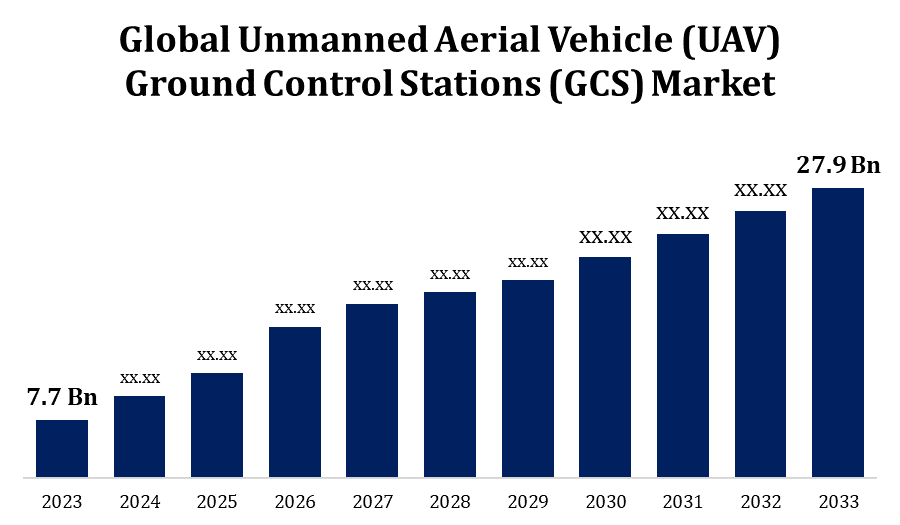

Global Unmanned Aerial Vehicle (UAV) Ground Control Stations (GCS) Market Size To Worth USD 27.9 Billion by 2033 | CAGR of 13.74%

Category: Aerospace & DefenseGlobal Unmanned Aerial Vehicle (UAV) Ground Control Stations (GCS) Market Size To Worth USD 27.9 Billion by 2033

According to a research report published by Spherical Insights & Consulting, The Global Unmanned Aerial Vehicle (UAV) Ground Control Stations (GCS) Market Size to Grow from USD 7.7 Billion in 2023 to USD 27.9 Billion by 2033, at a Compound Annual Growth Rate (CAGR) of 13.74% during the forecast period.

Get more details on this report -

Browse key industry insights spread across 200 pages with110 Market data tables and figures & charts from the report on the "Global Unmanned Aerial Vehicle (UAV) Ground Control Stations (GCS) Market Size By Operating Environment (Fixed-Site Installations, Platform-Mounted, and Mobile), By Component (Processing Unit, Wireless Datalink, Graphic User Interface, Command and Control System, Navigation and Position System, Software Suite, and Others), By Application (Perimeter Security & Border Management, Combat and Combat Support Missions, Emergency Management Services, Surveying, Mapping, Inspection & Monitoring, Precision Agriculture), By End-user (Government & Defense, Energy, Power, Oil & Gas, Construction & Mining, Agriculture, Forestry & Wild Life Conservation, Public Infrastructure & Homeland Security, Hospitals & Emergency Medical Services, Transportation & Logistics, Media, Entertainment, & Event Management, Others), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/unmanned-aerial-vehicle-uav-ground-control-stations-gcs-market

The Unmanned Aerial Vehicle (UAV) Ground Control Stations (GCS) market is expanding rapidly, driven by rising demand for UAVs in industries such as defence, agriculture, and surveillance. GCS are critical for UAV operations because they provide the required interface for control, mission planning, and data processing. Technological improvements in UAV systems, together with the incorporation of AI and machine learning, are improving the capabilities of GCS, making them more efficient and user friendly. Furthermore, the growing use of UAVs for commercial purposes, such as delivery services and infrastructure monitoring, is driving market growth. Key manufacturers are concentrating on producing compact, portable, and highly automated GCS to satisfy the changing needs of end users, assuring long-term market growth.

Unmanned Aerial Vehicle (UAV) Ground Control Stations (GCS) Market Value Chain Analysis

The Unmanned Aerial Vehicle (UAV) Ground Control Stations (GCS) market value chain includes various crucial phases, ranging from component suppliers to end users. It starts with the procurement of raw materials and electronic components, then moves on to the fabrication of GCS-specific hardware and software. This stage involves creating user interfaces, communication systems, and data processing units. The following phase is integration and assembly, which combines these components to form a functional GCS. Distributors and retailers then play an important role in making these technologies available to a variety of sectors, including military, agriculture, and commercial companies. Finally, end users, including government agencies, commercial corporations, and research organisations, employ these GCS for a variety of applications, generating demand and shaping future industry improvements.

Unmanned Aerial Vehicle (UAV) Ground Control Stations (GCS) Market Opportunity Analysis

The Unmanned Aerial Vehicle (UAV) Ground Control Stations (GCS) market offers substantial prospects as UAV applications develop across many sectors. The defence sector remains a large market, with increased investments in sophisticated GCS to improve surveillance and reconnaissance capabilities. In agriculture, GCS-enabled UAVs provide precision agricultural solutions that increase crop yields while lowering expenses. The commercial sector also offers attractive potential, with increased demand for UAVs in logistics, disaster management, and infrastructure monitoring. Technological improvements, like as AI integration and real-time data analytics, are opening up new opportunities for advanced GCS applications. Furthermore, growing markets in Asia-Pacific and Latin America hold tremendous potential, with governments and corporate sectors investing in UAV technology to enhance modernization and efficiency.

Increased drone acquisition in the military and commercial sectors has a substantial impact on the Unmanned Aerial Vehicle (UAV) Ground Control Stations (GCS) market growth. Drones are critical for military surveillance, reconnaissance, and combat tasks, increasing need for improved GCS with greater control and real-time data analysis. Commercially, industries such as agriculture, logistics, and infrastructure are increasingly using drones for crop monitoring, delivery services, and structural inspections. This increase in drone use demands sophisticated GCS to handle complicated activities and assure effective performance. Furthermore, technological breakthroughs like as artificial intelligence and machine learning are improving GCS capabilities, making them more reliable and user-friendly, hence driving market growth.

The high costs of developing and implementing advanced GCS technologies can dissuade potential buyers, especially in budget-constrained sectors. Regulatory barriers and differing international standards impede market expansion and compliance efforts, as UAV operations must follow tight aviation and data security requirements. Furthermore, concerns about cybersecurity pose substantial hazards, with GCS being possible targets for hacking and data leaks. Technical hurdles, including as maintaining dependable communication lines and managing the growing complexity of UAV operations, also stymie market expansion. Finally, the quick speed of technology improvement necessitates ongoing innovation and investment, providing a challenge for businesses to maintain their offers relevant and competitive.

Insights by Operating Environment

The mobile segment accounted for the largest market share over the forecast period 2023 to 2033. Mobile GCS, which are commonly built into trucks or portable equipment, let operators to operate drones from several places, improving operational efficiency and response. This is especially useful for applications like disaster relief, military missions, and field-based agricultural monitoring, where mobility is critical. Mobile GCS are becoming more robust and user-friendly as technology advances in communication systems and component miniaturisation. Furthermore, the increasing use of UAVs in commercial sectors such as logistics and infrastructure inspection is driving the demand for adaptable and quickly deployable GCS systems, which is fueling the expansion of the mobile segment.

Insights by Component

The command and control system segment is dominating the market with the largest market share over the forecast period 2023 to 2033. This component is crucial for assuring accurate navigation, mission planning, and real-time data processing in both military and commercial UAV missions. Advancements in technology such as artificial intelligence, machine learning, and secure communication protocols are improving the capabilities of command and control systems, increasing their efficiency and resilience. The integration of these systems into GCS enables greater situational awareness and autonomous operation, which is critical for applications such as surveillance, reconnaissance, and logistics. As UAV applications spread across industries, the demand for improved command and control systems fuels market expansion, enabling effective and safe UAV operations.

Insights by Application

The combat and combat support missions segment accounted for the largest market share over the forecast period 2023 to 2033. UAVs are rapidly being used for a variety of military missions, including intelligence, surveillance, and reconnaissance (ISR) and direct combat. This increase in usage needs modern GCS capable of delivering accurate control, real-time data processing, and secure communication linkages to ensure mission success. Technological improvements are improving the capabilities of these systems, making them more dependable and efficient in high-risk situations. Increased defence budgets and strategic measures to modernise armed forces in various countries are fueling this segment's expansion. Combat UAVs' ongoing evolution and crucial role in modern warfare highlight the requirement for sophisticated GCS solutions, ensuring strong market growth.

Insights by End User

The government and defence segment is dominating the market with the largest market share over the forecast period 2023 to 2033. Governments throughout the world are investing in UAV technology to improve their defence capabilities, such as surveillance, reconnaissance, intelligence gathering, and combat operations. Advanced GCS play an important role in these applications because they enable precise control over UAV operations, real-time data processing, and secure communication channels. Technological improvements like as AI integration, autonomous capabilities, and enhanced sensor systems are increasing the effectiveness and variety of GCS for military operations. The strategic importance of UAVs in modern combat, combined with ongoing military modernization initiatives, ensures long-term development potential in the government and defence segment of the UAV GCS market.

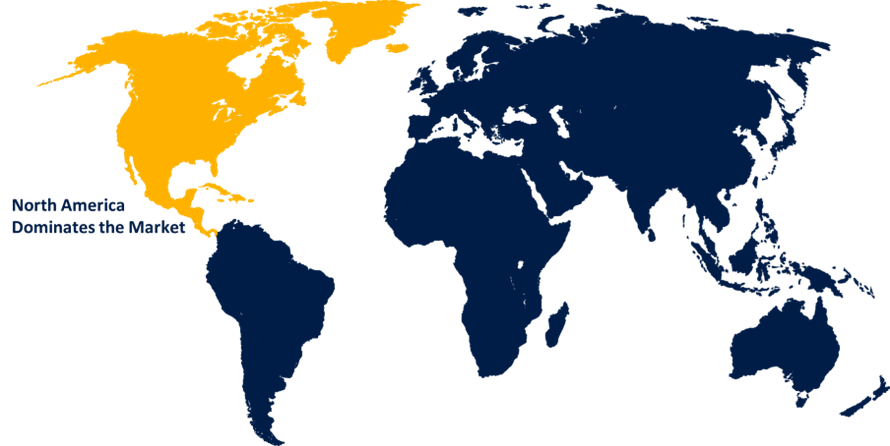

Insights by Region

Get more details on this report -

North America is anticipated to dominate the Unmanned Aerial Vehicle (UAV) Ground Control Stations (GCS) Market from 2023 to 2033. The United States leads the region in defence investments, using UAVs for surveillance, reconnaissance, and combat missions, resulting in a demand for improved GCS. The business sector is also quickly embracing UAVs for agricultural, logistics, and infrastructure inspection applications, which is driving market growth. Technological breakthroughs and innovation hubs in North America help to produce advanced GCS with expanded capabilities. Regulatory backing and measures to integrate UAVs into national airspace systems promote market growth, while the existence of important industry players provides a steady supply of cutting-edge GCS solutions.

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The growth is being driven by increased usage in the defence, agricultural, and commercial sectors. UAVs are used in agriculture for precision farming and crop monitoring, while commercial drones are used for infrastructure inspection, disaster management, and delivery services. Rapid urbanisation and industrialization in the region increase demand. Government measures and favourable rules that facilitate UAV integration improve business prospects. Furthermore, the presence of rising technology businesses and innovation centres in Asia-Pacific helps to create and deploy complex GCS solutions.

Recent Market Developments

- In October 2023, Aeronautics, an Israeli company, has received contracts to provide advanced Ground Control Stations (GCS) for its Orbiter UAV systems, as well as critical maintenance services for the Aeronautics UAV fleet.

Major players in the market

- Raytheon Technologies Corporation (US)

- General Atomics Aeronautical Systems, Inc. (GA-ASI) (US)

- Northrop Grumman Corporation (US)

- Elbit Systems Ltd. (Israel)

- Israel Aerospace Industries Ltd. (Israel)

- SZ DJI Technology Co., Ltd. (China)

- AeroVironment, Inc. (US)

- Lockheed Martin Corporation (US)

- Thales Group (France)

- Aeronautics Ltd. (Israel)

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Unmanned Aerial Vehicle (UAV) Ground Control Stations (GCS) Market, Operating Environment Analysis

- Fixed-Site Installations

- Platform-Mounted

- Mobile

Unmanned Aerial Vehicle (UAV) Ground Control Stations (GCS) Market, Component Analysis

- Processing Unit

- Wireless Datalink

- Graphic User Interface

- Command and Control System

- Navigation and Position System

- Software Suite

- Others

Unmanned Aerial Vehicle (UAV) Ground Control Stations (GCS) Market, Application Analysis

- Perimeter Security & Border Management

- Combat and Combat Support Missions

- Emergency Management Services

- Surveying, Mapping

- Inspection & Monitoring

- Precision Agriculture

Unmanned Aerial Vehicle (UAV) Ground Control Stations (GCS) Market, End User Analysis

- Government & Defense

- Energy

- Power

- Oil & Gas

- Construction & Mining

- Agriculture

- Forestry & Wild Life Conservation

- Public Infrastructure & Homeland Security

- Hospitals & Emergency Medical Services

- Transportation & Logistics

- Media

- Entertainment, & Event Management

- Others

Unmanned Aerial Vehicle (UAV) Ground Control Stations (GCS) Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?