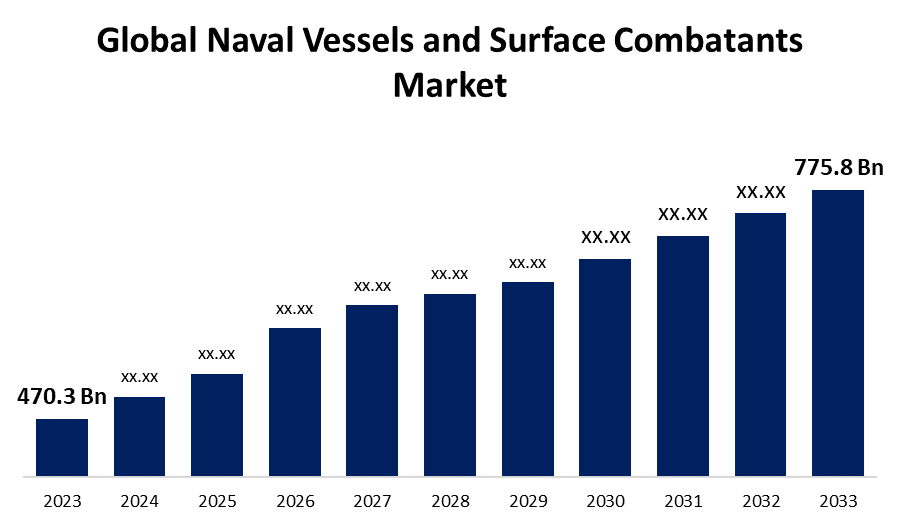

Global Naval Vessels and Surface Combatants Market Size To Worth USD 775.8 Billion By 2033 | CAGR of 5.13%

Category: Aerospace & DefenseGlobal Naval Vessels and Surface Combatants Market Size To Worth USD 775.8 Billion By 2033

According to a research report published by Spherical Insights & Consulting, the Global Naval Vessels and Surface Combatants Market Size to grow from USD 470.3 billion in 2023 to USD 775.8 billion by 2033, at a Compound Annual Growth Rate (CAGR) of 5.13% during the forecast period.

Get more details on this report -

Browse key industry insights spread across 240 pages with 110 Market data tables and figures & charts from the report on the "Global Naval Vessels and Surface Combatants Market Size, Share, and COVID-19 Impact Analysis, By Ship Type (Destroyers, Corvettes, Submarines, Amphibious Ships, Frigates, Auxiliary Vessels, and Others), By System (Marine Engine System, Weapon Launch System, Sensor System, Control System, Electrical System, Auxiliary System, and Communication System), By Solution (Line Fit and Retro Fit), By Application (Search and Rescue, Combat Operations, MCM Operations, Coastal Operations, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/naval-vessels-and-surface-combatants-market

The market for naval vessels and surface combatants is expanding rapidly, driven by rising global geopolitical tensions and the demand for improved marine defence systems. Nations are actively investing in modernising their naval fleets, with a focus on improving capabilities like stealth, firepower, and electronic warfare. Technological developments in shipbuilding, as well as the integration of sophisticated armament and surveillance systems, are driving market growth. Key segments include destroyers, frigates, corvettes, and aircraft carriers, with a focus on multi-mission capabilities. North America and Asia-Pacific are the top regions due to their large defence spending and regional security concerns. The industry is also seeing an increase in demand for unmanned surface vehicles (USVs) and autonomous systems, indicating a trend towards creative and versatile naval combat technologies.

Naval Vessels and Surface Combatants Market Value Chain Analysis

The naval vessels and surface combatants market value chain includes various crucial stages, ranging from raw material acquisition to final deployment. It starts with suppliers providing basic materials like as steel, aluminium, and sophisticated composites. Shipbuilders and defence contractors then design and build warships by combining propulsion systems, weaponry, and electronic warfare systems from specialised component makers. Key players include radar, sonar, and navigation system technology companies. To comply with demanding defence standards, the assembly step includes rigorous testing and quality assurance. Following manufacturing, warships are subjected to thorough sea trials before being transferred to naval forces. Maintenance, repair, and overhaul (MRO) services ensure that the vessel remains operational throughout its lifecycle. Collaborations between governments, defence agencies, and private sector companies help to improve operational capabilities and support the value chain.

Naval Vessels and Surface Combatants Market Opportunity Analysis

The market for naval vessels and surface combatants presents significant prospects as maritime security concerns and technical breakthroughs escalate. Increased defence spending, notably in the Asia-Pacific and Middle East, drive demand for new and improved boats. Manufacturers stand to profit from advancements in stealth technologies, autonomous systems, and improved weapons. The transition to multi-mission and modular platforms increases operational flexibility, which appeals to modern navies. Emerging markets, such as unmanned surface vehicles (USVs) and cyber warfare capabilities, provide new growth opportunities. Collaborations between defence contractors and technology companies amplify innovation. Furthermore, the expanding worldwide emphasis on naval modernization programmes creates ongoing potential for long-term contracts and strategic alliances, assuring consistent market growth.

Technological innovations are critical to propelling growth in the naval vessels and surface combatants market. Stealth technology innovations reduce detectability, which improves operational security. The integration of sophisticated radar, sonar, and electronic warfare systems increases situational awareness and danger identification. Autonomous systems and unmanned surface vehicles (USVs) enable distant operations while lowering crew risk. Enhanced propulsion technologies, such as hybrid and electric systems, provide higher efficiency while reducing environmental effect. The development of modular and multi-mission platforms enables navies to adapt warships to diverse duties, hence enhancing their utility. Advanced missile and laser weapon systems offer improved offensive and defensive capability. These technical advancements not only strengthen naval power, but also attract significant investment, accelerating market expansion.

The high expenses of developing, building, and maintaining sophisticated naval warships put a pressure on defence budgets, especially in smaller states. Technological complexity and the necessity for constant improvements impose enormous logistical and financial difficulties. Because of the long lifecycle of naval ships, modernization initiatives must keep up with significant technological breakthroughs. Geopolitical volatility and shifting defence objectives might jeopardise procurement strategies and international partnerships. Additionally, severe regulatory regulations and lengthy approval processes might cause project delays. Cybersecurity dangers are also becoming more prevalent as vessels become increasingly digitally connected.

Insights by Ship Type

The destroyers segment accounted for the largest market share over the forecast period 2023 to 2033. These ships are outfitted with modern missile systems, radar, and electronic warfare technology, making them critical for air defence, anti-submarine warfare, and surface combat operations. Increasing geopolitical tensions and the necessity for fleet modernization have prompted investments in next-generation destroyers with improved stealth, firepower, and multi-mission capabilities. Key markets, such as the United States, China, and Japan, are focusing on increasing and upgrading their destroyer fleets.

Insights by System

The marine engine segment accounted for the largest market share over the forecast period 2023 to 2033. The increased demand for high-speed, powerful engines helps modern naval forces operate more efficiently, allowing for speedier deployment and manoeuvrability. Investments in research and development are aimed at improving engine performance for a variety of vessel types, ranging from destroyers to autonomous surface vehicles. The continual upgrading of naval fleets throughout the world, as well as the integration of cutting-edge propulsion technology to satisfy growing defence requirements, are driving this segment's growth.

Insights by Solution

The line fit segment accounted for the largest market share over the forecast period 2023 to 2033. Line fit, or the installation of components and systems during the initial shipbuilding process, promotes seamless integration and operational efficiency. The shift towards modular and multi-mission platforms increases the appeal of line fit solutions, which allow for customisation and scalability. This segment benefits from increased spending in naval modernization programmes, particularly in North America and Asia-Pacific. Key components like as propulsion systems, weapons, and electronic warfare systems are being prepared to fulfil the severe standards of modern fleets.

Insights by Application

The coastal operations segment accounted for the largest market share over the forecast period 2023 to 2033. Coastal operations vessels are built to operate near to shorelines and in shallow waters, providing increased manoeuvrability and responsiveness for a variety of missions such as coastal surveillance, anti-smuggling operations, and EEZ protection. Nations with long coastlines, such as the United States, China, and India, are investing in specialised vessels outfitted with modern sensor suites, small calibre weapons, and unmanned systems designed specifically for littoral combat. This segment's growth is also being driven by advances in stealth technology and the integration of network-centric warfare capabilities, which provide effective marine defence and coastal security operations.

Insights by Region

Get more details on this report -

North America is anticipated to dominate the Naval Vessels and Surface Combatants Market from 2023 to 2033. The United States is the largest contributor, with significant naval modernization programmes aimed at increasing and improving its fleet with next-generation destroyers, aircraft carriers, and autonomous surface vehicles. Investing in sophisticated weapon systems, stealth technologies, and electronic warfare improves military readiness and efficiency. Collaboration between the US Navy, defence contractors, and technology companies promotes innovation and speeds up development. Canada's expenditures in multi-mission frigates and Arctic patrol vessels boost regional market growth. North America's significant emphasis on marine security and defence preparedness ensures a thriving and dynamic sector.

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Countries such as China, India, Japan, and South Korea are actively investing in naval force expansion and modernization in order to strengthen maritime supremacy and protect strategic interests. Key growth drivers include technological advances in indigenous shipbuilding capabilities, as well as the development of sophisticated stealth, missile, and electronic warfare weapons. Regional tensions and territorial conflicts in the South China Sea and Indian Ocean drive up demand for sophisticated destroyers, frigates, and submarines. Collaborations with Western defence contractors, as well as technological transfers, help to strengthen regional capabilities. This dynamic climate promotes strong market expansion and innovation in naval warfare technologies in Asia-Pacific.

Recent Market Developments

- In April 2023, The United Kingdom Ministry of Defence has given BAE System a contract to provide engineers with communication, command, control, computing, and intelligence (C4I) services for surface vessels. The total contract value was USD 57 million.

Major players in the market

- General Dynamics

- Huntington Ingalls Industries

- Austal, Naval Group

- Larsen & Toubro (L&T)

- Lockheed Martin

- Incntieri

- BAE Systems

- Hyundai Heavy Industries

- Daewoo Shipbuilding & Marine Engineering

- Abu Dhabi Ship Building

- PO Sevmash

- ThyssenKrupp

- CSSC

- Mazagon Docks

- MDL

- DSME

- CSIC

- Thales

- HHI

- ASC

- Damen Schelde Naval Shipbuilding (DSNS)

- Navantia

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Naval Vessels and Surface Combatants Market, Ship Type Analysis

- Destroyers

- Corvettes

- Submarines

- Amphibious Ships

- Frigates

- Auxiliary Vessels

- Others

Naval Vessels and Surface Combatants Market, System Analysis

- Marine Engine System

- Weapon Launch System

- Sensor System

- Control System

- Electrical System

- Auxiliary System

- Communication System

Naval Vessels and Surface Combatants Market, Solution Analysis

- Line Fit

- Retro Fit

Naval Vessels and Surface Combatants Market, Application Analysis

- Search and Rescue

- Combat Operations

- MCM Operations

- Coastal Operations

- Others

Naval Vessels and Surface Combatants Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?