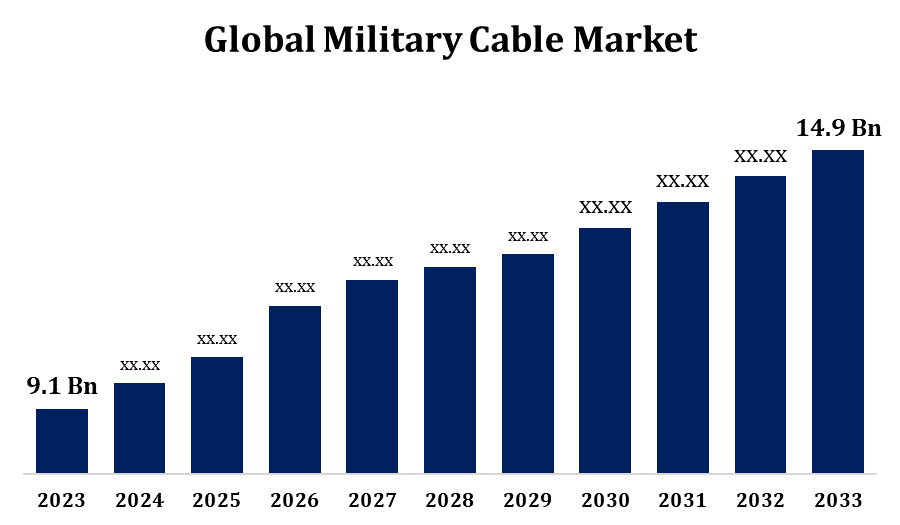

Global Military Cable Market Size To Worth USD 14.9 Billion By 2033 | CAGR of 5.05%

Category: Aerospace & DefenseGlobal Military Cable Market Size To Worth USD 14.9 Billion By 2033

According to a research report published by Spherical Insights & Consulting, the Global Military Cable Market Size to Grow from USD 9.1 Billion in 2023 to USD 14.9 Billion by 2033, at a Compound Annual Growth Rate (CAGR) of 5.05% during the forecast period.

Get more details on this report -

Browse key industry insights spread across 236 pages with 110 Market data tables and figures & charts from the report on the "Global Military Cable Market Size, Share, and COVID-19 Impact Analysis, By Application (Aerospace, Naval, Ground), By Cable Type (Coaxial Cable, Fiber Optic Cable, Twisted Pair Cable), By Material (Copper, Aluminum, Fiber), By End Use (Defense, Civilian, Commercial), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033." Get Detailed Report Description Here:https://www.sphericalinsights.com/reports/military-cable-market

The military cable market is steadily growing, driven by increasing defense budgets, escalating geopolitical tensions, and the demand for advanced communication and power distribution systems in military operations. Engineered to endure extreme conditions, these cables offer high durability, performance, and resistance to heat, moisture, and electromagnetic interference. They play a crucial role in aerospace, naval, ground vehicles, and weapon systems. The rising need for lightweight, high-speed data transmission solutions is fueling innovation in fiber optics and composite materials. Leading companies prioritize R&D to enhance cable efficiency and security. North America leads the market due to substantial military investments, while Asia-Pacific is rapidly expanding with ongoing defense modernization efforts. Stringent military regulations and continuous technological advancements further influence the evolving market landscape.

Military Cable Market Value Chain Analysis

The military cable market value chain comprises several critical stages, from raw material procurement to final deployment. It begins with sourcing high-performance materials such as copper, aluminum, fiber optics, and specialized insulation to ensure durability and resilience under extreme conditions. Manufacturers then design and produce cables that meet stringent military standards, incorporating advanced shielding, coatings, and ruggedization techniques. Suppliers and distributors play a vital role in delivering these cables to defense contractors and government agencies. System integrators integrate them into various military applications, including communication networks, aerospace, naval, and land-based defense systems. The final phase involves maintenance, testing, and upgrades to ensure long-term performance and reliability. Technological advancements, strict defense regulations, and collaborations between governments and private firms drive efficiency and innovation throughout the value chain.

Military Cable Market Opportunity Analysis

The military cable market offers substantial growth opportunities, driven by increasing defense spending, military modernization efforts, and advancements in communication and electronic warfare technologies. The shift toward lightweight, high-speed data transmission solutions, particularly fiber optic cables, presents significant innovation potential. Rising demand for unmanned systems, cyber defense, and advanced radar and surveillance technologies further expands market prospects. Growing defense budgets in emerging regions, especially in Asia-Pacific and the Middle East, create new opportunities for cable manufacturers. Collaborations between defense agencies and private firms are accelerating product development. Additionally, the adoption of smart, ruggedized cables with enhanced durability and cybersecurity features adds to market expansion. Companies prioritizing R&D and strategic partnerships can strengthen their competitive position in this evolving industry.

The rising demand for advanced communication systems is a major factor driving growth in the military cable market. Modern defense operations depend on secure, high-speed data transmission for battlefield communication, surveillance, and intelligence gathering. Military forces worldwide are investing in cutting-edge technologies such as satellite communication, software-defined radios, and encrypted networks, increasing the need for high-performance cables. Fiber optic cables, valued for their high bandwidth and low latency, are becoming more prominent in defense applications. Additionally, the adoption of 5G and IoT in military operations is further fueling demand. Governments and defense contractors prioritize ruggedized, interference-resistant cables to ensure reliable performance in harsh environments. Consequently, cable manufacturers are enhancing innovation, cybersecurity measures, and compliance with strict military standards to address evolving defense requirements.

Strict military standards and regulatory compliance add to manufacturing complexity and costs. Ensuring high durability, resistance to extreme conditions, and effective electromagnetic shielding requires advanced materials and technologies, increasing production expenses. Market stability is further impacted by supply chain disruptions, geopolitical tensions, and raw material shortages. Additionally, rapid technological advancements demand continuous innovation, making it challenging for manufacturers to keep pace with evolving military requirements. Cybersecurity threats pose another concern, as secure data transmission is critical for defense operations. Budget constraints in certain regions may also limit defense spending, affecting procurement levels. To stay competitive, companies must invest in R&D, foster strategic partnerships, and develop cost-effective solutions to address these challenges while meeting stringent military specifications.

Insights by Application

The aerospace segment accounted for the largest market share over the forecast period 2023 to 2033. Modern military aircraft rely on high-performance cables for secure communication, avionics, radar systems, and power distribution. The growing deployment of unmanned aerial vehicles (UAVs) and next-generation fighter jets is driving demand for lightweight, durable, and high-speed data transmission cables. Fiber optic cables are increasingly favored for their low latency, high bandwidth, and resistance to electromagnetic interference. Additionally, advancements in satellite communication and expanding space defense programs are further fueling market growth. Strict military standards for reliability and performance continue to push innovation in materials and shielding technologies. As aerospace modernization progresses, this segment remains a key contributor to the evolution of the military cable industry, ensuring secure and efficient operations in defense aviation and space missions.

Insights by Cable Type

The Coaxial cable segment accounted for the largest market share over the forecast period 2023 to 2033. Coaxial cables play a crucial role in military communication systems, radar, electronic warfare, and surveillance applications, where reliable data transmission is essential. The growing need for advanced radar and satellite communication systems is driving the demand for high-performance coaxial cables with superior shielding and durability. Military modernization programs across the U.S., Europe, and Asia-Pacific are further boosting market growth. Additionally, advancements in materials and design are enhancing signal integrity and improving resistance to harsh environmental conditions. With increasing defense budgets and rising investments in electronic warfare and secure communication networks, the coaxial cable segment continues to be a critical component of the military cable industry, ensuring robust and efficient connectivity for modern defense operations.

Insights by Material

The copper segment accounted for the largest market share over the forecast period 2023 to 2033. Copper cables are essential in military vehicles, naval ships, radar systems, and ground communication networks, ensuring secure and stable connections. The growing demand for high-performance power cables in defense infrastructure, coupled with ongoing military modernization efforts, is driving market growth. Advancements in insulation and shielding technologies are further improving copper cable efficiency, enhancing resistance to electromagnetic interference and extreme environmental conditions. While fiber optics is gaining popularity, copper cables remain indispensable due to their durability and cost-effectiveness. As global defense investments continue to rise, the copper segment remains a vital component of military cable applications, providing reliable and robust connectivity for various defense operations.

Insights by End Use

The defence segment accounted for the largest market share over the forecast period 2023 to 2033. Military forces worldwide rely on high-performance cables for secure communication, power distribution, radar systems, and electronic warfare. The growing adoption of advanced technologies, such as unmanned systems, cybersecurity solutions, and next-generation combat vehicles, is driving demand for ruggedized, interference-resistant cables. Fiber optic cables are becoming increasingly popular for their high-speed data transmission, while coaxial and copper cables remain crucial for power and signal integrity. North America and Asia-Pacific lead the market, driven by continuous defense infrastructure advancements. Strict military standards and the need for enhanced battlefield connectivity are fueling innovation. As military operations become more technology-driven, the defense segment is set to expand further, playing a critical role in the evolution of the military cable market.

Insights by Region

Get more details on this report -

North America is anticipated to dominate the Military Cable Market from 2023 to 2033. The United States, as the leading contributor, invests significantly in modernizing communication, surveillance, and weapon systems, driving demand for high-performance military cables. The region’s emphasis on cybersecurity, space defense, and unmanned systems further increases the need for secure and durable cable solutions. Strict military standards, set by entities like the U.S. Department of Defense, ensure high-quality and reliable performance. Additionally, ongoing R&D initiatives, partnerships between defense agencies and private companies, and the adoption of advanced technologies such as fiber optics and 5G accelerate market growth. With continuous investments in defense infrastructure, North America remains a key player in shaping the global military cable industry, ensuring innovation and technological advancement in military connectivity solutions.

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. China, India, Japan, and South Korea are making significant investments in advanced defense technologies, fueling the demand for high-performance military cables. The expansion of naval fleets, aerospace advancements, and the growing adoption of cyber defense and electronic warfare systems are further driving market growth. Governments across the region are prioritizing secure communication networks, increasing the need for fiber optic and ruggedized cables. Local manufacturers are strengthening collaborations with global defense contractors to enhance technological expertise. With ongoing military modernization and the expansion of defense infrastructure, Asia-Pacific remains one of the fastest-growing regions in the global military cable market, presenting substantial opportunities for innovation and development.

Recent Market Developments

- In January 2021, Carlisle Interconnect Technologies, a leading name in military cables, has launched the UTiPHASE microwave cable assembly series, an innovative solution that delivers outstanding electrical phase stability across temperature variations without compromising microwave performance. Engineered for defense, space, and testing applications, UTiPHASE provides reliable, high-performance connectivity in challenging environments.

Major players in the market

- Hawke International

- Curtis Wright

- Raychem

- General Cable

- Southwire Company

- Prysmian Group

- Amphenol

- Cable Manufacturing Company

- Belden

- LS Cable and System

- Acome

- Nexans

- Marmon Utility

- TE Connectivity

- Alcatel-Lucent

- Others

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Military Cable Market, Application Analysis

- Aerospace

- Naval

- Ground

Military Cable Market, Cable Type Analysis

- Coaxial Cable

- Fiber Optic Cable

- Twisted Pair Cable

Military Cable Market, Material Analysis

- Copper

- Aluminum

- Fiber

Military Cable Market, End Use Analysis

- Defense

- Civilian

- Commercial

Military Cable Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?