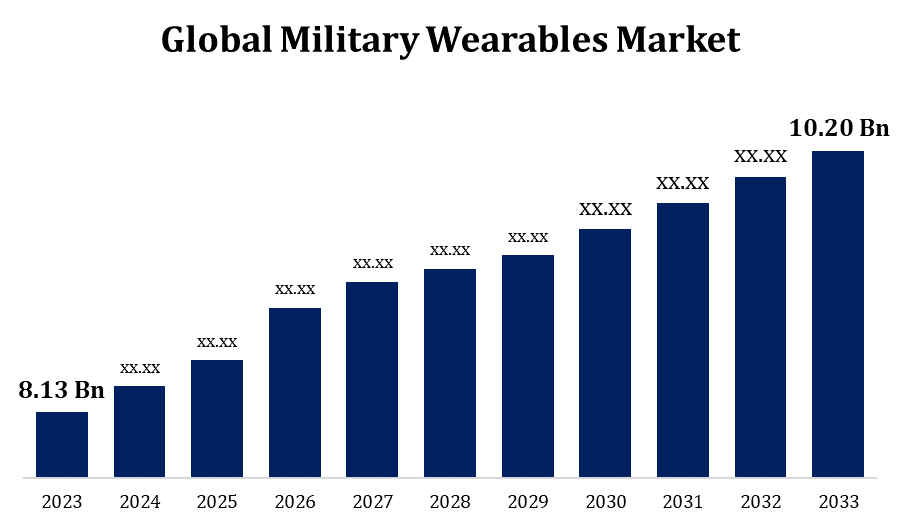

Global Military Wearables Market Size To Worth USD 10.20 Billion By 2033 | CAGR of 2.29%

Category: Aerospace & DefenseGlobal Military Wearables Market Size To Worth USD 10.20 Billion By 2033

According to a research report published by Spherical Insights & Consulting, the Global Military Wearables Market Size to Grow from USD 8.13 Billion in 2023 to USD 10.20 Billion By 2033, at a Compound Annual Growth Rate (CAGR) of 2.29% during the forecast period.

Get more details on this report -

Browse key industry insights spread across 206 pages with 110 Market data tables and figures & charts from the report on the “Global Military Wearables Market Size, Share, and COVID-19 Impact Analysis, By Wearable Type (Headwear, Eyewear, Wristwear, Hearables, and Bodywear), By Technology (Smart Textiles, Network and Connectivity Management, Exoskeleton, Vision & Surveillance, Communication & Computing Monitoring, Power and Energy Source, and Navigation), By End User (Land Forces, Naval Forces, and Air Forces), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.” Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/military-wearables-market

The military wearables market is expanding rapidly, fueled by technological breakthroughs and rising defence budgets around the world. These wearables, which include smart fabrics, exoskeletons, augmented reality (AR) gadgets, and biometric monitoring systems, aim to improve troop performance, safety, and situational awareness. North America dominates the market because to significant investment in R&D, followed by Europe and the Asia-Pacific region, where rising geopolitical tensions drive demand. Key market players prioritise innovation and the integration of artificial intelligence (AI) to enhance functionality. Furthermore, the increasing demand for real-time data and communication on the battlefield drives market growth. Challenges such as high costs and cybersecurity concerns are handled by continuous innovation and strategic collaboration among industry leaders.

Military Wearables Market Value Chain Analysis

The military wearables market value chain includes various crucial stages, ranging from R&D to end-user deployment. Initially, R&D focuses on new materials, improved sensors, and integrated technologies, frequently in conjunction with defence agencies, technological corporations, and academic institutions. Manufacturing follows, with a focus on durability and performance for components such as smart fabrics, augmented reality gadgets, and exoskeletons. The next step is system integration, which ensures wearables' smooth connectivity and functionality with existing military systems. Defence agencies oversee procurement processes that include demanding testing and validation requirements. Finally, deployment and maintenance are critical, necessitating ongoing support and updates to address emerging risks and operating requirements. Cybersecurity measures must be implemented throughout the value chain to secure sensitive data and communications.

Military Wearables Market Opportunity Analysis

The military wearables market offers significant prospects, driven by the demand for innovative technological solutions to improve soldier efficiency and safety. Smart fabrics, augmented reality, artificial intelligence, and biometric monitoring innovations provide new opportunities for the development of highly useful wearables. Increased defence spending worldwide, particularly in North America, Europe, and Asia-Pacific, drive demand for such modern equipment. There are also opportunities for integrating wearables with existing defence systems to give real-time data and increased situational awareness. Furthermore, the increased emphasis on troop health and performance monitoring creates opportunities for specialised biometric wearables. Collaboration among military organisations, technology businesses, and research institutions promotes market growth by solving obstacles such as high costs and cybersecurity concerns through innovation and strategic alliances.

The adoption of advanced wearable technologies is a major driver of growth in the military wearables market. Smart fabrics, augmented reality (AR), and biometric monitoring innovations have dramatically increased army skills by giving real-time data and situational awareness. These technologies provide significant benefits, such as increased operating efficiency, improved health monitoring, and superior communication, which drives rising demand. Military organisations throughout the world are investing extensively in R&D to integrate these wearables with current systems, accelerating market growth. The emphasis on creating lightweight, durable, and highly functioning wearables that can resist severe settings meets the critical needs of modern warfare. As defence budgets increase, notably in North America and Asia-Pacific, the rapid adoption of these advanced technologies drives market expansion.

The military wearables market confronts a number of hurdles that limit its growth and adoption. The high costs associated with developing and producing advanced wearable technology present a substantial obstacle to widespread application. Cybersecurity is another major issue, as wearables are vulnerable to hacking and data leaks, which might jeopardise sensitive military operations. Ensuring interoperability and smooth integration with existing military systems is technically challenging, necessitating significant testing and validation. Durability and dependability in hostile combat situations are critical, but difficult to achieve consistently. Furthermore, the rapid speed of technology innovation needs ongoing updates and upgrades, which strain resources and finances. Military organisations' resistance to change, as well as the necessity for considerable training for staff to efficiently use these wearables, impede market penetration.

Insights by Wearable Type

The bodywear segment accounted for the largest market share over the forecast period 2023 to 2033. Advancements in smart textiles and rising need for improved military protection and performance are driving the increase. Bodywear encompasses smart uniforms, vests, and exoskeletons that are intended to give real-time health monitoring, increased mobility, and enhanced physical capabilities. Materials science innovations have resulted in the production of lightweight, long-lasting fabrics embedded with sensors, allowing for thorough monitoring of vital signs and ambient conditions. This segment's growth is accelerated by the integration of bodywear with communication systems and situational awareness technologies, which provide soldiers with essential data during operations.

Insights by Technology

The communication and computing segment is dominating the market with the largest market share over the forecast period 2023 to 2033. The demand for improved real-time data exchange and battlefield decision-making skills is driving the growth. Wearable gadgets such as sophisticated headphones, wrist-worn computers, and smart glasses enable smooth communication and access to essential information. Technological developments in miniaturisation and power efficiency enable the creation of lightweight, long-lasting gadgets that connect with existing military systems. The rising emphasis on network-centric warfare and situational awareness drives up demand for these devices.

Insights by End User

The land forces segment is dominating the market with the largest market share over the forecast period 2023 to 2033. The growth is being driven by an increased emphasis on soldier upgrading programmes and the demand for improved operational capabilities. This sector includes wearables designed primarily for ground-based military operations, such as infantry personnel, special forces units, and armoured vehicle crews. Wearables are becoming increasingly popular among land forces thanks to innovations such as integrated sensor suites, augmented reality (AR) displays, and sophisticated body armour systems. These technologies improve situational awareness, communication, and protection, increasing soldiers' effectiveness and survivability on the battlefield.

Insights by Region

Get more details on this report -

North America is anticipated to dominate the Military Wearables Market from 2023 to 2033. The United States, as the world's largest defence spender, is an important player in this regional industry, investing considerably in research and development of advanced wearable technologies. These investments aim to improve military performance, safety, and situational awareness using technologies such as smart textiles, biometric monitoring, and augmented reality (AR) systems. Collaboration among the military, technology corporations, and academic institutions helps to speed the development and deployment of cutting-edge wearable technologies. Furthermore, North America's emphasis on modernising its armed services and integrating wearables into existing military systems reinforces the region's market leadership.

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Countries such as China, India, Japan, and South Korea are heavily investing in innovative military technologies to modernise their armies. The use of smart textiles, augmented reality (AR) gadgets, and biometric monitoring systems improves troop performance, safety, and situational awareness. Collaborations between defence agencies, local technology enterprises, and multinational corporations are promoting innovation and hastening the creation of cutting-edge wearables. The region's emphasis on integrating these wearables into existing military infrastructure is fueling market growth.

Recent Market Developments

- In October 2022, L3Harris Technologies has introduced a new device called Iridium Distributed Tactical Communications Systems (DTCS). This device is used for push-to-talk speech and data transmission by warriors all over the world.

Major players in the market

- Arralis (Ireland)

- Honeywell International Inc. (US)

- Safran Electronics & Defense (France)

- BeBop Sensors (US)

- DuPont (US)

- Panasonic Corporation (Japan)

- NXP Semiconductors (Netherlands)

- Leidos (US)

- TT Electronics (UK)

- Xsens (Netherlands)

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Military Wearables Market, Wearable Type Analysis

- Headwear

- Eyewear

- Wristwear

- Hearables

- Bodywear

Military Wearables Market, Technology Analysis

- Smart Textiles

- Network and Connectivity Management

- Exoskeleton

- Vision & Surveillance

- Communication & Computing Monitoring

- Power and Energy Source

- Navigation

Military Wearables Market, End User Analysis

- Land Forces

- Naval Forces

- Air Forces

Military Wearables Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Follow Us: LinkedIn | Facebook | Twitter

Need help to buy this report?