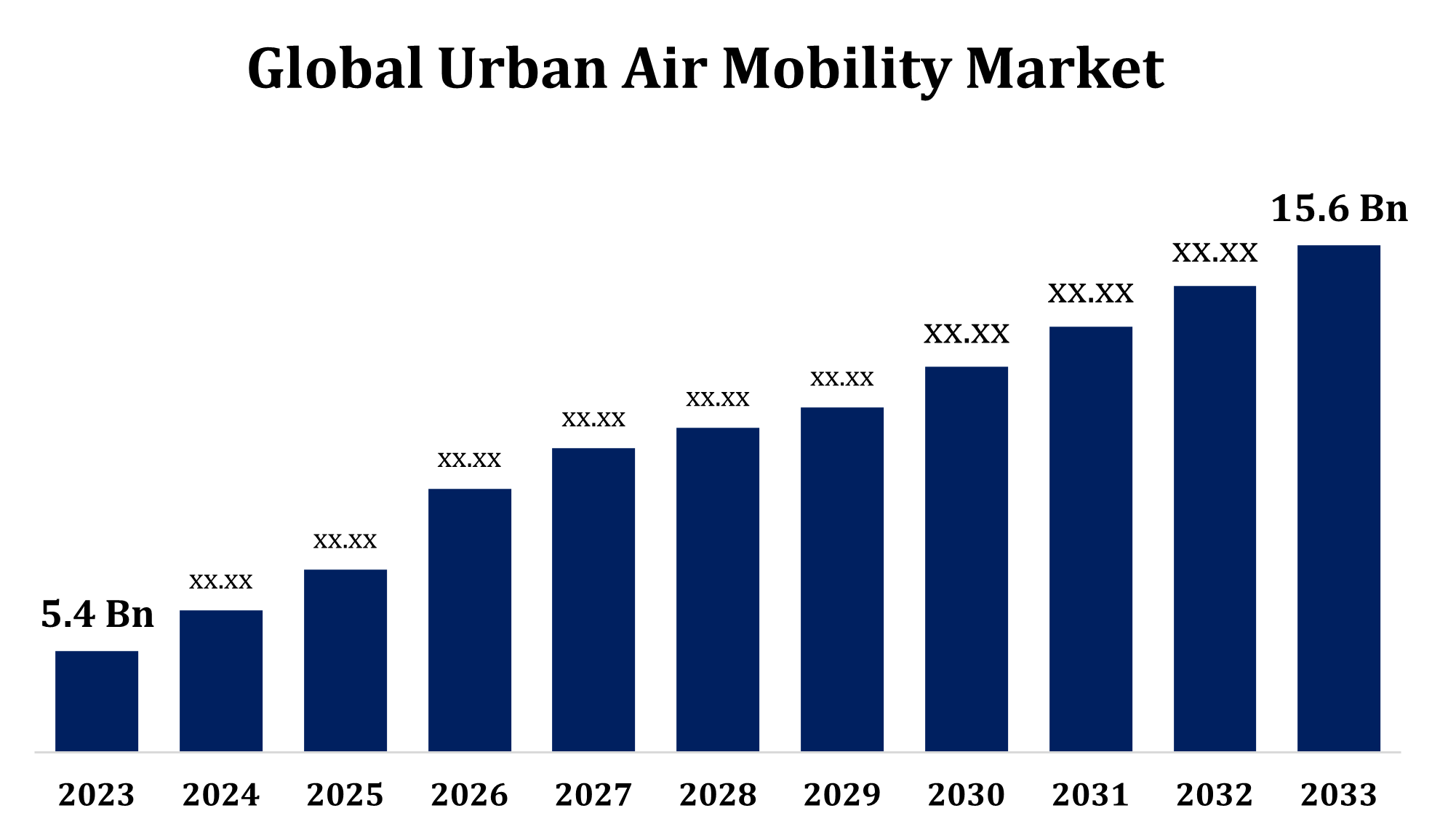

Global Urban Air Mobility Market Size To Worth USD 15.6 Billion By 2033 | CAGR of 11.19%

Category: Aerospace & DefenseGlobal Urban Air Mobility Market Size To Worth USD 15.6 Billion By 2033

According to a research report published by Spherical Insights & Consulting, the Global Urban Air Mobility Market Size to Grow from USD 5.4 Billion in 2023 to USD 15.6 Billion by 2033, at a Compound Annual Growth Rate (CAGR) of 11.19% during the forecast period.

Get more details on this report -

Browse key industry insights spread across 257 pages with 114 Market data tables and figures & charts from the report on the "Global Urban Air Mobility Market Size, Share, and COVID-19 Impact Analysis, By Vehicle Type (Air Taxi, Air Metro, Air Ambulance, Last-Mile Delivery, and Other), By Range (Intercity, and Intracity), By Operation (Piloted, Autonomous, and Hybrid), By End User (Ridesharing Companies, Scheduled Operators, E-Commerce Companies, Hospitals, and Medical Agencies and Private Operators), , and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/urban-air-mobility-market

The urban air mobility (UAM) market is rapidly advancing, driven by innovations in electric vertical take-off and landing (eVTOL) aircraft and a growing demand for eco-friendly transportation options. UAM aims to alleviate urban congestion by providing efficient aerial transportation within cities and surrounding areas. Market leaders are investing heavily in technological development, infrastructure, and regulatory compliance to ensure safety and scalability. Factors such as rising population, urbanization, and the emphasis on reducing carbon emissions are propelling market growth. Key applications include air taxis, cargo transportation, and emergency medical services. However, challenges like high startup costs, airspace management, and public acceptance persist. With strategic partnerships and government backing, UAM is set to revolutionize urban mobility in the coming years.

Urban Air Mobility Market Value Chain Analysis

The value chain of the urban air mobility (UAM) market consists of several interconnected segments essential for its growth and functioning. It starts with aircraft manufacturers, who design and create advanced eVTOL and drone systems. Component suppliers contribute key technologies, such as propulsion systems, batteries, avionics, and sensors. Infrastructure providers are crucial for developing vertiports, charging stations, and air traffic management systems. Service providers, including ride-hailing platforms and logistics companies, incorporate UAM into services like passenger transport, cargo delivery, and emergency response. Regulatory bodies establish and enforce safety, certification, and compliance standards. Lastly, end-users, including commuters, businesses, and healthcare sectors, drive demand. Effective collaboration among all these stakeholders is key to addressing challenges like scalability, airspace integration, and public acceptance, ensuring the continued growth of UAM.

Urban Air Mobility Market Opportunity Analysis

The urban air mobility (UAM) market offers significant growth prospects fueled by technological advancements, urbanization, and the growing demand for sustainable transportation. The increasing need for efficient intra-city transport is opening up opportunities for eVTOL aircraft and drone developers. Breakthroughs in battery technology and autonomous systems are making UAM more feasible and cost-effective. The development of smart cities presents opportunities for seamless integration with existing transportation networks, enhancing mobility services. Key sectors such as passenger air taxis, logistics, healthcare, and emergency services stand to benefit. Additionally, government support and funding for green mobility solutions are driving market expansion. Emerging markets in Asia-Pacific and the Middle East, with their rapidly growing urban populations, offer significant untapped potential. Despite challenges like regulatory hurdles and infrastructure needs, UAM offers transformative potential for the future of urban mobility.

The growing demand for alternative transportation options is driving the rapid expansion of the urban air mobility (UAM) market. As urbanization and traffic congestion worsen, there is an increasing need for faster, more efficient, and sustainable transportation solutions. UAM presents a viable alternative through electric vertical take-off and landing (eVTOL) aircraft, which help reduce travel times and carbon emissions. Key applications such as passenger air taxis, cargo transport, and medical emergency services are gaining significant traction. Both governments and private entities are investing in the necessary infrastructure, including vertiports and air traffic management systems, to facilitate this growth. Furthermore, advancements in autonomous flight and battery technology are making UAM more practical and scalable. With the shift toward eco-friendly transportation, UAM is poised to play a crucial role in the future of urban mobility.

High initial costs for developing eVTOL aircraft, infrastructure, and supporting technologies present significant barriers to the urban air mobility (UAM) market. Regulatory challenges, such as safety standards, airspace management, and pilot certification, complicate market entry. Public acceptance is another hurdle, as concerns about noise pollution, safety, and privacy need to be addressed to build trust. Developing infrastructure, including vertiports and charging stations, demands substantial urban planning and investment. Air traffic management systems must also be upgraded to integrate low-altitude aircraft into existing airspace. Additionally, overcoming technological challenges like improving battery capacity and ensuring reliable autonomous systems is essential. Addressing these obstacles will require collaboration among key stakeholders, including governments, manufacturers, and service providers.

Insights by Vehicle Type

The air taxis segment accounted for the largest market share over the forecast period 2023 to 2033. Air taxis, utilizing electric vertical take-off and landing (eVTOL) technology, offer fast, eco-friendly, and efficient transportation for both intra-city and regional travel. The increasing demand for premium mobility services among urban professionals, along with advancements in autonomous flight systems, is driving market growth. Pilot projects in cities such as Los Angeles, Dubai, and Singapore showcase the scalability potential of this technology. Investment from major industry players and startups in developing cutting-edge eVTOL designs is fostering competition and innovation. However, challenges such as securing regulatory approval, developing infrastructure, and gaining public acceptance remain. Through strategic partnerships, the air taxi segment is set to transform urban transportation in the years to come.

Insights by Range

The intercity range segment accounted for the largest market share over the forecast period 2023 to 2033. Advancements in electric vertical take-off and landing (eVTOL) technologies are enabling longer flight ranges, making intercity air mobility solutions increasingly feasible. This segment focuses on linking metropolitan areas with surrounding regions, cutting down travel times and alleviating congestion on ground transport networks. Key factors driving growth include improvements in battery capacity, autonomous flight systems, and air traffic management. Major industry players are investing in high-performance eVTOLs capable of covering longer distances, supporting both cargo delivery and passenger services. The intercity range segment is poised to benefit from government backing, infrastructure development, and the rising demand for faster, more sustainable travel options, positioning it as a key growth area for the UAM market.

Insights by Operation

The autonomous segment accounted for the largest market share over the forecast period 2023 to 2033. Autonomous flight technologies, such as advanced sensors, AI-driven navigation, and real-time data analytics, are advancing rapidly, making unmanned operations more feasible for urban air taxis and cargo delivery systems. The growing need for cost-effective solutions and a shortage of qualified pilots further drive the adoption of autonomous operations. As regulatory frameworks evolve and safety and certification standards are established, autonomous UAM services are expected to scale rapidly. Integrating autonomous systems with existing air traffic management and infrastructure is also crucial for market growth. This segment offers significant opportunities to reduce human error, optimize flight routes, and enhance the overall efficiency of UAM operations.

Insights by End User

The ridesharing companies segment accounted for the largest market share over the forecast period 2023 to 2033. As urban congestion grows, ridesharing companies are forming partnerships with UAM manufacturers to incorporate air taxis into their services, providing faster and more sustainable travel options. Companies like Uber, Lyft, and others are actively investing in eVTOL technology and infrastructure to offer on-demand aerial transportation in cities. Collaborations between ridesharing platforms and UAM developers are expected to drive market growth, with shared air taxis and short regional flights becoming more viable. Furthermore, advancements in autonomous flight and battery technology are making air mobility more cost-effective. As infrastructure and regulatory frameworks continue to evolve, this segment is set to play a crucial role in shaping the future of both urban and intercity transportation.

Insights by Region

Get more details on this report -

North America is anticipated to dominate the Urban Air Mobility Market from 2023 to 2033. The United States leads the region, supported by a strong aerospace industry, the presence of key UAM players, and active government initiatives promoting sustainable transportation. Cities like Los Angeles and Dallas are emerging as early adopters, with pilot projects and infrastructure development already in progress. The Federal Aviation Administration (FAA) plays a vital role in shaping air traffic management and certification standards, ensuring the safe integration of UAM into urban areas. The demand for eVTOL aircraft is driven by applications such as passenger air taxis, cargo logistics, and emergency medical services. With increasing interest from private investors and public agencies, North America is poised to lead in UAM adoption and innovation.

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. China is at the forefront, with substantial R&D investments and strong government support, while Japan and South Korea are exploring air taxi services and eVTOL deployment for events like the 2025 Osaka Expo. Singapore is leading the way in developing advanced UAM solutions, focusing on seamless integration into urban environments. Key applications in the region include passenger air taxis, logistics, and medical emergency services. Despite challenges such as regulatory frameworks and infrastructure gaps, the region’s technological progress and strategic collaborations position Asia-Pacific as a key growth hub for the UAM market.

Recent Market Developments

- In April 2024, Unifly, a subsidiary of the Terra Drone Corporation Group, has announced the successful completion of the CORUS-XUAM project. This joint initiative is set to redefine the future of urban air mobility in the coming years.

Major players in the market

- EHang

- Pipistrel Group

- Kitty Hawk

- Workhorse Group Inc.

- Airbus

- Lilium

- Opener

- Volocopter GmbH

- Neva Aerospace

- The Boeing Company

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Urban Air Mobility Market, Vehicle Type Analysis

- Air Taxi

- Air Metro

- Air Ambulance

- Last-Mile Delivery

- Other

Urban Air Mobility Market, Range Analysis

- Intercity

- Intracity

Urban Air Mobility Market, Operation Analysis

- Piloted

- Autonomous

- Hybrid

Urban Air Mobility Market, End User Analysis

- Ridesharing Companies

- Scheduled Operators

- E-Commerce Companies

- Hospitals

- Medical Agencies

- Private Operators

Urban Air Mobility Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?