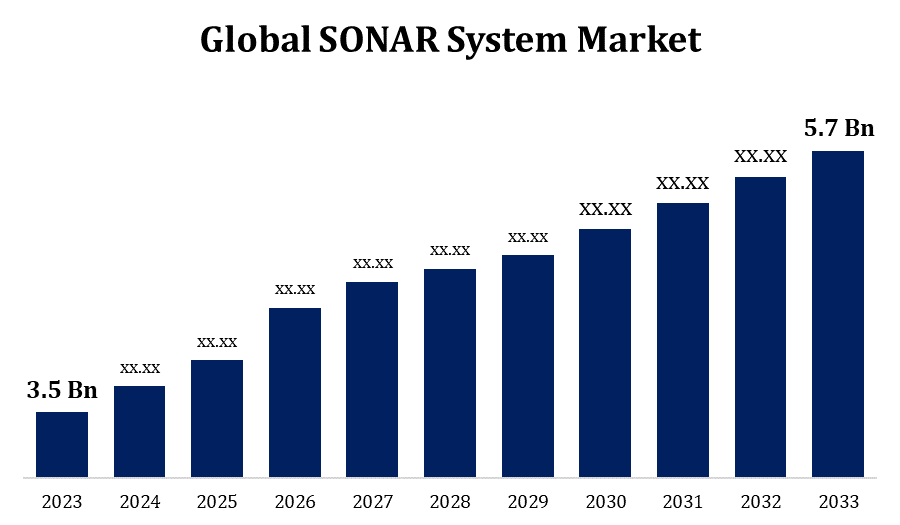

Global SONAR System Market Size To Worth USD 5.7 Billion By 2033 | CAGR of 5.00%

Category: Aerospace & DefenseGlobal SONAR System Market Size To Worth USD 5.7 Billion By 2033

According to a research report published by Spherical Insights & Consulting, the Global SONAR System Market Size to grow from USD 3.5 billion in 2023 to USD 5.7 billion by 2033, at a Compound Annual Growth Rate (CAGR) of 5.00% during the forecast period.

Get more details on this report -

Browse key industry insights spread across 200 pages with 120 Market data tables and figures & charts from the report on the "Global SONAR System Market Size By Application (Anti-submarine Warfare, Port Security, Mine Detection & Countermeasure Systems, Search & Rescue, Navigation, Diver Detection, Seabed Terrain Investigation, Scientific, Others); By Platform (Commercial Vessels, Defense Vessels, Unmanned Underwater Vehicles (UUVs), Aircrafts, Ports); By Type (Hull-mounted, Stern-mounted, Dipping, Sonobuoy), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/sonar-system-market

Naval defence relies heavily on SONAR systems to detect submarines, underwater mines, and other potential threats. Because of the need for increased maritime security and growing geopolitical tensions, defence funds set aside for the acquisition of SONAR systems are likely to drive market expansion. In the commercial sector, SONAR systems are used for navigation, fish detection, collision avoidance, and underwater obstacle locating. The expansion of the global marine industry and the growing demand for seafood are expected to drive up the requirement for SONAR systems in commercial shipping and fisheries applications. SONAR systems are extensively employed in offshore oil and gas exploration for the purposes of pipeline inspection, underwater infrastructure detection, and seabed mapping.

SONAR System Market Value Chain Analysis

During this time, companies, academic institutions, and research groups all spend in R&D to innovate and develop new SONAR technology. Important problems for improving SONAR performance include the development of complex signal processing algorithms, sensor technologies, acoustic transducers, and the integration of artificial intelligence and machine learning. Manufacturers create the hydrophones, transducers, display interfaces, signal processing units, acoustic arrays, and other subsystems required for SONAR systems. Distributors and sales channels are crucial for marketing and selling SONAR systems to end users in a range of industries, such as commercial shipping, defence, offshore oil and gas, and scientific research.

SONAR System Market Opportunity Analysis

A significant opportunity for SONAR systems used in anti-submarine warfare (ASW) is presented by the modernization of naval fleets and the escalation of geopolitical tensions. Advanced sonar devices that can detect underwater hazards and hidden submarines are in high demand. The need for safe passage in congested waterways and the growing global shipping industry are the primary drivers of the need for SONAR systems for ship navigation and collision avoidance. Improved features like real-time monitoring and autonomous collision avoidance algorithms offer opportunities for industry expansion. SONAR systems are essential to offshore oil and gas development because they can map the seabed's topography, identify geological characteristics, and pinpoint potential drilling locations.

Commercial ships significantly depend on SONAR systems for safety and navigation in challenging environments such as congested harbours, shallow rivers, and areas with underwater obstacles. As global trade and maritime transportation activities increase, more advanced SONAR technologies are required to ensure vessel safety and improve navigation accuracy. SONAR systems play a critical role in averting collisions by identifying other vessels, underwater obstacles, and potential threats in the ship's path. As the amount and quantity of maritime traffic continue to grow, there is a growing need for SONAR-based collision avoidance systems to prevent accidents and preserve seamless marine operations. Commercial shipping corporations use SONAR systems to monitor underwater infrastructure, such as bridges, piers, and offshore ports.

Building, acquiring, and maintaining SONAR systems can be expensive, particularly for more complex models with high-resolution imaging capabilities. Cost concerns could prevent the widespread use of SONAR systems, particularly in developing nations, smaller businesses, and commercial fishing fleets where resources are more scarce. SONAR systems generate enormous amounts of data, which need to be processed and interpreted in order to derive useful insights. Underwater habitat complexity and acoustic signal unpredictability pose challenges to accurate data interpretation, underwater object classification, and anomaly detection. As SONAR systems are increasingly networked and digitalized, cybersecurity risks such as hacking, data breaches, and unauthorised access jeopardise system integrity, confidentiality, and operational safety.

Insights by Application

The anti-submarine warfare segment accounted for the largest market share over the forecast period 2023 to 2033. Many countries are sponsoring navy modernization programmes to strengthen their capacity for maritime security, particularly in view of the growing threat presented by submarines. The navy forces have upgraded their arsenal to include modern surface vessels, submarines, and maritime patrol planes equipped with state-of-the-art SONAR systems for ASW missions. A major concern to international maritime security is the proliferation of submarines among both state and non-state entities. Nations are bolstering their ASW capabilities to detect, track, and neutralise submarines operating in their territorial seas and other critical locations. Unmanned underwater vehicles (UUVs), autonomous underwater vehicles (AUVs), and unmanned surface boats (USVs) equipped with SONAR sensors are critical components of ASW operations.

Insights by Platform

The defense vessels segment accounted for the largest market share over the forecast period 2023 to 2033. Numerous countries worldwide are presently engaged in extensive navy modernization initiatives aimed at enhancing their maritime capacities. Acquisition and modernization of defence boats equipped with state-of-the-art SONAR systems is often the focus of these initiatives. Investments in new surface combatants, submarines, and maritime patrol aircraft fitted with state-of-the-art SONAR technology are driving the demand for SONAR systems specifically made for defence vessels. Due to the proliferation of submarines among state and non-state entities, effective anti-submarine warfare (ASW) capabilities are becoming more and more important. Modern SONAR systems are essential for defence vessels, particularly naval surface combatants and anti-submarine warfare ships, to detect, track, and destroy underwater threats from submarines.

Insights by Type

The hull-mounted segment accounted for the largest market share over the forecast period 2023 to 2033. Many countries are sponsoring naval modernization programmes to strengthen their marine capabilities. SONAR systems are placed on the hulls of surface combatants, submarines, and marine patrol planes. Due to its necessity for underwater surveillance, mine detection, and anti-submarine warfare (ASW) on recently purchased and modernised naval warships, hull-mounted SONAR systems are in great demand. Naval warships equipped with hull-mounted SONAR systems undertake underwater surveillance and reconnaissance operations to monitor critical areas, identify potential threats, and gather intelligence. With the help of hull-mounted SONAR systems that provide real-time situational awareness, navy vessels can detect underwater obstacles, mines, and other dangers when travelling through coastal or broad ocean waters.

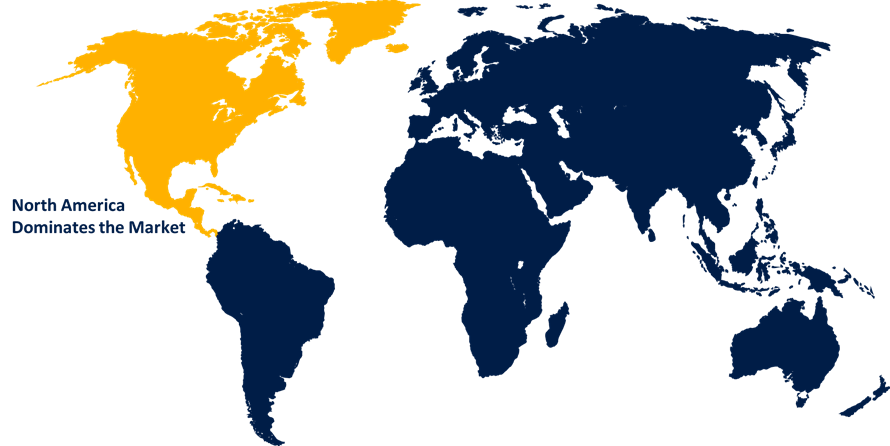

Insights by Region

Get more details on this report -

North America is anticipated to dominate the SONAR System Market from 2023 to 2033. North America, and the US in particular, have some of the largest defence budgets worldwide. SONAR systems are critical to naval defence and anti-submarine warfare (ASW) capabilities. North America is home to prestigious research institutions and defence contractors, which encourages creativity and the development of cutting-edge SONAR technology for military applications. Major ports on North America's east and west coasts, home to a booming marine economy, serve as significant hubs for international trade. SONAR systems are critical for port operations, undersea mapping, navigation, and commercial shipping collision avoidance.

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. A significant proportion of marine trade and business is made possible by the largest ports and busiest shipping lanes in the world, which are located in the Asia-Pacific area. SONAR systems are essential to commercial shipping in the Asia-Pacific region because they make port operations, underwater mapping, collision avoidance, navigation, and environmental monitoring easier. Benefits for providers of SONAR systems to the commercial shipping industry include increased port infrastructure, increased container traffic, and the need for efficient vessel traffic control. Australia, Malaysia, Indonesia, and China are among the countries actively engaged in offshore oil and gas production and exploration in the Asia-Pacific region. SONAR systems are used in offshore oil and gas areas for subsea infrastructure surveillance, pipeline inspection, environmental assessments, and seabed mapping.

Recent Market Developments

- In September 2022, Furuno Electric Co., Ltd. has unveiled the New FLEX Function Display SFD-1010/1012.

Major players in the market

- Atlas Elektronik

- Furuno Electric Co

- Japan Radio Company

- KONGSBERG

- L3Harris Technologies, Inc

- Lockheed Martin Corporation

- NAVICO Group

- Raytheon Technologies Corporation

- Sonardyne

- Thales Group

- Ultra Electronics

- Teledyne Technologies Inc.

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

SONAR System Market, Application Analysis

- Anti-submarine Warfare

- Port Security

- Mine Detection & Countermeasure Systems

- Search & Rescue

- Navigation

- Diver Detection

- Seabed Terrain Investigation

- Scientific

- Others

SONAR System Market, Platform Analysis

- Commercial Vessels

- Defense Vessels

- Unmanned Underwater Vehicles (UUVs)

- Aircrafts

- Ports

SONAR System Market, Type Analysis

- Hull-mounted

- Stern-mounted

- Dipping

- Sonobuoy

SONAR System Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?