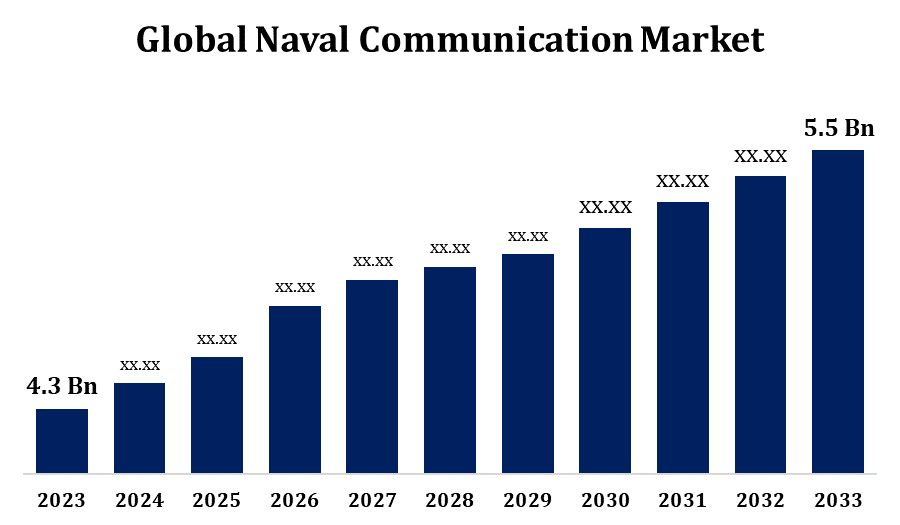

Global Naval Communication Market Size To Worth USD 5.5 Billion By 2033 | CAGR of 2.49%

Category: Aerospace & DefenseGlobal Naval Communication Market Size To Worth USD 5.5 Billion By 2033

According to a research report published by Spherical Insights & Consulting, the Global Naval Communication Market Size to Grow from USD 4.3 billion in 2023 to USD 5.5 billion by 2033, at a Compound Annual Growth Rate (CAGR) of 2.49% during the forecast period.

Get more details on this report -

Browse key industry insights spread across 200 pages with 110 Market data tables and figures & charts from the report on the "Global Naval Communication Market Size By Application (Command and Control, Intelligence Surveillance and Reconnaissance (ISR), Routine Operations, Others), By Platforms (Ships, Submarines, Unmanned System), By Technology (Naval Satcom System, Naval Radio Systems, Naval Security Systems and Communication Management Systems), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033." https://www.sphericalinsights.com/reports/naval-communication-market

Many countries are providing funding for the modernization of their navies, including infrastructure for communications. To remain competitive and adapt to emerging threats, the Navy is modernising its ageing technology with more advanced and interoperable communication tools. As naval forces rely more and more on networked naval communication systems, cybersecurity is becoming a bigger worry. Ensuring the security and resilience of communication networks against cyber threats is a top responsibility, which drives investments in cybersecurity solutions tailored for maritime environments. Satellite communication systems are critical to the long-range and beyond-line-of-sight communication capabilities that naval forces require. Warships can stay connected even during long deployments and in remote areas because to the growing demand for high-bandwidth satellite communication systems.

Naval Communication Market Value Chain Analysis

To develop new communication technologies tailored for naval applications, research institutes, defense contractors, and technology businesses invest in research and development (R&D). These efforts focus on advancing hardware and software components necessary for naval communication systems. Component providers play a crucial role by supplying essential networking hardware, antennas, sensors, semiconductors, radio frequency (RF) components, and encryption modules. These components are sourced from specialized manufacturers and commercial off-the-shelf (COTS) vendors. System integrators are responsible for assembling these diverse components into complete naval communication systems. Their task involves integrating hardware, software, and firmware to ensure compatibility, reliability, and performance. Manufacturing facilities adhere to stringent military standards and specifications during the production of tangible parts and subsystems for naval communication systems. This ensures that the final products meet the rigorous requirements of naval operations.

Naval Communication Market Opportunity Analysis

A large number of naval forces throughout the world are currently undergoing modernization programmes to improve their communication systems in order to meet their operational needs going forward. This presents an opportunity for providers to present state-of-the-art communication systems with enhanced capabilities, robustness, and interoperability. The increasing need for high-bandwidth communication capabilities is driving expansion in the satellite communication segment of the naval communication market. In order to provide naval troops operating in remote areas with dependable and secure connectivity, suppliers of marine-specific satellite communication equipment and services may want to take advantage of this opportunity. As cyber threats continue to evolve, there is an increasing need for cybersecurity solutions tailored specifically for maritime environments. Marine cybersecurity suppliers can offer naval communication networks defences against cyberattacks.

In order to ensure effective command, control, and coordination, countries need to make investments in expanding their naval fleets and outfitting these vessels with state-of-the-art communication equipment. The procurement of new ships and submarines presents an opportunity for communication system suppliers to provide innovative and efficient solutions. Many navies are putting their current fleets equipped with state-of-the-art technologies through modernization projects. This includes fitting more modern communication equipment to older vessels or merging newer vessels with state-of-the-art communication capabilities. These modernization initiatives stimulate the need for communication services and equipment. Larger naval fleets need robust communication networks to maintain situational awareness among dispersed units. Advanced communication systems provide real-time data transfer, which gives naval commanders the ability to effectively monitor and respond to threats.

The confidentiality, integrity, and availability of critical communications through naval communication systems can all be compromised by cyberattacks. To protect communication networks from cyberattacks, strong cybersecurity protocols including encryption, authentication, intrusion detection, and continuous monitoring are required. Bandwidth restrictions can cause problems for large data transfer volumes, particularly in remote maritime areas. Naval communication systems must optimise bandwidth consumption to prioritise vital messages, limit latency, and ensure timely information delivery. Naval communication systems must be dependable in harsh maritime environments, such as exposure to seawater, extremely high temperatures, high humidity, and mechanical vibrations. Budgetary constraints may prohibit investment in state-of-the-art communication systems and infrastructure upgrades, especially for navies with limited resources.

Insights by Application

The command and control segment accounted for the largest market share over the forecast period 2023 to 2033. Many navies throughout the world are pursuing modernization plans to enhance their command and control capabilities. The deployment of advanced communication systems enables real-time information exchange, supports decision-making, and enhances the situational awareness of naval commanders. Effective command and control between naval ships, aircraft, submarines, and shore-based command centres is essential for navy operations. Command and control communication systems that adhere to interoperability standards provide seamless coordination and communication across diverse assets, hence enhancing operational efficiency. Commanders must have rapid access to pertinent information in order to make decisions during naval operations. Command and control communication systems provide data fusion, analysis, and visualisation capabilities that enable commanders to monitor the maritime environment, assess threats, and adjust to changing conditions.

Insights by Platforms

The ships segment is dominating the market with the largest market share over the forecast period 2023 to 2033. Global efforts are being made to modernise naval fleets, with many navies investing in the purchase of new ships and equipping older vessels with state-of-the-art communication systems. Thanks to this modernization effort, vendors now have the opportunity to offer state-of-the-art communication systems specifically tailored for Navy boats. The growing number of naval deployments, including patrols, exercises, and humanitarian missions, has created a growing demand for stable and effective communication systems on board ships. On naval vessels, effective communication is essential for asset coordination, information sharing, and command and control operations. Situational awareness is a critical function of shipboard communication systems for navy crews and commanders.

Insights by Technology

The naval satcom system segment accounted for the largest market share over the forecast period 2023 to 2033. As maritime activities, such as disaster response, anti-piracy operations, surveillance, and reconnaissance, are becoming more sophisticated and expansive, it is imperative to have dependable communication systems that can operate across vast sea regions. Naval SATCOM systems enable naval forces to stay connected even in remote areas by enabling communication over long distances and beyond line of sight. The global coverage of SATCOM systems allows navy warships to maintain communication no matter where they are. For navies on extended deployments or those operating in areas with minimal or nonexistent terrestrial communication infrastructure, this is extremely crucial. Many navies employ commercial SATCOM services to augment their current military SATCOM capabilities.

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Naval Communication Market from 2023 to 2033. The United States and Canada's naval forces invest much on state-of-the-art communication systems in order to maintain their operational dominance. This includes high-frequency radio systems, satellite communication systems, secure voice and data networks, and interoperable communication platforms. Given the increasing threats to cybersecurity, the North American naval forces have made cybersecurity a top priority in its communication systems. It is possible that vendors offering secure network topologies, intrusion detection, and encryption tailored to naval environments may target this market. Given the increasing threats to cybersecurity, the North American naval forces have made cybersecurity a top priority in its communication systems. It is possible that vendors offering secure network topologies, intrusion detection, and encryption tailored to naval environments may target this market.

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The Asia-Pacific region is seeing an increase in naval activity, including joint operations, patrols, and exercises. Reliable and secure communication systems are needed to enable command and control, coordination, and information transmission between naval vessels, aircraft, and shore-based command centres. Cybersecurity concerns are a major challenge as naval communication systems become more digitally networked and dependent. Asia-Pacific countries are prioritising cybersecurity measures to protect confidential and sensitive data integrity, as well as to thwart cyberattacks on naval communication networks. The rapid economic growth in the Asia-Pacific area has led to a rise in defence and marine security investment.

Recent Market Developments

- In November 2021, Collins Aerospace created a unique directional communication system for tiny aerial platforms, such as UAVs operating in contested area, as part of the DARPA Pheme project, and it was on show.

Major players in the market

- Acorn Science & Innovation, Inc.

- Airbus SAS

- AIRtec Inc.

- Anduril Industries, Inc.

- Atlas Elektronik GmbH

- BAE Systems

- Bombardier Inc.

- Elbit Systems Ltd.

- General Dynamics Corporation

- Hanwha Systems Co., Ltd.

- Harris Corporation

- Huntington Ingalls Industries

- Inmarsat Global Limited

- L3 Harris Technologies

- Leonardo DRS, Inc.

- Lockheed Martin Corporation

- MAG Aerospace

- Northrop Grumann Corporation

- PAL Aerospace

- Raytheon Technologies Corporation

- Saildrone, Inc.

- Smartronix, LLC

- Terma A/S

- Textron Inc.

- Thales Group

- Trillium Engineering LLC

- Ultra Electronics Holdings

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Naval Communication Market, Application Analysis

- Command and Control

- Intelligence Surveillance and Reconnaissance (ISR)

- Routine Operations

- Others

Naval Communication Market, Platforms Analysis

- Ships

- Submarines

- Unmanned System

Naval Communication Market, Technology Analysis

- Naval Satcom System

- Naval Radio Systems

- Naval Security Systems

- Communication Management Systems

Naval Communication Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Follow Us: LinkedIn | Facebook | Twitter

Need help to buy this report?