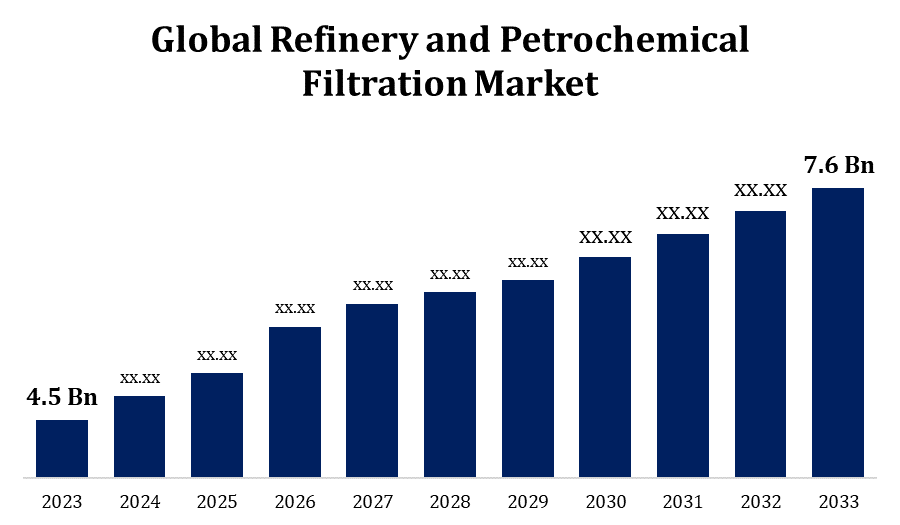

Global Refinery and Petrochemical Filtration Market Size To Worth USD 7.6 Billion By 2033 | CAGR of 5.38%

Category: Energy & PowerGlobal Refinery and Petrochemical Filtration Market Size To Worth USD 7.6 Billion By 2033

According to a research report published by Spherical Insights & Consulting, The Global Refinery and Petrochemical Filtration Market Size to Grow from USD 4.5 Billion in 2023 to USD 7.6 Billion by 2033, at a Compound Annual Growth Rate (CAGR) of 5.38% during the forecast period.

Get more details on this report -

Browse key industry insights spread across 235 pages with 120 Market data tables and figures & charts from the report on the "Global Refinery and Petrochemical Filtration Market Size, Share, and COVID-19 Impact Analysis, By Filter Type (Coalescer Filter, Cartridge Filter, Electrostatic Precipitator, Filter Press, Bag Filter and Others), By Application (Liquid-liquid Separation, Liquid-gas Separation, and Others), by End User (Refineries and Petrochemical Industry), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/refinery-and-petrochemical-filtration-market

The refinery and petrochemical filtration market is expanding due to rising demand for clean fuels and a greater emphasis on eco-friendly practices within the oil and gas sector. Filtration systems play a critical role in removing contaminants and optimizing the efficiency of refining and petrochemical processes. They enhance product quality, lessen environmental impact, and reduce equipment wear, leading to lower operational costs. With global regulatory standards tightening, particularly concerning emissions, companies are increasingly investing in advanced filtration technologies. Moreover, the need for dependable filtration solutions is driven by aging infrastructure in developed countries and rapid industrial growth in emerging economies. Key industry players are prioritizing innovation, such as nanotechnology-based filters, to improve filtration efficiency. This dynamic market is expected to continue its growth as energy companies modernize their operations.

Refinery and Petrochemical Filtration Market Value Chain Analysis

The value chain of the refinery and petrochemical filtration market begins with raw material suppliers who provide essential components, including specialized filter media, membranes, and filtration materials. Manufacturers utilize these materials to create filtration systems specifically designed to handle the complex contaminants and chemicals present in refining and petrochemical processes. These systems are often engineered to meet rigorous industry standards for safety, efficiency, and environmental compliance. Distributors, including specialized suppliers, ensure that filtration products are readily available to end-users such as refineries and petrochemical plants. Additionally, service providers like maintenance and consulting firms contribute significantly by assisting facilities in optimizing and maintaining filtration efficiency. Throughout each stage, continuous research, quality control, and innovation are vital for advancing filtration technology to address evolving regulatory requirements and operational demands.

Refinery and Petrochemical Filtration Market Opportunity Analysis

The refinery and petrochemical filtration market offers substantial growth opportunities, fueled by increasing environmental regulations and the demand for efficient processing. With a global emphasis on sustainability, refineries are pressured to enhance their filtration systems to reduce waste and emissions. The adoption of advanced filtration technologies, including membrane filtration and nanofiltration, is gaining momentum to comply with stringent quality standards for process water and product purity. Additionally, the growth of renewable energy and biofuels is encouraging refineries to invest in innovative filtration solutions capable of handling diverse feedstocks. Ongoing infrastructure upgrades and expansions in emerging economies are also boosting the demand for efficient filtration systems. By leveraging technological advancements and enhancing operational efficiencies, stakeholders can take advantage of these opportunities for sustained growth in the filtration sector.

The growth of the refinery and petrochemical filtration market is being strongly propelled by advancements in filtering technologies. Innovations such as nanotechnology-based filters and membrane filtration enhance efficiency in contaminant removal, resulting in better product quality and operational reliability. These cutting-edge filtration systems are specifically designed to comply with stringent environmental regulations and lower emissions, which is increasingly important as governments around the globe enforce stricter standards. High-performance filters also lead to reduced maintenance costs by prolonging equipment lifespan and minimizing downtime, making them invaluable in refining and petrochemical operations. Furthermore, increased industrial activity, particularly in developing regions, is driving the demand for dependable, advanced filtration solutions. As companies focus on eco-friendly practices and cost-effective production, the adoption of next-generation filtration technologies continues to fuel market growth.

One major challenge is the high expense associated with advanced filtration systems, which can discourage smaller refineries from making upgrades, even with the advantages of enhanced filtration. Additionally, the requirement for ongoing maintenance to ensure peak performance adds operational complexity and escalates costs. The varied nature of contaminants in petrochemical processes—including harsh chemicals, corrosive materials, and fine particulates—necessitates specialized filtration solutions, making design and implementation technically demanding. Furthermore, stringent environmental regulations place pressure on refineries to comply with increasingly rigorous emission and waste disposal standards, leading to frequent upgrades. Finally, fluctuations in oil prices and global economic uncertainties may impede investment in new filtration technologies, potentially slowing market adoption and innovation.

Insights by Filter Type

The filter press segment accounted for the largest market share over the forecast period 2023 to 2033. Filter presses offer high precision in filtration, making them well-suited for applications that require strict contaminant removal and effective sludge management. As refineries and petrochemical plants strive to meet environmental regulations and enhance operational sustainability, the demand for dependable filtration solutions like filter presses is increasing. Advanced technologies in filter presses, including automated and high-pressure systems, are being adopted to lower maintenance costs and boost productivity. Furthermore, the growing emphasis on reducing wastewater and optimizing resource utilization is driving the expansion of this segment. Given these benefits, the filter press segment is projected to experience continued growth as the industry places greater importance on efficiency and regulatory compliance.

Insights by Application

The liquid-liquid separation segment accounted for the largest market share over the forecast period 2023 to 2033. As regulatory pressures for cleaner products and reduced emissions escalate, companies are increasingly investing in advanced liquid-liquid separation technologies, including coalescers and electrostatic separators, to enhance efficiency and product quality. These systems effectively remove water and other contaminants from oil, thereby minimizing corrosion and extending the lifespan of equipment. Additionally, the expansion of oil refining capacities in regions such as Asia Pacific and the Middle East further fuels the demand for efficient separation solutions. With companies prioritizing eco-friendly and cost-effective processes, the liquid-liquid separation segment is well-positioned for ongoing growth in the market.

Insights by End User

The petrochemical industry segment accounted for the largest market share over the forecast period 2023 to 2033. Filtration plays a crucial role in petrochemical processes, as it helps eliminate impurities to maintain the purity and performance of end products. The pressure of stringent environmental regulations and the demand for sustainable operations are driving the industry towards advanced filtration technologies, such as nanofiltration and membrane filtration, which enhance efficiency and minimize waste. Furthermore, rapid industrialization and increased production capacities in Asia Pacific and the Middle East are significantly boosting the petrochemical industry's demand for effective filtration solutions. As companies prioritize compliance with regulatory standards and the optimization of production processes, the petrochemical segment is anticipated to experience robust growth within the filtration market.

Insights by Region

Get more details on this report -

North America is anticipated to dominate the Refinery and Petrochemical Filtration Market from 2023 to 2033. The refinery and petrochemical filtration market in North America is witnessing steady growth, primarily driven by increasing regulatory pressures aimed at reducing emissions and minimizing environmental impact. The United States and Canada, home to established refining and petrochemical sectors, are making investments in advanced filtration systems to boost efficiency, adhere to stringent environmental standards, and enhance operational sustainability. There is a rising demand for high-performance filtration technologies, such as membrane and nanotechnology-based filters, as companies seek to improve fuel quality and extend equipment lifespan while reducing maintenance costs. Additionally, the aging infrastructure of North American refineries calls for upgrades and retrofits with cutting-edge filtration solutions. With a sustained emphasis on eco-friendly practices and operational optimization, the North American market is poised for significant adoption of innovative filtration technologies to ensure compliance and efficiency in the years ahead.

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Emerging nations are increasing their refining capacities, creating a demand for advanced filtration systems to boost operational efficiency and comply with heightened environmental standards. Stringent regulations concerning emissions and pollutants have prompted investments in high-performance filtration technologies, including nanotechnology-based and membrane filters, to improve product quality and mitigate environmental impact. Additionally, the rising awareness of sustainable practices within the region's refining and petrochemical industries has hastened the adoption of eco-friendly filtration solutions. As Asia Pacific continues to be a major player in global oil and petrochemical production, the market for innovative filtration technologies is projected to grow significantly.

Recent Market Developments

- On September 2022, Parker Hannifin Corporation completed its acquisition of Meggitt, a strategic move that enhanced its aerospace solutions portfolio.

Major players in the market

- 3M

- Amazon Filters Ltd.

- Brother Filtration

- Camfil Ab

- Compositech Products Manufacturing, Inc.

- Eaton

- Filson Filter

- Filtcare Technology Pvt. Ltd.

- Filtration Group

- Filtration Technology Corporation

- Huading Separator

- Kel India Filters

- Lenntech B.V.

- Norman Filter Company

- Pall Corporation

- Parker Hannifin Corp.

- Pentair Filtration Solutions, LLC

- Porvair Filtration Group

- Sungov Engineering

- W.L. Gore & Associates, Inc.

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Refinery and Petrochemical Filtration Market, Filter Type Analysis

- Coalescer Filter

- Cartridge Filter

- Electrostatic Precipitator

- Filter Press

- Bag Filter

- Others

Refinery and Petrochemical Filtration Market, Application Analysis

- Liquid-liquid Separation

- Liquid-gas Separation

- Other

Refinery and Petrochemical Filtration Market, End Use Analysis

- Refineries

- Petrochemical Industry

Refinery and Petrochemical Filtration Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?