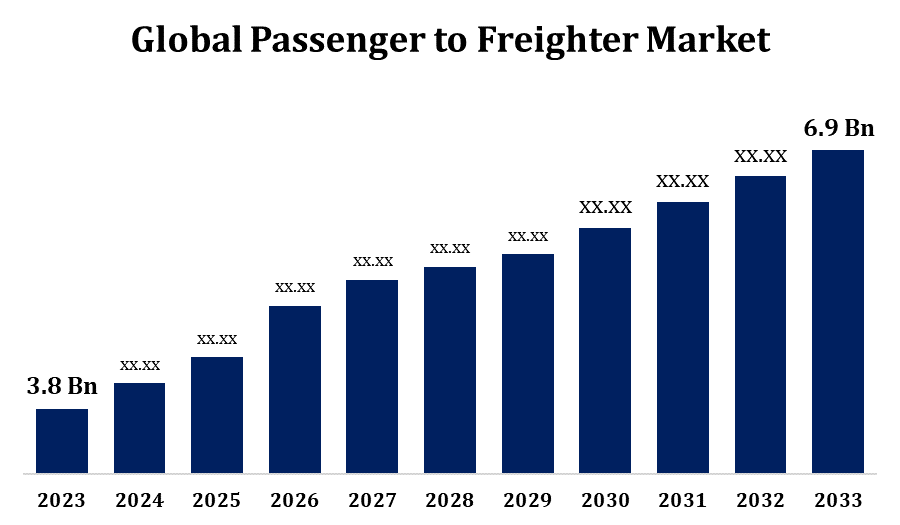

Global Passenger to Freighter Market Size to Worth USD 6.9 Billion by 2033 | CAGR of 6.15%

Category: Aerospace & DefenseGlobal Passenger to Freighter Market Size To Worth USD 6.9 Billion By 2033

According to a research report published by Spherical Insights & Consulting, the Global Passenger to Freighter Market Size to Grow from USD 3.8 Billion in 2023 to USD 6.9 Billion by 2033, at a Compound Annual Growth Rate (CAGR) of 6.15% during the forecast period.

Get more details on this report -

Browse key industry insights spread across 200 pages with 110 Market data tables and figures & charts from the report on the "Global Passenger to Freighter Market Size By Build Type (New Build and Refurbished), By Aircraft Model (Narrow Body, Wide Body, and Regional Jets), By Fitment (Slot/Retro Fitment and Line Fitment), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/passenger-to-freighter-market

Air freight services are becoming more and more necessary as e-commerce and international trade grow. The most economical way to satisfy this demand is to switch from passenger to freighter, especially during the peak shipping seasons. It is sometimes more expensive to buy new cargo aircraft than to convert existing passenger aircraft into freighters. It extends the life of aeroplanes for airlines and freight firms while utilising the current infrastructure. Trade policy, fuel prices, economic growth, and other factors pertaining to the air cargo sector all affect the demand for freighter aircraft and, consequently, the market for passenger to freighter conversions.

Passenger to Freighter Market Value Chain Analysis

Market research firms and consultants look at market trends, the need for air cargo services, and the feasibility of passenger to freighter conversions. Airlines and cargo operators examine the benefits of converting passenger planes into freighters in addition to their fleet needs. Engineering firms that specialise in aircraft modifications create the conversion process, accounting for factors such as cargo capacity, structural integrity, and regulatory compliance. Maintenance, repair, and overhaul (MRO) facilities or conversion centres physically convert passenger aircraft to freighters. The specialist systems and components required for passenger to freighter conversions, including as cargo doors, floor reinforcements, and cargo handling equipment, are made by manufacturers.

Passenger to Freighter Market Opportunity Analysis

Assessing the need for air cargo services worldwide, accounting for the demand for air freight fueled by the perishables, pharmaceutical, e-commerce, and other industries. identifying the routes that have a high freight capacity and the locations where passenger to freighter conversions can solve inefficiencies or capacity problems. looking for places where the current fleets of passengers and freighters could be refurbished and modernised by looking at their age and composition. Recognising airlines that, with their fleets of older passenger aircraft, may discover that passenger to freighter conversions are a more cost-effective option than purchasing new freighters. evaluating which passenger aircraft, taking into consideration the type, age, condition, and market availability, would be a good fit for conversion.

The expansion of conversion facilities is meeting the growing demand for freighter aircraft by allowing more aircraft to undergo passenger to cargo conversions at the same time. The need for freighter aircraft is increasing because to the rise of global trade and e-commerce, which has resulted in a growing desire for efficient air cargo transportation. If there were more conversion slots available, lead times for passenger to freighter conversions might be reduced. In order to take advantage of market opportunities and bring converted freighters into service sooner, airlines and cargo operators seeking to convert current passenger aircraft into freighters want faster turnaround times.

When converting passenger aircraft into freighters, significant structural and engineering changes are needed to ensure cargo compatibility and airworthiness. Technical problems include weight distribution, structural strengthening, and goods handling systems integration require specialised knowledge and resources. The passenger to freighter market may be impacted by the need for air cargo, the health of the economy, fuel prices, and geopolitical concerns. Uncertainties in the market can impact fleet planning, investment choices, and conversion project timelines, which can lead to issues for conversion suppliers and operators. The process of converting a passenger to a freighter relies on a complex supply chain that purchases parts, supplies, and specialised equipment from multiple suppliers.

Insights by Build Type

The refurbished segment accounted for the largest market share over the forecast period 2023 to 2033. Restoring outdated freighter aeroplanes could be less expensive than purchasing new ones. Operators can maximise return on investment and extend the service life of their aircraft by making use of current assets. The availability of retired or used passenger and freighter aircraft creates an easily accessible pool of assets for refurbishment. Because refurbished aircraft may be acquired for far less money than new aircraft, operators looking to replace aged fleets or expand their fleet find refurbishment to be a viable alternative. Reconditioned freighter aircraft are in high demand due to a number of factors, such as the growth of e-commerce, the creation of air cargo networks, and the increasing need for time-sensitive and accelerated cargo transportation services.

Insights by Aircraft Model

The narrow body segment accounted for the largest market share over the forecast period 2023 to 2033. The rise in e-commerce has increased demand for air freight delivery, particularly for smaller, faster items. Because narrow-body freighters are ideal for short- and regional-haul routes, they are ideal for fulfilling the demands of e-commerce logistics networks. Because narrow-body freighters may go to remote locations and smaller airports, they facilitate last-mile connections in the air cargo supply chain. This capacity increases network coverage and service reliability by flying to places that larger freighter aircraft might not be able to. Narrow-body freighters are in high demand because to the growth of specialist markets and the need for specialised cargo transportation. Smaller, more manoeuvrable aircraft are often required to efficiently suit the needs of operators that cater to certain sectors or niche markets.

Insights by Fitment

The slot/ retro segment accounted for the largest market share over the forecast period 2023 to 2033. Converting outdated passenger aircraft into freighters is a cost-effective alternative to purchasing new freighter aircraft. It helps operators to extend the useful life of present assets and maximise return on investment. Freighter aircraft are becoming more and more necessary to support the expansion of air cargo networks, particularly in regions where trade volumes are rising and e-commerce is growing rapidly. Retrofit conversions offer a quick solution for operators trying to meet this demand by increasing their cargo capacity. Operators can modernise their fleets by equipping older aircraft with updated features and technology through retrofit conversions. Modern avionics equipment and fuel-efficient engines can be added to freighters to improve their efficiency and performance.

Insights by Region

Get more details on this report -

North America is anticipated to dominate the Passenger to Freighter Market from 2023 to 2033. In North America, there is a substantial market for passenger to freighter conversions, as there are a lot of passenger aircraft available. Due to factors like shifting supply chain dynamics, the growth of e-commerce, and the increasing demand for air cargo services, the business is still developing. The industries in North America that are driving the need for freighter aircraft include retail, automobile, pharmaceutical, and perishable. Because of the region's extensive trade networks, just-in-time inventory management, and dynamic economy, efficient air freight transportation is highly sought for. North America has a vast infrastructure of conversion facilities, maintenance, repair, and overhaul (MRO) centres, and support services for the passenger to freighter sector.

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The Asia-Pacific region serves as a major centre for air cargo operations, requiring a significant amount of freighter aircraft due to the region's extensive supply chains and commercial networks. The market for passenger to freighters in Asia-Pacific is growing quickly because to rising consumer demand, urbanisation, and economic expansion. The need for freighter aircraft is driven by several industries in the Asia-Pacific area, including consumer goods, electronics, manufacturing, and automotive. Passenger to freighter conversions and air cargo services are in high demand due to the region's expanding e-commerce sector, particularly in countries like China and India. The Passenger to Freighter sector is supported by a robust infrastructure of shipping terminals, MRO centres, and conversion facilities throughout the Asia-Pacific area.

Recent Market Developments

- In February 2022, a contract has been announced between ST Engineering and Vaayu Group (Vaayu) to lease up to five Airbus A320 P2F aircraft. The first two of the five A320P2F aircraft from Vaayu will be subleased to Astral Aviation, an all-cargo airline based in Nairobi, Kenya, which has one of the fastest growth rates in the world, to act as the launch operator.

Major players in the market

- Commercial Aircraft Corporation of China, Ltd

- Airbus Group

- General Electric

- The Boeing Company

- Lockheed Martin Corporation

- General Dynamics Corporation

- Embraer S.A.

- Raytheon Technologies Corporation,

- Textron Inc.

- Dassault Aviation

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Passenger to Freighter Market, Build Type Analysis

- New Build

- Refurbished

Passenger to Freighter Market, Aircraft Model Analysis

- Narrow Body

- Wide Body

- Regional Jets

Passenger to Freighter Market, Fitment Analysis

- Slot/Retro Fitment

- Line Fitment

Passenger to Freighter Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?