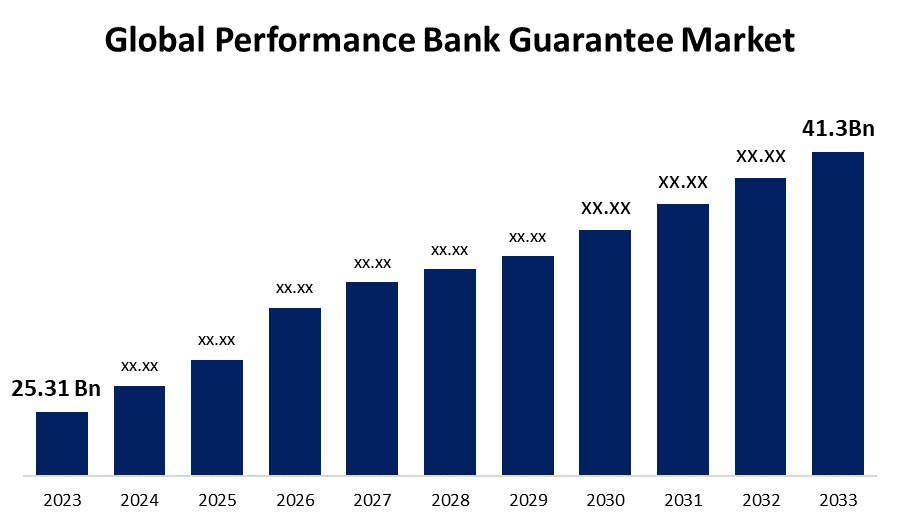

Global Performance Bank Guarantee Market Size To Worth USD 41.3 Billion By 2033 l CAGR Of 5.02%

Category: Banking & FinancialGlobal Performance Bank Guarantee Market Size To Worth USD 41.3 Billion By 2033

According to a research report published by Spherical Insights & Consulting, the Global Performance Bank Guarantee Market Size is to Grow from USD 25.31 Billion in 2023 to USD 41.3 Billion by 2033, at a Compound Annual Growth Rate (CAGR) of 5.02% during the projected period.

Get more details on this report -

Browse key industry insights spread across 289 pages with 110 Market data tables and figures & charts from the report on the "Global Performance Bank Guarantee Market Size, Share, and COVID-19 Impact Analysis, By Type (Tender Guarantee, Financial Guarantee, Advance Payment Guarantee, Foreign Bank Guarantee, and Others), By Application (Small and Medium Enterprise, Large Enterprise, and Others), By Service Deployment (Online, and Offline), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033." https://www.sphericalinsights.com/reports/performance-bank-guarantee-market

A performance bank guarantee (PBG) is a financial instrument offered by a bank on behalf of the contractor or supplier that assures the beneficiary, that the contractor will perform contractual responsibilities as specified in the contract. If a contractor fails to fulfil these obligations, the client can claim compensation up to the guaranteed amount. Performance bank guarantees mitigate risk, enhance trust, and maintain financial stability for large projects, particularly in high-value industries like construction and manufacturing. They are a crucial part of international finance. Market trends show rapid industrialization and infrastructure development, boosting the demand for PGBs. The market is driven by several factors including increasing infrastructural development projects, a rise in international trade and globalization, and supportive government policies and regulations. However, factors anticipated to restrain the global performance bank guarantee market include high fees and long processing time, complex documentation and approval processes, economic uncertainty, and financial instability.

The tender guarantee segment is anticipated to hold the greatest share of the global performance bank guarantee market during the projected timeframe.

Based on the type, the global performance bank guarantee market is divided into tender guarantee, financial guarantee, advance payment guarantee, foreign bank guarantee, and others. Among these, the tender guarantee segment is anticipated to hold the greatest share of the global performance bank guarantee market during the projected timeframe. This is because it is crucial in public procurement and large-scale infrastructure projects where significant financial investments are at stake. It minimizes the financial risk of project owners, as only financially capable and serious bidders would participate. The rise of public sector projects also boosts the demand for tender guarantees.

The large enterprise segment is anticipated to hold the greatest share of the global performance bank guarantee market during the projected timeframe.

Based on application, the global performance bank guarantee market is divided into small and medium enterprises, large enterprises, and others. Among these, the large enterprise organizations segment is anticipated to hold the greatest share of the global performance bank guarantee market during the projected timeframe. Large enterprises are involved in projects that need dependable financial assurances, as they engage in complex and high-value transactions. Also, large enterprises can bear the costs and meet the strict regulations associated with performance guarantees. It helps them secure the supply chain, ensure compliance, and minimize the risks involved.

The online segment is anticipated to grow at the fastest pace in the global performance bank guarantee market during the projected timeframe.

Based on service deployment, the global performance bank guarantee market is divided into online, and offline. Among these, the online segment is anticipated to grow at the fastest pace in the global performance bank guarantee market during the projected timeframe. Online deployment offers benefits such as better accessibility, low processing time, and more transparency. The convenience of digital platforms enables companies to manage guarantees remotely.

North America is anticipated to hold the largest share of the global performance bank guarantee market over the forecast period.

Get more details on this report -

North America is anticipated to hold the largest share of the global performance bank guarantee market over the predicted timeframe. The North American region’s market is driven by the presence of key market players who frequently require performance guarantees and the established financial infrastructure. The region’s financially strong economy and domestic and international trade also support the market growth. Additionally, the financial regulations in the region are supportive of the issuance and enforcement of these guarantees. The technological adoption in the financial sector improves the accessibility of performance guarantees.

Asia Pacific is expected to grow at the fastest pace in the global performance bank guarantee market during the forecast period. The foreign trade, exports, and rise in foreign investments in the region, particularly in developing countries like India, and China, drive the market growth. The increase in manufacturing and construction activities creates a healthy environment for performance guarantees.

Major vendors in the Global Performance Bank Guarantee Market include Goldman Sachs, United Overseas Bank Limited, Macquarie Group Limited, Barclays, HDFC Bank Ltd, Citigroup, Federal Bank, Wells Fargo & Company, Standard Chartered, HSBC Group, JPMorgan Chase & Co, UBS Group AG, Deutsche Bank, Bank of America, DBS Bank, and Others.

Recent Developments

- In January 2023, India’s largest lender State Bank of India (SBI), launched an e-Bank Guarantee (e-BG) facility by joining hands with National e-Governance Services Limited (NeSL). With the advent of e-BG, this function is replaced by e-stamping and e-signature.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Global Performance Bank Guarantee Market based on the below-mentioned segments:

Global Performance Bank Guarantee Market, By Application

- Small and Medium Enterprise

- Large Enterprise

- Others

Global Performance Bank Guarantee Market, By Type

- Tender Guarantee

- Financial Guarantee

- Advance Payment Guarantee

- Foreign Bank Guarantee

- Others

Global Performance Bank Guarantee Market, By Service Deployment

- Online

- Offline

Global Performance Bank Guarantee Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?