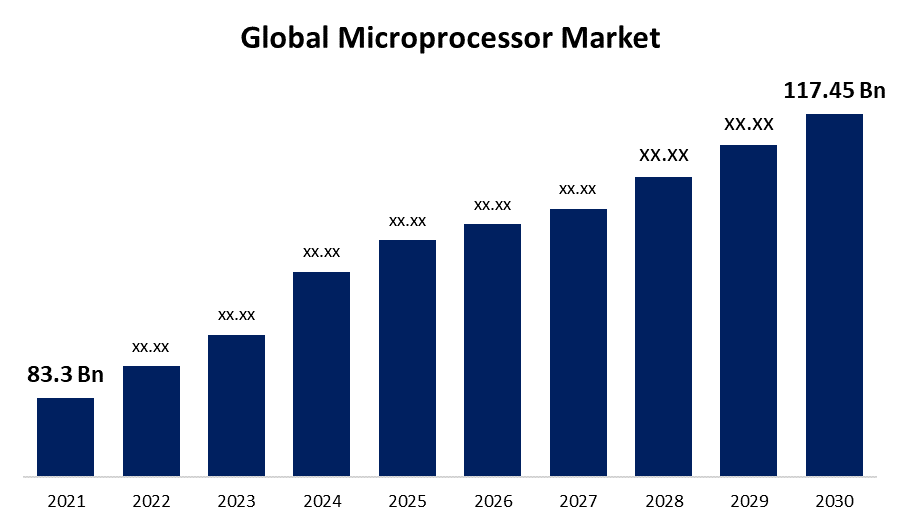

Global Microprocessor Market Size Is Anticipated To Grow At a CAGR of 4.1% from 2022 to 2030

Category: Semiconductors & ElectronicsGlobal Microprocessor Market Size Is Anticipated To Grow At a CAGR of 4.1% from 2022 to 2030

According to a research report published by Spherical Insights & Consulting,The Global Microprocessor Market size was valued at $83.3 billion in 2021 and is expected to reach at a CAGR of 4.1% from 2022 to 2030. Global demand for the market is anticipated to rise due to the expanding use of microprocessors in consumer electronics including smartphones, personal computers (PC), and laptops.

Get more details on this report -

The smartphone market and industry have been growing and changing throughout time in terms of size and models. The number of smartphone subscriptions will top six billion globally in 2021, and will continue to grow by several hundred million over the following years, predicts Ericsson. China, India, and the United States are the three nations with the highest smartphone usage rates. According to predictions, there will be 7516 million smartphone customers by 2026. The demand for cellphones is growing, thus the producers are creating more effective products. The microprocessor enhances the performance of a smartphone because it is used to increase its speed and effectiveness. The performance of the microprocessor directly affects how quickly a smartphone performs.

Browse key industry insights spread across 145 pages with 108 market data tables and figures & charts from the report “ Global Microprocessor Market Size, Share, and COVID-19 Impact Analysis, By Technology (CISC, RISC, ASIC, Superscalar, DSP), By Substrate (Rigid, Flexible, Rigid-flex), By Application (Automotive & Transportation, Consumer Electronics & Home Appliances, Industrial, Medical & Healthcare, Aerospace & Défence, IT & Telecom), By Region (North America, Europe, Asia Pacific, Middle East & Africa, and South America) – Market Size & Forecasting To 2030 ” in detail along with the table of contents. https://www.sphericalinsights.com/reports/microprocessor-market

Over the course of the projected period, a rapidly expanding demand for tablets and smartphones is anticipated to drive market expansion. Globally, roughly 75% of all mobile phone owners will have a smartphone by 2025, per GVR study. Because it is utilised to increase the speed and efficiency of a smartphone, a microprocessor improves the device's performance. Any smartphone's processing speed is closely correlated with the capability of the microprocessor. In addition, with the rise of "smart" gadgets, electronic items like televisions, digital cameras, laptops, and wearable devices now provide a variety of advanced technologies including flat screens, touch screen monitors and displays, and Bluetooth, which call for more integrated circuits (ICs).

Personal computers and servers were the first devices to use microprocessors in. Currently, these ICs are employed in automotive applications including infotainment systems and Advanced Driver-Assistance Systems (ADAS) to provide increased connectivity and high-speed to car systems. In addition, servers, personal computers, and big mainframes are controlled by microprocessors. They are additionally employed for embedded processing in a wide range of systems, including networking hardware, wearable technology, computer peripherals, set-top boxes, medical devices, televisions, industrial machinery, video game consoles, and Internet of Things (IoT) applications. A variety of RISC (Reduced Instruction Set Computer) architectures or a generic x86 processor are typically utilised in digital consumer applications, PCs, and communications microprocessors.

It is anticipated that market growth will be hampered in the coming years by factors such as high raw material prices, declining shipments of standalone computers, rising sales of low-cost mobile devices, high manufacturing costs for microprocessor integrated circuits, and rising sales of low-cost mobile devices. Nevertheless, due to several developments in these processors, such as Internet of Things (IoT) and Artificial Intelligence, server processors are often preferred over ordinary desktop CPUs depending on the applications (AI).

Covid 19 Impact on Global Microprocessor Market

In the first half of 2020, the market has been significantly damaged by the COVID-19 pandemic. The supply chain for raw materials and components experienced interruptions in the early months of 2020 as a result of protracted lockdowns and international trade restrictions. Additionally, a number of vehicle and consumer electronics firms closed their factories, which further hampered the market's acceptance of microprocessors. However, the industry need for personal computers, laptops, and workstations has increased due to the expanding work-from-home (WFH) trend among IT firms.

Global Microprocessor Market, By Technology

In the upcoming years, it is projected that the ASIC segment would grow the fastest. Due to their dependable performance and other benefits like low power consumption, IP security, small size, and increased bandwidth, ICs are being used more and more in the consumer electronics industry, which is a major factor in this segment's growth. Additionally, ASIC chips replace conventional parts like solder joints and PCB traces with a single IC, helping to lower the possibility of failure and providing dependable industrial systems.

Additionally, manufacturers offer a variety of ASICs, including fully customised and semi-custom ASICs. Full custom ASIC enables designers to alter logic cells, mechanical components, layouts and circuits, and memory cell optimization on an IC, which reduces processing time and hazards. A semi-custom ASIC, on the other hand, features an advanced integrated static random-access memory and internet protocol cores that aid in the system's efficient operation.

Global Microprocessor Market, By Application

Over the course of the projection period, the servers segment is anticipated to experience significant expansion. To maintain its performance level and be capable of overcoming failures in the event of a power outage or crash, the server microprocessor supports numerous cores, threads, and processors. The server microprocessor has evolved throughout time thanks to numerous inventions and advancements, including higher clock speed, storage capacity, and transistor and resistor operating frequencies.

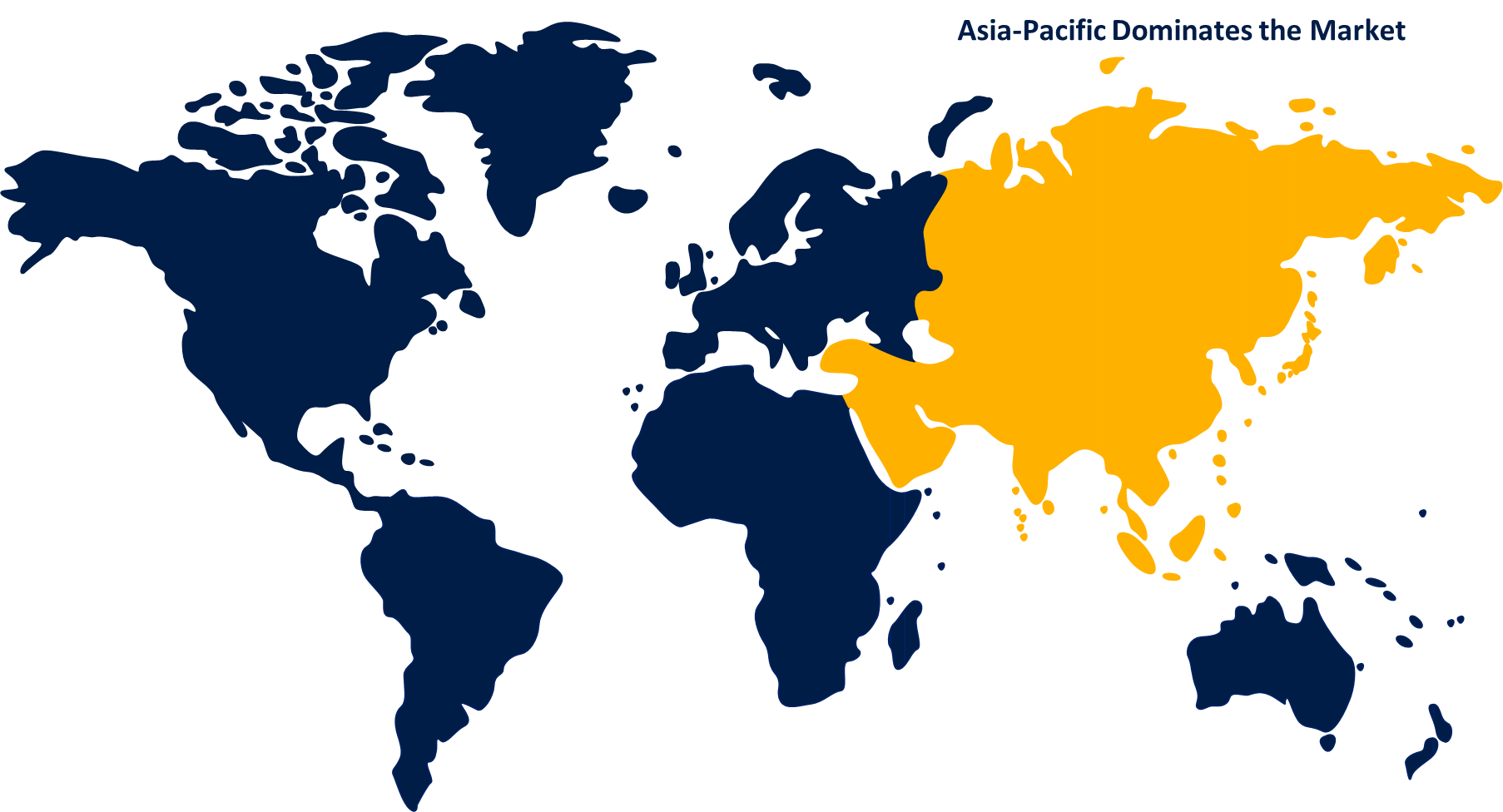

Global Microprocessor Market, By Region

North America is expected to experience significant growth during the projection period. The major presence of well-known companies in the area, including as Intel Corporation, Qualcomm Technologies Inc., and Texas Instruments Inc., is credited with the rise. Currently, the United States controls a large portion of the North American market. One of the main factors driving the market expansion in the U.S. is the rapid development of consumer electronics items, healthcare monitoring systems, and electric and hybrid automobiles.

Get more details on this report -

Some Recent Developments in Global Microprocessor Market

March 2022: SMIC and the Chinese government have invested 2.35 billion USD in building a new semiconductor foundry in China by 2022. The new facility will focus on manufacturing chipsets with cutting-edge 28 nm process technologies.

Recent Developments in Global Microprocessor Market

- March 2022: By 2022, a new semiconductor foundry will be built in China thanks to a 2.35 billion USD investment by SMIC and the Chinese government. The new facility will concentrate on producing chipsets using process technologies as advanced as 28 nm.

Segmentation

By Technology

- CISC

- RISC

- ASIC

- Superscalar

- DSP

By Application

- Automotive & Transportation

- Consumer Electronics & Home Appliances

- Industrial

- Medical & Healthcare

- Aerospace & Defense

- IT & Telecom

By Region:

North America

- North America, by Country

- U.S.

- Canada

- Mexico

- North America, by Technology

- North America, by Application

Europe

- Europe, by Country

- Germany

- Russia

- U.K.

- France

- Italy

- Spain

- The Netherlands

- Rest of Europe

- Europe, by Technology

- Europe, by Application

Asia Pacific

- Asia Pacific, by Country

- China

- India

- Japan

- South Korea

- Australia

- Indonesia

- Rest of Asia Pacific

- Asia Pacific, by Technology

- Asia Pacific, by Application

Middle East & Africa

- Middle East & Africa, by Country

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

- Middle East & Africa, by Technology

- Middle East & Africa, by Application

South America

- South America, by Country

- Brazil

- Argentina

- Colombia

- Rest of South America

- South America, by Technology

- South America, by Application

Need help to buy this report?