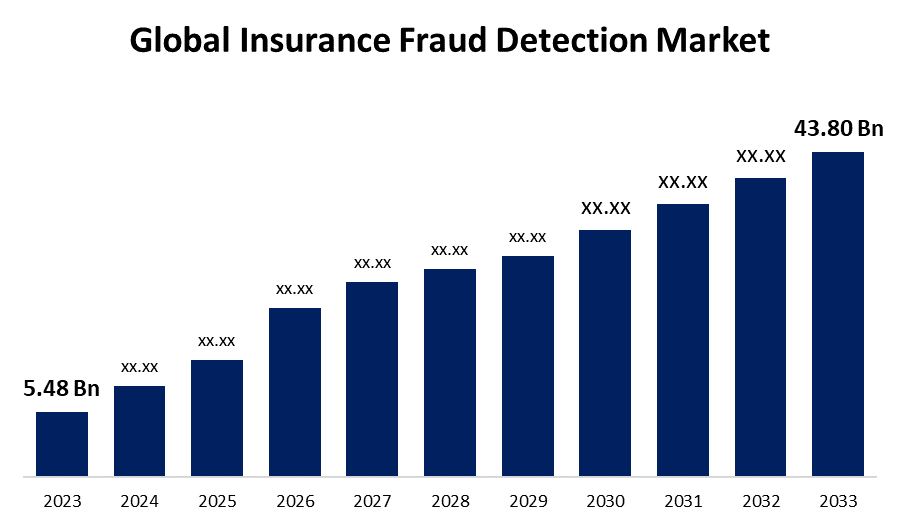

Global Insurance Fraud Detection Market Size To worth USD 43.80 Billion by 2033 | CAGR of 23.10%

Category: Banking & FinancialGlobal Insurance Fraud Detection Market Size, To worth USD 43.80 Billion by 2033

According to a research report published by Spherical Insights & Consulting, the Global insurance fraud detection market size was valued at USD 5.48 Billion in 2023 and is slated to cross USD 43.80 Billion by 2033, growing at a CAGR of 23.10% from 2023 to 2033

Get more details on this report -

Browse key industry insights spread across 235 pages with 107 Market data tables and figures & charts from the report on the "Global Insurance Fraud Detection Market Size, Share, and COVID-19 Impact Analysis, By Component (Solutions, Services), By Deployment (Cloud, On-Premise), Organization Size (SMB, Large Organization), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/insurance-fraud-detection-market

The insurance fraud detection sector develops software and services to help insurance firms recognize and prevent fraud, a critical part of their operations to avoid financial losses. The global insurance fraud detection market is growing due to rising fraud cases, advanced technology adoption leading to greater risks, and user-friendly features from service providers.

Growing disposable income in developing nations has led to greater financial awareness and demand for long-term strategies, driving the growth of motor, life, and home insurance. Life insurance, in particular, is gaining popularity as consumers seek to protect their families' financial stability. The rising demand for insurance and sector growth necessitate robust fraud detection to secure claimed policies. Insurance firms are focusing on digital platforms to launch innovative products, enhance consumer connections, and expand their financial portfolios, using sophisticated threat solutions. Increasing fraud cases prompt companies to invest in advanced technology-based tools, boosting the insurance fraud detection industry's growth through state-of-the-art systems.

However, Insurance companies face the dual challenges of evolving fraud threats and the substantial cost of advanced detection technologies. These expenses can be especially challenging for smaller insurance firms, restricting their capacity to implement vital solutions and leaving them vulnerable to fraud. The ongoing demand for enhanced security solutions in the industry poses significant technical difficulties and financial burdens.

The solutions segment secured a dominant share in 2023 and is anticipated to grow at a notable CAGR during the forecast period.

Based on the component, the global insurance fraud detection market is divided into solutions and services. Among these, the solutions segment accounted for the highest share in 2023 and is anticipated to grow at a notable CAGR during the forecast period. The increasing use of state-of-the-art technology by insurance companies looking to strengthen their fraud detection capabilities is responsible for segmental domination. Additionally, in order to enhance the security of client-organization interactions, insurance companies are implementing authentication procedures. Therefore, it is anticipated that authentication will offer an extra layer to confirm payments, account changes, send authentication alerts, and customer acknowledgments or policy approvals. This acceptance is steadily rising and supporting the solutions' segmental domination.

The on-premise segment accounted largest market share in 2023 and is projected to grow at a remarkable CAGR during the forecast period.

Based on the deployment, the global insurance fraud detection market is classified into cloud and on-premise. Among these, the on-premise segment largest market share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. This significant shareholding is primarily motivated by the increasing demand for data security and adherence to strict regulations, leading many insurance firms to choose on-premises solutions. These solutions offer companies total control over their confidential data, reducing the chances of breaches and unauthorized access. Additionally, the customizable and integrative capabilities of on-premises deployment enable a tailored approach to fraud detection, aligning perfectly with the organization’s unique requirements and existing systems.

The large organization segment held a major share in 2023 and is expected to grow at a phenomenal CAGR during the forecast period.

Based on the organization size, the global insurance fraud detection market is separated into SMBs and large organizations. Among these, the large organization segment held a major share in 2023 and is anticipated to grow at a phenomenal CAGR during the forecast period. This dominant holding is attributed to various factors, primarily the scale of the financial and reputational dangers associated with insurance fraud that large corporations face. Consequently, the increasing incidence of scams such as damage claims, car theft, unnecessary treatments, and deceptive health insurance billing has driven insurers to implement innovative strategies to combat these deceptive practices. The ability of major corporations and fraud detection agencies greatly aids in the expansion of this industry.

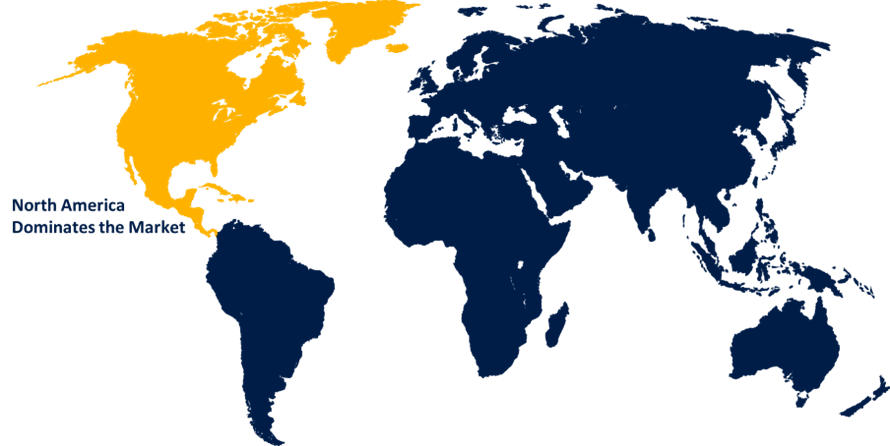

North America region is expected to hold the largest share of the global insurance fraud detection market during the forecast period.

Get more details on this report -

North America region is expected to hold the largest share of the global insurance fraud detection market during the forecast period. This expansion is fuelled by the widespread use of advanced technologies such as AI, machine learning, and big data analytics that improve fraud detection in a tech-oriented market. The drive for digital transformation in the insurance industry, while generating opportunities for fraud, requires strong technology to prevent such fraudulent activities. Strict regulatory systems and substantial funding in fraud detection additionally enhance the market. Insurers in North America need to create robust fraud detection systems to adhere to government regulations, prompting continuous improvements and encouraging market growth.

The Asia-Pacific region is expected to witness the most rapid expansion in the insurance fraud detection market throughout the forecast duration. This is fuelled by a growing insurance industry, backed by a rising middle-class population emphasizing family security. Insurers are making substantial investments in advanced technologies to fight against insurance fraud. Countries like India, China, and several others are witnessing significant growth in their life insurance sectors, resulting in a higher demand for fraud detection systems. Additionally, companies are working together with insurers to enhance customer experiences. For example, in December 2024, Neysa collaborated with DSW to launch a cutting-edge Insurance AI Cloud Platform for India. These collaborations are driving market expansion in the region.

Major key players in the insurance fraud detection market include Lexisnexis Risk Solutions Inc. (RELX Group plc), BAE Systems plc, SAP SE, Fiserv Inc., Equifax Inc., Experian plc, SAS Institute Inc., Fair Isaac Corporation, International Business Machines Corporation, FRISS, ACI Worldwide Inc., and Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In May 2024, Solutis collaborated with FICO to combat fraud and minimize losses for medium-sized banks and insurance firms, aiming to enhance financial inclusion.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global insurance fraud detection market based on the below-mentioned segments:

Global Insurance Fraud Detection Market, By Component

- Solutions

- Services

Global Insurance Fraud Detection Market, By Deployment

- Cloud

- On-Premise

Global Insurance Fraud Detection Market, By Organization Size

- SMB

- Large Organization

Global Insurance Fraud Detection Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?