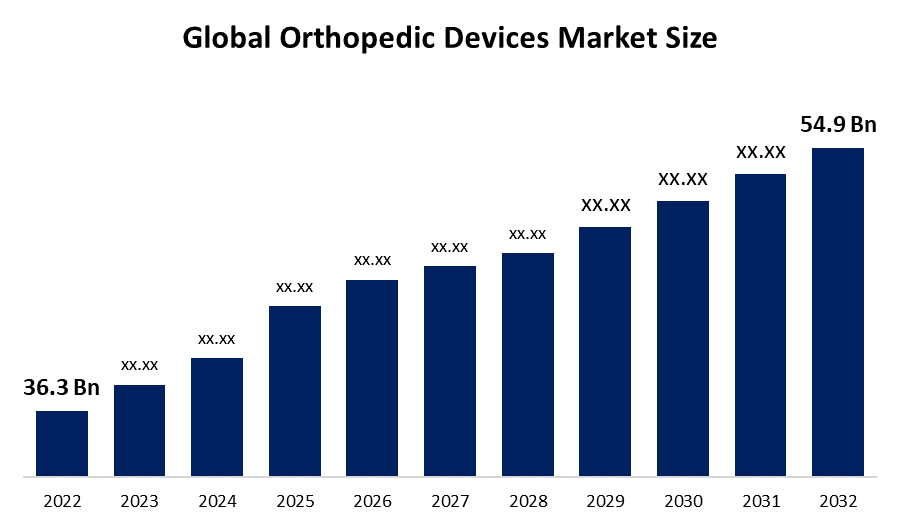

Global Orthopedic Devices Market Size To Grow USD 54.9 Billion by 2032 | CAGR of 4.2%

Category: HealthcareGlobal Orthopedic Devices Market to Grow $54.9 Billion by 2032

According to a research report published by Spherical Insights & Consulting the Global Orthopedic Devices Market Size is to grow from USD 36.3 Billion in 2022 to USD 54.9 Billion by 2032, at a Compound Annual Growth Rate (CAGR) of 4.2% during the forecast period.

Get more details on this report -

Browse key industry insights spread across 200 pages with 131 Market data tables and figures & charts from the report on the " Global Orthopedic Devices Market Size, Share, and COVID-19 Impact Analysis, By Product (Fixation, Replacement Devices {knee, Hip, Shoulder}, Braces, Spinal Implants, Arthroscopy, Orthobiolgics), By Application (Hip, Knee, Spine, Cranio-Maxillofacial, Sports Medical, Extremities & Trauma {SET}), By End User (Hospitals, Orthopedic Clinic, Ambulatory Surgical Centers, and Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022– 2032 "Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/orthopedic-devices-market

Orthopedic devices are designed to preserve body posture by correcting irregularities and restoring normal skeletal function by replacing or reinforcing the affected area. Furthermore, these advancements, together with modern diagnostic procedures, have significantly reduced the need for complex orthopedic surgical operations. The growing number of joint reconstruction surgeries, the increasing burden of orthopedic disorders, trauma, and accident cases, and the development of bioabsorbable and titanium implants are driving the growth of the researched market. Furthermore, joint surgery is common among the elderly. The elderly are more prone to accidents and other bone problems because their bones are weaker. According to the United Nations Projections 2022 report, there will be 771 million people in the globe aged 65 and older in 2022, increasing to 994 million by 2030 and 1.6 billion by 2050.

As people grow more aware of the availability of innovative products, hospitals are constantly improving their technology and services. Furthermore, financial coverage for orthopedic therapies has fueled the popularity of orthopedic surgeries. These factors allow clients to select more sophisticated and expensive treatment options, boosting overall income. In addition, the development of contemporary orthopedic devices is expected to significantly reduce the cost of old ones. This helps to a wider acceptability of the latter in growing economies such as the Asia Pacific and the Middle East, where medical reimbursement is low. These initiatives are expected to have a favorable influence on procedure volume and market development. Furthermore, The most common orthopedic procedures are total hip and complete knee arthroplasty. Though hip arthroplasty generates positive benefits, it can also have serious risks and repercussions, such as surgical-site infections, deep vein thrombosis, and implant failures due to the cement's failure to keep the hip implants in place.

Covid 19 Impacts

The COVID-19 pandemic had a negative influence on the market because of the cancellation of elective treatments, low demand, and poor sales. Companies also faced operational issues as a result of supply chain delays, company closures, travel restrictions, staff illness or quarantines, stay-at-home regulations, and other protracted interruptions. Several public health organizations in the United States, for example, have advocated deferring elective procedures to minimize cross-infection and satisfy the demand for managing COVID-19 patients.

- The spinal implants segment is dominating the market with the largest market share over the forecast period.

The global orthopedic devices market is segmented into fixation, knee, hip, and shoulder replacement devices, braces, spinal implants, arthroscopy, and ortho biologics. The spinal implants segment has the highest revenue share across all segments throughout the forecast period. Some of the factors driving the growth of the orthopedic devices market's spinal implants and surgical devices segment during the forecast period include an aging population, growth in the number of players offering cutting-edge spinal implants and surgical instruments, a rising desire for less invasive spine procedures, and the launch of novel bone transplants.

- The knee segment is influencing the largest market share over the forecast period.

The worldwide orthopedic devices market is segmented by application into hip, knee, spine, cranio-maxillofacial, sports medical, extremities, and trauma (SET). Because of the rising number of knee surgeries, the knee sector dominates the market. However, high costs and extended follow-up periods are significant impediments to sector growth. Furthermore, strict regulatory criteria for class III medical device licensing are hindering device acceptance.

- The hospital segment is leading the largest market share during the forecast period.

The worldwide orthopedic devices market is divided into hospitals, orthopedic clinics, ambulatory surgery centers, and others based on end users. The hospital sector leads the market among these categories because the success of the hospital and clinic segments may be ascribed to the simple availability of modern healthcare infrastructure in industrialized nations and the rising demand for high-quality healthcare services. In comparison to alternative surgical venues, hospitals provide intensive care during and after surgery due to the large number of skilled surgeons and medical professionals.

- North America influencing the largest market growth during the forecast period

Get more details on this report -

During the projection period, North America will dominate considerable market growth. The regional market is expected to lead because of the presence of well-developed healthcare infrastructure, industry heavyweights, and reimbursement coverage. Because of aging and rising car accidents, the region's orthopedic surgery volume is continually growing.

Due to China and India having the world's largest elderly populations, Asia Pacific is likely to see strong revenue market growth throughout the projection period. As a result, demand from these countries is expected to skyrocket shortly.

Major vendors in Global Orthopedic Devices Market include Medtronic PLC, Stryker Corporation, Zimmer-Biomet Holdings, Inc., DePuy Synthes, Smith and Nephew PLC, Aesculap Implant Systems, LLC, Conmed Corporation, Donjoy, Inc., NuVasive, Inc., and Others.

key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2023, Zimmer Biomet bought Embody, Inc. to boost its brand position in the orthopedic products market.

- In November 2022, The DynaNail Helix fixation technique developed by Enovis is used to treat bone fractures, joint fusion, and bone healing.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2022 to 2032. Spherical Insights has segmented the Global Orthopedic Devices Market based on the below-mentioned segments:

Global Orthopedic Devices Market, By Product

- Fixation

- Replacement Devices {knee, Hip, Shoulder}

- Braces

- Spinal Implants

- Arthroscopy

- Orthobiolgics

Global Orthopedic Devices Market, By Application

- Hip

- Knee

- Spine

- Cranio-Maxillofacial

- Dental

- SET

Global Orthopedic Devices Market, By End Users

- Hospitals

- Orthopedic Clinic

- Ambulatory Surgical Centers

- Others

Orthopedic Devices Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?