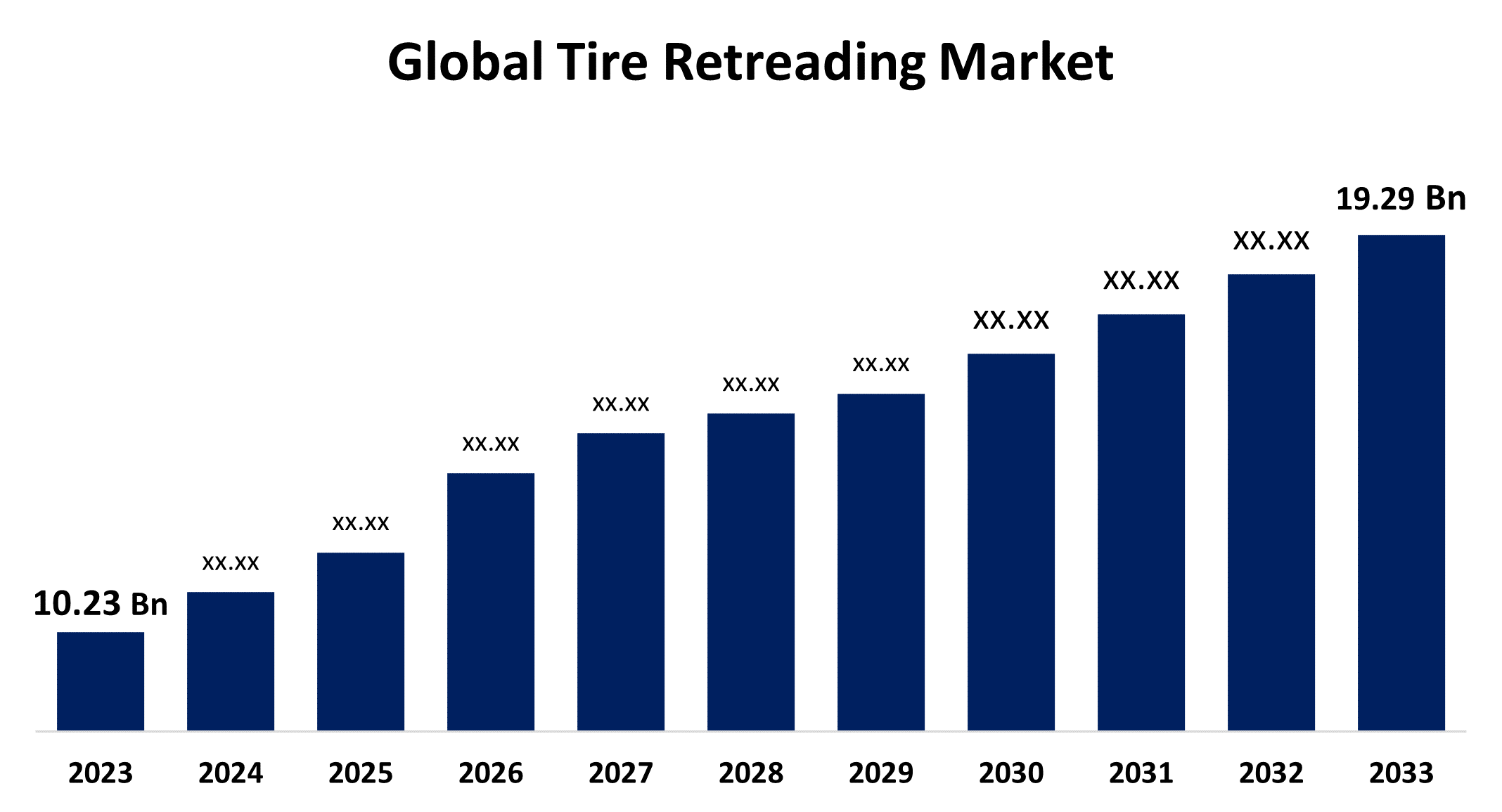

Global Tire Retreading Market Size To Worth USD 19.29 Billion By 2033 | CAGR OF 6.55%

Category: Automotive & TransportationGlobal Tire Retreading Market Size To Worth USD 19.29 Billion By 2033

According to a research report published by Spherical Insights & Consulting, the Global Tire Retreading Market Size is to Grow from USD 10.23 Billion in 2023 to USD 19.29 Billion by 2033, at a Compound Annual Growth Rate (CAGR) of 6.55% during the projected period.

Get more details on this report -

Browse key industry insights spread across 189 pages with 110 Market data tables and figures & charts from the report on the "Global Tire Retreading Market Size, Share, and COVID-19 Impact Analysis, By Method (Pre-Cure and Mold-Cure), By Vehicle Type (Commercial Vehicle and Off-highway Vehicle), By Tire Type (Radial, Bias, and Solid), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/tire-retreading-market

Retreading, or remoulding, recycles worn tires by replacing their treads while keeping the original structure intact. This extends the tire's lifespan, reduces waste, and conserves raw materials. Though less common among car drivers, it's popular with lorry drivers who need frequent replacements. Retreading is cost-effective and environmentally friendly, using less rubber than new tires. Advances in retreading technology have improved performance and safety, making retreaded tires comparable to new ones. Additionally, market trends show increased adoption by trucking companies, supported by governmental incentives in various regions. Economic and environmental factors drive the global tire retreading market, with key influences being cost savings for commercial fleets, the reduction of waste, and the conservation of resources. Technological advancements and government incentives further boost market growth, alongside increasing demand from the commercial vehicle and logistics sectors. However, the market faces several challenges, including consumer scepticism about quality and safety, high initial setup costs, competition from affordable new tires, and limited access to advanced retreading technologies in developing regions.

The pre-cure segment is anticipated to hold the greatest share of the global tire retreading market during the projected timeframe.

Based on the method, the global tire retreading market is divided into pre-cure and mold-cure. Among these, the pre-cure segment is anticipated to hold the greatest share of the global tire retreading market during the projected timeframe. Pre-cure retreading involves applying a pre-vulcanized tread to the tire casing, and then curing it in a chamber, ensuring quality and consistency. This method offers a smooth, uniform tread pattern, enhancing performance and safety, and is cost-effective with versatile design options, making it popular among commercial fleets.

The commercial vehicle segment is anticipated to hold the greatest share of the global tire retreading market during the projected timeframe.

Based on vehicle type, the global tire retreading market is divided into commercial vehicles and off-highway vehicles. Among these, the commercial vehicle is anticipated to hold the greatest share of the global tire retreading market during the projected timeframe. Retreading provides a cost-effective solution for commercial fleets, reducing tire replacement expenses due to high operational costs and frequent tire needs. Additionally, its economic viability, sustainability benefits, and enhanced performance from advanced technologies drive demand in the commercial vehicle sector.

The radial segment is anticipated to grow at the fastest pace in the global tire retreading market during the projected timeframe.

Based on tire type, the global tire retreading market is divided into radial, bias, and solid. Among these, the radial segment is anticipated to grow at the fastest pace in the global tire retreading market during the projected timeframe. Radial tires are popular for their enhanced fuel efficiency, durability, and comfort, offering better heat dissipation and less rolling resistance, which extends lifespan and retreading potential. Their adoption in commercial and passenger vehicles, driven by technological advancements and regulatory support for sustainable tires, fuels the market growth.

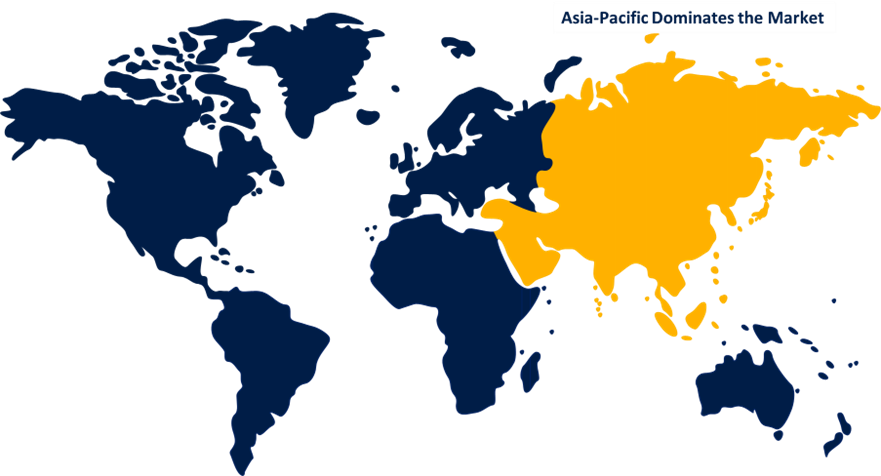

Asia-Pacific is anticipated to hold the largest share of the global tire retreading market over the forecast period.

Get more details on this report -

Asia-Pacific is anticipated to hold the largest share of the global tire retreading market over the predicted timeframe. The regional market is driven by the expanding automotive sector in countries like China, India, and Japan, and the high volume of commercial vehicles necessitating cost-efficient tire solutions. The economic benefits of retreading resonate in these cost-sensitive markets, with technological improvements enhancing tire quality and reliability, boosting consumer confidence. Additionally, government policies promoting sustainability and resource conservation further foster retreading by extending tire lifecycles and reducing environmental impact.

Europe is expected to grow at the fastest pace in the global tire retreading market during the forecast period. The focus on sustainability and EU regulations promoting waste reduction boost the adoption of retreaded tires, aligning with environmental goals. Europe's advanced transportation infrastructure and high commercial vehicle usage, combined with technological innovations in tire retreading, drive significant market growth.

Major vendors in the Global Tire Retreading Market include Michelin, Kit Loong Commercial Tyre Group, JK TYRES, The Goodyear Tire & Rubber Company, Fortune Tire Tech Limited, Bridgestone, MRF, Tread Wright Tire, Carloni Tire, Rosler Tech Innovators, YOKOHAMA RUBBER COMPANY, Eastern treads, Continental AG, Pilipinas Kai Rubber Corporation, Nokian Tyres Plc., and others.

Recent Developments

- In June 2024, During the 2024 edition of the Brazilian tire retreading exhibition Pneushow, tread rubber manufacturer Tipler announced the launch of its new RT74+ tread.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Global Tire Retreading Market based on the below-mentioned segments:

Global Tire Retreading Market, By Method

- Pre-Cure

- Mold-Cure

Global Tire Retreading Market, By Vehicle Type

- Commercial Vehicle

- Off-highway Vehicle

Global Tire Retreading Market, By Tire Type

- Radial

- Bias

- Solid

Global Tire Retreading Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?