Global Industrial Tapes Market Size to Worth USD 111.3 Billion by 2032 | CAGR of

Category: Construction & ManufacturingGlobal Industrial Tapes Market Size to Worth USD 111.3 Billion by 2032

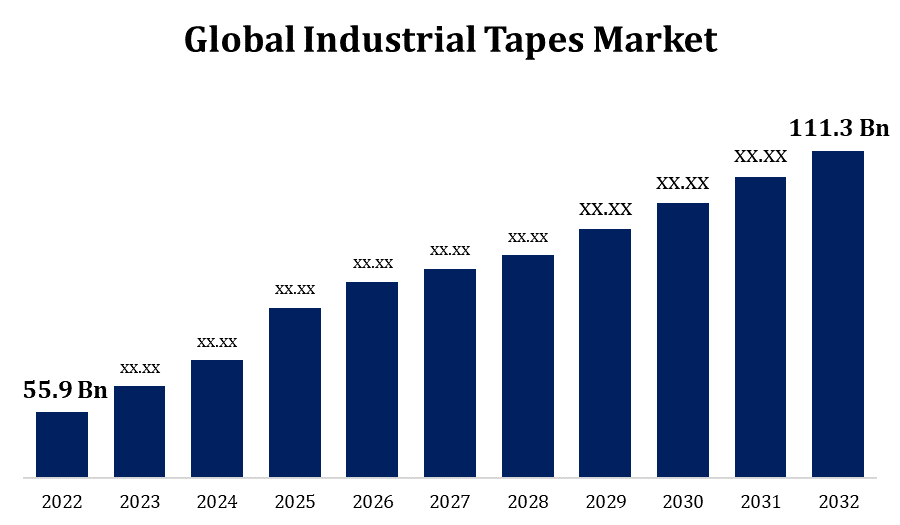

According to a research report published by Spherical Insights & Consulting, the Global Industrial Tapes Market Size to Grow from USD 55.9 Billion in 2022 to USD 111.3 Billion by 2032, at a Compound Annual Growth Rate (CAGR) of 6.1% during the forecast period.

Get more details on this report -

Browse key industry insights spread across 200 pages with 100 market data tables and figures & charts from the report on The "Global Industrial Tapes Market Size By Product (Filament Tapes, Aluminum Tapes, Duct Tapes), By Backing Material (Polypropylene, Paper, Polyvinyl Chloride), By End-User (Manufacturing Industry, Automotive Industry, Logistics Industry), By Geographic Scope And Forecast, 2023 - 2032." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/industrial-tapes-market

Sticky materials known as industrial tapes were developed specifically for a variety of industrial uses. These tapes are made to provide strong adhesion, durable use, and resistance to environmental factors like temperature, moisture, chemicals, and UV rays. They are employed in a wide range of jobs in the construction, manufacturing, automotive, aerospace, and electronics industries. Wires and other components are covered with insulating tape. It provides electrical insulation as well as protection against abrasion and moisture. In the construction, automotive, and electronics industries, foam tapes are used to close gaps, lessen vibrations, and provide cushioning or insulation. They also have a backing that resembles foam. The demand for cost-efficient and reliable bonding solutions has increased across industries, which has led to steady market growth for industrial tapes.

COVID 19 Impact

The pandemic's interruption of the world's supply chains delayed the production and distribution of industrial tape. Lockdowns, industrial closures, and transit restrictions had an influence on the ability to create and supply cassettes as well as the accessibility of raw materials. Some important industrial users, such as the automotive and construction industries, saw a decline in demand for industrial tapes as a result of lockdowns and economic uncertainty. As a result, orders for industrial tapes decreased in these sectors. Variations in the price of raw materials, particularly petrochemical-based components used in adhesives, made it more difficult for tape manufacturers to control costs. Due to the pandemic's increased emphasis on cleanliness and hygiene, sticky tapes are now used more frequently in cleaning and sanitation-related applications, particularly in the healthcare industry.

Industrial tape producers and sellers now have access to consumers in remote or underdeveloped areas of developing countries via e-commerce platforms. Businesses and customers in these areas now have access to a wider choice of industrial tape products as a result. Foreign producers of industrial tape now have an easier time breaking into emerging countries because to e-commerce. These manufacturers may now sell their items directly to customers in these locations, frequently at reasonable prices. Thanks to e-commerce, purchasing industrial tape is now easier for businesses. They no longer require face-to-face interactions with distributors or suppliers to make orders, follow shipments, or get customer support. In developing countries, logistics issues are frequent, such as an inadequate transportation infrastructure.

Variations in the cost of raw materials, especially petroleum-based products like adhesives, may put pressure on producers of industrial tape to lower prices. When the price of raw materials increases, manufacturers may decide to pass those costs forward to customers or absorb them, which could have an effect on product pricing and profitability. Variations in the calibre and accessibility of raw materials may have an impact on the consistency and efficiency of industrial tapes. Customers might not be satisfied by discrepancies in tape performance and quality brought on by inconsistencies in the raw materials. Changes in the price of raw materials might have an impact on the competitive climate of the market for industrial tapes.

Insights by Product

The duct tapes segment accounted for the largest market share over the forecast period 2023 to 2032. Duct tape is frequently used for sealing, repairing, and holding various materials together in the building and maintenance industries. The growth of these sectors, driven by infrastructure and building developments, raises the demand for duct tapes. Due to the growth of e-commerce platforms, users and businesses now have easier access to a large variety of duct tapes. Online retailers offer a convenient way to purchase these tapes in a variety of sizes and colours. Producers and retailers frequently offer educational resources and tutorials to persuade customers to learn more about the uses of duct tape.

Insights by Backing Material

The Paper segment accounted for the largest market share over the forecast period 2023 to 2032. To seal cartons and boxes, paper tapes are extensively used in the packaging industry. Due to the growth of e-commerce and the increased need for eco-friendly packaging choices, the market for paper tape is expanding. Paper tapes with specific use in mind, such painter's tape or masking tape, are available. These tapes may become more necessary as the building and home improvement industries develop. Some paper tapes can withstand high temperatures, making them suitable for electrical, automotive, and industrial applications where heat resistance is required.

Insights by End User

The Paper segment accounted for the largest market share over the forecast period 2023 to 2032. Current infrastructure development projects, such as those involving roads, bridges, airports, and public buildings, are what fuel the market for construction-related tapes. These tapes can be used for sealing joints, insulation, and bonding materials. Insulation, waterproofing, and the sealing of windows, doors, and HVAC (heating, ventilation, and air conditioning) systems are just a few of the many uses for which tapes are utilised throughout the building of both residential and commercial structures. The demand for construction tape is increasing as the housing industry grows.

Insights by Region

Get more details on this report -

North America is anticipated to dominate the Industrial Tapes market from 2023 to 2032. It has experienced steady growth over time as a result of the presence of a robust manufacturing sector, construction activity, and demand from industries like the automobile and aerospace. Industrial tapes are utilised throughout several different industries in North America. These include the packaging, construction, automotive, electronics, aerospace, healthcare, and other industries. Tapes can be used for a variety of purposes, such as sealing, bonding, and insulation.

Asia Pacific is witnessing the fastest market growth between 2023 to 2032. The region's expansion is facilitated by construction projects, strong manufacturing and industrial sectors, and growing electronics and automotive industries. In the Asia-Pacific area, industrial tapes are used in the automotive, electronics, construction, packaging, healthcare, and other industries. These tapes are employed for sealing, bonding, sealing, and masking. Two of the major players in the Asia-Pacific region's automobile manufacturing sector are China and Japan. Industrial tapes are frequently used in the automotive industry for assembly, bonding, noise reduction, and vibration dampening tasks.

Competitive Landscape

Major players in the market

- 3M Company

- Avery Dennison Corporation

- Tesa SE

- Nitto Denko Corporation

- Intertape Polymer Group Inc.

- Shurtape Technologies, LLC

- Scapa Group plc

- Lintec Corporation

- Berry Global, Inc.

- Saint-Gobain S.A.

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2032.

Industrial Tapes Market, Product Analysis

- Filament Tapes

- Aluminum Tapes

- Duct Tape

Industrial Tapes Market, Backing Material Analysis

- Polypropylene

- Paper

- Polyvinyl Chloride

Industrial Tapes Market, End User Analysis

- Manufacturing Industry

- Automotive Industry

- Logistics Industry

Industrial Tapes Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Frequently Asked Questions (FAQ)

-

1.What is the market size of the Industrial Tapes Market?The global Industrial Tapes Market is expected to grow from USD 55.9 Billion in 2023 to USD 111.3 Billion by 2032, at a CAGR of 6.1% during the forecast period 2023-2032.

-

2.Who are the key market players of the Industrial Tapes Market?Some of the key market players of market are 3M Company, Avery Dennison Corporation, Tesa SE, Nitto Denko Corporation, Intertape Polymer Group Inc., Shurtape Technologies, LLC, Scapa Group plc, Lintec Corporation, Berry Global, Inc., Saint-Gobain S.A..

-

3.Which segment holds the largest market share?Paper segment holds the largest market share are going to continue its dominance.

-

4. Which region is dominating the Industrial Tapes Market?North America is dominating the Industrial Tapes Market with the highest market share.

Need help to buy this report?