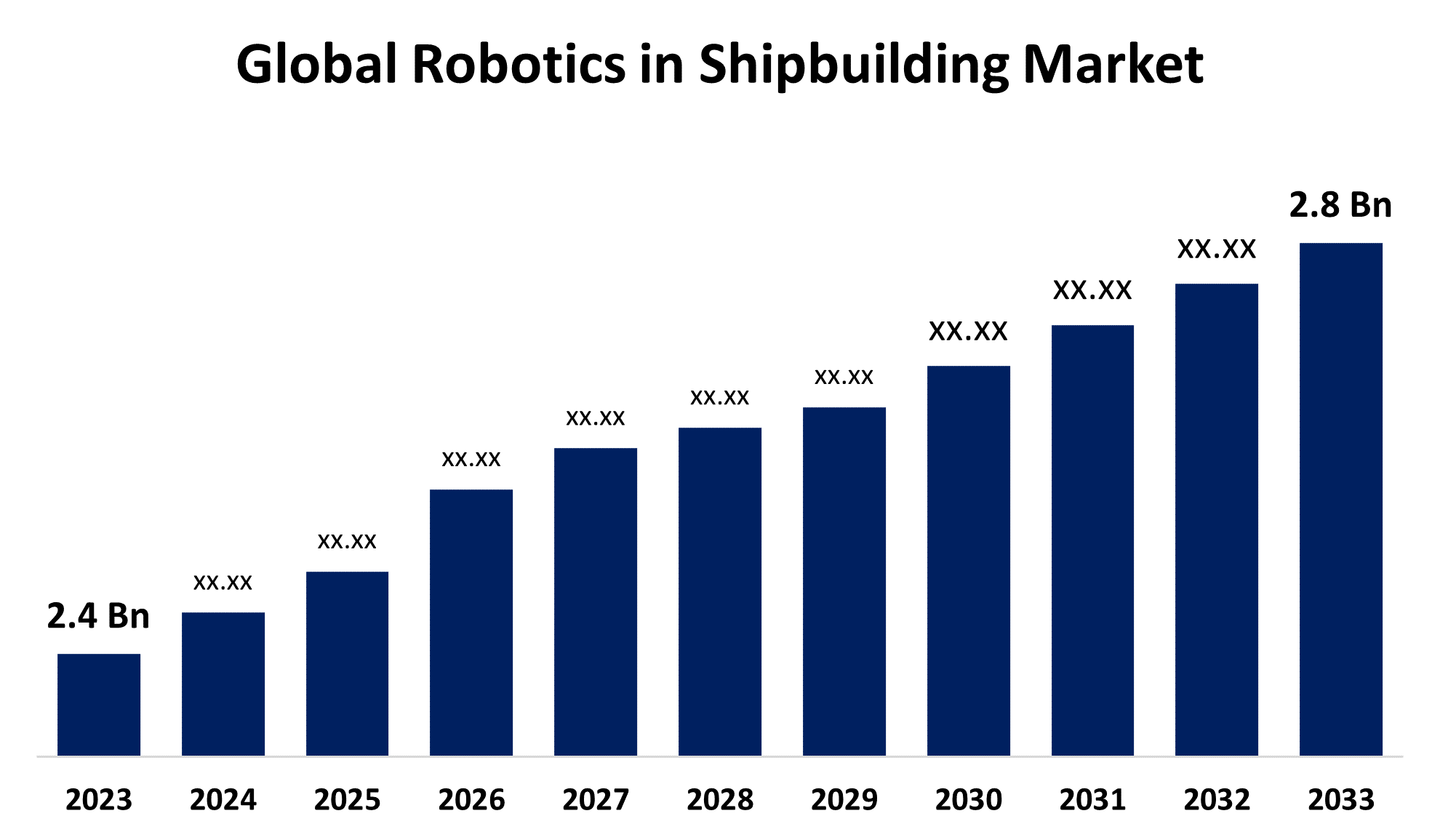

Global Robotics in Shipbuilding Market Size To Worth USD 2.8 billion By 2033 | CAGR Of 1.55%

Category: Aerospace & DefenseGlobal Robotics in Shipbuilding Market Size To Worth USD 2.8 billion By 2033

According to a research report published by Spherical Insights & Consulting, the Global Robotics in Shipbuilding Market Size to grow from USD 2.4 billion in 2023 to USD 2.8 billion by 2033, at a Compound Annual Growth Rate (CAGR) of 1.55% during the forecast period.

Get more details on this report -

Browse key industry insights spread across 200 pages with 110 Market data tables and figures & charts from the report on the "Global Robotics in Shipbuilding Market Size By Type (Articulated Robot, Cartesian Robot, SCARA Robot, Cylindrical Robot, and Others), By Application (Handling, Welding, Assembling, Inspection, and Others), By Lifting Capacity (Less than 500 kg, 500 to 1000 kg, and Over 1000 kg), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033."Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/robotics-in-shipbuilding-market

The employment of robotics in shipbuilding has transformed the maritime sector by revolutionising several aspects of ship construction and maintenance. Robots are increasingly being used in shipyards to automate a wide range of processes, including welding, painting, blasting, material handling, and inspection. Automation not only boosts production, but it also enhances safety by reducing the need for human workers in hazardous environments. Drones and underwater robots equipped with cameras and sensors monitor ship hulls, pipelines, and other critical components. These robots can detect flaws, corrosion, and other anomalies, allowing for timely maintenance and repair. The market for robots in shipbuilding is expected to grow gradually in the next years due to rising need for efficient and cost-effective manufacturing processes.

Robotics in Shipbuilding Market Value Chain Analysis

The value chain for robotics in shipbuilding includes research and development for customised solutions, hardware component manufacturing, integration into shipyard infrastructure, personnel training, deployment for various tasks, ongoing maintenance and upgrades, performance monitoring for optimisation, and end-of-life management. This requires a collaborative effort among robotics manufacturers, shipyard engineers, and project managers to ensure seamless integration, operational efficiency, quality control, and safety throughout the lifecycle of robotic systems, ultimately driving innovation, cost reduction, and value creation in the maritime industry.

Robotics in Shipbuilding Market Opportunity Analysis

The robots in shipbuilding market provides significant prospects for stakeholders in the maritime industry. With the increasing demand for efficient and cost-effective production processes, robotics offers a disruptive alternative. This opportunity covers a wide range of disciplines, including the automation of critical processes such as welding, painting, blasting, and inspection, resulting in higher output and quality assurance. Furthermore, the employment of robotics allows shipyards to improve workplace safety by reducing human exposure to potentially hazardous conditions. Furthermore, advancements in robotics technology, such as AI-powered automation and remote operation capabilities, offer chances for innovation and a competitive edge. Furthermore, the rising emphasis on sustainability stimulates the use of robotics to improve resource utilisation and reduce environmental impact in shipbuilding processes.

The increasing use of robotics to address labour shortages in the shipbuilding industry is predicted to significantly grow the market for robotics in shipbuilding. With the maritime industry facing challenges such as an ageing workforce, skill shortages, and a demand for enhanced efficiency, robotics provide an enticing option. Robotics can augment human work by automating repetitive and labor-intensive tasks such as welding, painting, and inspection, as well as filling critical labour gaps and optimising industrial processes. This not only boosts operational efficiency, but it also reduces project timelines and improves overall project outcomes. Furthermore, robotics enable shipyards to overcome geographical constraints by allowing for remote operation and monitoring, thereby expanding their talent pool and operational scope.

Shipbuilding requires complicated procedures, from design to construction, that may not always be automatable. The diverse shapes, sizes, and materials of ships make it difficult to design robots that can meet these specific requirements. Implementing robotics in shipbuilding requires significant investments in both technology and infrastructure. The cost of procuring, installing, and maintaining robotic equipment, as well as training people to utilise them, can be high. Ships are frequently built to fit specialised requirements, needing flexibility in production procedures. It is still challenging to create robots that can manage this level of modification efficiently.

Insights by Type

The articulated robots segment accounted for the largest market share over the forecast period 2023 to 2033. The usage of articulated robots in shipbuilding is increasing in emerging markets such as Asia-Pacific and elsewhere as shipyards upgrade processes to meet rising vessel demand. As these markets expand into infrastructure construction and maritime sectors, the demand for articulated robots is expected to climb even further. Articulated robots are increasingly integrating with digital technologies such as 3D scanning, virtual reality, and simulation software to improve their performance and efficiency in shipbuilding applications. These digital technologies enable shipbuilders to design, organise, and execute robotic activities more efficiently, resulting in greater productivity and quality in shipyard operations.

Insights by Application

The handling segment is dominating the market with the largest market share over the forecast period 2023 to 2033. Shipbuilding includes transporting massive and unwieldy materials, components, and structures throughout the facility. Material handling robots can efficiently transport these items throughout the manufacturing facility, removing the need for manual labour, improving workflows, and lowering the risk of accidents or injuries. Handling robots increase productivity by automating repetitive and time-consuming tasks like as loading and unloading supplies, palletizing, and transporting components between workstations. By optimising material flow and decreasing idle time, these robots help shipyards fulfil production deadlines and improve overall productivity. Despite the initial investment required to implement handling robots, shipyards benefit from long-term cost savings through decreased labour expenses, better operational efficiency, and reduced material waste.

Insights by Lifting Capacity

The over 1,000 kg segment accounted for the largest market share over the forecast period 2023 to 2033. Shipbuilding requires working with enormous, heavy materials such as steel plates, ship sections, and machinery components. Lifting, moving, and positioning these large objects at various stages of the construction process necessitates robotics capable of handling payloads weighing more than 1,000 kg. Large payload robots make it easier to put together larger ship components and structures, such as hull sections and superstructures. These robots can accurately position and align heavy components during welding, fitting, and assembly procedures, resulting in precise construction with minimum rework or errors. Emerging markets with growing maritime industries, particularly in Asia Pacific, are driving up demand for heavy payload robots in shipbuilding.

Insights by Region

Get more details on this report -

North America is anticipated to dominate the Robotics in Shipbuilding Market from 2023 to 2033. Labour costs in North America are frequently higher than in other regions, making automation an interesting option for shipyards looking to increase efficiency and reduce production costs. Robotics can help to alleviate workforce shortages and increase productivity in shipbuilding processes. The demand for ships, such as commercial boats, navy ships, and offshore structures, is pushing investment in shipbuilding robotics solutions. North America's large maritime sector, which includes shipyards, port facilities, and offshore energy production, provides opportunities for robotics companies to develop innovative ship construction and maintenance solutions. The existence of established shipbuilding and robotics companies, as well as emerging startups, contributes to a competitive market climate in North America. Competition encourages innovation and the development of cost-effective robotics solutions tailored to specific challenges.

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Asia-Pacific is a major shipbuilding hub, with China, South Korea, and Japan leading the pack. The region accounts for a significant portion of global shipbuilding output, creating a high need for robotics solutions to improve efficiency and competitiveness in shipyard operations. Rapid urbanisation and infrastructure development in Asia-Pacific countries are driving up demand for a diverse range of vessels, including commercial ships, offshore platforms, and navy vessels. Robotics technology can help meet this growing need by enabling faster and more efficient ship production, repair, and maintenance. The Asia-Pacific shipbuilding industry is highly competitive, with both established and emerging companies fighting for market supremacy. Robotics manufacturers in the region are investing in R&D to develop innovative solutions.

Recent Market Developments

- In January 2023, Daewoo Shipbuilding & Marine Engineering, a South Korean shipbuilder, has developed a collaborative robot (cobot) to improve efficiency.

Major players in the market

- ABB (Switzerland)

- The Fanuc Corporation (Japan)

- Comau (Italy)

- Yaskawa America, Inc. (U.S.)

- Kuka AG (Germany)

- Sarcos Technology and Robotics Corp. (U.S.)

- Epson (Japan)

- Universal Robots (Denmark)

- Kawasaki Robotics (Japan)

- Stäubli International AG (Switzerland)

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Robotics in Shipbuilding Market, Type Analysis

- Articulated Robot

- Cartesian Robot

- SCARA Robot

- Cylindrical Robot

- Others

Robotics in Shipbuilding Market, Application Analysis

- Handling

- Welding

- Assembling

- Inspection

- Others

Robotics in Shipbuilding Market, Lifting Capacity Analysis

- Less than 500 kg

- 500 to 1000 kg

- Over 1000 kg

Robotics in Shipbuilding Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Follow Us: LinkedIn | Facebook | Twitter

Need help to buy this report?