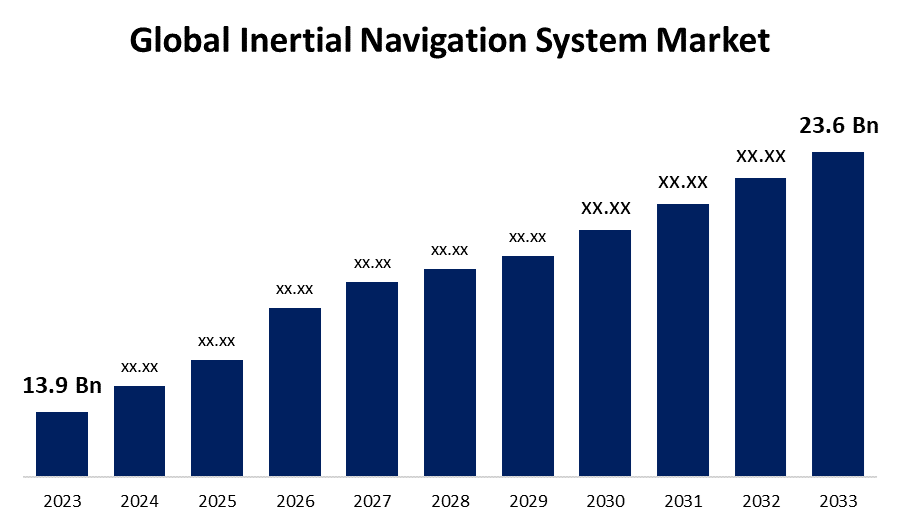

Global Inertial Navigation System Market Size To Worth USD 23.6 Billion By 2033 | CAGR of 5.44%

Category: Aerospace & DefenseGlobal Inertial Navigation System Market Size worth USD 23.6 billion by 2033

According to a research report published by Spherical Insights & Consulting, the Global Inertial Navigation System Market Size to Grow from USD 13.9 Billion in 2023 to USD 23.6 Billion by 2033, at a Compound Annual Growth Rate (CAGR) of 5.44% during the forecast period.

Get more details on this report -

Browse key industry insights spread across 200 pages with 110 Market data tables and figures & charts from the report on the "Global Inertial Navigation System Market Size By Component (Accelerometers, Gyroscopes, and Others), By Technology (Mechanical Gyro, Ring Laser Gyro, Fiber Optics Gyro, MEMS, and Others), By Platform (Airborne, Ground, Maritime, and Space), By End-User (Commercial and Military), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/inertial-navigation-system-market

The military's use of INS technology has been the primary driver of its growth. Military aircraft, ships, armoured vehicles, and missiles all employ INS for navigation and targeting. Modern INS technology is in high demand due to the modernization of military systems and increased defence budgets of several countries across the globe. In the aviation business, trustworthy navigation data is crucial for both human and unmanned aerial vehicles, and this is where INS excels. Unmanned aerial vehicles (UAVs) are being employed more often for military, commercial, and civilian objectives, which has increased the requirement for INS. The INS is widely used by marine boats for navigation, stabilisation, and location.

Inertial Navigation System Market Value Chain Analysis

Component vendors provide the hardware and software components required to build inertial navigation systems. Among these components are microprocessors, accelerometers, magnetometers, GPS receivers, and gyroscopes. As part of the manufacturing process, whole INS systems are assembled using components from several vendors. INS system manufacturers may operate dedicated production facilities where this function is performed. Distributors are crucial to the supply of inertial navigation systems to end users in the military, aerospace, marine, automotive, and industrial sectors, among other industries. Inertial navigation systems usually need to be connected with other navigation, communication, and control systems as part of larger systems or platforms, such as aeroplanes, ships, vehicles, and drones. End users rely on inertial navigation system (INS) technology for navigation, positioning, stabilisation, guidance, and control in a range of contexts and applications, from robots, wearable technology, and unmanned vehicles to aeroplanes and ships.

Inertial Navigation System Market Opportunity Analysis

Many countries are investing in modernising their defence capabilities, which includes enhancing the navigational systems of military aircraft, naval vessels, and ground vehicles. INS system suppliers can bid on defence contracts and provide advanced navigation systems that meet military requirements for accuracy, dependability, and toughness. The expanding use of robotic systems, autonomous vehicles, drones, and unmanned aerial vehicles (UAVs) in several industries presents significant opportunities for inertial navigation technology. INS systems are essential to unmanned systems that need precise navigation and control, such as aerial surveys, drones used for agriculture, deliveries, and surveillance. The marine sector employs inertial navigation systems for ship, offshore vessel, and undersea vehicle navigation, positioning, and stabilisation.

The commercial aviation business is steadily expanding due to factors such as growing demand for air travel, rising disposable incomes, and an increase in global tourism. Airlines need to expand their fleets and purchase new aircraft to meet the demand for passengers, which makes the usage of sophisticated navigation systems like INS necessary to ensure safe and efficient operations. The critical navigation data provided by INS aids in route planning, accurate landings, and collision avoidance for commercial aircraft. The primary causes of various nations' ongoing increases in defence spending include the need to strengthen national security, modernization projects, and geopolitical concerns.

The high cost of developing and manufacturing inertial navigation systems may prevent them from entering new markets, especially for emerging economies and smaller companies. More applications and consumers of INS will need to be encouraged to utilise it if manufacturing efficiency, advances in sensor technology, and economies of scale can reduce costs. Drift is an error that can accumulate over time and reduce positioning accuracy in inertial navigation systems. Increasing the accuracy and stability of INS systems remains a technical challenge, especially for long-term missions in extremely dynamic settings. Error correction and calibration techniques are constantly being developed to minimise these issues. It can be difficult to integrate inertial navigation systems with other sensors, navigational aids, and control systems, especially in multi-sensor fusion architectures.

Insights by Component

The gyroscope segment accounted for the largest market share over the forecast period 2023 to 2033. The need for sophisticated gyroscope technology is growing as industries like robotics, aircraft, defence, marine, and automotive look for navigation systems that are more dependable and accurate. In situations when GPS signals are intermittent or unreliable, gyroscopes are essential for providing precise and consistent orientation data. The increasing number of autonomous systems, including robots, drones, self-driving cars, and unmanned aerial vehicles (UAVs), is driving the demand for advanced gyroscopes. The capacity of these systems to maintain stability, control direction, and navigate precisely without human aid is dependent on their gyroscopes. High-performance gyroscopes for military application are required as a result of global defence modernization activities.

Insights by Technology

The MEMS segment accounted for the largest market share over the forecast period 2023 to 2033. MEMS-based accelerometers and gyroscopes provide advantages over traditional mechanical or fiber-optic gyroscopes, including miniaturisation, low power consumption, and lightweight design. For applications where weight, space, and power constraints are critical, such as wearables, portable electronics, and unmanned aerial vehicles (UAVs), MEMS sensors are therefore ideally suited. The proliferation of wearable technology, Internet of Things (IoT) devices, and autonomous systems is driving the need for MEMS-based navigation solutions. Because MEMS sensors enable precise motion tracking, gesture recognition, indoor navigation, augmented reality, and virtual reality applications, the market for MEMS-based INS systems is expanding. Advanced driver assistance systems (ADAS), driverless automobiles, and navigation systems are among the automotive industry's growing uses of MEMS-based sensors.

Insights by Platform

The airborne segment accounted for the largest market share over the forecast period 2023 to 2033. The commercial aviation sector is steadily growing due to factors such as growing airline fleets, increased disposable incomes, and worldwide demand for air travel. Airborne inertial navigation systems are essential for commercial aircraft navigation because they provide the accurate location, attitude, and velocity information required for safe and efficient flight operations. Modern airborne INS technologies are becoming more and more necessary as airlines purchase new aircraft and embark on fleet renewal programmes. Global defence agencies are investing financial resources to modernise their fighter jet, transport, and reconnaissance platform fleets. Airborne inertial navigation systems (INS) play a critical role in the execution of missions, weapon delivery, targeting, and navigation of military aircraft in a range of operational environments.

Insights by End User

The military segment accounted for the largest market share over the forecast period 2023 to 2033. A lot of countries are spending money modernising their armed forces as a result of geopolitical conflicts, evolving security concerns, and technological advancements. As part of defence modernization projects, military agencies purchase sophisticated navigation systems, such the Inertial Navigation System (INS), to enhance the navigation, targeting, and mission capabilities of military assets, such as ships, aircraft, ground vehicles, and missiles. Over time, the defence expenditures of many nations have increased, enabling the acquisition of state-of-the-art defence hardware, such as navigation systems. Thanks to rising defence funding that makes it possible for military agencies to invest in them, new INS technologies meet the rigorous requirements of contemporary military operations with their improved accuracy, dependability, and performance.

Insights by Region

Get more details on this report -

North America is anticipated to dominate the Inertial Navigation System Market from 2023 to 2033. The North American region dominates the global market for robotic systems, drones, and unmanned aerial vehicles (UAVs) for usage in the military, business, and civilian sectors. INS is necessary for autonomous UAV navigation and control in order to support UAV tasks such as infrastructure inspection, agricultural work, surveillance, and reconnaissance. Large aircraft fleets are flown by major airlines in North America, a major commercial aviation market. INS technology is essential for commercial aircraft to offer safe and efficient navigation, especially on long-haul flights, over remote places, and in bad weather.

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Defence budgets are being dramatically boosted in a number of Asia-Pacific countries, including China, India, South Korea, Australia, and others, in an effort to strengthen military capabilities and address security concerns. Defence modernization programmes drive the requirement for advanced navigation systems including in-flight navigation (INS) for military aircraft, naval vessels, ground vehicles, and missile systems. The commercial aviation sector in the Asia Pacific area is expanding quickly as a result of factors like rising passenger demand, bigger airline fleets, and easier access to air travel. The use of INS technology enables commercial aircraft to fly safely and effectively, which is essential, especially in regions with limited ground-based navigational infrastructure and highly crowded airspace.

Recent Market Developments

- In May 2023, the United States Navy awarded a contract to Honeywell International Inc.'s aerospace business to supply ring laser gyros for the AN7/WSN inertial navigation system.

Major players in the market

- Honeywell International Inc.

- Northrop Grumman Corporation

- Collins Aerospace

- Raytheon Technologies Corporation

- Safran Electronics & Defense

- Thales Group

- Trimble Inc

- iXblue SAS

- VectorNav Technologies, LLC

- Inertial Sense LLC

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Inertial Navigation System Market, Component Analysis

- Accelerometers

- Gyroscopes

- Others

Inertial Navigation System Market, Technology Analysis

- Mechanical Gyro

- Ring Laser Gyro

- Fiber Optics Gyro

- MEMS

- Others

Inertial Navigation System Market, Platform Analysis

- Airborne

- Ground

- Maritime

- Space

Inertial Navigation System Market, End User Analysis

- Commercial

- Military

Inertial Navigation System Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?