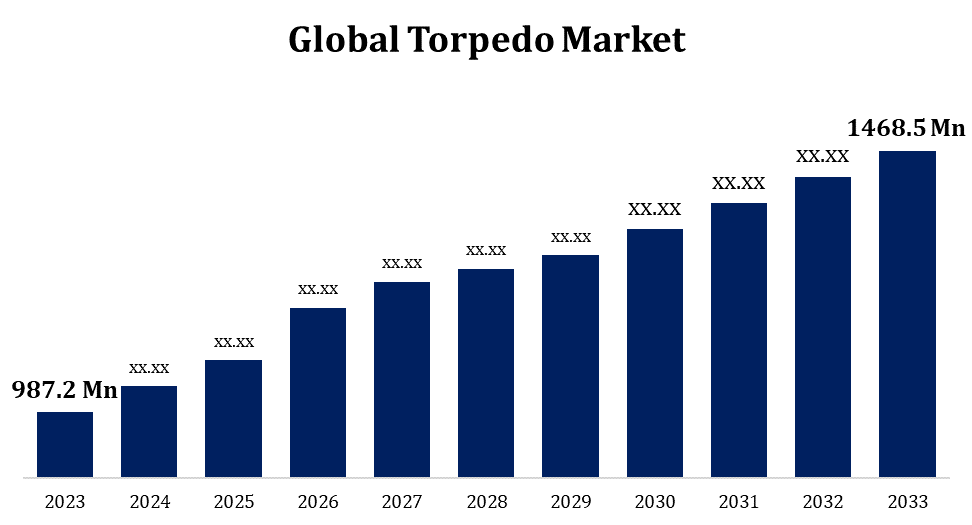

Global Torpedo Market Size To Worth USD 1468.5 Million By 2033 | CAGR of 4.05%

Category: Aerospace & DefenseGlobal Torpedo Market Size To Worth USD 1468.5 Million By 2033

According to a research report published by Spherical Insights & Consulting, the Global Torpedo Market Size to grow from USD 987.2 million in 2023 to USD 1468.5 million by 2033, at a Compound Annual Growth Rate (CAGR) of 4.05% during the forecast period.

Get more details on this report -

Browse key industry insights spread across 200 pages with 120 Market data tables and figures & charts from the report on the "Global Torpedo Market Size By Weight (Heavyweight Torpedoes and Lightweight Torpedoes), By Launch Platform (Air-Launched, Surface-Launched, and Underwater-Launched), By Propulsion (Electric Propulsion and Conventional Propulsion), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/torpedo-market

Improvements in guiding systems, stealth, autonomy, and other technological breakthroughs are shaping next-generation torpedoes. These advancements aim to improve accuracy, range, and effectiveness while reducing the threat to friendly forces. The requirement for torpedoes varies by region, with the primary forces behind purchase being states with significant maritime interests and naval might. In regions where there are marine conflicts or threats, there may be a greater investment in torpedo capability. Exports are regularly regulated by governments to ensure that they respect international agreements and do not incite unstable conflicts. The international torpedo commerce is governed by export laws and regulations.

Torpedo Market Value Chain Analysis

Research and development goes into the design and development of torpedo systems, or they are enhanced by utilising pre-existing ones. In order to improve capabilities like stealth, precision, and range in response to shifting threats and technological advancements, businesses invest money in research and development (R&D). After the design is complete, the torpedoes are produced at facilities. This means sourcing materials, putting together, examining, and testing to ensure the torpedoes' dependability and efficiency. The supply chain includes the coordinating of the procurement of components and subsystems from several providers. This group includes sensors, guidance systems, propulsion systems, explosives, and other specialised components. Effective supply chain management ensures timely component inspection and delivery. Manufacturers and defence contractors market their torpedo systems to potential customers, including military units and governments. Torpedoes are delivered to military locations or naval vessels via logistics networks. This means navigating customs, complying with export regulations, and working with shipping companies.

Torpedo Market Opportunity Analysis

Many fleets throughout the world are undertaking modernization programmes to improve their naval capabilities. This includes replacing antiquated torpedo systems with more advanced, contemporary models. These modernization initiatives may help torpedo development and manufacturing enterprises by bringing innovative solutions to meet the evolving needs of the armed services. Developing nations with increasing maritime interests are investing in naval forces to protect their sea lanes, maintain their maritime borders, and safeguard their natural resources. Torpedo manufacturers have an excellent opportunity to provide these countries with modern systems that are tailored to their specific requirements. Defence companies may consider selling torpedo systems to foreign markets through direct commercial contracts or government-to-government agreements.

Armed forces and tensions in neighbouring nations sometimes increase during conflicts over maritime borders. Nations that seek to assert their sovereignty over disputed maritime territory invest in naval capabilities, such as anti-submarine warfare (ASW) weapons like torpedoes, in an effort to protect their interests and fend off any threats. In reaction to disputes over maritime borders, governments may accelerate the acquisition of state-of-the-art torpedo systems to bolster their naval arsenals. Modern torpedoes with sophisticated guidance, navigation, and targeting systems are essential for maintaining marine security and effectively thwarting potential attacks by hostile forces. Maritime border disputes occasionally overlap with naval modernization projects aimed at updating ageing fleets and enhancing maritime defence capabilities.

The research and production of torpedoes need large financial investments because of the complexity of the systems involved, as military-grade armament must meet high quality and safety criteria. There could be competition between conflicting defence priorities for limited resources if budgetary constraints in the defence sector limit the availability of torpedo procurement alternatives. In order to prevent unauthorised proliferation and safeguard national security interests, countries have enforced strict export regulations and banned the global trade of military torpedoes. Due to the complexity of export compliance rules and obtaining the necessary export licences, manufacturers may find it challenging to expand into new markets and grow their businesses.

Insights by Weight

The heavyweight torpedo segment accounted for the largest market share over the forecast period 2023 to 2033. Numerous fleets globally were implementing modernization initiatives, which entailed obtaining state-of-the-art torpedoes to enhance their ability to defend underwater targets. Heavyweight torpedoes, which are known for having a greater range and more deadly power, were a crucial part of these purchases. As tensions in various regions increased, nations were investing more on their naval capabilities to protect their maritime interests. This includes acquiring state-of-the-art torpedoes to counter any dangers posed by hostile surface boats and submarines. The increasing use of submarines in naval operations for both conventional and strategic goals necessitated the development of more advanced torpedoes capable of effectively neutralising modern submarine threats.

Insights by Launch Platform

The underwater launched segment accounted for the largest market share over the forecast period 2023 to 2033. Navigators are exploring a variety of platforms to increase their fleet size, including surface ships, underwater drones, unmanned underwater vehicles (UUVs), and submarines. This diversity is driving up the requirement for torpedoes that can be fired from a range of underwater platforms. Unmanned underwater vehicles (UUVs) have become more capable and adaptable as a result of significant technological advancements. Consequently, torpedoes that can be fired from these platforms are becoming more and more important for a range of tasks, such as mine clearance, anti-submarine warfare, and reconnaissance. Anti-submarine warfare (ASW) is still a major concern for many countries due to the widespread deployment of submarines worldwide.

Insights by Propulsion

The electric propulsion segment accounted for the largest market share over the forecast period 2023 to 2033. Electric-propelled torpedoes have advanced significantly in terms of efficiency, performance, and reliability. Among these advances are electric motors, batteries, power management systems, and algorithms for propulsion control. Electric propelled torpedoes, particularly ones with contemporary battery technology, may travel farther and last longer. As a result, torpedoes powered by electricity can operate for longer periods of time and cover a wider spectrum of missions. The increasing usage of unmanned underwater vehicles (UUVs) in naval operations has led to a growing requirement for torpedoes with electric propulsion systems that can be readily coupled with unmanned platforms.

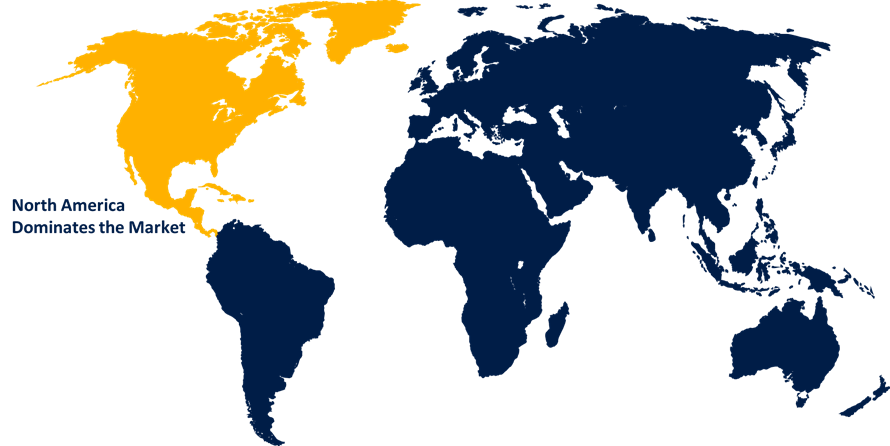

Insights by Region

Get more details on this report -

North America is anticipated to dominate the Torpedo Market from 2023 to 2033. The United States Navy (USN) is one of the major users of torpedoes in North America, having purchased them for use by its surface ships and submarines. To maintain a state-of-the-art and proficient underwater combat capability, the US Navy consistently invests in updating its torpedo supply. North American fleets, like the USN and the Royal Canadian Navy (RCN), emphasise modernization efforts in order to outfit their torpedo systems with cutting-edge capabilities. Enhancing the effectiveness, accuracy, and range of torpedoes in a range of operational scenarios is the aim of these modernization initiatives. North American defence contractors leverage export opportunities to supply friendly and allied nations with torpedoes around the world. Exporting torpedoes benefits manufacturers financially as well as bilateral defence relations and regional security cooperation.

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Several countries in the Asia-Pacific region, including Australia, South Korea, China, India, Japan, and South Korea, are investing heavily on military modernization projects. In order to maintain maritime dominance and enhance underwater combat capabilities, these programmes often entail the acquisition of advanced torpedo systems. Many of the countries in the region are strengthening their military forces by acquiring new surface combatants and submarines. Without their torpedoes, these naval platforms would not be the same since they are essential for defending boundaries and maritime interests against surface warfare and submarines.

Recent Market Developments

- In February 2020, Lockheed Martin is to build the AN/SQQ-89A(V)15 anti-torpedo and anti-submarine warfare (ASW) systems for surface warships as part of a contract worth USD 59.5 million.

Major players in the market

- Aselsan

- Atlas Elektronik GmbH

- BAE Systems

- Bharat Dynamics Limited

- Honeywell International Inc

- Leonardo SpA

- Lockheed Martin Corporation

- Naval Group

- Northrop Grumman Corporation

- Raytheon Company

- Rosoboronexport

- Saab AB

- Sechan Electronics Inc.

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Torpedo Market, Weight Analysis

- Heavyweight Torpedoes

- Lightweight Torpedoes

Torpedo Market, Launch Platform Analysis

- Air-Launched

- Surface-Launched

- Underwater-Launched

Torpedo Market, Propulsion Analysis

- Electric Propulsion

- Conventional Propulsion

Torpedo Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?