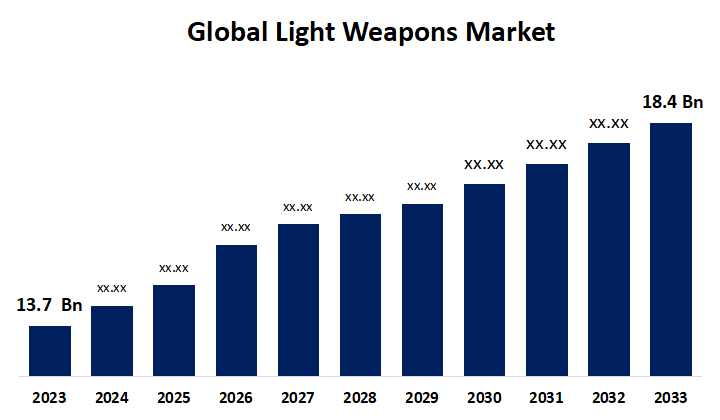

Global Light Weapons Market Size To Worth 18.4 Billion By 2033 | CAGR Of 2.99%

Category: Aerospace & DefenseGlobal Light Weapons Market Size To Worth 18.4 Billion By 2033

According to a research report published by Spherical Insights & Consulting, the Global Light Weapons Market Size to grow from USD 13.7 billion in 2023 to USD 18.4 billion by 2033, at a Compound Annual Growth Rate (CAGR) of 2.99% during the forecast period.

Get more details on this report -

Browse key industry insights spread across 200 pages with 110 Market data tables and figures & charts from the report on the "Global Light Weapons Market Size By Type (Heavy machine guns, MANPAT, Infantry Mortar, Anti-Tank Weapons, Recoilless Rifles, Launchers, Light Cannon, Anti-Tank Missiles, MANPADS, Grenade, Landmines), Guidance (Guided, Unguided), Application (Defense, Homeland Security), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033."Get Detailed Report Description Here:https://www.sphericalinsights.com/reports/light-weapons-market

The main users of light weapons are the military and law enforcement organisations for a range of applications, including combat operations, homeland security, and law enforcement responsibilities. Demand from these businesses often propels market growth, especially in times of increased security risks and armed conflicts. In addition, individuals have a significant demand for light weapons, particularly in places where pistol ownership or gun culture are prevalent. Hunting, sport shooting, and self-defense are some of the reasons why citizens want to acquire guns. Economic factors such as the rate of GDP growth, levels of disposable income, and purchasing patterns of consumers may have an impact on the accessibility and affordability of light weapons.

Light Weapons Market Value Chain Analysis

Suppliers provide the wood, plastics, metals (such steel and aluminium), and other components required to create weapons. Suppliers provide the wood, plastics, metals (such steel and aluminium), and other components required to create weapons. Component suppliers provide barrels, triggers, sights, grips, magazines, and other specialty parts and components that are utilised in the production of weapons. These suppliers may be individual businesses that specialise in certain gun parts, or they may be incorporated into larger gun manufacturers. Distributors are necessary to get firearms from manufacturers to dealers, law enforcement, and other end users. Logistics companies manage the movement, handling, and storage of weapons and related equipment, ensuring efficient and timely delivery. End users include law enforcement organisations, military units, and other organisations that purchase and deploy light weapons for a range of purposes. End users may require firearms for self-defense, law enforcement, hunting, target practice, military activities, or collection.

Light Weapons Market Opportunity Analysis

Better security and accountability characteristics are offered by smart guns, especially for law enforcement and military applications. To improve worker safety and operational efficacy, government agencies may invest money in sophisticated weaponry. Concerns about gun safety and unauthorised access are driving up demand for smart firearms in the consumer market. Particularly in places with strict gun prohibitions, buyers might be willing to pay extra for weapons with cutting-edge safety and identification features. In certain places, laws mandating or promoting the use of smart gun technology may be enacted in an attempt to lower gun violence and improve public safety. Gun makers can gain a competitive advantage and penetrate new markets by developing innovative, law-abiding smart weapons.

As they are widely available and reasonably priced, weapons can become more accessible, particularly in places with lax laws or porous borders. This accessibility may contribute to law-abiding individuals making lawful purchases as well as the proliferation of firearms and unlawful trafficking. Because affordable firearms can make it easier for criminals to get weapons for crimes like armed robbery, gang violence, and terrorism, their availability may contribute to an increase in crime and bloodshed. This could have major social, economic, and security repercussions for communities and nations. Reduced entry barriers and increased competition in the market for light weapons may push manufacturers to innovate, set themselves apart from the competitors, and reduce costs.

The use of light weapons in armed conflicts and human rights violations raises ethical difficulties for manufacturers, governments, and international organisations. Companies that deal in light weapons are required to respect human rights norms, engage in moral corporate conduct, and abstain from selling or transferring weapons carelessly in order to start wars or inflict suffering on others. The light weapons industry's global reach exposes companies to supply chain risks, including disruptions in the availability of raw materials, components, and manufacturing capacity. Natural disasters, trade disputes, political upheaval, and sanctions can all disrupt supply chains, which can lead to delays, overspending, and operational challenges for industry players.

Insights by Type

The anti tank weapons segment accounted for the largest market share over the forecast period 2023 to 2033. Many countries are investing in modernising their armed forces to counter emerging threats, and part of that investment involves acquiring state-of-the-art anti-tank weapons. More potent anti-tank weaponry is needed for military vehicles with greater armour to destroy these targets.As geopolitical tensions in various nations have grown, so has the demand for anti-tank weapons. Purchasing anti-tank missiles, rockets, and other weapons is one method that countries trying to fortify their defences against non-state actors or adjacent states attempt to do so. The advent of hybrid warfare tactics, which blend conventional and unconventional methods, has led to a greater need for anti-tank weapons that can effectively fend off a variety of threats, such as armoured vehicles, fortifications, and infrastructure targets.

Insights by Guidance

The guided segment accounted for the largest market share over the forecast period 2023 to 2033. Guided weapons are more accurate and precise than unguided projectiles, which makes them very powerful against specific targets. Precise targeting minimises collateral damage and enhances operational efficacy, particularly in urban settings and when interacting with mobile or defended targets. Many countries are purchasing guided missile systems as part of their modernization efforts in the armed services. To increase military might and maintain a technological edge over potential adversaries, new guided missiles, rockets, and projectiles are being developed or acquired. Many guided weapon systems are designed to do many tasks, which allows them to target and destroy a variety of targets, including ships, armoured vehicles, aeroplanes, and fortified bunkers.

Insights by Application

The defence segment accounted for the largest market share over the forecast period 2023 to 2033. Many countries are pursuing global military modernization programmes as a result of the convergence of shifting security concerns, rising technologies, and geopolitical constraints. Part of these modernization initiatives aims to provide defence forces with state-of-the-art light weapons so they can maintain a competitive advantage in warfare. Because of the global threat that terrorism poses, military troops engaged in counterterrorism operations are asking for more light weapons. Specialised weaponry, such as sniper rifles, assault rifles, and grenade launchers, are needed for precise strikes on terrorist targets and threat neutralisation in metropolitan settings. The growing urbanisation of conflict zones has necessitated the development of light weapons intended for urban combat situations.

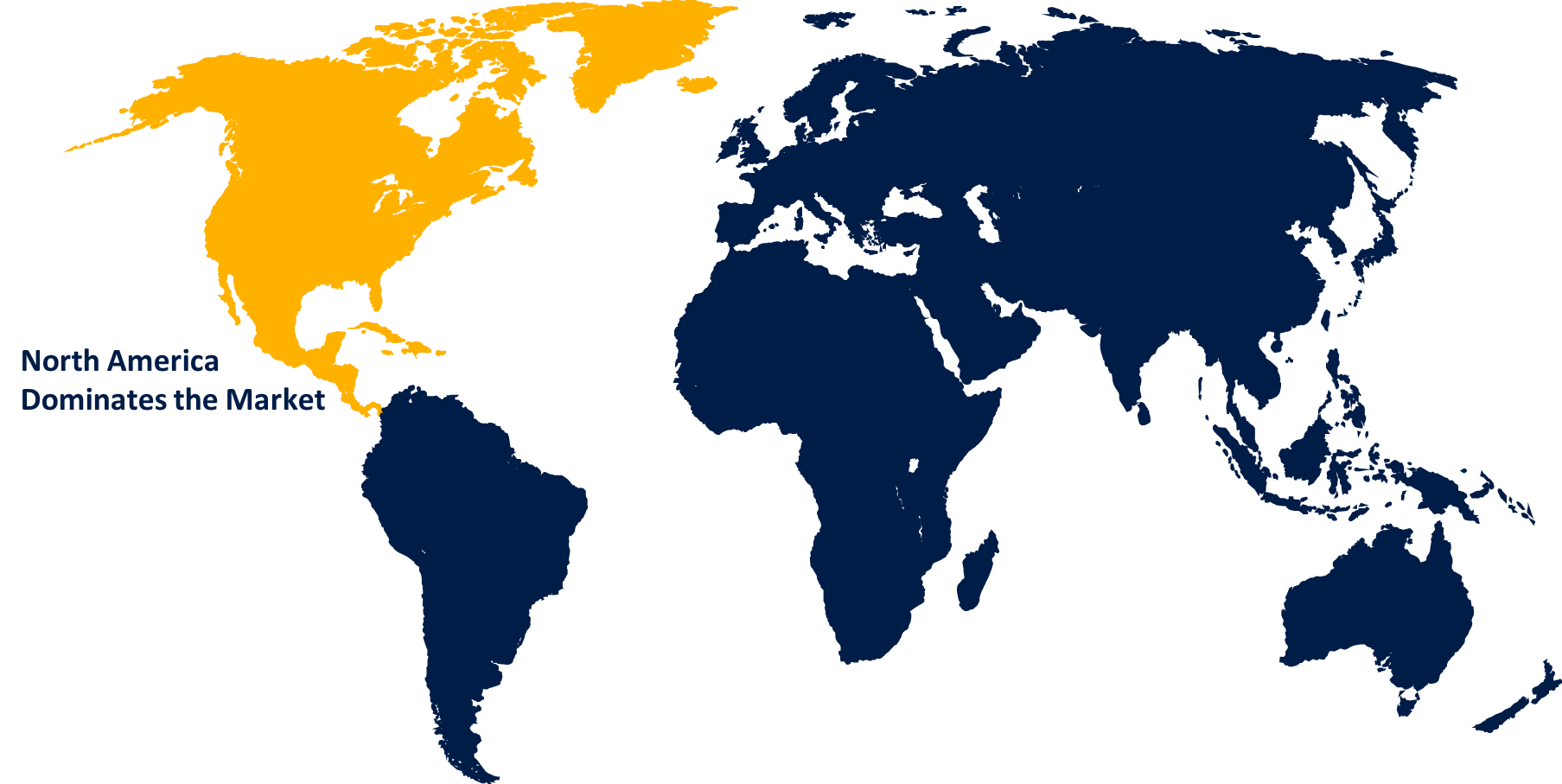

Insights by Region

Get more details on this report -

North America is anticipated to dominate the Light Weapons Market from 2023 to 2033. North America has a strong weapons culture and a sizable civilian gun ownership population, particularly in the United States. This culture fuels the desire for light weapons, such as handguns, rifles, and shotguns, for purposes including hunting, target practice, self-defense, and collection. Law enforcement forces in North America employ light weapons extensively to combat crime and safeguard public safety. Police departments, sheriff's offices, and federal law enforcement agencies regularly purchase weapons, including patrol rifles, tactical shotguns, and handguns. Specialised tools and weaponry are required by law enforcement to manage a range of operational situations. This covers tactical gear and less-lethal weapons.

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Many countries in the Asia-Pacific region are sponsoring military modernization programmes in order to improve their defence capabilities. This entails purchasing light weapons, such as rifles, machine guns, handguns, and grenade launchers, in order to outfit its armed forces. The region's light weapons industry is growing thanks to rising defence budgets in countries including Australia, Japan, South Korea, China, India, and South India. The Asia-Pacific region's military and paramilitary groups are motivated to get light weapons because of security threats, territorial conflicts, and geopolitical tensions. The continuous wars and territorial disputes in areas like the South China Sea and the Korean Peninsula feed the need for weapons and related equipment.

Recent Market Developments

- In Januay 2021, An deal has been signed between Bharat Electronics Limited (BEL) with the Indian Navy to supply light amplification using laser dazzler emission stimulation. In accordance with the arrangement, the business will give the Navy twenty laser dazzlers.

Major players in the market

- Lockheed Martin

- Raytheon

- General Dynamics

- BAE Systems

- Thales Group

- Alliant Techsystems

- Saab

- Rheinmetall

- Cockerill Maintenance & Ingenierie

- Heckler & Koch Defense

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Light Weapons Market, Type Analysis

- Heavy machine guns

- MANPAT

- Infantry Mortar

- Anti-Tank Weapons

- Recoilless Rifles

- Launchers

- Light Cannon

- Anti-Tank Missiles

- MANPADS

- Grenade

- Landmines

Light Weapons Market, Guidance Analysis

- Guided

- Unguided

Light Weapons Market, Application Analysis

- Defense

- Homeland Security

Light Weapons Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?