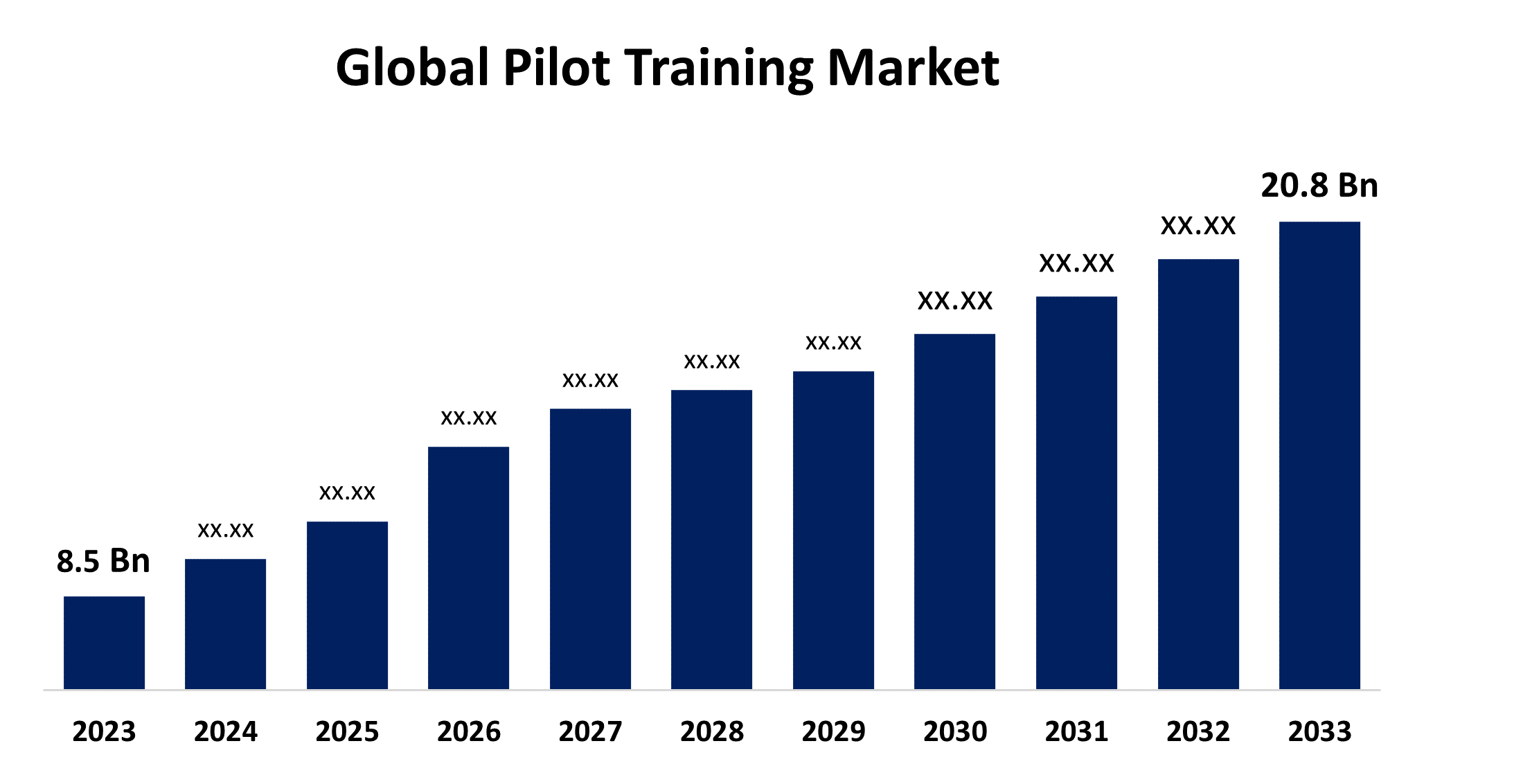

Global Pilot Training Market Size To Worth USD 20.8 Billion By 2033 | CAGR Of 9.36%

Category: Aerospace & DefenseGlobal Pilot Training Market Size To Worth USD 20.8 Billion By 2033

According to a research report published by Spherical Insights & Consulting, the Global Pilot Training Market Size to grow from USD 8.5 billion in 2023 to USD 20.8 billion by 2033, at a Compound Annual Growth Rate (CAGR) of 9.36% during the forecast period.

Get more details on this report -

Browse key industry insights spread across 207 pages with 65 Market data tables and figures & charts from the report on the "Global Pilot Training Market Size, Share, and COVID-19 Impact Analysis, By Aircraft Type (Airplane (Airbus 320, Boeing 737, and Others) and Helicopter), By License Type (Commercial Pilot License, Private Pilot License, Airline Transport Pilot License, and Others), By Training Mode (Flight Training, Simulator Training, Ground Training, and Recurrent Training), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033."Get Detailed Report Description Here:https://www.sphericalinsights.com/reports/pilot-training-market

The pilot training market is expanding rapidly, driven by an increase in demand for commercial pilots as the aviation sector expands and air travel grows. Advanced training technologies, including virtual reality (VR) and artificial intelligence (AI), are transforming pilot education, boosting simulation experiences, and raising safety requirements. Government initiatives and investments in aviation infrastructure are also helping to boost the business. Key players are focused on strategic collaborations and acquisitions to increase their market presence. However, barriers such as expensive training prices and tight regulatory standards may stymie industry expansion. Despite these challenges, the pilot training market is poised for significant growth, fueled by ongoing technology developments and a growing global demand for skilled pilots.

Pilot Training Market Value Chain Analysis

The pilot training market value chain consists of numerous essential steps, beginning with the creation of training programmes and curricula by educational institutions and training organisations. These programmes are intended to meet regulatory standards and industry requirements. The next step is to provide advanced training equipment and technology, such as flight simulators, VR systems, and AI-powered tools, which are offered by specialised vendors. Training providers, such as flying schools and airlines, use these materials to provide complete training to aspiring pilots. Furthermore, regulatory authorities play an important role in certifying training programmes and verifying compliance with safety regulations. The value chain is also supported by ongoing research and development, which aims to improve training approaches and equipment.

Pilot Training Market Opportunity Analysis

The pilot training market is poised for significant expansion, driven by increased global demand for commercial pilots and expanding air travel. Emerging regions, particularly in Asia-Pacific and the Middle East, are experiencing an increase in aviation activity, necessitating large pilot training programmes. Technological breakthroughs such as virtual reality, artificial intelligence, and enhanced flight simulation technologies provide new opportunities for novel training solutions that can cut costs while improving safety. Furthermore, government attempts to improve aviation infrastructure and support training programmes are creating new opportunities. Collaborations between training institutes and airlines can result in customised training modules, which improves efficiency. Despite constraints like as high training costs and strict restrictions, the market is positioned for growth through ongoing innovation and strategic investments.

As more airlines enter the market, the demand for competent pilots increases, necessitating costly training programmes. This surge in airline startups, particularly in quickly growing regions like Asia-Pacific, Latin America, and Africa, adds significantly to the demand for both initial pilot training and recurrent training for current pilots. Furthermore, new airlines frequently aim to differentiate themselves by offering higher safety and service standards, emphasising the importance of high-quality pilot training. As a result, flying schools and training organisations will have more chances, prompting additional investments in innovative training technology and infrastructure to fulfil the growing demand.

High training costs remain a significant barrier, discouraging many potential candidates from pursuing pilot jobs. Furthermore, stringent regulatory regulations and certification processes can cause delays in training programme approvals and increase operational complications for training providers. In addition, the industry faces a shortage of skilled flight instructors, which can have an impact on training quality and availability. Technological developments, while advantageous, necessitate significant expenditure, making it harder for smaller training facilities to compete. Furthermore, variable economic situations and changing demand for air travel can result in inconsistent enrollment rates. Despite these hurdles, continued innovation and strategic investments are critical to overcome them and ensuring the market's long-term success.

Insights by Aircraft Type

The airplane segment accounted for the largest market share over the forecast period 2023 to 2033. The growth is being driven by rising commercial air travel demand and the global expansion of airline fleets. Airlines are extensively investing in training programmes to alleviate the global pilot shortage and maintain a stable supply of competent pilots. Technological advances, like as next-generation flight simulators and virtual reality (VR) training modules, are improving the effectiveness and safety of pilot training. The expansion of low-cost carriers and the establishment of new airlines, particularly in emerging markets, have increased demand for professional airline pilots. Furthermore, severe regulatory requirements for pilot certification and recurrent training help to drive the segment's growth.

Insights by License Type

The Commercial Pilot License (CPL) segment dominates the market and has the largest market share over the forecast period 2023 to 2033. As airlines expand their fleets and open new routes, the demand for CPL holders grows, particularly in rapidly rising countries like Asia-Pacific and the Middle East. Advanced training technologies, such as flight simulators and virtual reality (VR), are increasing training efficiency and accessibility. Government incentives and subsidies to assist aviation vocations drive higher enrollment in CPL programmes. Despite high training prices and severe regulatory requirements, the CPL training market is thriving thanks to ongoing investments in aviation infrastructure and the constant demand for skilled pilots, providing a sustained development trajectory for this critical industry.

Insights by Training Mode

The flight training mode segment accounted for the largest market share over the forecast period 2023 to 2033. Traditional on-the-ground flight training is being complemented by sophisticated flight simulators and virtual reality (VR) systems, which improve the realism and safety of training experiences. These technologies enable more efficient training schedules and lower operating expenses, making pilot education more affordable. The increased use of e-learning and online theoretical courses contributes to more flexible and comprehensive training programmes. As airlines and training institutions work to fulfil increased demand for pilots, particularly in expanding areas such as Asia-Pacific, investment in new training methods grows.

Insights by Region

Get more details on this report -

North America is anticipated to dominate the Pilot Training Market from 2023 to 2033. The United States and Canada, with their huge airline networks and advanced aviation infrastructure, are important drivers of industry expansion. The use of cutting-edge technology like virtual reality (VR) and artificial intelligence (AI) into training programmes improves the quality and effectiveness of pilot instruction. Furthermore, solid regulatory frameworks guarantee excellent safety and training standards. The presence of prominent aviation training institutions, as well as strategic relationships between airlines and training providers, help to strengthen the market. However, issues such as high training prices and a lack of skilled instructors persist. Despite these challenges, North America remains a critical market for pilot training, constantly adapting to meet industry needs.

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. This expansion requires a large rise in the number of skilled pilots. Investing in modern training technology like flight simulators and virtual reality (VR) improves training efficiency and safety. Government initiatives and partnerships with international training organisations are also accelerating market growth. Despite constraints such as high training costs and regulatory complexity, the Asia-Pacific region provides numerous opportunities. Continuous economic expansion and a growing middle class with more discretionary cash are driving up the demand for pilot training in this dynamic industry.

Recent Market Developments

- In March 2023, Airways Aviation, a flight training provider based in the UAE, collaborated with Asia Pacific Flight Training Academy Limited (APFT), headquartered in India, to provide a unique pilot pathway plan to prospective Indian students and airline cadets.

Major players in the market

- ATP Flight School LLC

- Airways Aviation

- CAE Inc.

- ELITE Simulation Solutions AG

- FlightSafety International Inc.

- Indra Sistemas SA

- L3Harris Technologies Inc.

- Lockheed Martin

- Phoenix East Aviation

- Raytheon Technologies Corporation

- Thales Group

- Upper Limit Aviation Inc.

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Pilot Training Market, Aircraft Type Analysis

- Airplane

- Helicopter

Pilot Training Market, License Type Analysis

- Commercial Pilot License

- Private Pilot License

- Airline Transport Pilot License

- Others

Pilot Training Market, Training Mode Analysis

- Flight Training

- Simulator Training

- Ground Training

- Recurrent Training

Pilot Training Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?