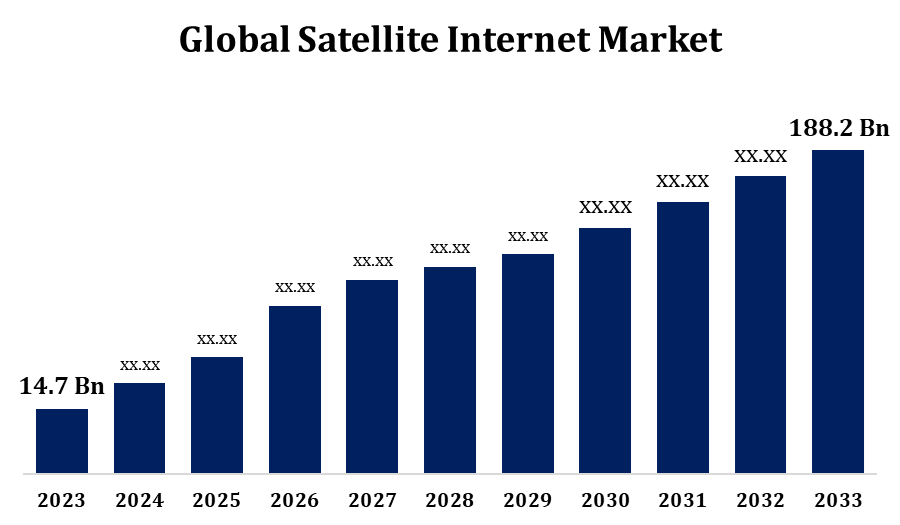

Global Satellite Internet Market worth USD 188.2 Billion By 2033 | (CAGR) of 29.04%

Category: Aerospace & DefenseGlobal Satellite Internet Market worth USD 188.2 Billion By 2033

According to a research report published by Spherical Insights & Consulting, the Global Satellite Internet Market Size to grow from USD 14.7 billion in 2023 to USD 188.2 billion by 2033, at a Compound Annual Growth Rate (CAGR) of 29.04% during the forecast period.

Get more details on this report -

Browse key industry insights spread across 210 pages with 115 Market data tables and figures & charts from the report on the "Global Satellite Internet Market Size, Share, and COVID-19 Impact Analysis, By Orbit (LEO, MEO/GEO Orbit), By Connectivity (Two Way Service, One Way Service, and Hybrid Connectivity), By Verticals (Commercial, Government & Defense), By Frequency (C-Band, L-Band, X-Band, Ka-Band, Ku-Band), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033" Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/satellite-internet-market

The satellite internet market is witnessing substantial growth, fueled by the rising demand for high-speed internet in remote and underserved regions. As satellite technology advances, companies like SpaceX's Starlink and Amazon's Project Kuiper are launching low Earth orbit (LEO) satellites, offering faster and more reliable connections. These services are particularly beneficial in areas where traditional broadband infrastructure is scarce or absent. The market is also expanding due to the increasing need for remote work, digital education, and IoT applications that require stable internet connectivity. Furthermore, innovations in satellite communication, such as enhanced bandwidth and reduced latency, are driving market development. The satellite internet market is expected to continue its growth, playing a vital role in global connectivity and helping bridge the digital divide.

Satellite Internet Market Value Chain Analysis

The satellite internet market value chain consists of several key stages, starting with satellite manufacturing. Companies design and produce both geostationary and low Earth orbit (LEO) satellites. These satellites are then launched into space, often in collaboration with aerospace firms. Once in orbit, satellite operators are responsible for managing and maintaining the infrastructure to ensure reliable connectivity. Next, service providers deliver internet access to end users, typically using ground stations to transmit signals, while also overseeing customer subscriptions and technical support. Ultimately, end users, including individuals, businesses, and government entities, access the internet. Throughout the value chain, technology developers enhance satellite systems, communication protocols, and software platforms, improving service delivery. The market thrives due to the collaboration between the aerospace, telecommunications, and technology industries.

Satellite Internet Market Opportunity Analysis

The satellite internet market offers significant opportunities, especially in underserved and remote areas where traditional broadband infrastructure is scarce. The increasing demand for global connectivity, driven by remote work, e-learning, and telemedicine, creates a strong need for reliable internet in rural and difficult-to-reach locations. Advances in low Earth orbit (LEO) satellite technology, which provide faster speeds and reduced latency, open new possibilities for service providers to offer competitive broadband solutions. Furthermore, government initiatives promoting digital inclusion and closing the digital divide offer collaboration and funding prospects. The growing use of IoT applications, autonomous vehicles, and smart cities further drives the need for continuous, high-speed internet. With ongoing technological advancements, satellite internet is well-positioned to meet both commercial and residential needs, presenting substantial growth potential.

The increasing demand for satellite internet from the military is a major factor driving the growth of the satellite internet market. Military operations rely on secure, reliable, and high-speed internet, particularly in remote or conflict zones where traditional infrastructure is lacking. Satellite internet offers a crucial solution by providing global coverage and supporting communication, real-time data transfer, and surveillance. The rise of advanced military technologies such as drones, autonomous systems, and IoT devices has amplified the need for robust satellite communication networks. Furthermore, the military's growing interest in deploying low Earth orbit (LEO) satellites to enhance bandwidth and reduce latency is fueling market expansion. As nations continue investing in defense modernization and global connectivity, the military’s increasing need for satellite internet remains a central driver of market development.

A major challenge in the satellite internet market is the high cost of satellite manufacturing and launch, which limits access for smaller service providers and impacts pricing for end-users. While low Earth orbit (LEO) satellites provide lower latency, they require large constellations, leading to significant infrastructure costs and regulatory challenges. Bandwidth limitations and signal interference, particularly in dense urban environments or areas with adverse weather conditions, can also degrade service quality. Additionally, competition from traditional broadband providers and emerging technologies such as 5G presents obstacles in capturing market share and achieving customer adoption. Lastly, regulatory issues, including spectrum allocation and international collaboration, complicate the expansion of global satellite networks, slowing the overall pace of market growth.

Insights by Orbit

The LEO segment accounted for the largest market share over the forecast period 2023 to 2033. LEO satellites orbit at altitudes between 500 and 2,000 kilometers, bringing them closer to the Earth and enabling more efficient data transmission. This proximity improves service quality, particularly for applications like video conferencing, gaming, and IoT communications. Companies such as SpaceX's Starlink and Amazon's Project Kuiper are spearheading the LEO satellite movement, deploying large constellations of small satellites to provide global coverage. The growing need for internet access in remote regions, combined with advances in satellite technology, is driving rapid growth in the LEO segment. As the cost of satellite deployment continues to decrease, this segment is set to play a dominant role in the satellite internet market.

Insights by Connectivity

The Two-Way Service segment accounted for the largest market share over the forecast period 2023 to 2033. This service enables users to transmit and receive data simultaneously, facilitating real-time communication for activities such as video conferencing, live streaming, and cloud-based services. As the need for reliable internet in remote areas grows, two-way satellite services are becoming essential for both consumers and businesses in underserved regions. The segment is gaining momentum as technological advancements, including reduced latency and increased bandwidth, enhance service quality. Moreover, two-way services are crucial for the expansion of Internet of Things (IoT) applications and remote operations in sectors like agriculture, logistics, and energy management. With rising demand for interactive, bidirectional communication, the Two-Way Service segment is poised to play a key role in the continued growth of the satellite internet market.

Insights by Verticals

The commercial segment accounted for the largest market share over the forecast period 2023 to 2033. The growth of the commercial segment is driven by the rising demand for reliable connectivity across industries such as aviation, maritime, transportation, and enterprise applications. Businesses require high-speed, global internet access to support operations, remote work, and cloud-based services. In aviation, satellite internet is enhancing the passenger experience with in-flight connectivity, while in maritime, it enables communication on vessels in remote locations. The digital transformation and the growing use of IoT applications across sectors are further increasing the need for satellite internet solutions. Companies like Viasat and SES Networks are providing customized commercial services to meet sector-specific demands, such as secure data transmission, high bandwidth, and low latency. As industries continue to depend on global connectivity, the commercial segment is expected to expand, becoming a key driver of the satellite internet market.

Insights by Frequency

The Ka-band segment accounted for the largest market share over the forecast period 2023 to 2033. The growth of the Ka-band segment is fueled by its ability to deliver higher throughput and greater bandwidth compared to traditional Ku-band and C-band frequencies. Operating in the 26.5 to 40 GHz frequency range, Ka-band supports faster data speeds and enhanced capacity, making it ideal for high-speed internet applications like video streaming, cloud services, and large-scale data transfers. With advancements in satellite technology and the increasing need for reliable, high-speed internet in remote areas, Ka-band has become a vital enabler for satellite internet providers such as SpaceX’s Starlink and ViaSat. Its higher capacity allows service providers to offer improved performance and cost-effective solutions, driving market growth. As the demand for fast and scalable satellite internet continues to rise, the Ka-band segment is expected to play a pivotal role in shaping the future of the market.

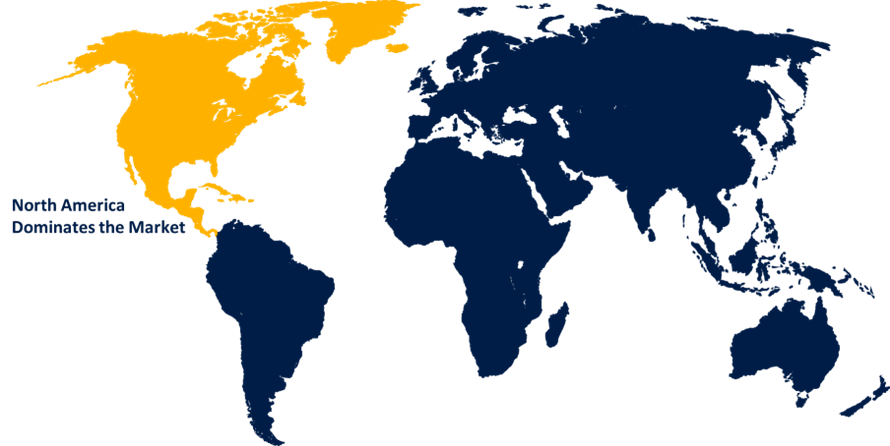

Insights by Region

Get more details on this report -

North America is anticipated to dominate the Satellite Internet Market from 2023 to 2033. With large portions of the population in these areas lacking dependable broadband access, satellite internet presents a practical solution. Companies like SpaceX’s Starlink and Viasat are leading the way by offering fast and affordable satellite services. The growing adoption of satellite internet is further supported by government initiatives, such as the Federal Communications Commission’s (FCC) Rural Digital Opportunity Fund, which aims to expand broadband access. Additionally, the military’s demand for secure, global connectivity drives market growth. North America’s advanced technological infrastructure, combined with a strong need for reliable internet in remote regions, ensures that satellite internet will continue to grow and evolve in the region.

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The increasing dependence on digital services in the region, such as e-learning, telemedicine, and e-commerce, is driving the demand for strong and reliable connectivity. Companies like SpaceX’s Starlink and SES Networks are making significant strides in the market, providing affordable, high-speed internet through low Earth orbit (LEO) satellites. Additionally, government efforts to enhance digital inclusion, along with rising internet penetration, are accelerating the adoption of satellite internet. As the Asia-Pacific region continues to modernize, satellite internet will play a crucial role in bridging the digital divide and supporting regional economic development.

Recent Market Developments

- In October 2022, Viasat has formed a strategic partnership with AXESS Maritime, allowing Viasat’s maritime operations to extend their global reach by providing a diverse range of products and services through AXESS.

Major players in the market

- Singtel Group

- Freedomsat

- EchoStar Corporation

- Thuraya TelecommuniLEOions Company

- Eutelsat CommuniLEOions SA

- OneWeb.net

- SpaceX

- Viasat, Inc.

- Axess

- DSL Telecom

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Satellite Internet Market, Orbit Analysis

- LEO

- MEO/GEO Orbit

Satellite Internet Market, Connectivity Analysis

- Two Way Service

- One Way Service

- Hybrid Connectivity

Satellite Internet Market, Verticals Analysis

- Commercial

- Government & Defense

Satellite Internet Market, Frequency Analysis

- C-Band

- L-Band

- X-Band

- Ka-Band

- Ku-Band

Satellite Internet Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?