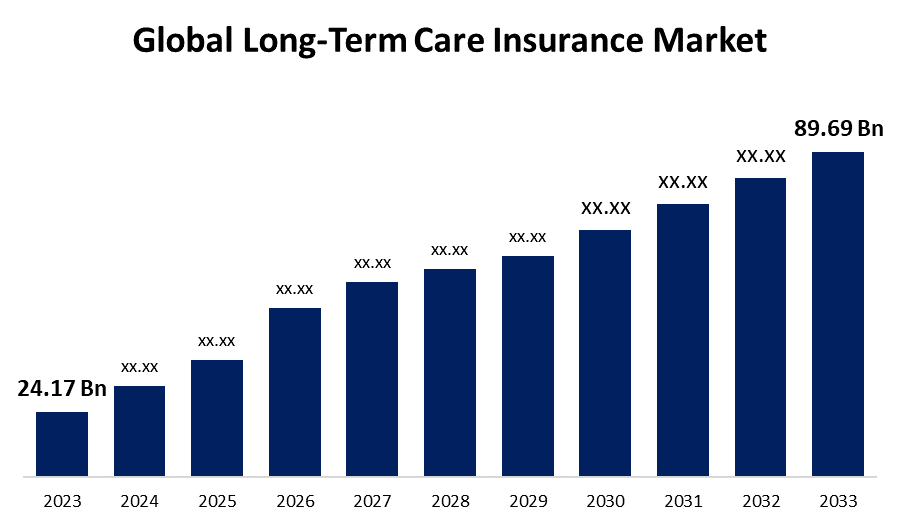

Global Long-Term Care Insurance Market Size To Worth USD 89.69 Billion by 2033 | CAGR of 14.01%

Category: Banking & FinancialGlobal Long-Term Care Insurance Market Size To Worth USD 89.69 Billion by 2033

According to a research report published by Spherical Insights & Consulting, The Global Long-Term Care Insurance Market Size is to Grow from USD 24.17 Billion in 2023 to USD 89.69 Billion by 2033, at a Compound Annual Growth Rate (CAGR) of 14.01% during the projected period.

Get more details on this report -

Browse key industry insights spread across 232 pages with 110 Market data tables and figures & charts from the report on the "Global Long-Term Care Insurance Market Size, Share, and COVID-19 Impact Analysis, By Service (Nursing Care and Home Healthcare), By Payer (Out-of-Pocket and Public), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/long-term-care-insurance-market

More alternatives and flexibility are available with long-term care (LTC) insurance than with many public assistance programs, like Medicaid. For those 65 years of age or older, as well as those with a chronic or incapacitating condition requiring round-the-clock monitoring, it includes personal or adult daycare, home health care, and nursing facility care. The insurance industry's long-term care insurance (LTCI) sector is dedicated to providing financial stability and assistance to individuals requiring long-term care because of age-related illnesses, impairments, or disorders. This type of insurance covers costs related to non-medical and medical services rendered in a range of environments, such as assisted living facilities, nursing homes, and private homes; it also covers long-term care services, such as help with eating, dressing, taking a shower, and getting around. Furthermore, there is increased strain on governments to provide services as a result of the world's expanding older population. These nations are making changes to their healthcare systems so that senior persons can get the services they need at affordable prices. Over the forecast period, growth in the market is anticipated. Furthermore, the advancement of healthcare delivery technology is another factor propelling the industry's growth. Initially, the management primarily used walkers, wheelchairs, and safety blankets, among other durable medical equipment. Throughout the course of the forecast period, advanced, user-friendly products and services like telemedicine, smartphone health apps, and internet-enabled home monitoring are anticipated to propel the market. However, many individuals with modest salaries cannot afford this kind of medical protection because the rates are growing. Though largely for the aged, the monthly or annual premium rates are too exorbitant for retired military personnel. Some choose not to buy this insurance rather than paying higher premiums for plans with lower benefits. Long-term care insurance market growth is anticipated to be constrained as a result.

The nursing care segment is anticipated to hold the greatest share of the global long-term care insurance market during the projected timeframe.

Based on the service, the global long-term care insurance market is divided into nursing care and home healthcare. Among these, the nursing care segment is anticipated to hold the greatest share of the global long-term care insurance market during the projected timeframe. This is attributed to the inclination for taking care of the elderly and the rising demand from developing countries. The aging population and the increased incidence and prevalence of chronic illnesses such as cancer, Alzheimer's disease, and heart problems are driving up the need for nursing care. The demographics most likely to use home healthcare include people over 65, those recently discharged from hospitals, those with mental health disorders, new mothers, and those who want to give their parents in-home medical care. The demand for customized, affordable long-term care at home is fueling the market growth for home healthcare. More people who need care now receive it at home as a result of growing healthcare costs.

The public segment anticipated for the largest revenue share of the global long-term care insurance market during the projected timeframe.

Based on the payer, the global long-term care insurance market is divided into out-of-pocket and public. Among these, the public segment anticipated for the largest revenue share of the global long-term care insurance market during the projected timeframe. The primary factor of this significant segment share is the strong governmental spending that has been seen, particularly in the US and Europe. One significant example is identified in the United States, where Medicaid pays for over 50% of long-term care expenses, however, state-by-state differences exist.

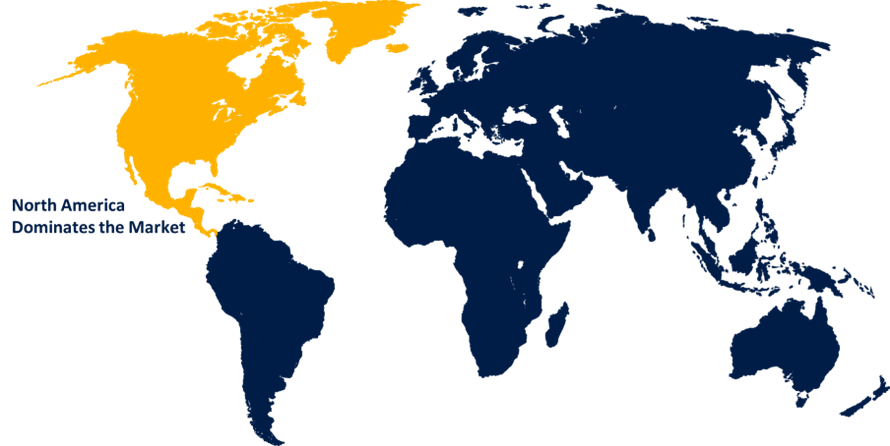

North America is expected to hold the largest share of the global long-term care insurance market over the forecast period.

Get more details on this report -

North America is expected to hold the largest share of the global long-term care insurance market over the forecast period. Some of the primary reasons for this regional dominance are the abundance of long-term care institutions, an ever-improving reimbursement structure, and government rules that are favorable to this sector of those in need of long-term care services, including home healthcare, assisted living facilities, and nursing homes. Furthermore, the country's substantial healthcare expenditures and firmly established healthcare system facilitate the accessibility and availability of a wide range of long-term care alternatives.

Asia Pacific is predicted to grow at the fastest pace in the global long-term care insurance market during the projected timeframe. as a result of the aging population and rising healthcare costs. Long-term care insurance is expected to become more necessary as the population ages and the need for long-term care services increases. An increase in the population with chronic illnesses in the Asian region is driving up demand for long-term care insurance. In addition, as healthcare costs rise, more and more consumers are showing interest in long-term care insurance. In addition, the governments of several Asian countries provide financial incentives to encourage the purchase of long-term care insurance by its inhabitants.

Major vendors in the Global Long-Term Care Insurance Market include Genworth, John Hancock, Aviva, Allianz, Aegon, Dai-ichi, AXA, China Life, Prudential, Generali Italia, Unum Life, Sumitomo Life Insurance, Northwestern Mutual, and Others.

Recent Developments

- In September 2023, The Agency for Integrated Care (AIC) and Homage have partnered with Singapore Life Limited to improve client access to long-term care services in Singapore.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Global Long-Term Care Insurance Market based on the below-mentioned segments:

Global Long-Term Care Insurance Market, By Service

- Nursing Care

- Home Healthcare

Global Long-Term Care Insurance Market, By Payer

- Out-of-Pocket

- Public

Global Long-Term Care Insurance Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?