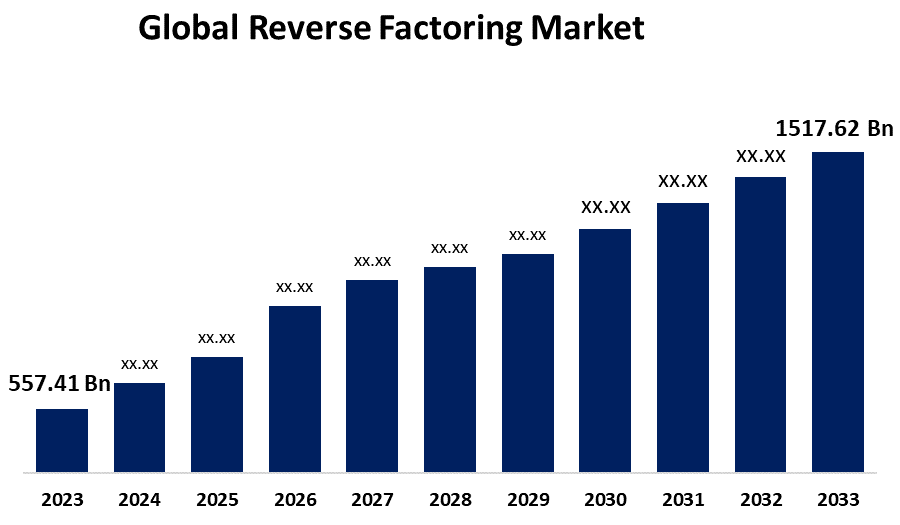

Global Reverse Factoring Market Size To Worth USD 1517.62 Billion By 2033 | CAGR of 10.53%

Category: Banking & FinancialGlobal Reverse Factoring Market Size To Worth USD 1517.62 Billion By 2033

According to a research report published by Spherical Insights & Consulting, the Global Reverse Factoring Market Size is to Grow from USD 557.41 Billion in 2023 to USD 1517.62 Billion by 2033, at a Compound Annual Growth Rate (CAGR) of 10.53% during the projected period.

Get more details on this report -

Browse key industry insights spread across 180 pages with 95 Market data tables and figures & charts from the report on the "Global Reverse Factoring Market Size, Share, and COVID-19 Impact Analysis, By Category (Domestic, and International), By Financial Institution (Bank, and Non-Banking Financial Institution), By End-Use (Manufacturing, Healthcare, Transport and Logistic, Information Technology, Construction and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/reverse-factoring-market

A big corporation partners with a banking institution to assist its vendors in obtaining funding at a reduced interest rate compared to what they could obtain on their own. Reverse factoring or supply chain finance is the term used for this financial arrangement. In this setup, the financial institution makes payments to the suppliers on behalf of the large company, often before the scheduled date. The suppliers offer a discount in return for the total amount billed. This benefits both the suppliers and the large organization. The suppliers' financial situation is enhanced by obtaining affordable financing, leading to a secure supply chain. The increasing need for companies to increase available funds while facing rising operating costs is a significant driver driving the worldwide reverse factoring market. The increasing focus on supply chain financing to uphold competitive supplier ties globally is also pushing the market. The digitalization of B2B payment networks and processes is a beneficial development for the reverse factoring market. However, one of the main challenges for the reverse factoring industry is the complexity of merging platforms with different IT systems used in global supply chains. Another difficulty involves guaranteeing the safety and adherence to regulations of confidential financial and payment information gathered on reverse factoring platforms.

The domestic segment is anticipated to hold the greatest share of the global reverse factoring market during the projected timeframe.

Based on the category, the global reverse factoring market is divided into domestic, and international. Among these, the domestic segment is anticipated to hold the greatest share of the global reverse factoring market during the projected timeframe. The increasing popularity of SCF services among local MSMEs has resulted in the expansion of the category. Most suppliers globally are MSMEs, which stands for micro, small, and medium-sized enterprises. Suppliers find it difficult to uphold consistent manufacturing cycles when payments are held back by buyers. The absence of other funding choices for the suppliers worsens the issue further and affects their entire business activities.

The bank segment is anticipated to hold the greatest share of the global reverse factoring market during the projected timeframe.

Based on the financial institution, the global reverse factoring market is divided into bank and non-banking financial institutions. Among these, the bank segment is anticipated to hold the greatest share of the global reverse factoring market during the projected timeframe. The growth is due to the rising adoption of digitization for closing gaps in financial services and banks' focus on enhancing customer experiences. During the forecast period, the growth of cross-border transactions and increased use of mobile payment systems are expected to drive the expansion of the bank sector.

The manufacturing segment is predicted to hold the greatest share of the reverse factoring market during the estimated period.

Based on the end-use, the global reverse factoring market is divided into manufacturing, healthcare, transport and logistics, information technology, construction, and others. Among these, the manufacturing segment is predicted to hold the greatest share of the reverse factoring market during the estimated period. Reverse factoring improves cash flow by allowing suppliers to opt for early invoice payments and extending a manufacturer's supplier payment terms. Manufacturing companies in different sectors like pallet, chemical, metal & machinery, welding, and plastics & polymers utilize reverse factoring services, enhancing the prospects of the supply chain financing services market. Reverse factoring offers industrial companies the opportunity to keep multiple banking connections and a liquidity backup choice.

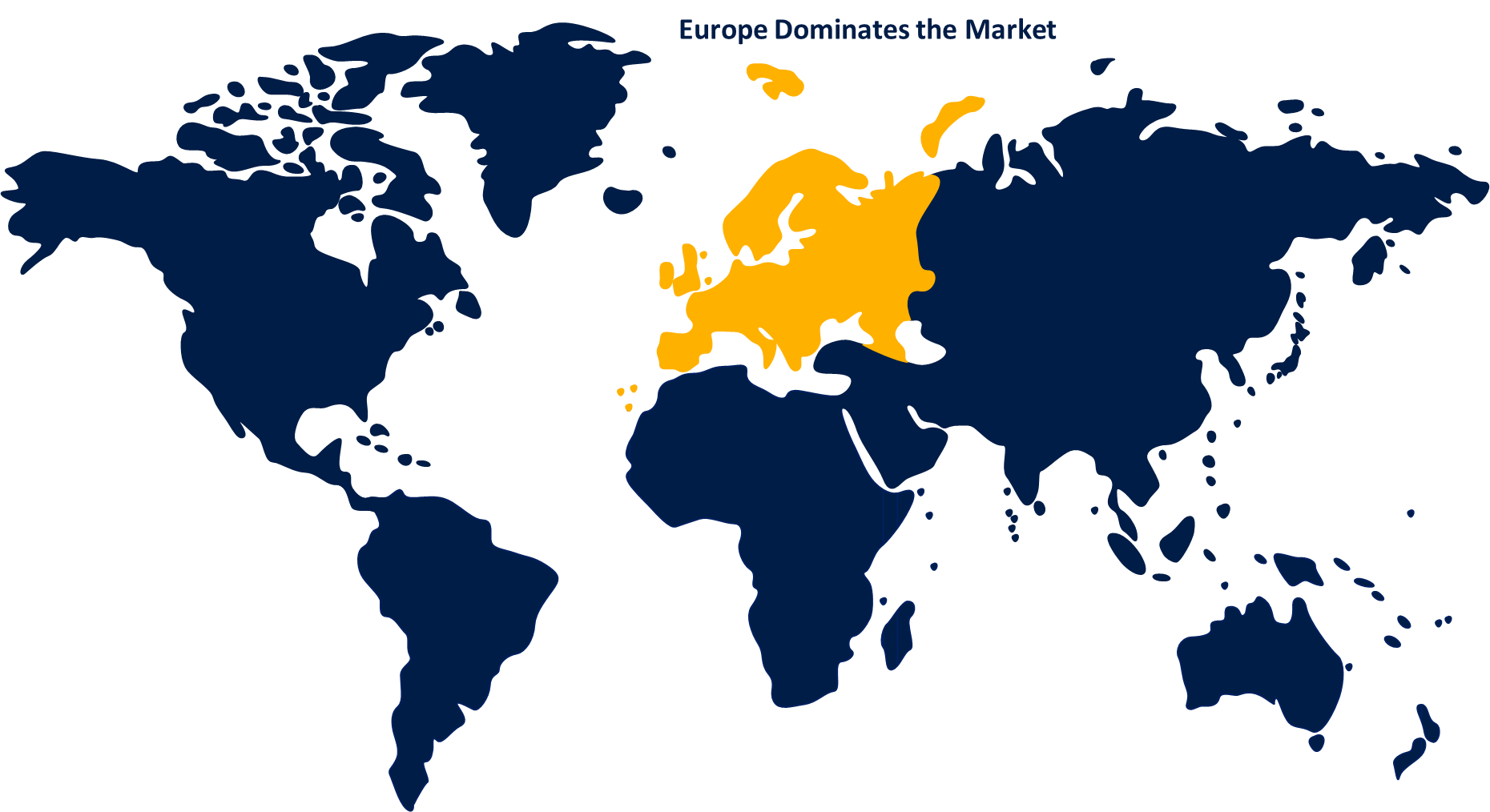

Europe is expected to hold the largest share of the global reverse factoring market over the forecast period.

Get more details on this report -

Europe is expected to hold the largest share of the global reverse factoring market over the forecast period. This is due to its widespread acceptance and beneficial regulatory structure. European companies, especially in Germany and the UK, have embraced reverse factoring to enhance cash flow, build stronger relationships with suppliers, and ensure a reliable supply chain. Reverse factoring is among the various supply chain finance options offered by the region's reputable banking institutions, all of which are involved in a flourishing financial services sector. The market in Europe has expanded due to efforts and supportive laws that have encouraged the adoption of supply chain financing methods.

North America is predicted to grow at the fastest pace in the global reverse factoring market during the projected timeframe. Businesses are increasingly focusing on handling cash flow and optimizing working capital, leading to a growing interest in innovative financing solutions such as reverse factoring. Moreover, the rise of large corporations has led to a greater adoption of supply chain financing methods like reverse factoring, particularly within the manufacturing, technology, and healthcare sectors. Moreover, the presence of advanced financial infrastructure and technological advancements has simplified the implementation and expansion of reverse factoring solutions in various sectors in North America.

Major vendors in the Global Reverse Factoring Market include Citibank, HSBC, Santander, Banco Bilbao Vizcaya Argentaria (BBVA), Caixabank, JPMorgan Chase, Bank of America, BNP Paribas, Deutsche Bank, Barclays, Société Générale, Credit Suisse, ING Group, Wells Fargo, and Others.

Recent Developments

- In September 2023, to transform supply chain financing, Bank of America introduced the CashPro Supply Chain Solutions, the first of a multi-year project. Through this initiative, the bank will be able to better serve its clients who are involved in supply chain management and financing by giving creative and effective solutions.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Global Reverse Factoring Market based on the below-mentioned segments:

Global Reverse Factoring Market, By Category

- Domestic

- International

Global Reverse Factoring Market, By Financial Institution

- Bank

- Non-Banking Financial Institution

Global Reverse Factoring Market, By End-Use

- Manufacturing

- Healthcare

- Transport and Logistics

- Information Technology

- Construction

- Others

Global Reverse Factoring Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?