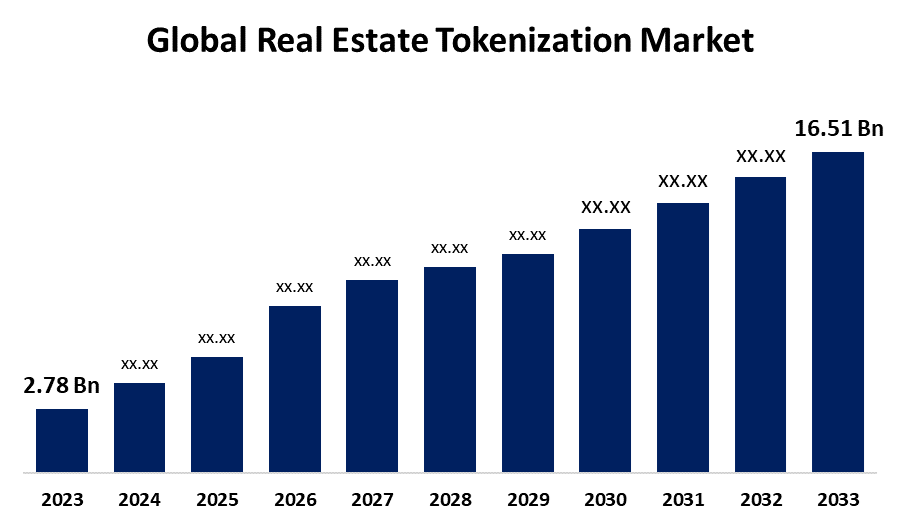

Global Real Estate Tokenization Market Size To Exceed USD 16.51 Billion By 2033 | CAGR of 19.50%

Category: Consumer GoodsGlobal Real Estate Tokenization Market Size To Exceed USD 16.51 Billion By 2033

According to a research report published by Spherical Insights & Consulting, the Global Real Estate Tokenization Market Size Expected to Grow from USD 2.78 Billion in 2023 to USD 16.51 Billion by 2033, at a CAGR of 19.50% during the forecast period 2023-2033.

Get more details on this report -

Browse key industry insights spread across 241 pages with 110 Market data tables and figures & charts from the report on the "Global Real Estate Tokenization Market Size, Share, and COVID-19 Impact Analysis, By Asset Type (Residential, Commercial, Industrial), By Token Type (Security Tokens, Utility Tokens), By End-User (Investors, Developers), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/real-estate-tokenization-market

The real estate tokenization business is rapidly expanding, driven by increased blockchain usage and demand for accessible assets. The primary drivers of this rise include fractional ownership, enhanced liquidity and transparency, global market access, and lower transaction costs. With continuing technological and legal improvements, real estate investments are bound to alter through tokenization, giving additional options and more efficient operations for investors. Furthermore, the worldwide market for real estate tokenization represents a significant opportunity in fractional ownership because it allows access to high-value properties. Such developments include rising usage of blockchain technology, better liquidity and transparency in investments, and expanded cross-border investment opportunities. However, the real estate tokenization business is hampered by legislative uncertainty, a lack of investor knowledge, and slow adoption by traditional real estate operators.

The commercial segment is expected to hold the largest share of the global real estate tokenization market during the projected timeframe.

Based on asset type, the global real estate tokenization market is categorized as residential, commercial, and industrial. Among these, the commercial segment is expected to hold the largest share of the global real estate tokenization market during the projected timeframe. This is because commercial buildings such as offices, retail spaces, and warehouses offer consistent income flows at high values. Also, tokenizing commercial real estate allows investors to enter high-value markets with less capital.

The security tokens segment is expected to grow at the fastest CAGR during the projected timeframe.

Based on the token type, the global real estate tokenization market is categorized as security tokens, and utility tokens. Among these, the security tokens segment is expected to grow at the fastest CAGR during the projected timeframe. This growth can be attributed to their regulatory compliance, fractional ownership, and liquidity; they provide legal protection, attract institutional investors, and provide transparency via blockchain technology.

The investors segment is expected to hold the largest share of the global real estate Tokenization market during the projected timeframe.

Based on end-user, the global real estate tokenization market is categorized as investors, and developers. Among these, the investors segment is expected to hold the largest share of the global real estate tokenization market during the projected timeframe. This is because tokenization offers investors fractional ownership, increased liquidity, and a broader range of real estate assets with lower entry hurdles. It attracts both institutional and retail investors looking for diverse portfolios and efficient, transparent investing possibilities.

North America is projected to hold the largest share of the global real estate tokenization market over the forecast period.

Get more details on this report -

North America is projected to hold the largest share of the global real estate tokenization market over the forecast period. This is mostly due to the region's strong financial markets, regulatory clarity, and widespread use of blockchain technology. The United States has established legal frameworks for security tokens, luring institutional investors and real estate developers.

Europe is expected to grow at the fastest CAGR growth of the global real estate tokenization market during the forecast period. This can be attributed to increased legislative clarity surrounding blockchain-based investments, as various European countries create progressive frameworks for digital assets. Furthermore, Europe's robust financial sector, high demand for real estate investments, and increased interest in novel, fractional investment alternatives all contribute to the rise in real estate tokenization.

Major vendors in the global real estate tokenization market are Realty Mogul, Templum, Smartlands, Brickblock, RealBlocks, Slice, SolidBlock, Elevated Returns, Harbor, RealtyBits, RealT, Fluidity, AssetBlock, and Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, Templum, Inc., the operating system for private markets and alternative assets, is pleased to announce a partnership with SoFi, the all-in-one digital personal finance company, to make investment opportunities more accessible to everyday investors through the new branch, Alternative Investments by SoFi.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global real estate tokenization market based on the below-mentioned segments:

Global Real Estate Tokenization Market, By Asset Type

- Residential

- Commercial

- Industrial

Global Real Estate Tokenization Market, By Token Type

- Security Tokens

- Utility Tokens

Global Real Estate Tokenization Market, By End-User

- Investors

- Developers

Global Real Estate Tokenization Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?