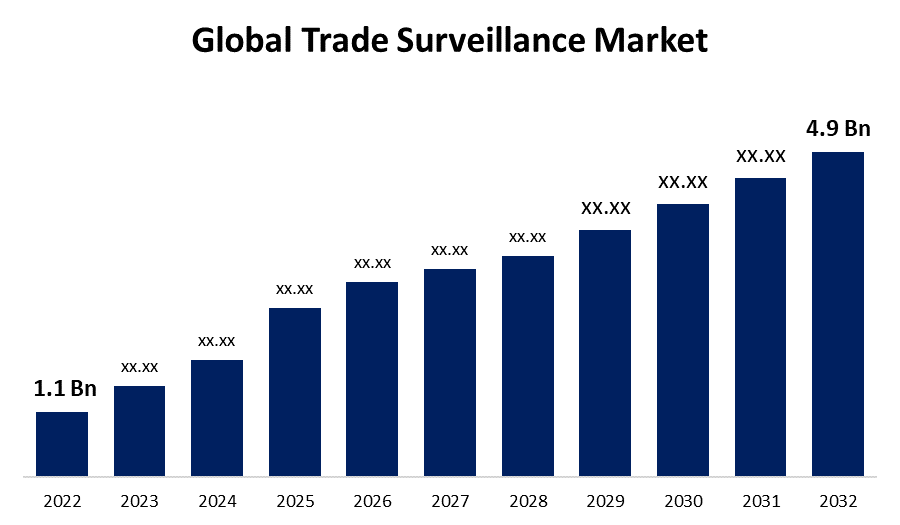

Global Trade Surveillance Market Size to Exceed USD 4.9 Billion by 2032 | CAGR of 16.1%

Category: Banking & FinancialGlobal Trade Surveillance Market Size to Exceed USD 4.9 Billion by 2032

According to a research report published by Spherical Insights & Consulting, the Global Trade Surveillance Market Size is to Grow from USD 1.1 Billion in 2022 to USD 4.9 Billion by 2032, at a Compound Annual Growth Rate (CAGR) of 16.1% during the projected period.

Get more details on this report -

Browse key industry insights spread across 200 pages with 100 market data tables and figures & charts from the report on "Global Trade Surveillance Market Size, Share, and COVID-19 Impact Analysis, By Component (Solution, Services), By Deployment (On-Premise, Cloud), By Enterprise Size (Large Enterprises, SMEs), By End User (Banks, Institutional Brokers, Retail Brokers, Market Centers & Regulators, Others) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/trade-surveillance-market

The monitoring of securities trading activity by financial institutions and their workers to detect and prevent market abuse, insider trading, market manipulation, and other illegal activities is known as trade surveillance, sometimes known as market surveillance. It is critical for maintaining fair and transparent markets, financial system integrity, and investor trust. Trade surveillance system solutions assist businesses and market experts in detecting fraud, and incorrect, or abusive trading. The market for trade surveillance demand for 360-degree commerce surveillance is rising. In response to difficult regulatory compliances and escalating trade malpractices, vendors provide holistic trade surveillance system solutions and services with 360-degree monitoring. To provide a more extensive analysis, these trade surveillance systems capture and analyze transactions, communications, and behavioral trends. The 360-degree approach to trade surveillance systems improves true positives, reduces false positive processing efforts, and improves trade surveillance pattern detection. The need for efficient trade surveillance solutions that collect data from several channels, such as trade and order data, social networking site data, phone communications, and behavioral data, is growing all the time. Regulatory unpredictability and cost-benefit arguments where new regulatory requirements are frequently subjected to major adjustments before being implemented, or they are simply postponed for an indefinite amount of time.

COVID-19 Impact

The COVID-19 outbreak has had a small impact on the trade surveillance system industry, owing to increased pressure on enterprises to keep essential data in a pandemic situation and a reduction in end-user spending. Furthermore, there is enormous volatility in the market as a result of the global lockdown, and corporations are encountering various obstacles in monitoring various suspicious trading actions. As a result, many companies are using trade surveillance systems to monitor multiple questionable actions during the pandemic condition and to regulate exceeding market volumes, which is encouraging market growth.

The Solution segment dominates the market with the largest revenue share over the forecast period.

Based on components, the global trade surveillance market is segmented into solutions and services. Among these, the solution segment is dominating the market with the largest revenue share over the forecast period. The rising share is owing to the increased use of internet protocol in surveillance systems. Trade surveillance companies offer services such as risk and compliance, reporting and monitoring, surveillance and analytics, and case management. These businesses provide managed and professional trade surveillance services. Smart trade monitoring technology outperforms traditional trade surveillance, leading to market expansion. Implementing an efficient surveillance system solution also lowers operating costs because fewer workers are needed to monitor the data, resulting in more efficient use of all resources.

The on-premise segment is witnessing significant CAGR growth over the forecast period.

Based on deployment, the global trade surveillance market is segmented into on-premise and cloud. Among these, the on-premise segment is witnessing significant CAGR growth over the forecast period. On-premise trade surveillance systems, including pattern recognition and behavioral analysis, ensure data protection. Enterprises with sensitive data, such as the government and banking industries, need the protection and privacy that an on-premise environment provides. Because of worries about information security and privacy in the cloud, as well as the fact that analytics usually deal with very valuable data, many businesses prefer to stay on-premise, which is contributing to market growth.

The large enterprises segment is expected to hold the rapid revenue growth of the global trade surveillance market during the forecast period.

Based on enterprise size, the global trade surveillance market is classified into large enterprises and SMEs. Among these, large enterprises are expected to grow at a rapid pace during the forecast period. To improve operational efficiency, industrial and other corporate enterprises are installing improved physical and electronic security systems. Large-scale organizations are becoming safer and more sensible as a result of trade surveillance technology, which delivers business analytics to minimize operational risk. The trade surveillance system for large-scale enterprises includes risk assessment, remote viewing and administration, live monitoring, electronic and biometric access control, integrated solutions for improved security management and reporting, and mobile security management.

The institutional brokers segment is projected to grow at the highest CAGR in the market during the forecast period.

Based on end-users, the global trade surveillance market is segmented into banks, institutional broker’s, retail brokers, market centers & regulators, and others. Among these, the institutional brokers segment grows at the highest CAGR growth over the forecast period. Institutional brokers represent businesses, insurance companies, and investment corporations. They assist their clients, which include banks, mutual funds, pension funds, and others, in making large-scale securities buys and sales. These firms provide institutional brokerage services that are completely different from those provided by retail brokers in terms of compliance, disclosure, clearing, and settlement rules because they are a form of administrator keeping money for others.

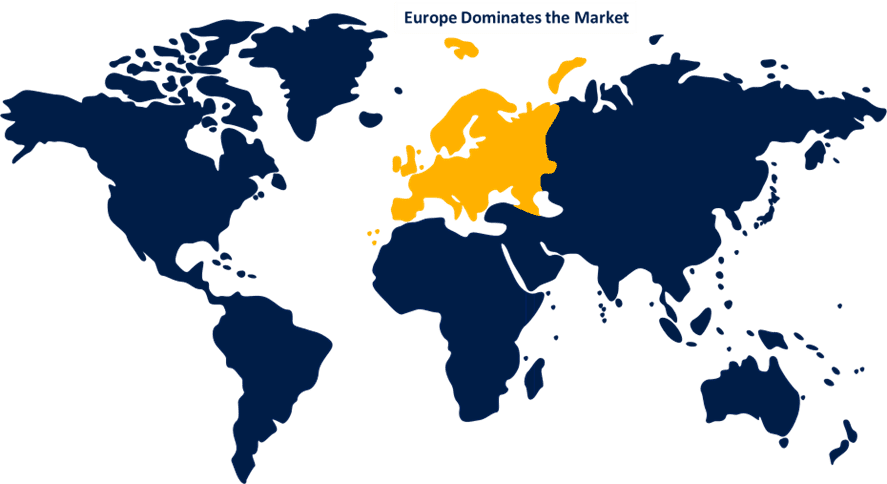

Europe dominates the market with the largest market share over the forecast period.

Get more details on this report -

Over the projection period, Europe will hold the greatest market share. Europe offers attractive chances to market participants. The market is being driven by the increasing use of cloud-based trade monitoring solutions by businesses of all sizes, as well as the expansion of the European economy. Rising living standards, rising per capita income, and increased adoption of technological advancements in surveillance and security systems are expected to boost industrial expansion in the region. The market for trade surveillance systems is expanding due to an increase in suspicious behavior among European businesses, such as insider trading and market manipulation, caused by digitalization, electronic devices, and networks. The Asia-Pacific market is expected to grow the fastest during the projected period, with expansion of the banking and insurance industries in Asia-Pacific countries such as India, China, Singapore, South Korea, and Japan. Governments in these nations have begun to invest significantly in trade monitoring systems as financial institutions become increasingly concerned about the security of trading activities. The Asia-Pacific region's trade surveillance system is developing rapidly as a result of an increase in market abuse and fraud incidents, as well as the complexity of regulatory compliance requirements for corporations, banks, and insurance organizations. North America is a significant contributor to the growth of the trade surveillance industry. Moreover, the area is projected to take the lead in adopting trade surveillance systems because of its dominance with reliable and established economies that allow it to invest in R&D activities and support the production and innovation of new technology.

Major vendors in the Global Trade Surveillance Market include IBM, CRISIL, b-next, FIS, Nasdaq, IPC, SIA S.p.A., ACA Group, NICE, Software AG, OneMarketData, Aquis Technologies, BAE Systems, Scila, Trading Technologies and among others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2022, Solidus Labs partnered with CoinDCX, India's first crypto unicorn and the country's most secure crypto exchange. This collaboration sought to protect users from recognized forms of market abuse as well as the majority of emerging crypto-specific risks.

- Market Segment

This study forecasts revenue at global, regional, and country levels from 2022 to 2032. Spherical Insights has segmented the global trade surveillance market based on the below-mentioned segments:

Trade Surveillance Market, Component Analysis

- Solution

- Services

Trade Surveillance Market, Deployment Analysis

- On-Premise

- Cloud

Trade Surveillance Market, Enterprise Size Analysis

- Large Enterprises

- SMEs

Trade Surveillance Market, Technology Analysis

- Banks

- Institutional Brokers

- Retail Brokers

- Market Centers & Regulators

- Others

Trade Surveillance Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?