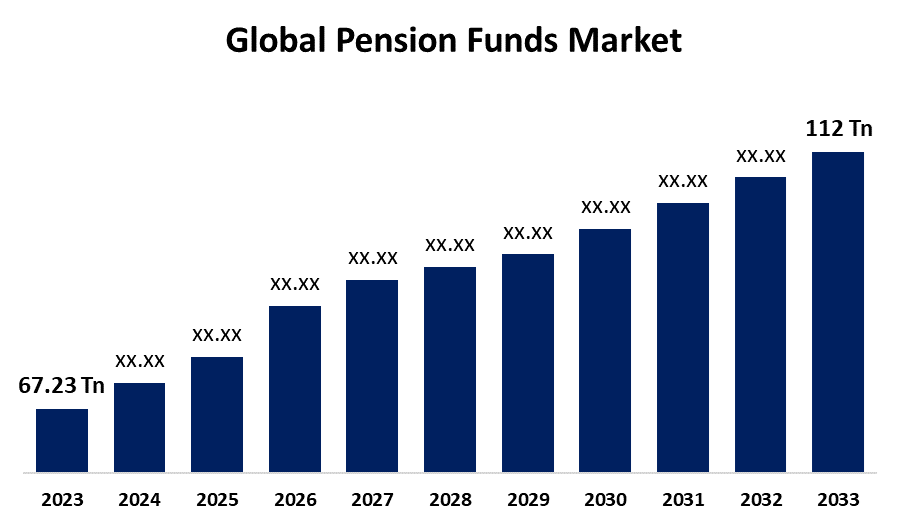

Global Pension Funds Market Size To Worth USD 112 Trillion By 2033 | CAGR Of 5.24%

Category: Banking & FinancialGlobal Pension Funds Market Size To worth USD 112 Trillion By 2033 | CAGR Of 5.24%

According to a research report published by Spherical Insights & Consulting, The Global Pension Funds Market Size is to Grow from USD 67.23 Trillion in 2023 to USD 112 Trillion by 2033, at a Compound Annual Growth Rate (CAGR) of 5.24% during the projected period.

Get more details on this report -

Browse key industry insights spread across 217 pages with 123 Market data tables and figures & charts from the report on the "Global Pension Funds Market Size, Share, and COVID-19 Impact Analysis, By Type of Pension Plan (Defined Benefit, Defined Contribution, Reserved Fund, and Hybrid), By End-User (Government, Corporate, Individuals), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033."Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/pension-funds-market

Pension funds are investment pools that collect, manage, and invest contributions for retirement benefits, ensuring long-term financial stability for retirees. It includes defined benefit plans, which guarantee specific monthly payments, and defined contribution plans like 401(k), where benefits depend on investment performance. Pension funds offer risk management, professional management, and regular post-retirement income. Emerging economies present growth opportunities for pension funds due to rapid economic development and urbanization. The global pension funds market is driven by the aging population, increased awareness about financial planning, regulatory reforms, rapid economic growth in emerging markets, and technological advancements in fund management and accounting. However, challenges restraining the global pension funds market include market volatility, prolonged low interest rates, complex regulations, and demographic shifts increasing retiree-to-contributor ratios, leading to potential funding shortfalls.

The defined contribution segment is anticipated to hold the greatest share of the global pension funds market during the projected timeframe.

Based on the type of pension plan, the global pension funds market is divided into defined benefit, defined contribution, reserved fund, and hybrid. Among these, the defined contribution segment is anticipated to hold the greatest share of the global pension funds market during the projected timeframe. Defined contribution plans are preferred for flexibility and lower financial burden on employers, with investment risk shifted to employees. The portability of these plans increases their appeal, along with increasing individual responsibility for retirement planning. Employers benefit from predictable costs, while employees enjoy control and potential for higher returns, supporting these plans as the largest segment in the pension funds market.

The government segment is anticipated to hold the greatest share of the global pension funds market during the projected timeframe.

Based on end-users, the global pension funds market is divided into government, corporate, and individuals. Among these, the government segment is anticipated to hold the greatest share of the global pension funds market during the projected timeframe. Government pension funds are extensive, due to mandatory participation by public sector employees and the large number of beneficiaries providing defined benefit plans for financial security. The stability and reliability of these funds, and backing by public finances and long-term strategies, make them the foundation of the pension landscape. Governments' focus on social welfare ensures these plans are well-funded and managed, highlighting the dominance of the government segment in the pension funds market.

North America is anticipated to hold the largest share of the global pension funds market over the forecast period.

Get more details on this report -

North America is anticipated to hold the largest share of the global pension funds market over the predicted timeframe. The North American region’s market is driven by its mature financial infrastructure and robust regulatory environment ensuring efficient management and investment of pension funds. High income levels, significant savings, and extensive corporate and public sector pension plans contribute to substantial fund contributions. The aging population and technological advancements in fund management further drive the demand and efficiency of pension schemes in the region.

Asia Pacific is expected to grow at the fastest pace in the global pension funds market during the predicted timeframe. This rapid growth of pension funds in the Asia Pacific is driven by robust economic development, rising disposable incomes, and proactive government policies encouraging retirement savings. Additionally, increasing financial planning awareness and a young, expanding workforce further boost the market.

Major vendors in the Global Pension Funds Market include Wells Fargo, Bank of America Corporation, JPMorgan Chase & Co., Deutsche Bank AG, BNP Paribas, UBS, State Street Corporation, BlackRock, The Vanguard Group, State Street Global, Fidelity Investments, BNY Mellon, Legal & General Investment, Wellington Management, and Others.

Recent Developments

- In July 2024, The Pensions Management Institute (PMI) in the UK, launched Global Innovation Centre to provide international learnings and best practices, to encourage curiosity and innovation in the pensions industry.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Global Pension Funds Market based on the below-mentioned segments:

Global Pension Funds Market, By Type of Pension Plan

- Defined Benefit

- Defined Contribution

- Reserved Fund

- Hybrid

Global Pension Funds Market, By End-User

- Government

- Corporate

- Individuals

Global Pension Funds Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Follow Us: LinkedIn | Facebook | Twitter

Need help to buy this report?