industrial capabilities. Venture capital firms, private equity investors, and institutional investors are becoming interested in funding space-related ventures. North America is home to some of the world's premier research universities and academic institutes for space science, engineering, and technology. Collaborations between academia and industry facilitate the technology transfer and commercialization of space manufacturing developments. The increasing commercialization of space operations, such as satellite deployment, space tourism, and resource utilisation, creates new opportunities for space manufacturing. To meet the growing demand for space-related products and services, companies are exploring novel applications such as in-space assembly, on-orbit servicing, and microgravity additive manufacturing.

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Countries such as China, India, Japan, and South Korea have made considerable investments in their space projects, resulting in a rapid expansion of the regional space industry. This development creates opportunities for space manufacturing companies to provide components, materials, and services to support space missions and satellite launches. While government space organisations have traditionally dominated the Asia-Pacific space sector, private companies focusing in space exploration, satellite technology, and space manufacturing are gaining traction. Startups and established businesses are leveraging new technologies and business models to enter the space industry value chain. The Asia-Pacific region has a vast and diverse market for space-related products and services, including satellite communication, Earth observation, navigation, and remote sensing.

Recent Market Developments

- In August 2023, Sierra Space has formed a strategic partnership with Redwire Corporation, a space infrastructure industry leader. The collaboration is intended to improve commercial pharmaceutical and biotech research and manufacture in low-Earth orbit (LEO).

Major players in the market

- Made In Space

- Orbit Fab

- Airbus

- Northrop Grumman Corporation

- Honeybee Robotics

- Momentus Space

- Atomos Space

- Chandah Space Technologies

- Astroscale

- Tethers Unlimited Inc.

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

In Space Manufacturing Market, Product Analysis

- Perovskite Photovoltaics cell

- Graphene and solid-state Lithium batteries

- Quantum Dot Display

In Space Manufacturing Market, Point of Use Analysis

- Space

- Terrestrial

In Space Manufacturing Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?