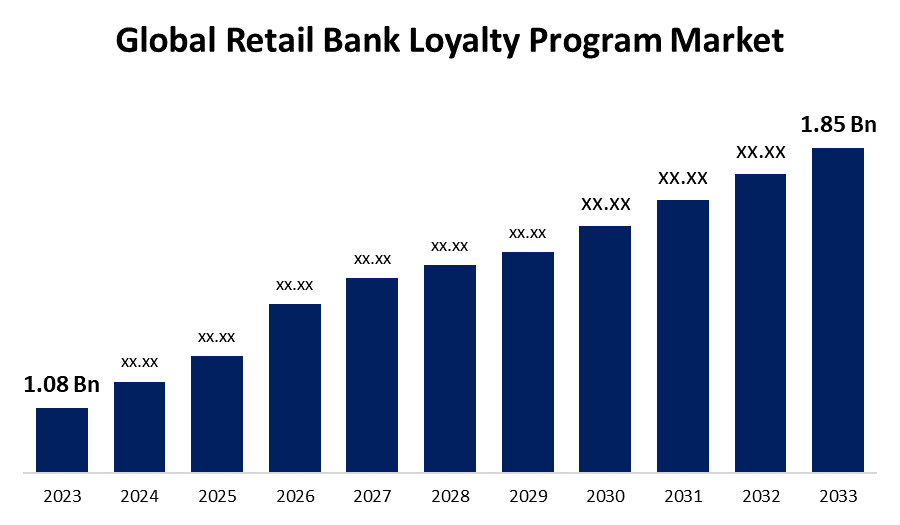

Global Retail Bank Loyalty Program Market Size To Worth USD 1.85 Billion By 2033 | CAGR Of 5.53%

Category: Banking & FinancialGlobal Retail Bank Loyalty Program Market Size To Worth USD 1.85 Billion By 2033

According to a research report published by Spherical Insights & Consulting, The Global Retail Bank Loyalty Program Market Size is to Grow from USD 1.08 Billion in 2023 to USD 1.85 Billion by 2033, at a Compound Annual Growth Rate (CAGR) of 5.53% during projected period.

Get more details on this report -

Browse key industry insights spread across 240 pages with 110 Market data tables and figures & charts from the report on the "Global Retail Bank Loyalty Program Market Size, Share, and COVID-19 Impact Analysis, By Type (B2C Solutions, B2B Solutions), By Enterprise Size (Large Enterprise, Small & Medium Enterprises), By End-Use (Personal, Business), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/retail-bank-loyalty-program-market

Retail bank loyalty programs reward customers for their banking activities, fostering brand loyalty and stronger customer relationships. These programs often feature points and reward systems for actions like maintaining accounts, using credit cards, and taking loans. These points can be redeemed for lower interest rates, waived fees, travel perks, and merchandise. Personalized offerings enhance customer experience, while discounts and cashback at select retailers add value. Emerging markets offer significant opportunities due to rapid digital transformation and rising mobile banking. Recent economic slowdowns have driven banks to shift loyalty programs to cost-efficient mobile platforms and social media.

Increasing competition among banks drives the need for innovative loyalty programs, helping to differentiate and retain customers with personalized rewards. The rapid adoption of digital banking, AI, and data analytics enhances program effectiveness, enabling tailored offers and improved customer satisfaction. However, the market faces several challenges, such as high implementation costs, data privacy concerns, regulatory issues, and the need for constant innovation to restrain the growth of the global retail bank loyalty program market.

The B2C solutions segment is anticipated to hold the greatest share of the global retail bank loyalty program market during the projected timeframe.

Based on the type, the global retail bank loyalty program market is divided into B2C solutions and B2B solutions. Among these, the B2C solutions segment is anticipated to hold the greatest share of the global retail bank loyalty program market during the projected timeframe. Banks can directly interact with individual customers, facilitating easy implementation and management of B2C loyalty programs. Designed to reward personal banking activities, these programs enhance customer experience with personalized rewards, driven by the widespread adoption of digital banking platforms.

The large enterprises segment is anticipated to hold the greatest share of the global retail bank loyalty program market during the projected timeframe.

Based on enterprise size, the global retail bank loyalty program market is divided into large enterprises and small & medium enterprises. Among these, the large enterprises segment is anticipated to hold the greatest share of the global retail bank loyalty program market during the projected timeframe. Large enterprises leverage extensive resources, substantial budgets, and established brand recognition to implement comprehensive, personalized loyalty programs with diverse rewards and effective targeting.

The business segment is anticipated to grow at the fastest pace in the global retail bank loyalty program market during the projected timeframe.

Based on end-use, the global retail bank loyalty program market is divided into personal and business. Among these, the business segment is anticipated to grow at the fastest pace in the global retail bank loyalty program market during the projected timeframe. This rapid growth is driven by the increasing emphasis on corporate banking relationships and the need for differentiation in the competitive business banking landscape. Business loyalty programs offer tailored financial products and exclusive rewards, cater to their needs, enhance customer service and create stable revenue streams.

North America is anticipated to hold the largest share of the global retail bank loyalty program market over the forecast period.

Get more details on this report -

North America is anticipated to hold the largest share of the global retail bank loyalty program market over the predicted timeframe. The North American region’s market is driven by its well-established banking infrastructure, enabling seamless implementation and management of loyalty programs amidst high competition. Consumers' receptiveness to digital banking and personalized experiences, along with technological advancements like AI and data analytics, enhance customer engagement with tailored rewards. Economic stability and higher disposable incomes further boost banking activities, accelerating loyalty program adoption.

Europe is expected to grow at the fastest pace in the global retail bank loyalty program market during the forecast period. The rapid digital transformation in Europe's banking sector and the adoption of innovative technologies to enhance loyalty programs drive regional growth. Strong regulatory pushes for improved customer transparency, coupled with a diverse and competitive landscape, encourage banks to implement attractive and personalized loyalty strategies.

Major vendors in the Global Retail Bank Loyalty Program Market include IBM, Oracle Corporation, and Bank of America Corporation. Other notable companies in this market are Comarch SA, Exchange Solutions, Aimia, TIBCO Software, Customer Portfolios, HSBC Bank, Creatio, FIS Corporate, Citigroup Inc., Maritz, Royal Bank of Canada, and Bank of India.

Recent Developments

- In February 2024, Bank of America (NYSE: BAC) and Starbucks Coffee Company (NASDAQ: SBUX) announced a partnership that offers millions of the Bank of America cardholders and Starbucks Rewards members in the U.S. the ability to earn even more benefits by linking accounts.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Global Retail Bank Loyalty Program Market based on the below-mentioned segments:

Global Retail Bank Loyalty Program Market, By Type

- B2C Solutions

- B2B Solutions

Global Retail Bank Loyalty Program Market, By Enterprise Size

- Large Enterprise

- Small & Medium Enterprises

Global Retail Bank Loyalty Program Market, By End-Use

- Personal

- Business

Global Retail Bank Loyalty Program Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Follow Us: LinkedIn | Facebook | Twitter

Need help to buy this report?