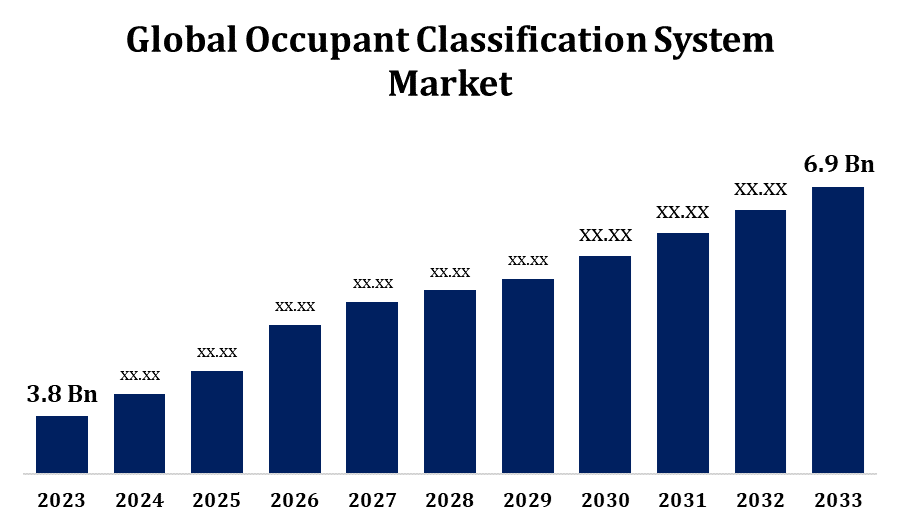

Global Occupant Classification System Market Size To Worth USD 6.9 Billion By 2033 | CAGR of 6.15%

Category: Automotive & TransportationGlobal Occupant Classification System Market Size To Worth USD 6.9 Billion By 2033

According to a research report published by Spherical Insights & Consulting, the Global Occupant Classification System Market Size to Grow from USD 3.8 Billion in 2023 to USD 6.9 Billion by 2033, at a Compound Annual Growth Rate (CAGR) of 6.15% during the forecast period.

Get more details on this report -

Browse key industry insights spread across 229 pages with 111 Market data tables and figures & charts from the report on the "Global Occupant Classification System Market Size, Share, and COVID-19 Impact Analysis, By Component (Sensors, Microcontrollers, Software, Algorithms), By Application (Passenger Vehicles, Commercial Vehicles, Motorcycles, Heavy-Duty Vehicles), By End Use (OEMs, Aftermarket), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/occupant-classification-system-market

The Occupant Classification System (OCS) market is experiencing substantial growth, driven by stringent automotive safety standards and the increasing demand for advanced passenger protection systems. OCS technology plays a vital role in detecting the presence, size, and position of passengers to ensure optimal airbag deployment and minimize injury risks during accidents. The market is propelled by advancements in sensor technology and the integration of Artificial Intelligence (AI) for improved precision. Regulatory mandates and a heightened focus on reducing traffic-related fatalities further support adoption. Automakers are incorporating OCS across passenger and commercial vehicles, with innovations tailored for electric and autonomous models. While North America and Europe lead the market, the Asia-Pacific region is emerging as a high-potential area due to its expanding automotive manufacturing sector.

Occupant Classification System Market Value Chain Analysis

The value chain of the Occupant Classification System (OCS) market comprises several interconnected stages. It starts with raw material suppliers providing essential components like sensors, microcontrollers, and wiring systems. Manufacturers specializing in OCS design and production then procure these components and incorporate advanced technologies such as AI and machine learning to enhance system precision. Tier 1 suppliers assemble OCS components into modules and deliver them to automotive original equipment manufacturers (OEMs), who integrate these systems into vehicles during production. Distribution channels, including dealerships and aftermarket services, facilitate the delivery of vehicles equipped with OCS to end-users. Regulatory bodies and safety standard organizations play a significant role by establishing stringent compliance requirements, which drive continuous innovation and improvements throughout the value chain.

Occupant Classification System Market Opportunity Analysis

The Occupant Classification System (OCS) market offers substantial growth prospects, fueled by advancements in automotive technology and an increasing focus on passenger safety. The rising adoption of electric and autonomous vehicles drives demand for advanced OCS solutions to enhance safety and improve energy efficiency. Emerging markets in Asia-Pacific and Latin America present untapped opportunities due to growing automotive production and rapid urbanization. Globally, stringent safety regulations push automakers to integrate sophisticated safety systems, accelerating OCS adoption. Innovations such as AI-driven sensors and edge computing enable greater accuracy and cost efficiency, broadening their appeal to a wider customer base. Additionally, the aftermarket sector offers potential for retrofitting OCS into older vehicles. Collaboration among automakers, technology providers, and regulators further propels the market’s expansion.

The increasing emphasis on advanced driver-assistance systems (ADAS) is a key factor driving growth in the Occupant Classification System (OCS) market. ADAS features like adaptive airbags and seatbelt pre-tensioners depend on accurate occupant detection to operate effectively. OCS enhances safety by ensuring these systems adapt appropriately to the occupant’s size, weight, and seating position. The rising integration of ADAS in modern vehicles, driven by consumer demand for safer driving experiences and regulatory requirements, has heightened the significance of OCS technology. Moreover, advancements in AI and sensor technologies have enabled OCS to seamlessly integrate with ADAS frameworks, enhancing data sharing and system efficiency. This synergy aligns with the industry's transition toward smarter, automated vehicles, further boosting the adoption of OCS solutions.

High development and integration costs present notable challenges, particularly for small and medium-sized automakers. The complexity of calibrating sensors and ensuring system accuracy across diverse occupant profiles adds to technical difficulties. Adhering to stringent safety regulations demands ongoing innovation, which can strain resources and extend timelines. As OCS integrates with advanced connected vehicle systems, cybersecurity concerns arise, exposing potential vulnerabilities to hacking or data breaches. Furthermore, variations in global automotive standards complicate the creation of universal OCS solutions. Market growth is also hindered by limited awareness and adoption in emerging economies, where cost-conscious customers often prioritize basic safety features over advanced systems. These factors together pose significant obstacles to the widespread implementation and scalability of OCS technologies.

Insights by Component

The sensors segment accounted for the largest market share over the forecast period 2023 to 2033. Advanced sensors, such as weight, pressure, and ultrasonic sensors, play a crucial role in accurately identifying occupant size, position, and presence, ensuring optimal airbag deployment and improved passenger safety. The growing adoption of electric and autonomous vehicles further fuels the demand for high-performance sensors, as these vehicles rely on advanced safety systems. Innovations like AI-driven sensors and miniaturized designs enhance precision while lowering costs, making these technologies more accessible to automakers. Additionally, stringent global safety regulations and the increasing integration of smart safety features in vehicles drive the need for advanced sensor solutions. These factors firmly establish the sensors segment as a key driver of growth in the Occupant Classification System (OCS) market.

Insights by Application

The passenger vehicles segment accounted for the largest market share over the forecast period 2023 to 2033. The passenger vehicles segment serves as a major growth driver in the Occupant Classification System (OCS) market, driven by rising consumer demand for advanced safety features. Growing awareness of passenger safety and compliance with strict government regulations have prompted automakers to implement OCS in both mass-market and premium vehicles. The increasing adoption of electric and autonomous cars further boosts OCS integration, as these vehicles depend on advanced safety systems. Features like adaptive airbags and seatbelt tensioners rely on accurate occupant classification for optimal performance. Innovations in OCS technology, including AI-driven solutions and improved sensor systems, address the evolving demands of passenger vehicle manufacturers. With rising urbanization and vehicle ownership, especially in emerging economies, the passenger vehicles segment is positioned for continued growth.

Insights by End Use

The OEMs segment accounted for the largest market share over the forecast period 2023 to 2033. OEMs are increasingly integrating Occupant Classification Systems (OCS) into a diverse range of vehicles, from mass-market to luxury models, driven by strict safety regulations and growing consumer demand for advanced safety features. The rise of electric and autonomous vehicles offers OEMs new opportunities to adopt more advanced OCS technologies, enhancing passenger safety and facilitating the implementation of advanced driver-assistance systems (ADAS). Advancements in sensor technology further benefit OEMs by improving OCS precision while reducing production costs. Moreover, collaborations between OEMs and technology providers are accelerating the development of cost-efficient, high-performance OCS solutions, contributing significantly to market expansion.

Insights by Region

Get more details on this report -

North America is anticipated to dominate the Occupant Classification System Market from 2023 to 2033. North America leads the Occupant Classification System (OCS) market, driven by strict safety regulations and advanced automotive manufacturing capabilities. Regulatory authorities, such as the National Highway Traffic Safety Administration (NHTSA), require the integration of advanced safety systems, including OCS, to enhance passenger protection. High demand for premium vehicles with advanced safety features further propels market growth. The region benefits from a strong presence of major automakers and technology innovators in the U.S. and Canada, fostering rapid adoption and innovation in OCS technology. Additionally, the increasing adoption of electric and autonomous vehicles amplifies the demand for advanced occupant detection systems. Supported by growing investments in research and development and government incentives for safety enhancements, North America remains a critical market for OCS development and implementation.

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The Asia-Pacific region is rapidly becoming a key growth area for the Occupant Classification System (OCS) market, driven by increasing automotive production and the rising adoption of advanced safety technologies. Factors such as rapid urbanization, higher disposable incomes, and growing vehicle ownership in developing nations are boosting market demand. Governments in the region are enforcing stricter safety regulations, prompting automakers to integrate OCS to enhance passenger protection. The transition to electric and autonomous vehicles in countries like South Korea and China further expands opportunities for OCS implementation. The presence of major automotive manufacturers and their focus on cost-effective, scalable solutions also drive market expansion. However, challenges like price sensitivity and limited awareness in certain markets highlight the need for affordable and adaptable OCS solutions.

Recent Market Developments

- In January 2024, ZF Friedrichshafen AG (Germany) launched an intelligent seat belt technology aimed at reducing the impact of accidents. This system is designed to ease the implementation of the enhanced adaptability requirements for restraint systems specified in the NCAP Roadmap 2030 for vehicle manufacturers.

Major players in the market

- Toyota

- General Motors

- Aisin Seiki

- Texas Instruments

- Denso

- Nissan

- Infineon Technologies

- Continental

- Ford

- Bosch

- NXP Semiconductors

- Toshiba

- Mercedes Benz

- Teledyne FLIR

- Valeo

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Occupant Classification System Market, Component Analysis

- Sensors

- Microcontrollers

- Software

- Algorithms

Occupant Classification System Market, Application Analysis

- Passenger Vehicles

- Commercial Vehicles

- Motorcycles

- Heavy-Duty Vehicles

Occupant Classification System Market, End User Analysis

- OEMs

- Aftermarket

Occupant Classification System Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?